- Home

- »

- Medical Devices

- »

-

U.S. Biopharmaceuticals Contract Manufacturing Market, Industry Report, 2030GVR Report cover

![U.S. Biopharmaceuticals Contract Manufacturing Market Size, Share, & Trends Report]()

U.S. Biopharmaceuticals Contract Manufacturing Market Size, Share, & Trends Analysis Report By Service (Upstream, Downstream, Fill/Finish), By Source (Mammalian, Non-mammalian), By Product (Biologics, Biosimilar), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-223-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

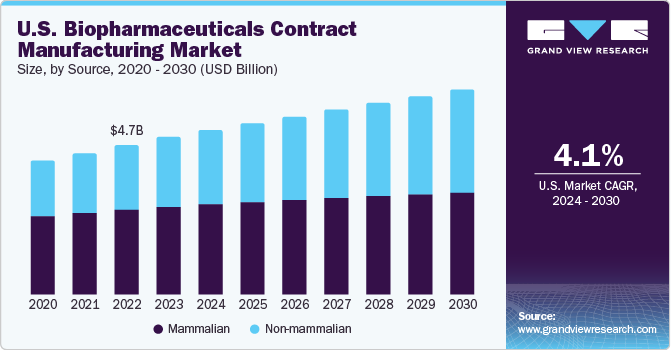

The U.S. biopharmaceuticals contract manufacturing market was valued at USD 4.96 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. With a perpetual expansion of the biopharmaceutical industry, companies are facing production issues, such as the need for more expertise and sophisticated equipment while practicing in-house manufacturing. The maturity of biotechnology and the availability of external funding has resulted in growth of several early-stage bio/pharma companies. These companies are recognized as core customers of CMOs, as these organizations lack the capabilities to develop robust manufacturing operations.

The market is witnessing lucrative growth owing to rising R&D spending for the biologic’s development coupled with the presence of large number of FDA approved drugs in the country. U.S. is hosting many biopharmaceutical pipeline in various stages of development. More than 900 biologic molecules are under clinical investigation in the country. Steady growth in the number of new biological approvals in the country is anticipated to boost revenue generation for the market.

Increasing adoption and investment in advanced manufacturing technologies by CMOs based in the U.S. is propelling the market growth. In addition, quality services offered by service providers are driving the biopharma and CMO partnerships in the country. Also, expansion of foreign CMOs and CROs into the country is expected to propel the market growth.

Market Concentration & Characteristics

The U.S. biopharmaceuticals contract manufacturing market is characterized by a high level of M&A activities undertaken by leading players. This is due to factors including the increasing focus on enhancing companies' portfolio and the need to consolidate in a rapidly growing market.

Breakthrough technological advancements and innovations in bioprocessing have played a pivotal role in the progress of contract service providers by overcoming the manufacturing issues such as high production cost and need of changeover with every batch. Furthermore, the fast turnaround offered by single-use products while limiting allied activities, such as changeover and cleaning validation, has supported the growth of CMOs to a significant extent.

Several players in the market are undertaking multiple strategies to strengthen their portfolio. For instance, in February 2022, Recipharm acquired Arranta Bio, a provider of advanced therapy medicinal products, to expand its biologics offerings in the U.S.

Highly regulated process of biopharmaceutical manufacturing and expansion of manufacturing facilities of big pharma companies is expected to hamper the market growth. Various services are offered by the market players that allow production of biopharmaceuticals as per the established Current Good Manufacturing Practice (cGMP) guidelines. Increasing number of gene therapies advancing from clinical trials to regulatory approval and the development of well-characterized and robust methods for cell therapy production has become increasingly important. Furthermore, the growing approvals for biologics and biosimilar by the regulatory agencies is expected to further improve the market demand.

There has been a paradigm shift in the pharmaceutical industry, from small molecules to large and complex biopharmaceuticals. In addition, several existing drugs are likely to go off patent, driving demand for robust therapeutics. The emergence of CMOs is expected to help address the issue of insufficient capacity associated with production of biologics and thus, boost the biologics manufacturing.

Companies such as Thermo Fisher Scientific, Inc., FUJIFILM Diosynth Biotechnologies U.S.A., Inc., and AGC Biologics among others have a strong presence in the U.S. market. However, these companies are also focusing on market expansion in various other countries. For instance, in June 2021, FUJIFILM Corporation, a multinational conglomerate, invested USD 850 million for expansion of its biopharmaceutical Contract Development and Manufacturing Organization (CDMO) subsidiary FUJIFILM Diosynth Biotechnologies. This investment was intended to improve the manufacturing of cell culture production, gene therapy production, and other biopharmaceutical manufacturing operations of the company.

Source Insights

The mammalian source segment accounted for the highest share of 56.1% in 2023. The growth is attributable to the higher costs of obtaining products from these sources. Companies that provide contract services using mammalian cell culture include AbbVie Contract Manufacturing, AMRI, Avid Bioservices, Boehringer Ingelheim Biopharmaceuticals Gmbh, and Catalent Pharma Solutions. Consequently, companies such as Lonza and Charles River Laboratories are significantly investing in expanding their mammalian cell culture manufacturing facilities for biologics and biosimilar development.

The non-mammalian segment is anticipated to witness the fastest CAGR during the forecast period. Non-mammalian cell line -E. coli is recognized as the widely adopted non-mammalian cell culture for biopharmaceutical production owing to its rapid access and cost-effective cultivation. Development of transgenic non-mammalian expression system is projected to be opportunistic for market growth. Abbott Bioresearch, Avecia Biotechnology, BioReliance, Biovitrum AB, Dow Pharmaceutical, and Celltrion are a few companies working as CMOs using microbial cultures.

Service Insights

Process development services led the market in 2023 and accounted for a share of 32.6%. This is due to high capital expenditure in downstream processing. Downstream operations demand vigorous attention for final product recovery and purification steps to maintain product quality and prevent wastage. CMOs have provided biopharma players with a wide array of services ranging from cell cultivation to final packaging of the product.

The analytical & QC studies segment is anticipated to witness the fastest CAGR from 2024 to 2030. Growing quality concerns and regulatory changes for biopharmaceutical development are expected to impel future growth opportunities for this segment. The analytical capabilities and expertise offered by the market players have a wide range of technologies & services to support the proper launch of products in market. These capabilities are implemented for MAbs, fusion proteins, chemically conjugated proteins, hormones, enzymes, and other biopharmaceuticals. Furthermore, entities offer validated analytical methods to assist release of early phase clinical products.

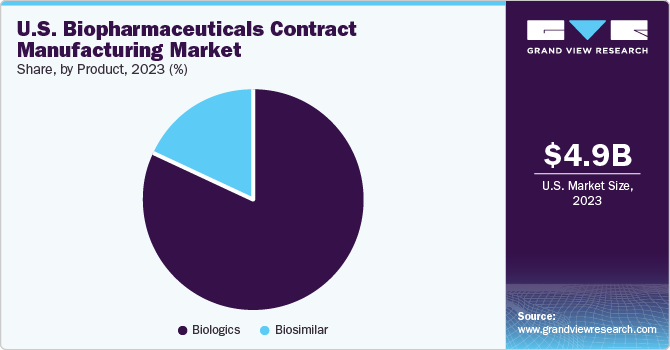

Product Insights

The biologics product segment led the market in 2023, with a share of over 81.8%. Contract manufacturers have played a vital role in the success of both biologics and biosimilars. This is majorly due to the huge commercial success of biologics, which is depicted through the presence of many FDA-approved biologics in the market. Among all the biologics, Monoclonal Antibodies (MAb) have captured the largest share in 2023. A high capital requirement for the construction of a MAb plant has accelerated the uptake of contract services for Mab production, thereby contributing to the major share of this segment.

The biosimilar segment is expected to witness a significant growth from 2024 to 2030. Biosimilar production is considered one of the key strategies for business expansion in comparison with biologics because investment in biosimilar manufacturing helps in speedy market reach of biopharmaceuticals. Moreover, biosimilars have supported the biopharmaceutical CMO industry owing to cost-saving advantages. Hence, the low cost of production, along with the growing patent expiry of blockbuster biologics, has further boosted the demand for its manufacturing services, including outsourced services.

Key U.S. Biopharmaceuticals Contract Manufacturing Company Insights

The companies in U.S. biopharmaceuticals contract manufacturing market are focused on the expansion of their manufacturing capabilities as well as establishing new services to meet the growing demand of biopharmaceutical companies. Along with small players, these entities are also engaged in a partnership with established biopharma companies. All the major biopharmaceutical firms have a wide-ranging product pipeline and are investing in developing new products.

Key U.S. Biopharmaceuticals Contract Manufacturing Companies:

- Lonza

- WuXi Biologics

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Boehringer Ingelheim

- Thermo Fisher Scientific Inc.

- Samsung BioLogics

- AGC Biologics

- Catalent Pharma Solutions

- Rentschler Biopharma SE

- Eurofins Scientific SE

Recent Developments

-

In May 2023, Aurigene Pharmaceutical Services Limited, a biopharmaceutical CDMO, announced the construction of a state-of-the-art manufacturing and development facility for therapeutic proteins, viral vectors, and antibodies.

-

In June 2022, FUJIFILM Corporation acquired cell therapy manufacturing facility from Atara Biotherapeutics, Inc. This acquisition expands its CDMO capability for production of cell therapies for clinical and commercial purposes.

-

In April 2022, Lonza extended the capability of its Coccon platform used in the manufacturing of automated cell therapy. The new capabilities included integrated capabilities in cell separation, cell binding, and bead removal.

-

In March 2022, Cambrex, expanded its biopharmaceutical testing services business with the addition of 11 cGMP laboratories in its U.S. facility. The expansion included the addition of instruments for nanoparticle size analysis, qPCR, imaging, mass spectrometry, immunoblotting, and next-generation sequencing, as well as for other applications.

-

In February 2022, Thermo Fisher Scientific, Inc. invested $40 million to build a bioprocessing manufacturing site in Millersburg, Pennsylvania for developing critical vaccines and biologics.

U.S. Biopharmaceuticals Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.19 billion

Revenue forecast in 2030

USD 6.49 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, service, product

Country scope

U.S.

Key companies profiled

Lonza; WuXi Biologics; FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; Boehringer Ingelheim; Thermo Fisher Scientific Inc.; Samsung BioLogics; AGC Biologics; Catalent Pharma Solutions; Rentschler Biopharma SE; Eurofins Scientific SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biopharmaceuticals Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. biopharmaceuticals contract manufacturing market report on the basis of source, service, and product:

-

Source (Revenue, USD Million, 2018 - 2030)

-

Mammalian

-

Non-mammalian

-

-

Service (Revenue, USD Million, 2018 - 2030)

-

Process Development

-

Downstream

-

Upstream

-

-

Fill & Finish Operations

-

Analytical & QC studies

-

Packaging

-

-

Product (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Monoclonal antibodies (MABs)

-

Recombinant Proteins

-

Vaccines

-

Antisense, RNAi, & Molecular Therapy

-

Others

-

-

Biosimilar

-

Frequently Asked Questions About This Report

b. The U.S. biopharmaceuticals contract manufacturing market was valued at USD 4.96 billion in 2023 and is expected to reach USD 5.19 billion in 2024.

b. The U.S. biopharmaceuticals contract manufacturing market is expected to grow at a CAGR of 4.1% from 2024 to 2030 to reach USD 6.49 billion in 2030.

Which segment accounted for the largest U.S. biopharmaceuticals contract manufacturing market share?b. The global biologics product segment led the market in 2023, with a share of over 81.8%. Contract manufacturers have played a vital role in the success of both biologics and biosimilars.

b. Some prominent key players in the U.S. biopharmaceuticals contract manufacturing market include Lonza, WuXi Biologics, FUJIFILM Diosynth Biotechnologies U.S.A., Inc., Boehringer Ingelheim, Thermo Fisher Scientific Inc., Samsung BioLogics, AGC Biologics, Catalent Pharma Solutions, Rentschler Biopharma SE, Eurofins Scientific SE

b. The market is witnessing lucrative growth owing to rising R&D spending for the biologic’s development coupled with the presence of large number of FDA approved drugs in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."