- Home

- »

- Biotechnology

- »

-

U.S. Biomaterials Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Biomaterials Market Size, Share & Trends Report]()

U.S. Biomaterials Market Size, Share & Trends Analysis Report By Product (Metallic, Natural, Ceramics), By Application (Cardiovascular, Ophthalmology, Wound Healing), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-243-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Biomaterials Market Size & Trends

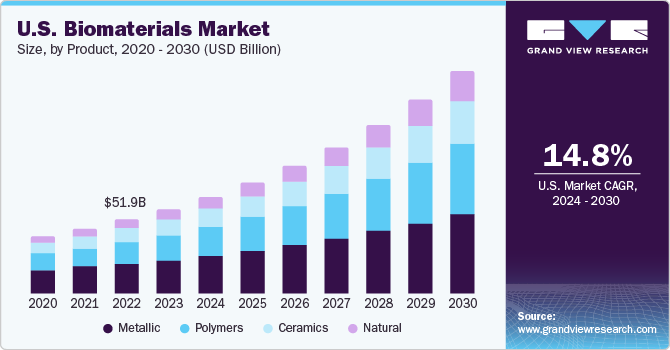

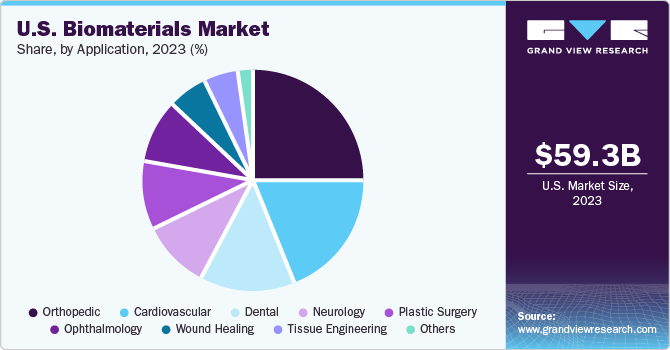

The U.S. biomaterials market size was estimated at USD 59.3 billion in 2023 and is expected to grow at a CAGR of 14.8% from 2024 to 2030. The surge in the need for biomaterials is tied to an increase in accidental injuries and a higher incidence of chronic diseases. Moreover, the interest in innovative biomaterials has increased due to their expanding use in the replacement and repair of tissues, including bones, teeth, and other organs. This growing usage is linked to advancements in technology, especially those involving nanotechnology for delivering molecular treatments. In addition, the use of biomaterials is experiencing a boost in various healthcare sectors, such as tissue engineering, medical 3D printing, implants, nanomaterials, diagnostic systems, biotechnology, bioimaging, and regenerative medicine, among others.

The U.S. accounted for over 33.3% of the global biomaterials market 2023. The need for orthopedic implants is also on the rise due to the growing elderly population, who are more susceptible to osteoarthritis, osteoporosis, and other Musculoskeletal Disorders (MSDs). Thus, the growing occurrence of musculoskeletal and chronic skeletal health issues is anticipated to drive the need for implants made from biomaterials, thereby enhancing market expansion. The creation of various biomaterials and biomedical devices is in high demand for detecting and treating the coronavirus. Early identification of the virus during this pandemic is critical to prevent its spread. The COVID-19 infection can be identified using biomedical devices based on either Polymerase Chain Reaction (PCR) or Non-PCR techniques.

Advanced biomaterials provide a promising solution to the challenges of autologous or allograft-based treatments, including donor shortages, potential immune rejection, and mismatches in size or modality. Polymeric biomaterials are synthetic structures designed to mimic the structural and functional characteristics of the extracellular matrix. The function of these biomaterials is to provide a suitable environment for the growth of cells, facilitating their development. Several advanced polymeric substances are also being introduced to complement current implant solutions and enhance their efficiency. For example, in March 2022, Evonik expanded its offerings for 3D-printable biomaterials by launching its osteoconductive VESTAKEEP iC4800 3DF PEEK filament, which can improve the fusion between implants and bone. These advancements are expected to broaden the growth prospects for the biomaterials market.

Progress in technology has enhanced the versatility of biomaterials and expanded their use in various healthcare sectors, including bioengineering and tissue engineering. Intelligent biomaterials that engage with biological systems for diverse biomedical applications, such as carrying bioactive molecules or aiding in the functioning of engineered functional tissues, are increasing market revenue. Companies are leveraging innovative drug delivery methods to control the release of medications, driving market growth. For example, in January 2019, DSM Biomedical collaborated with ProMed Pharma to utilize its biomedical biomaterials and ProMed's molding and extrusion capabilities to develop innovative controlled-release drug implants and combination devices.

Orthopedic implants, whether fully or partially porous, have become increasingly popular due to their porous coating. The porous structures of these implants lower the elastic modulus and promote bone growth around the implant. Techniques such as powder metallurgy, 3D printing, and additive manufacturing are potential methods for producing these porous metallic and ceramic implants. There is a rising demand for intelligent biomaterials to generate and transmit bioelectric signals similar to those found in natural tissues for precise physiological functions. This demand is anticipated to drive market growth. Piezoelectric scaffolds, a type of smart material, are crucial in tissue engineering. They stimulate signaling pathways, enhancing tissue regeneration at the damaged site.

The use of biomaterials in healthcare is expanding, with applications in tissue engineering, 3D printing, implants, nanomaterials, diagnostics, biotechnology, and regenerative medicine. Advanced fabrication techniques drive the adoption of biocompatible biomaterials for 3D-printed scaffold materials, hydrogels, and tissue-engineered implants. Market leaders are meeting the demand for 3D printed solutions by launching innovative products like Invibio Biomaterial Solutions' Peek-Optima Am filament for medical device printing. Biomaterials are also being explored for drug delivery and organ-on-chip applications, particularly in cancer and stem cell research. Synthetic polymers like PC, PDMS, PET, and polyurethane create membranes for organ-on-chip microdevices.

Market Concentration & Characteristics

The U.S. biomedical industry is characterized by intense competition and is highly fragmented, with numerous companies holding industry shares. Despite this, the industry maintains a moderate growth rate that is steadily increasing. Key players engage in strategic initiatives like product innovation, mergers, acquisitions, partnerships, product expansion and expanding into new regions to strengthen their industry presence. This dynamic landscape fosters innovation and drives companies to continuously evolve to stay competitive in this rapidly changing sector.

Companies in the industry constantly innovate their products to meet evolving demands, drive growth, and stay competitive. Innovation allows them to enhance product performance, cater to changing consumer needs, comply with regulations, and capitalize on emerging technologies. This continuous innovation is crucial for maintaining industry relevance and sustaining profitability. For instance, in March 2020, Covalon Technologies Ltd. announced the development of innovative antimicrobial technology to eliminate COVID-19 and other bacteria & viruses. This was aimed to strengthen revenue generation despite of COVID-19 pandemic.

Industry players leverage the strategies of mergers, acquisitions, and collaborations to increase their manufacturing capabilities, tap into their customer base, and know more about consumer demands and the geographic reach of their product offerings. For instance, in August 2021, Evonik Industries AG acquired JeNaCell, a German biotech company, expanding its biomaterials portfolio with biotechnologically derived cellulose for medical and dermatological applications. The acquisition supports Evonik's shift towards system solutions in the Nutrition & Care division.

Regulatory authorities are focusing on establishing stringent guidelines for developing, characterizing, and evaluating biomaterials. This involves setting standards for testing biocompatibility, assessing toxicity, and labeling products. In addition, there is a growing emphasis on post-industry surveillance to monitor the long-term efficacy and safety of biomaterials. While these factors will likely enhance patient safety, compliance challenges could restrict industry expansion to a certain extent. The healthcare system and the regulatory environment for biomaterials in healthcare are complex and highly regulated to ensure patient safety and product efficacy. For instance, in April 2021, Medtronic received FDA approval for the Pipeline Flex Embolization Device with Shield Technology. The device, a breakthrough in biomaterial science, reduces material thrombogenicity and enhances flow diversion therapy for brain aneurysms. Published results show improved safety and efficacy.

Companies in the sector execute this tactic to enhance their range of products and provide cutting-edge and creative solutions. For instance, in December 2022, Stryker launched Citrefix, a suture anchor system for foot and ankle surgeries, featuring Citregen, an award-winning bioresorbable material designed to mimic native bone chemistry for improved healing and bone regeneration.

Industry participants use this approach to extend the reach of their offerings in the market and enhance the availability of their products across various regions. As an example, Corbion declared a comprehensive plan to increase its capability for manufacturing lactic acid and its derivatives at its production units located in Gorinchem (Netherlands), Campos (Brazil), Rayong (Thailand), and Montmeló (Spain) in March 2021.

Product Insights

Metallics dominated the market and held the largest revenue market share of 40.2% in 2023, as they are mostly used for dental and orthopedic applications. Metals are the most widely used biomaterials and are generally used for manufacturing load-bearing implants. For instance, metallic implants are used on a large scale during orthopedic surgeries. They consist of simple wires, screws, fracture fixation plates, and total joint prostheses (artificial joints) for hips, knees, shoulders, ankles, etc. Metals as biomaterials offer high mechanical strength and toughness. Some special properties of metals must be considered for their use as biomaterials, such as wear resistance, corrosion, and biocompatibility.

Natural is expected to grow at the fastest CAGR of 18.2% from 2024 to 2030. Natural polymers have several advantages over synthetic biomaterials. When comparing synthetic and natural biomaterials, factors such as biocompatibility, biodegradability, & remodeling are considered; therefore, natural biomaterials are widely used in the repair & replacement of damaged tissues and organs. Natural biomaterials can support cell adhesion, proliferation, and differentiation when implanted. Currently, the available sources of tissues/organs are limited. Thus, developing artificial tissues and organs is the need of the hour, and their applicability in clinical applications & tissue remodeling is expected to drive the market.

Application Insights

Orthopedic dominated the market and held the largest revenue share of 25.2% in 2023. A substantial portion of the population relies on various biomaterials within orthopedic treatments to address bone and joint degenerative issues. These biomaterials are typically categorized into three generations based on their properties and functions. The first generation encompasses bioinert materials such as metallic substances, ceramics, and polymers. Moving to the second generation, we find bioactive and biodegradable ceramics, cement, metals, and polymers. These materials possess enhanced qualities that promote biological interaction. The third generation comprises biomaterials engineered to trigger specific molecular-level responses within the body. These advancements cater to diverse needs, including scenarios like fractures, extensive resections, joint dysfunctions, spinal pathologies, and other related conditions. Consequently, the demand for medical devices and biomaterials in this domain is anticipated to surge significantly in the foreseeable future.

Plastic surgery is predicted to show the fastest CAGR of 18.0% during the forecasted period. The usage of biomaterials in plastic surgery has increased significantly due to the abundance of commercial products available in recent years. These products include various items such as soft tissue fillers, bioengineered skins, acellular dermal matrices, craniofacial surgery materials, and peripheral nerve repair solutions. Plastic surgery has both cosmetic and reconstructive applications, with popular procedures including breast augmentation, rhinoplasty, and facelifts. Ensuring the development of safe and reliable products is crucial for advancing this important surgical field. Biomaterials within plastic surgery are constantly evolving, focusing on continuous improvement. In 2022, the American Society of Plastic Surgeons released data indicating a substantial 19.0% increase in cosmetic surgeries compared to 2019, with 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures performed in the United States. The growth of plastic surgery highlights its increasing demand and significance in modern healthcare practices.

Key U.S. Biomaterials Company Insights

Leading companies invest heavily to broaden their reach and retain a competitive advantage. They employ agreements, partnerships, and collaborative models to enhance their product range. Furthermore, primary suppliers are leaning towards creating more innovative products to broaden their selection of biomaterials. For example, in April 2023, Novo Nordisk partnered with Aspect Biosystems, specializing in bioprinting biomaterials, to develop bioprinted tissue treatments for obesity and diabetes.

Key U.S. Biomaterials Companies:

- Medtronic plc

- Evonik Industries AG

- Carpenter Technology Corporation

- Berkeley Advanced Biomaterials

- Invibio Ltd.

- Zimmer Biomet Holdings, Inc.

- BASF SE

- Covalon Technologies Ltd.

- Stryker

- Johnson & Johnson

- Corbion

- Collagen Matrix, Inc.

Recent Developments

-

In October 2023, Evonik introduced VESTAKEEP iC4612 3DF and iC4620 3DF, the world's first carbon-fiber-reinforced PEEK filaments for 3D-printed medical implants, offering strength, flexibility, and adaptability. This innovation signifies Evonik's commitment to advancing patient-specific medical treatments.

-

In September 2023, BASF SE introduced bio-based 2-octyl acrylate with 73% 14C-traceable content, highlighting sustainability and reduced carbon footprint. The monomer offers performance advantages for applications, such as adhesives and coatings, using castor oil-derived 2-Octanol. Global registrations are ongoing.

-

In January 2023, Zimmer Biomet Holdings, Inc. announced plans to acquire Embody, Inc. for USD 155 million at closing, potentially increasing to USD 275 million based on future milestones. The deal can strengthen Zimmer Biomet's sports medicine portfolio, focusing on soft tissue healing solutions.

U.S. Biomaterials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 59.3 billion

Revenue forecast in 2030

USD 155.2 billion

Growth rate

CAGR of 14.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Medtronic plc; Evonik Industries AG; Carpenter Technology Corporation; Berkeley Advanced Biomaterials; Invibio Ltd.; Zimmer Biomet Holdings, Inc.; BASF SE; Covalon Technologies Ltd.; Stryker; Johnson & Johnson; Corbion; Collagen Matrix, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biomaterials Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biomaterials market based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallic

-

Natural

-

Ceramics

-

Polymers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Sensors

-

Stents

-

Guidewires

-

Implantable Cardiac Defibrillators

-

Pacemakers

-

Vascular Grafts

-

Others

-

-

Ophthalmology

-

Synthetic Corneas

-

Intraocular Lens

-

Contact Lens

-

Ocular Tissue Replacement

-

Others

-

-

Dental

-

Tissue Regeneration Materials

-

Dental Implants

-

Bone Grafts & Substitutes

-

Dental Membranes

-

Others

-

-

Orthopedic

-

Joint Replacement Biomaterials

-

Orthobiologics

-

Bioresorbable Tissue Fixation Products

-

Viscosupplementation

-

Spine Biomaterials

-

Others

-

-

Wound Healing

-

Fracture Healing Device

-

Adhesion Barrier

-

Skin Substitutes

-

Internal Tissue Sealant

-

Surgical Hemostats

-

Others

-

-

Tissue Engineering

-

Plastic Surgery

-

Facial Wrinkle Treatment

-

Soft Tissue Fillers

-

Craniofacial Surgery

-

Bioengineered Skins

-

Peripheral Nerve Repair

-

Acellular Dermal Matrices

-

Others

-

-

Neurology

-

Neural Stem Cell Encapsulation

-

Shunting Systems

-

Hydrogel Scaffold For CNS Repair

-

Cortical Neural Prosthetics

-

Others

-

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biomaterials market size was estimated at USD 59.3 billion in 2023.

b. The U.S. biomaterials market is expected to grow at a compound annual growth rate (CAGR) of 14.8% from 2024 to 2030 to reach USD 155.2 billion by 2030.

b. Orthopedic dominated the market and held the largest revenue share of 25.2% in 2023. A substantial portion of the population relies on various biomaterials within orthopedic treatments to address bone and joint degenerative issues.

b. Some prominent players in the U.S. biomaterials market include Medtronic plc, Evonik Industries AG, Carpenter Technology Corporation, Berkeley Advanced Biomaterials, Invibio Ltd. Among others.

b. The surge in the need for biomaterials is tied to an increase in accidental injuries and a higher incidence of chronic diseases. Moreover, the interest in innovative biomaterials has increased due to their expanding use in the replacement and repair of tissues, including bones, teeth, and other organs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."