U.S. Biogas Market Size, Share & Trends Analysis Report By Source (Municipal, Agricultural, Industrial), By Application (Vehicle Fuel, Electricity, Heat, Upgraded Biogas, Cooking Gas), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-220-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

U.S. Biogas Market Size & Trends

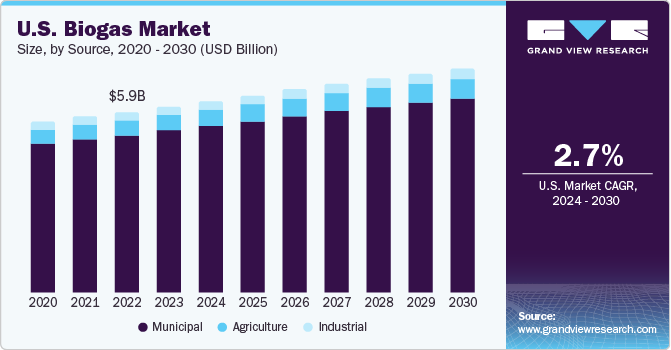

The U.S. biogas market size was estimated at USD 6.08 billion in 2023 and is projected to grow at a CAGR of 2.7% from 2024 to 2030. The growing demand for the product in applications, such as cooking gas, electricity, vehicle fuel, heat, and others, is expected to have a positive impact on the industry growth over the forecast period. Adoption and innovation of new technologies to propel the production of raw materials used to generate biogas in the U.S. are expected to boost the overall growth of biogas market in the region over the forecast period.

Other significant factors that are influencing the biogas market growth are favorable regulatory & political support, environmental support, customer support, geopolitical support, agricultural and economic support. The U.S. Department of Agriculture (USDA) and the Department of Energy (DOE) have detailed rules that enhance the use of biogas and addresses the U.S. renewable energy objectives. Furthermore, high demand for green fuels, stringent environmental regulations, and increased investment for the development of refineries are driving the market growth. The significant driver factors that have boosted U.S. market are technological advancement and awareness related to biogas used as a clean fuel. In October 2023, bp P.L.C announced commencement of operations of its first biogas plant following the acquisition of Archaea Modular Design (AMD) renewable natural gas (RNG) plant in Medora, Indiana, U.S. The plant is located near a landfill owned by Rumpke Waste and Recycling. The plant has a capacity to process 3,200 cubic feet of landfill gas per minute into RNG, which is enough to heat 13,026 homes in the U.S. annually. Rapid adoption of renewable energy for power generation and investments by the major players in the biogas market in the country are expected to foster market growth over the forecast period.

However, global biogas market faces a set of significant challenges that affect its growth, as well as the adoption of biogas. One of the foremost challenges is the high initial investments required for establishing biogas production facilities. The establishment of efficient biogas manufacturing plants involves considerable expenses for the development of necessary infrastructures, equipment, and technologies. These high investments often deter potential players from entering the market and restrict the growth of the market, particularly in regions with limited financial resources. Overcoming this challenge necessitates innovative financing solutions, public-private partnerships, and government incentives to make biogas projects financially accessible and attractive for potential investors and project developers.

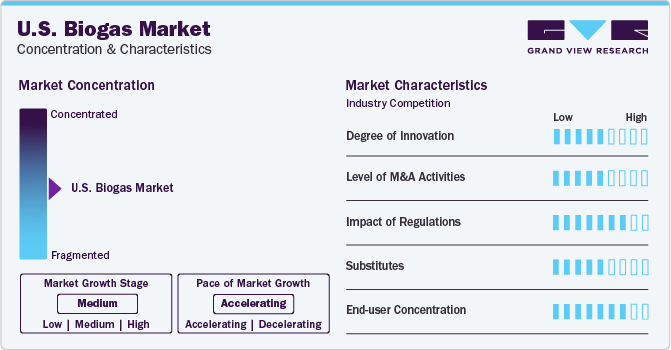

Market Concentration & Characteristics

The market is moderately consolidated in nature. The key players are adopting the following strategies such as production capacity expansion, collaboration or partnership agreement, and technology collaboration to get a strong hold of the market. R&D projects are running to smoothen the biogas production process however, the degree of innovation is low.

Players in the market are widely adopting merger and acquisition strategy to diversify their products, reduce risks & competition, and increase their profit margins and market share. For instance, in May 2023 TotalEnergies, a Texas company acquired a 20% stake in Ductor, a Finland based company engaged in the development and processing of high-nitrogen organic waste such as poultry manure.

The impact of regulations is positive for the market since the government is providing financial aids to the biogas plants. Government initiatives and concerns towards sustainable and green energies are further boosting the market. For instance, U.S.: The government of Ohio reintroduced the Agricultural Environmental Stewardship Act. The act aims to expand the biogas market by providing a 30% investment tax credit to help offset the upfront costs associated with building biodigester systems.

The threat of substitute for biogas primarily comes from other renewable energy sources such as wind, solar, and hydropower. However, the advantage of biogas is that it also helps in waste management simultaneously producing energy. This advantage makes threat of substitute moderate for the market.

Source Insights

The municipal segment dominated the market with a revenue share of 87% in 2023. In municipal source types, solid waste such as food waste, glass, yard trimmings, non-recyclable paper woody waste materials, rags, and sludge from wastewater is widely used as a feedstock to produce biogas. The growing usage of this municipal solid waste (MSW) in the production of biogas to reduce landfills, and greenhouse gas emissions is expected to support the market growth over the forecast period. Moreover, the increasing government focus on improving the economic viability of municipal solid waste-to-energy facilities is further anticipated to fuel the growth of the market in the coming years. The market for landfill biogas is flourishing worldwide due to the rise in the global electricity consumption. Ongoing advancements in urban garbage management in U.S. are expected to fuel the growth of the market in the coming years. According to the U.S. Environmental Protection Agency, the country has approximately 2,600 operating municipal solid waste (MSW) landfills. Of these, more than 530 landfills use biogas in some capacity for recovery. There are 470 more landfills in the U.S. that are suitable for waste-to-energy conversion.

The industrial segment is expected to witness the fasted growth of 3.7% over the forecast period. The growing interest in finding effective means to obtain bio-products and biofuel from industrial food waste coupled with an increasing need for wastewater treatment in the industrial sector is expected to fuel the market demand over the forecast period. Moreover, the growing trend of the circular economy, particularly in European countries, is shifting the focus of food and beverage industries towards proper management of food waste to attain a zero-waste economy. Therefore, companies such as PepsiCo, Inc., and Unilever plc have started directing some food waste to biogas production to generate power for manufacturing units.

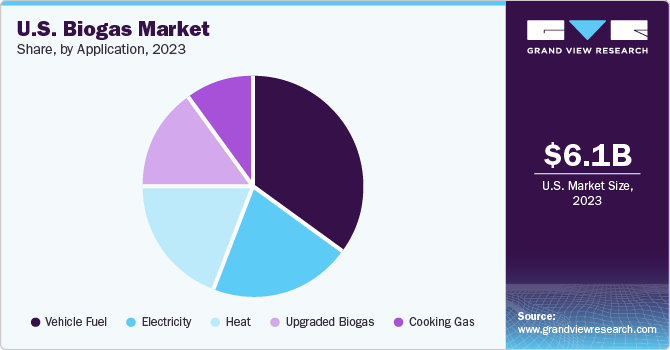

Application Insights

The vehicle fuel segment dominated the market with a revenue share of 35% in 2023. The growing awareness of greenhouse emissions in the transportation sector coupled with various stringent regulations laid by the government are driving the demand for biogas in vehicle fuel application. Transportation accounts for 30% of global energy use and switching to biogas as an alternative vehicle fuel can help in reducing greenhouse gas emissions between 60% and 80% in the transport sector as compared to fossil-based fuels like diesel and gasoline. Therefore, US has been promoting the usage of biogas-driven trucks, cars, and buses by the combination of investment subsidies, tax exemptions, and incentives for biogas injection into the natural gas grid. These factors are expected to fuel the market demand in the coming years.

The heat segment is expected to expand at the fastest during the forecast period. The reason behind this growth is wide usage of biogas for heating purposes in the industrial as well as the domestic sector for increasing thermal energy production and water heating application. The biogas production through the anaerobic decomposition process of organic material is used to generate heat via combined heat and power gas engine (CHP). The heat is recovered from heat exchangers embedded into cooling and exhaust systems of CHP engine during the combustion process of organic materials which helps in reducing energy costs as well as emissions compared to conventional electrical generators and onsite boilers.

Key U.S. Biogas Companies Insights

The market is moderately competitive. The threat of new entrants is low owing to the high capital requirements since building and operating an efficient biogas requires substantial investment. Additionally, regulatory compliance and expertise in waste management & biogas technologies is essential making it challenging for newcomers to establish a foothold in the market.

Key U.S. Biogas Companies:

- Air Liquide

- Bright Renewables

- PlanET Biogas

- TotalEnergies

- Xebec Adsorption Inc.

Recent Development

-

In September 2023, Bright Renewables made a substantial stride in Germany with an expansion of three biogas projects. These projects are expected to help the company expand its footprint across the globe.

-

In August 2023, TotalEnergies signed a 100 GWh biomethane purchase agreement with Saint-Gobain France for a three-year period starting in 2024. This deal is seen as company’s first step towards emergence in Europe of a merchant biomethane market, allowing the development of production without public subsidies.

-

In July 2022, Air Liquid announced the operations of its first biomethane production unit in China. The company aims expand its operations globally with this expansion.

U.S. Biogas Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.26 billion |

|

Revenue forecast in 2030 |

USD 7.34 billion |

|

Growth Rate |

CAGR of 2.7% from 2024 to 2030 |

|

Actual data |

2018- 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, application |

|

Key Companies |

Air Liquide; Bright Renewables; PlanET Biogas; TotalEnergies; Xebec Adsorption Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Biogas Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global biogas market report based on source, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Landfill

-

Wastewater

-

-

Industrial

-

Food Scrap

-

Wastewater

-

-

Agricultural

-

Dairy

-

Poultry

-

Swine Farm

-

Agricultural Residue

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Vehicle Fuel

-

Electricity

-

Heat

-

Upgraded Biogas

-

Cooking Gas

-

Frequently Asked Questions About This Report

b. The U.S. biogas market was valued at USD 6.08 billion in the year 2023 and is expected to reach USD 6.26 billion in 2024.

b. The U.S. biogas market is expected to grow at a compound annual growth rate of 2.7% from 2024 to 2030 to reach USD 7.34 billion by 2030.

b. The municipality segment emerged as a dominating segment in the market with over a share of 87% in 2023 due to growing usage of this municipal solid waste (MSW) in the production of biogas to reduce landfills, and greenhouse gas emissions.

b. The key market player in the U.S. biogas market includes Air Liquide; Bright Renewables; PlanET Biogas; TotalEnergies; and Xebec Adsorption Inc.

b. The key factors that are driving the U.S. biogas market include, shift towards low-carbon fuels and the presence of stringent environmental regulations in U.S.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."