- Home

- »

- Medical Devices

- »

-

U.S. Biosensors Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Biosensors Market Size, Share & Trends Report]()

U.S. Biosensors Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Electrochemical, Thermal, Piezoelectric), By Application (Medical, Food Toxicity, Bioreactor), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-281-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biosensors Market Size & Trends

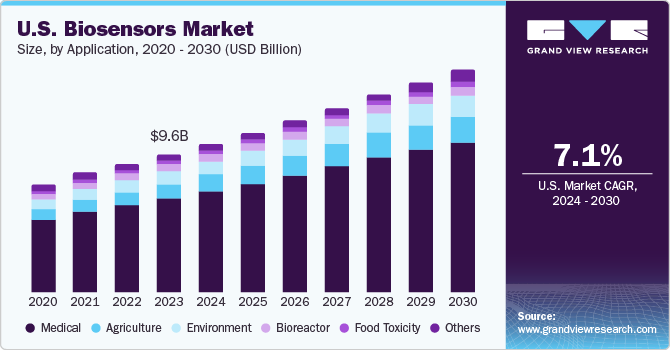

The U.S. biosensors market size was estimated at USD 9.64 billion in 2023 and is projected to grow at a CAGR of 7.13% from 2024 to 2030. The demand for biosensors is increasing due to increasing demand for point-of-care (PoC) testing, technological advancements, rising chronic diseases, focus on personalized medicines, expansion of applications beyond healthcare, and many others. For instance, in April 2021, B.D., a prominent medical technology firm, received emergency use authorization from the U.S. Food and Drug Administration (FDA) for its latest biosensor, engineered to swiftly and precisely identify SARS-CoV-2.

The biosensors market is helping the U.S. to grow in several key aspects, such as healthcare advancements, economic growth, innovation and research, public health and safety, environmental protection, and others. This market is on the verge of significant growth due to technological innovation and environmental sustainability. For instance, in January 2023, Intricon announced the launch of a new Biosensors Center of Excellence (CoE), combining its expertise and capabilities in biosensor devices into a vertically integrated business unit. The CoE is dedicated to delivering biosensor devices to the medical market.

Nanotechnology-based biosensors are revolutionizing industries with their versatility. In healthcare, they enable precise disease diagnosis and personalized treatment. Environmental applications include monitoring air and water quality, detecting pollutants, and ensuring sustainability. Similarly, technological advancements, driven by innovations such as miniaturization and increased sensitivity, alongside the growing prevalence of chronic diseases and emphasis on point-of-care testing, are propelling the global biosensors market forward. According to the U.S. Department of Health and Human Services, in 2023, the U.S. was expected to witness around 2.0 million cancer diagnoses, with breast cancer emerging as the primary diagnosis among women, followed by prostate cancer as the predominant diagnosis among men, amounting to 297,790 and 2,800 cases, respectively. Moreover, bronchus and lung cancer was noted as the third most prevalent cancer diagnosis, with an estimated 238,340 new cases anticipated.

Growing healthcare spending is fueling the market growth in the U.S. According to the Centers for Medicare & Medicaid Services, healthcare spending in the U.S. climbed by 4.1% to USD 4.5 trillion in 2022, surpassing the 3.2% increase in 2021 but lagging behind the significant 10.6% growth seen in 2020. This growth was primarily driven by a substantial rise in Medicaid and private insurance expenditures, although reduced federal COVID-19 relief funds somewhat offset it. Private insurance enrollment saw an uptick of 2.9 million individuals. In contrast, Medicaid enrollment increased by 6.1 million, resulting in a record-high insured population of 92%, with the number of uninsured individuals decreasing from 28.5 million in 2021 to 26.6 million.

The U.S. market is governed by regulatory bodies such as the FDA, ensuring the safety and effectiveness of biosensor products. Businesses within this industry must adhere to regulatory guidelines concerning product approval, quality assurance, and post-market monitoring.

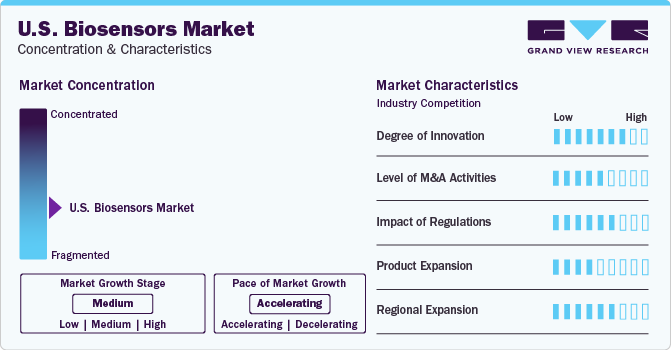

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. The U.S. biosensors industry is characterized by a high degree of innovation as companies and research entities continuously advance biosensor technologies to improve their accuracy, efficiency, and applicability across various sectors, such as healthcare and environmental monitoring. For instance, in November 2023, Siemens Healthineers and the U.S. Department of Health and Human Services (HHS) collaborated to develop an innovative biosensor platform to deliver swift, precise, and economical diagnostic solutions.

The U.S. biosensors industry is also characterized by moderate to high levels of merger and acquisition (M&A) activity. Companies in the biosensor U.S. industry often merge to strengthen their product portfolios, expand their industry presence, acquire innovative technologies, and gain competitive advantages. For instance, in August 2022, NanoDx and SkyWater Technology partnered up and announced highly sensitive printable biosensors tailored for PoC applications, demonstrating ongoing biosensor technology advancements for healthcare diagnostics.

The impact of regulations on the U.S. biosensors industry is generally high. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) play a crucial role in overseeing biosensor product safety, efficacy, and quality. For instance, in September 2021, the FDA granted de novo clearance to a new biosensor developed by Sentinel Diagnostics, to swiftly detect group A Streptococcus, a bacterium known for causing strep throat and other infections.

The regional expansion in the market involves the widening presence of biosensor technologies across various geographical areas. This expansion is driving market growth by facilitating greater accessibility to biosensor-based solutions for healthcare diagnostics, environmental monitoring, and food safety applications, thereby meeting the increasing demand for advanced sensing technologies across diverse sectors and demographics. For instance, in November 2022, Salvus LLC inaugurated a biosensor manufacturing plant in Valdosta, Georgia, to boost capabilities in engineering, research, testing, and production of interferometric-based biosensors designed for poultry contaminant detection. The facility's establishment signifies Solvus’s commitment to enhancing biosensor technology for poultry safety, catering to the industry's increased demand for reliable contaminant detection solutions.

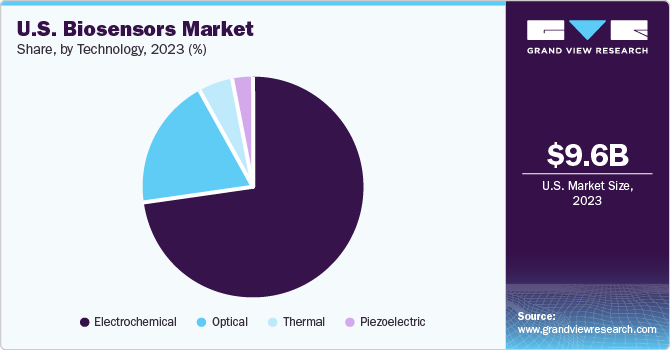

Technology Insights

Based on technology, the electrochemical segment led the market with the largest revenue share of 72.86% in 2023. This is due to the compatibility with various electrode materials and detection mechanisms, allowing for versatile applications across different fields and industries. For instance, the fabrication of custom-designed electrodes for electrochemical biosensors is enabled by 3D printing technology; according to the article published in August 2022 by the National Center for Biotechnology Information (NCBI), 3D printing can potentially improve the performance of electrochemical biosensors for cancer detection in several ways. 3D printing allows for the fabrication of complex sensor designs with high resolution. This enables the creation of sensors that are more sensitive and selective for cancer biomarkers. 3D-printed microfluidic channels can improve the capture of target cells in a sample, enhancing the sensitivity of the biosensor. Moreover, 3D printing allows for the creation of sensors with a wider range of properties.

The optical segment is expected to grow at the fastest CAGR during the forecast period. There is an anticipated rise in demand for optical biosensors in analysis due to their extensive analytical capabilities. Optical biosensors enable receptor-cell interactions, fermentation monitoring, structural investigations, concentration assessments, and kinetic and equilibrium studies.

Application Insights

Based on application, the medical segment led the market with the largest revenue share of 67.57% in 2023. The demand for the medical segment has risen due to the increasing prevalence of chronic diseases, advancements in healthcare technology, and the demand for accurate diagnostic tools. For instance, in February 2024, at the European Congress of Radiology (ECR), Koninklijke Philips N.V. announced a new computed tomography (CT) system tailored for the burgeoning cardiac coronary CT angiography (CCTA) market, boasting an innovative detector optimized for artificial intelligence (AI) image reconstruction algorithms. The CT 5300 system promises enhanced accuracy in imaging, addressing the rise in complex cardiac cases, and integrates advanced AI capabilities for diagnosis, interventional procedures, and screening, thereby streamlining workflow efficiency to bolster patient outcomes and departmental productivity amidst growing shortages of radiologists and technologists.

The agriculture segment is expected to grow at the fastest CAGR during the forecast period. There is an increasing demand for food production to meet growing population needs, an emphasis on sustainable agriculture and environmental management, precision farming and crop management, and regulatory requirements for pesticide and fertilizer use. For instance, reducing greenhouse gas emissions is a critical aspect of environmental sustainability, and biosensors came to light as significant tools for observing these emissions in several industries.

End-use Insights

Based on end-use, the PoC testing segment held the market with the largest revenue share of 47.67% in 2023. There are several factors driving PoC testing such as rapid results causing on-the-spot diagnosis and treatment decisions, user-friendly, cost-effective, and market demand. In September 2023, Emergency use authorizations (EUAs) for two distinct point-of-care (POC) assay for SARS-CoV-2 from Tangen Biosciences and SD Biosensor were approved by the U.S. FDA, intended solely for application in CLIA-certified labs capable of conducting various complexity tests, ensuring compliance with regulatory standards and quality control within patient care settings under specified CLIA certificates.

The home healthcare diagnostics segment is expected to grow at the fastest CAGR during the forecast period. This is due to an aging population, increasing chronic diseases, demand for convenient and accessible healthcare solutions, and technological advancements enabling home-based monitoring and diagnostics. According to the Population Reference Bureau, the number of Americans aged 65 and older was estimated to surge from 58 million in 2022 to 82 million by 2050, marking a 47% increase, with the demographic's proportion of the total population expected to climb from 17% to 23%. This demographic shift reflected the aging trend in the U.S., as evidenced by the rise in the median age from 30.0 to 38.9 between 1980 and 2022, with approximately one-third of states recording a median age surpassing 40 in 2022.

Key U.S. Biosensors Company Insights

Some of the key companies operating in the market include Abbott, Medtronic, Roche Diagnostics, Dexcom, and SENTINEL.

-

Abbott is a renowned global healthcare, provider dedicated to enhancing people’s quality of life across all life stages. Their diverse range of transformative technologies covers diagnostics, medical devices, nutritional products, and branded generic medicines, positioning them as leaders in the healthcare industry

-

Medtronic is renowned for innovating and producing medical devices and treatments designed to enhance patient well-being globally. Their product range encompasses diverse medical fields, such as cardiovascular, diabetes management, spinal care, and neurological disorders

Molecular Devices, LLC, Thermo Fisher Scientific Inc.are some of the other market participants in the U.S. market.

U.S. Biosensors Companies:

- Abbott

- Medtronic

- F. Hoffmann-La Roche Ltd

- Dexcom, Inc.

- SENTINEL

- Intricon Corporation

- Quanterix

- Koninklijke Philips N.V.

- Masimo

- Siemens Healthcare Private Limited

- Molecular Devices, LLC.

- Johnson & Johnson Services, Inc.

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Covaris, LLC

Recent Developments

-

In December 2023, PerkinElmer Inc., a prominent provider of analytical services and solutions worldwide, recently acquired Covaris LLC, a key player in developing solutions for advancing life sciences breakthroughs. This acquisition is balanced to enhance Covaris LLC’s growth opportunities and broaden PerkinElmer Inc’s life sciences offerings into the rapidly expanding diagnostics sector

-

In January 2022, Abbott announced the development of a new category of consumer bio wearables named Lingo for keeping track of signals such as ketones, lactate, and glucose in the body to develop a better understanding among people for their health and take necessary actions

-

In September 2021, the Defense Advanced Research Projects Agency (DARPA) of the U.S. Department of Defense introduced a new initiative named the Biological Technologies Office (BTO) to allocate resources towards advancing biosensor technology for diverse applications

U.S. Biosensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.37 billion

Revenue forecast in 2030

USD 15.61 billion

Growth rate

CAGR of 7.13% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, country

Country scope

U.S.

Key companies profiled

Abbott; Medtronic; Roche Diagnostics; Dexcom; SENTINEL; Intricon Corporation; Quanterix; Koninklijke Philips N.V.; Masimo; Siemens Healthcare Private Limited; Molecular Devices, LLC.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific Inc.; PerkinElmer Inc.; Covaris, LLC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biosensors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biosensors market report based on technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermal

-

Electrochemical

-

Piezoelectric

-

Optical

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Cholesterol

-

Blood Glucose

-

Pregnancy Test

-

Drug Discovery

-

Infectious Disease

-

-

Food Toxicity

-

Bioreactor

-

Agriculture

-

Environment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Healthcare Diagnostics

-

PoC Testing

-

Food Industry

-

Research Laboratories

-

Security and Bio-defence

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. biosensors market size was valued at USD 9.64 billion in 2023 and is projected to reach USD 10.37 billion in 2024.

b. The U.S. biosensors market is projected to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030 to reach USD 15.61 billion by 2030.

b. The electrochemical segment dominated the industry and accounted for a revenue share of over 70% of the revenue in 2023. This is due to their compatibility with various electrode materials and detection mechanisms, allowing for versatile applications across different fields and industries.

b. Some of the key companies operating in the market include Abbott, Medtronic, Roche Diagnostics, Dexcom, and SENTINEL, among others.

b. The demand for biosensors is increasing due to increasing demand for point-of-care (PoC) testing, technological advancements, rising chronic diseases, focus on personalized medicines, expansion of applications beyond healthcare, and many others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.