- Home

- »

- Pharmaceuticals

- »

-

U.S. Biodefense Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Biodefense Market Size, Share & Trends Report]()

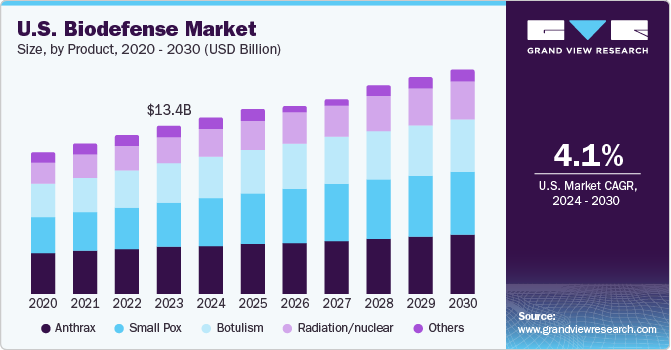

U.S. Biodefense Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Anthrax, Small Pox, Botulism, Radiation/nuclear), And Segment Forecasts

- Report ID: GVR-4-68040-313-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Biodefense Market Size & Trends

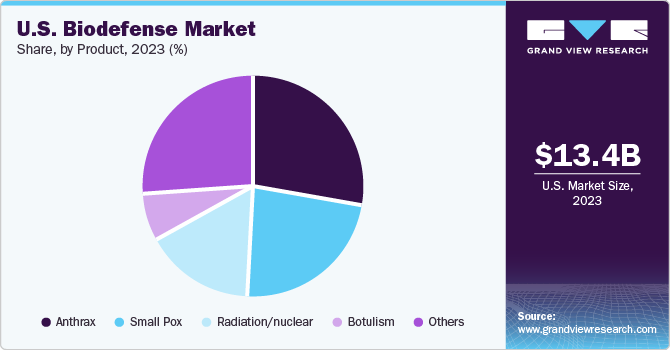

The U.S. biodefense market size was estimated at USD 13.4 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. With increasing incidents of bioterrorism and the potential for new and emerging infectious diseases, governments and organizations worldwide are investing more in biodefense to protect public health and safety. The governments are providing significant funding and support to the biodefense market to enhance research, development, and production of countermeasures against these biological threats. According to a press release by the U.S. Department of State, in October 2022, its administration released its National Biodefense Strategy that established a roadmap to help plan and protect against future biological threats. It outlined the vision of the government to transform the ability to prevent, detect, and prepare for outbreaks.

Partnerships between the public and private sectors have played a crucial role in advancing research, development, and deployment of biodefense solutions, further fueling market growth. Favorable regulatory environments and policies that encourage innovation and investment in the biodefense market contribute to its growth. Moreover, the U.S. government establishes policies and strategies to guide biodefense efforts through organizations such as the Department of Health and Human Services. In April 2024, the Bipartisan Commission on Biodefense is expected to launch an event called ‘2024 National Blueprint on Biodefense,’ which optimized the efforts to prevent, prepare, and respond to naturally occurring biological events. These policies help coordinate efforts among various government agencies, private sector partners, and international collaborators to enhance the nation's biodefense capabilities.

In October 2022, The U.S. government announced a new biodefense strategy aiming to strengthen the nation's defenses against future pandemics and biological threats, with a key objective of developing vaccines within 100 days of outbreaks. The strategy emphasized the administration's focus on driving the healthcare workforce, enhancing international collaborations for vaccine distribution, and reinforcing laboratory safety measures.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The country witnessed a rise in infectious diseases, bioterrorism threats, and the potential for pandemics. The COVID-19 pandemic highlighted the need for robust biodefense measures to protect public health and ensure national security. This increased awareness of health risks drives the demand for better diagnostic tools, vaccines, and treatments, fueling market growth. Many countries' governments remain committed to collaborating with several international partners to support response activities and increase preparedness, eventually driving the global biodefense market. For instance, as of November 17, 2019, an experimental single-dose Ebola vaccine manufactured by Merck under the name rVSV-ZEBOV-GP has been authorized for safe usage by both the World Health Organization (WHO) and the Ministry of Health in the Democratic Republic of the Congo (DRC). Roughly 250,000 individuals who are at risk of contracting Ebola have received this vaccine.

The U.S. biodefense market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Combining resources and expertise through mergers allows companies to operate more efficiently and cost-effectively. By consolidating research facilities, manufacturing capabilities, and distribution networks, companies can reduce overhead costs and improve profitability, making them more competitive in the market. In April 2022, Elusys Therapeutics Inc. was acquired by Heat Biologics (Nighthawk Biosciences, Inc.) to advance the commercialization of novel biopharmaceuticals and vaccines. In addition, through partnerships with the U.S. government, Elusys has provided Anthim (obiltoxaximab) to the U.S. Strategic National Stockpile (SNS), the government's repository of essential medical resources for biowarfare readiness.

The U.S. biodefense market is also subject to increasing regulatory scrutiny. The Department of Health and Human Services (HHS) plays a significant role in biodefense through its agencies, such as the Biomedical Advanced Research and Development Authority (BARDA) and the National Institutes of Health (NIH). BARDA is responsible for the advanced research and development of medical countermeasures against chemical, biological, radiological, and nuclear threats. The NIH supports biodefense research through its institutes, such as the National Institute of Allergy and Infectious Diseases (NIAID) and the National Institute of General Medical Sciences (NIGMS).

In June 2020, SIGA Technologies announced its first international delivery of Tpoxx (tecovirimat) to the U.S. This helped the organization expand and increase its reach. Regional expansion in the U.S. biodefense market fosters innovation, creates jobs, enhances collaboration, and improves preparedness and response capabilities. This growth can lead to a stronger and more resilient biodefense infrastructure.

Product Insights

Anthrax dominated the market and accounted for a share of 28.1% in 2023. Bacillus anthracis is a gram-positive bacterium that causes anthrax. It is one of the most used weapons for a bioterrorist attack. Anthrax has a mortality rate of around 80-90% if left untreated. This high lethality makes anthrax a significant concern for bioterrorism and emphasizes the need for effective biodefense measures. In July 2023, EMERGENT announced FDA approval for CYFENDUS (Adjuvanted, Anthrax Vaccine Adsorbed) for use in individuals aged 18-65 following suspected or confirmed exposure to Bacillus anthracis when given alongside recommended antibacterial drugs. CYFENDUS's efficacy for post-exposure prophylaxis is supported exclusively by animal model studies.

The radiation/nuclear segment is expected to register a CAGR of 4.7% over the forecast period. The possibility of nuclear terrorism, where radioactive materials are used as weapons, has become a major concern for security. Biodefense plays a crucial role in addressing these threat by developing strategies to detect, prevent, and respond to potential attacks. Moreover, radioactive materials released during nuclear accidents or acts of terrorism can contaminate the environment, posing long-term risks to human health and ecosystems. Biodefense strategies can help mitigate these risks by developing methods to remediate contaminated areas and minimize the spread of radioactive materials.

Key U.S. Biodefense Company Insights

Some of the key companies operating in the U.S. biodefense market include XOMA Corporation, Altimmune Inc., Emergent BioSolutions, Inc., and Dynavax Technologies Corporation.

-

XOMA engages in discovering, developing, and manufacturing antibody therapeutics targeting inflammatory, autoimmune, infectious, and cancerous ailments. Within its proprietary product pipeline, XOMA features XOMA 052, an antibody against IL-1 beta, and XOMA 3AB, a candidate anti-botulism antibody for biodefense purposes.

Key U.S. Biodefense Companies:

- XOMA Corporation

- Altimmune, Inc.

- EMERGENT

- Dynavax Technologies

- SIGA Technologies.

- Elusys Therapeutics Inc.

- Ichor Medical Systems

- Dynport Vaccine Company (General Dynamics Information Technology, Inc.)

- Cleveland Biolabs

- Bavarian Nordic

- Ology Bioservices, Inc.

- Alnylam Pharmaceuticals, Inc.

Recent Developments

-

In September 2022, EMERGENT obtained exclusive global rights to Tembexa, the inaugural oral antiviral sanctioned by the U.S. Food and Drug Administration (FDA) for smallpox treatment.

-

In August 2022, the U.S. Department of Health and Human Services (HHS) allocated USD 11 million to facilitate the inaugural U.S.-based fill-and-finish manufacturing of Jynneos, a vaccine employed for smallpox and monkeypox prevention.

-

In April 2021, National Resilience, Inc.'s acquisition of Ology Bioservices boosted its biopharmaceutical manufacturing capabilities with skilled personnel, expansive facilities, and a substantial government contract portfolio.

U.S. Biodefense Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.90 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

XOMA Corporation; Altimmune, Inc.; EMERGENT; Dynavax Technologies; SIGA Technologies.; Elusys Therapeutics Inc.; Ichor Medical Systems; Dynport Vaccine Company (General Dynamics Information Technology, Inc.); Cleveland Biolabs; Bavarian Nordic; Ology Bioservices, Inc.; Alnylam Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Biodefense Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. biodefense market report based on product:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Anthrax

-

Smallpox

-

Botulism

-

Radiation/nuclear

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. biodefense market size was valued at USD 13.4 billion in 2023.

b. The U.S. biodefense market is projected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030 to reach USD 17.90 billion by 2030.

b. Anthrax dominated the market, accounting for a share of 28.1% in 2023. Bacillus anthracis is a gram-positive bacterium that causes anthrax. It is one of the most used weapons for a bioterrorist attack. If left untreated, anthrax has a mortality rate of around 80-90%. This high lethality makes anthrax a significant concern for bioterrorism and emphasizes the need for effective biodefense measures.

b. Some of the key companies operating in the U.S. biodefense market include XOMA Corporation; Altimmune Inc.; Emergent BioSolutions, Inc.; and Dynavax Technologies Corporation.

b. With increasing incidents of bioterrorism and the potential for new and emerging infectious diseases, governments and organizations worldwide are investing more in biodefense to protect public health and safety. The governments are providing significant funding and support to the biodefense market to enhance research, development, and production of countermeasures against these biological threats.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.