U.S. Bioanalytical Testing Services Market Size, Share & Trends Analysis Report By Molecule (Small Molecule, Large Molecule), By Test, By Workflow, By End-use (Pharma & BioPharma Companies, CDMO, CRO), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-292-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. bioanalytical testing services market size was estimated at USD 1.98 billion in 2024 and is expected to grow at a CAGR of 9.33% from 2025 to 2030. The growth of the U.S. bioanalytical testing services industry is driven by several factors, such as the rising drug development and approval process, growing demand for biologics, biosimilars, and gene therapies, and rising outsourcing of testing services. In addition, Stringent FDA regulations are driving the need for precise bioanalytical testing. Furthermore, the expansion of bioanalytical testing facilities is another key aspect driving the market growth.

Several industry players and biopharmaceutical companies are investing significantly to upgrade and expand their testing infrastructure to meet the growing demand for advanced bioanalytical services. Moreover, a surge in the number of complex biologics, biosimilars, gene therapies, and personalized medicine development is further creating the need for sophisticated testing platforms to perform complex bioanalyses, such as pharmacokinetics, biomarker discovery, and immunogenicity assessments.

Moreover, several service providers are developing state-of-the-art facilities integrated with high-resolution mass spectrometry (HRMS), NGS, and automation technologies to offer faster, more accurate, and cost-effective bioanalytical testing, further propelling market progression. For instance, in September 2024, Laboratory Corporation of America Holdings announced the completion expansion of its laboratory in Greenfield. The expansion aimed to o support the development and validation of preclinical and clinical molecular bioanalytical testing services for advanced therapies, including cell and gene therapies for rare diseases, oncology, and other therapeutic areas. This expansion offered a competitive advantage to the firm.

Increasing regulatory control and awareness regarding the importance of bioanalytical testing are key factors propelling the growth of the bioanalytical testing service market. The introduction of stringent guidelines on drug development, particularly in pharmacokinetics, pharmacodynamics, and bioequivalence testing by several regulatory agencies, such as the U.S. FDA and EMA, leads to a rising preference for outsourcing. These guidelines highlight the need for precise and reliable bioanalytical methods to enhance the safety and efficacy of new drugs & biosimilars. For instance, the U.S. FDA’s Bioanalytical Method Validation Guidance provides clear standards for method development, validation, and sample analysis, which have driven pharmaceutical companies to seek specialized expertise from contract service providers. Moreover, the market participants assist sponsors in complying with regulatory requirements by offering advanced analytical platforms and standardized protocols, driving market demand.

Likewise, technological advancements and growing R&D investments are key factors driving the U.S. bioanalytical testing service industry growth. The continuous developments of innovative technologies, such as High-Throughput Screening (HTS), Liquid Chromatography-Mass Spectrometry (LC-MS), and Next-generation Sequencing (NGS), have significantly enhanced the precision, speed, and sensitivity of bioanalytical testing. These innovations assist service providers in conducting more complex studies and gaining accurate data on drug efficacy, safety, and pharmacokinetics, among others. Moreover, integrating automation and Artificial Intelligence (AI) into bioanalytical workflows streamlined processes, reduced human error, and improved throughput. Such factors are anticipated to drive the market over the estimated period.

Opportunity Analysis

The U.S. bioanalytical testing services industry is expected to benefit from several emerging trends and technological advancements. AI and ML are expected to revolutionize bioanalytical testing by enabling predictive analytics, optimizing method development, enhancing data interpretation, and automating routine tasks. Enhanced miniaturization and portability of analytical devices will make them more accessible for point-of-care and field applications. The expansion of Multiomics and systems biology will provide comprehensive insights into biological systems, supporting the development of personalized medicine and targeted therapies. The importance of developing sustainable and green analytical techniques is growing, with a focus on reducing solvent usage, energy consumption, and waste generation to support global sustainability goals. Furthermore, quantum computing holds the potential to transform data processing and analysis in bioanalytical testing, enabling the handling of complex datasets with unprecedented speed and accuracy

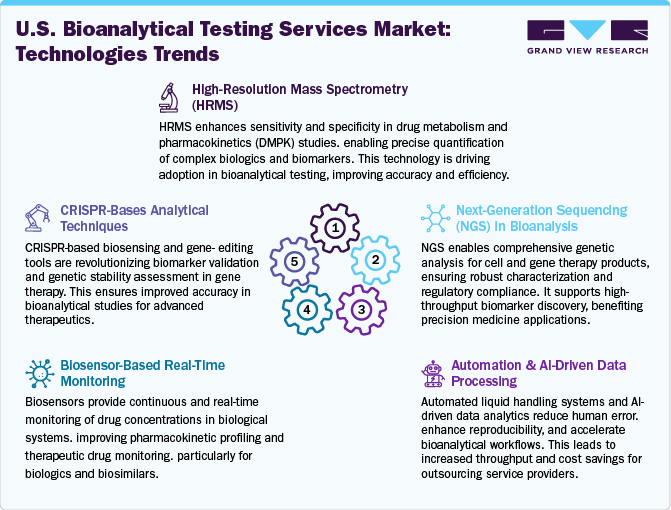

Technological Advancements

The bioanalytical testing services market is witnessing significant technological advancements aimed at enhancing sensitivity, throughput, and data integration. HRMS offers unparalleled accuracy in mass determination, enabling the detection of low-abundance analytes and complex mixtures. Ultra-High-Performance Liquid Chromatography (UHPLC) reduces analysis time while increasing resolution and sensitivity, facilitating high-throughput workflows. Automation and AI integration optimize method development, data analysis, and predictive maintenance of instruments, leading to smarter and more efficient laboratories. Advanced sample preparation techniques, such as microextraction and Solid-Phase Extraction (SPE), enhance sample cleanup processes, improving data quality and reproducibility. In addition, the integration of Multiomics data-combining genomics, proteomics, and metabolomics-provides comprehensive insights into biological systems, supporting personalized medicine and biomarker discovery.

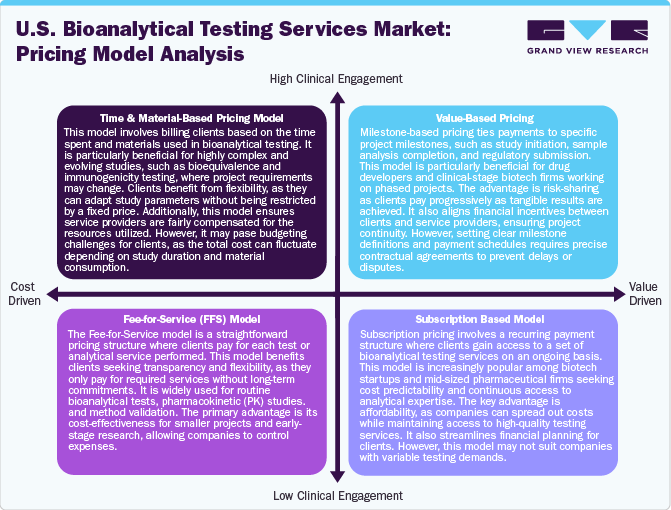

Pricing Model Analysis

The bioanalytical testing services market incorporates a wide range of specialized analytical services significant for the pharmaceutical, biotechnology, and medical device industries. Pricing models within this market are pivotal in determining competitiveness, profitability, and client satisfaction. A pricing model defines how a company sets the price for its services based on several factors, including costs, value delivered, competition, and customer demand. In the bioanalytical testing services market, selecting an appropriate pricing model is essential to balance profitability with market competitiveness and client needs. Among the pricing model, the cost-plus pricing is an up-front and widely utilized pricing strategy in which a company calculates the total cost of delivering a service, including both direct and indirect expenses, and then adds a predetermined percentage markup to establish the closing price charged to the client. This model ensures that all operational costs are covered while also guaranteeing a consistent profit margin.

Besides, value-based pricing sets prices primarily based on the perceived value to the customer rather than solely on the costs incurred to provide the service. Similarly, bundled pricing requires packaging multiple services and offering them at a combined price, often at a discounted rate, as compared to purchasing each service individually. This approach aims to provide comprehensive solutions to clients while enhancing the provider's sales volume. Moreover, subscription-based pricing involves clients paying a recurring fee monthly, quarterly, or annually to access a set of services or a specified volume of testing.

Market Concentration & Characteristics

The U.S. bioanalytical testing services market growth stage is medium, and growth is accelerating. The market is characterized by regulatory considerations, evolving technologies, materials innovation, and globalization & outsourcing of services.

Bioanalytical testing services are advancing with automation, AI-driven data analysis, and high-resolution mass spectrometry to improve accuracy and efficiency. The market innovations emphasizing biosimilars, gene therapies, and personalized medicine have accelerated the adoption of testing services. Besides, microfluidic-based assays for rapid biomarker detection, NGS for genetic analysis, and LC-MS/MS enhancements for ultra-sensitive quantification are some of the ongoing innovations in the market. Stringent FDA regulations are expected to further drive innovation in bioanalytical testing services.

Regulatory bodies, such as the U.S. FDA, continually upgrade their regulatory guidelines by enforcing GLP, bioequivalence, and validation guidelines. Compliance with ICH M10 ensures accuracy in drug development. Increasing oversight of biosimilars, gene therapies, and personalized medicine enhances data integrity, standardization, and reliability across bioanalytical testing services.

Mergers and acquisitions (M&A) are increasing as companies seek to expand service portfolios, integrate advanced technologies, and strengthen regulatory expertise. Growing demand for specialized testing in biosimilars and gene therapy development is fueling strategic acquisitions further improving capabilities, and compliance with evolving FDA regulations.

The U.S. bioanalytical testing market is moderately fragmented, comprising global CROs, specialized labs, and emerging niche players. New market entrants are enhancing service offerings, ensuring quality assurance, regulatory compliance, and greater competition.

U.S. bioanalytical testing services are experiencing substantial regional expansion, driven by the growth of the pharmaceutical & biotechnology industry, decentralized clinical trials, and increased investments in advanced laboratories. Key states such as Boston, California, and the Midwest are witnessing increased demand, driven by the growing need for innovative therapeutic solutions.

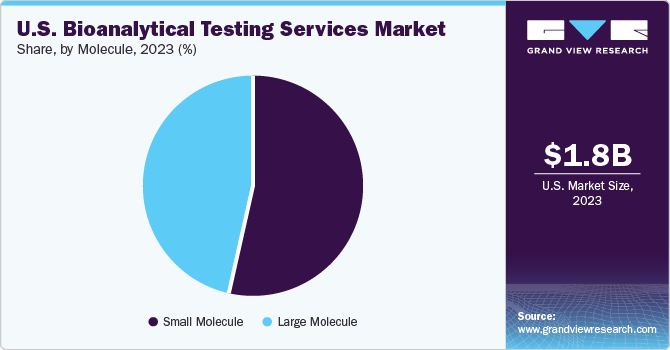

Molecule Insights

Based on molecule, the market is classified into small molecule, and large molecule. The large molecule segment is further divided into LC-MS studies, immunoassays, and others. Immunoassays include Pharmacokinetics (PK), ADA assays, and others. Small molecules held the largest share in 2024. Growth of the segment can be attributed to medical breakthroughs related to small molecules and unmet medical needs. Besides, stringent regulatory requirements, rising demand for generic drugs, and increasing complexity of therapeutics are expected to drive the segment growth. In addition, increasing focus on bioequivalence studies, growing demand for personalized medicine, and expanded outsourcing services contribute to market growth. Besides, bioanalytical testing of small molecules is crucial for gaining insights into their ADME properties, determining the appropriate dosage, evaluating the therapeutic effectiveness, and safeguarding patient well-being. Thus, with the growing pharmaceutical & biopharmaceutical pipelines, the small molecule is anticipated to witness robust demand for bioanalytical testing services to ensure compliance, efficacy, and market approval.

The large molecule segment is expected to grow at a lucrative CAGR over the analysis timeframe. Bioanalytical testing of large-molecule drugs is crucial in expanding the drug development process from research to market. In recent years, the demand for large-molecule therapeutics has increased due to their enhanced potency and reduced toxicity, making them a preferred option for innovative treatments. Besides, a unique combination of innovative technologies in bioanalytical testing services provides a workflow with quantitative accuracy & sensitivity, which drives the segment growth. Moreover, numerous pharmaceutical companies are expanding their portfolio of large-molecule drugs. For instance, BioAgilytix expanded its bioanalytical testing capabilities, specializing in large molecule bioanalysis, benefitting from a bioanalytical laboratory focusing on all phases of biologics drug development from drug discovery to commercial. With the rising demand for biology pipelines, the segment is expected to grow significantly over the forecast period.

Test Insights

Based on test, the market is segregated into ADME, pharmacokinetics (PK), pharmacodynamics (PD), bioavailability, bioequivalence, biomarker testing, cell-based assay, virology testing, and other tests. The ADME tests segmented into in-vivo, and in-vitro. The bioavailability segment accounted for the largest market share in 2024. The segment growth is driven by stringent FDA regulations, technological advancements, increasing demand for generics and biosimilars, and improving precision in drug absorption analysis. These studies support identifying drug efficacy and bioequivalence for regulatory approval, ensuring consistent therapeutic effects across formulations. Moreover, these studies offer significant advantages in drug administration and aid in establishing equivalence between early and late clinical trial formulations. This technique helps to ensure therapeutic equivalence between a pharmaceutically equivalent test drug & a generic/reference drug. Thus, the demand for bioavailability studies and a strong demand for generic products are rising, boosting the need for bioavailability studies.

The ADME segment is expected to grow at the fastest CAGR over the forecast period. ADME ideally provides information on the absorption, distribution, metabolism, and excretion of novel compounds, determined via a suite of bioanalytical services. It is ideally studied in vitro & in vivo to assess the pharmacokinetic profile. Furthermore, technological advancement in ADME supports enhanced sensitivity, selectivity, and ease of automation relative to traditional analytical methods. For instance, in March 2024, Eurofins Discovery launched new DiscoveryAI SAFIRE predictions for in-silico refinement and evaluation. It is a suite of absorption, distribution, metabolism, excretion, and toxicity (ADMET). Besides, it is a platform leveraging datasets, Machine Learning (ML), and Artificial Intelligence (AI), offering a capability for expediting discovery.

Workflow Insights

Based on workflow, the market is segregated into sample collection and preparation, method development and validation, sample analysis, and other processes. Sample analysis accounted for the largest revenue share in 2024. Some key factors contributing to the growth are increasing requirements for quantification and identification of drugs and the growing availability of advanced techniques such as LC-MS/MS to ensure accuracy in the studies, further supporting drug development, regulatory approval, and therapeutic monitoring. In addition, the analysis helps determine the concentration of chemical elements or compounds. This workflow aids in accurately assessing drug molecule stability and identifying impurities that are present in the sample. Sample analysis can help with Pharmacokinetic (PK) studies, further supporting market growth.

On the other hand, the sample collection and preparation segment growth can be attributed to the rise in the identification and quantification of an analyte from a biological sample. It is an analytical step that contains extraction procedures to help extract the component required from the matrix. Being one of the earliest stages of the analytical method, selecting a suitable sample preparation technique is vital to obtain accurate and reliable downstream measurements. Thus, sample preparation refers to an analytical aspect that consists of extraction procedures that aid in extracting the component needed from the matrix. This process differs based on convenience, degree of selectivity, speed, and configuration of the extraction phase.

End-use Insights

Based on end use, the market is segregated into pharma & biopharma companies, CDMO, CRO, and others. The pharma & biopharma companies segment dominated in 2024 and is expected to grow at the fastest CAGR during the forecast period. Pharmaceutical and biopharmaceutical companies are witnessing increased demand for bioanalytical testing services as these companies focus on producing lifesaving drugs for various diseases. Therefore, the bioanalytical testing services market holds immense importance for producing personalized medicine and patient care among pharmaceutical and biopharmaceutical companies. Moreover, the growing focus on drug development & assessing PK, PD, and toxicity data for drug safety and efficacy, supporting regulatory decisions, drives the segment growth. Besides, increasing requirement for bioanalytical testing services with sensitivity, speed, accuracy, and cost efficiency is expected to drive the segment growth over the estimated period. Furthermore, the presence of small and midsized biopharmaceutical companies that offer end-to-end functions to bioanalytical testing services contributes to market growth.

In addition, CROs are expected to witness lucrative growth over the forecast period. The growing number of large and small molecule-based therapeutics coming to the U.S. market has increased requirements for bioanalytical testing services with standard regulation compliance, meeting a wide range of international standards and guidelines for evaluating extremely sensitive drug samples. Besides, growing complex innovations in the CRO have caused a rise in demand for quality and technologically advanced bioanalytical testing services from preclinical to clinical and commercial scales, further expanding the market growth.

Key U.S. Bioanalytical Testing Services Company Insights

Market players are undertaking various strategic initiatives, such as the launch of new product partnerships, collaborations, and mergers & acquisitions, to strengthen their service portfolio and provide a competitive advantage. For instance, in July 2024, Charles River Laboratories International, Inc. entered into a collaboration agreement with the FOXG1 Research Foundation (FRF) to accelerate drug development through the clinical phase for FOXG1 syndrome. Such innovations are expected to drive the market over the estimated time period.

Key U.S. Bioanalytical Testing Services Companies:

- Thermo Fisher Scientific, Inc.

- ICON plc

- Charles River Laboratories International, Inc.

- Laboratory Corporation of America Holdings.

- IQVIA Inc.

- Syneos Health

- SGS SA

- Intertek Group Plc

- Pace Analytical Services, LLC

- Medpace Holdings, Inc.

- North America Science Associates Inc. (NAMSA)

Recent Developments

-

In March 2025, NAMSA announced the acquisition of WuXi AppTec's U.S. medical device testing operations. This acquisition will unite two companies specializing in biological safety testing for medical devices, benefiting over 4,000 manufacturers worldwide.

-

In August 2024, SGS introduced its new specialized bioanalytical testing services in Hudson, New Hampshire, North America. Through these services, the company provides advanced bioanalytical services to both biopharmaceutical and pharmaceutical companies.

-

In March 2024, Pace Analytical Services announced the acquisition of Lebanon, a New Jersey laboratory facility from Curia. The acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry.

U.S. Bioanalytical Testing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.17 billion |

|

Revenue forecast in 2030 |

USD 3.39 billion |

|

Growth rate |

CAGR of 9.33% from 2025 to 2030 |

|

Historical year |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Molecule, test, workflow, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; ICON plc; Charles River Laboratories International, Inc.; Laboratory Corporation of America Holdings; IQVIA; Syneos Health; SGS SA; Intertek Group plc; Pace Analytical Services LLC; Medpace Holdings, Inc.; North America Science Associates Inc. (NAMSA) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Bioanalytical Testing Services Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bioanalytical testing services market report based on molecule, test, workflow, and end-use:

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

LC-MS Studies

-

Immunoassays

-

Pharmacokinetics (PK)

-

ADA Assay

-

Other immunoassays

-

-

Other Large Molecule Tests

-

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

ADME

-

In-vivo

-

In-vitro

-

-

Pharmacokinetics (PK)

-

Pharmacodynamics (PD)

-

Bioavailability

-

Bioequivalence

-

Biomarker Testing

-

Cell-based Assay

-

Virology Testing

-

Other Tests

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Collection and Preparation

-

Sample Collection, Handling and Storage

-

Protein Precipitation

-

Liquid-Liquid Extraction

-

Solid Phase Extraction

-

Others

-

-

Method Development and Validation

-

Sample Analysis

-

Hyphenated Technique

-

Chromatographic Technique

-

Electrophoresis

-

Ligand Binding Assay

-

Mass Spectrometry

-

Spectroscopic Techniques

-

Nuclear Magnetic Resonance (NMR)

-

Others

-

-

Genomic and Molecular Techniques

-

Polymerase Chain Reaction (PCR)

-

Next-Generation Sequencing (NGS)

-

Others

-

-

-

Other Processes

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & BioPharma Companies

-

CDMO

-

CRO

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bioanalytical testing services market size was estimated at USD 1.98 billion in 2024 and is expected to reach USD 2.17 billion in 2025.

b. The U.S. bioanalytical testing services market is expected to grow at a compound annual growth rate of 9.33% from 2025 to 2030 to reach USD 3.39 billion by 2030.

b. Based on molecule, small molecule segment dominated the U.S. bioanalytical testing services market with a share of 53.20% in 2024. The segment growth is attributable to increasing generic drug approvals, stringent FDA bioequivalence requirements, and rising outsourcing trends. Continuous advancements in LC-MS/MS technology enhance pharmacokinetics, drug metabolism studies, and regulatory compliance, driving market growth.

b. Some key players operating in the U.S. bioanalytical testing services market include Thermo Fisher Scientific, Inc., ICON plc, Charles River Laboratories International, Inc., Laboratory Corporation of America Holdings, IQVIA, Syneos Health, SGS SA, Intertek Group plc, Pace Analytical Services LLC, Medpace Holdings, Inc., North America Science Associates Inc. (NAMSA).

b. Key factors that are driving the market growth include a rising biopharmaceutical R&D, increasing regulatory scrutiny, growing demand for biosimilars and cell therapies, advancements in analytical technologies, outsourcing trends, personalized medicine growth, and the need for high-throughput, cost-efficient, and compliant bioanalytical solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."