Market Size & Trends

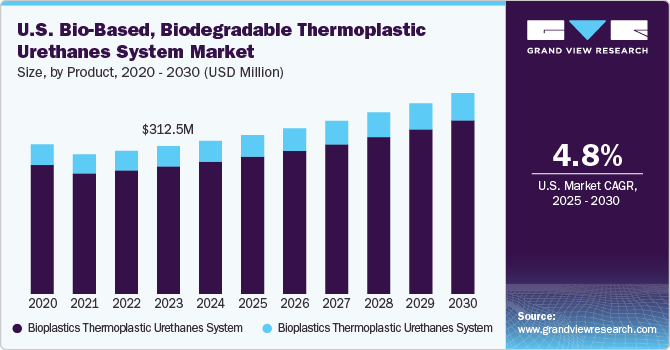

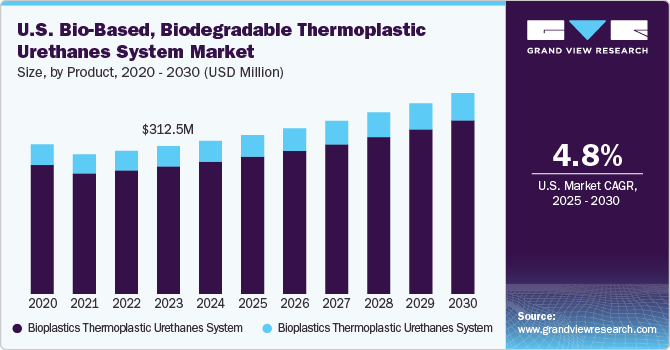

The U.S. bio-based, biodegradable thermoplastic urethanes system market size was estimated at USD 323.74 million in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2030. The market is primarily driven by the growing ecommerce sector, which is increasing the demand for consumer electronics and the packaging needed for various products. Moreover, the rising adoption of bio-based and biodegradable thermoplastic urethanes by several building & construction companies across the country is likely to fuel market growth.

A significant trend in the market is the increasing demand for the product in automotive industry. The automotive industry in the U.S. has been experiencing a significant shift towards lightweight, durable, and high-performance materials, with thermoplastic polyurethanes (TPUs) emerging as a key material in this transformation.

Drivers, Opportunities & Restraints

The expanding automotive and footwear industries are key drivers for the market. The rise of electric vehicles (EVs) and simultaneously increasing sales of EVs in the U.S. is anticipated to open new opportunities for TPU applications. EVs require materials that can withstand high temperatures, provide excellent electrical insulation, and offer durability in challenging environments. Moreover, the expansion of the footwear industry is a significant driving factor in the growth of the U.S. thermoplastic polyurethanes (TPU) market. TPUs are highly favored in footwear manufacturing due to their unique properties such as flexibility, durability, and abrasion resistance.

The growth in sustainable solutions presents a significant opportunity for the market. Consumers and industries are progressively prioritizing environmentally friendly products, prompting manufacturers to invest in bio-based and biodegradable TPUs.As legislation such as the U.S. Green New Deal gains traction, industries are incentivized to adopt greener alternatives, further boosting the bio-based TPU market segment.

Despite its potential, the high production cost represents a significant restraint for the market. Moreover, the scaling up of production for bio-based and biodegradable TPUs remains a challenge. While there has been significant advancement in technology, the large-scale production infrastructure for these materials is still limited in the U.S. Investments in specialized equipment, research and development, and skilled labor further increase the overall cost of production.

Product Insights

Based on product, the market has been segmented into conventional and bioplastics. The conventional segment accounted for the largest revenue share of 86.40%in 2024. Conventional TPUs are typically produced by reacting diisocyanates, polyols, and chain extenders, leading to polymers with excellent elasticity, toughness, and resistance to abrasion. These TPUs offer a range of mechanical properties such as flexibility, high tensile strength, and impact resistance, making them suitable for general-purpose applications in diverse sectors, from footwear to automotive parts.

The bioplastics segment is expected to grow at the fastest CAGR during the forecast period. The segment is experiencing significant growth due to increasing environmental concerns and stricter regulations on plastic use worldwide. These materials offer a more sustainable alternative to traditional petroleum-based TPUs, combining the performance characteristics of conventional thermoplastic polyurethanes with improved environmental credentials.

End Use Insights

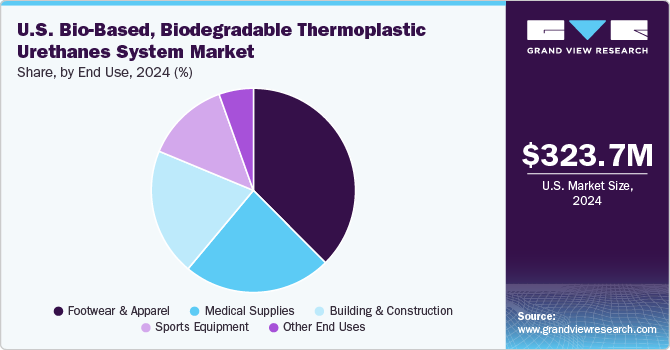

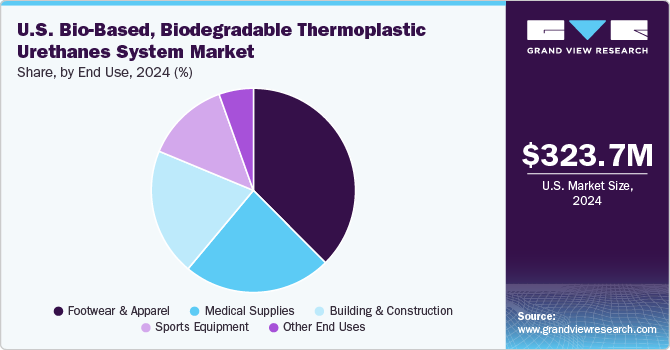

The industrial segment dominated the U.S. bioplastics TPU market, accounting for 87.02% in 2023 and is expected to grow at a significant CAGR over the forecast period. In the industrial sector, automotive applications are driving substantial demand for bio-based and biodegradable TPUs. These materials are being used in interior components such as dashboard skins, seat cushions, and armrests. For example, automakers can incorporate bio-based TPUs in their vehicles to reduce their carbon footprint and appeal to environmentally conscious consumers. The materials' durability, flexibility, and resistance to abrasion make them ideal for these applications.

The building and construction industry is another significant market for bio-based TPUs. These materials are being used in flooring, weather stripping, and sealants due to their excellent weather resistance and durability.

The footwear and apparel segment dominated the conventional TPU market, accounting for over 37% in 2023 and is expected to grow at a significant CAGR over the forecast period.The U.S. footwear industry is a notable end use segment of the conventional TPU market. The U.S. footwear industry characterized by diverse product offerings ranging from athletic shoes to formal footwear. In recent years, industry has seen steady growth, driven by factors such as changing fashion trends and the rise of athleisure wear.

Medical Supplies are also likely to present lucrative opportunities for conventional TPU market growth in the coming years. The medical supplies industry in the country encompasses a wide range of products essential for healthcare delivery, including disposable medical consumables, diagnostic equipment, surgical instruments, and personal protective equipment (PPE). This sector has experienced significant growth in recent years, driven by factors such as an aging population in the U.S., increasing prevalence of chronic diseases, and technological advancements in healthcare.

Country Insights

The U.S. bio-based and biodegradable thermoplastic urethanes system market is experiencing significant growth due to increasing environmental concerns and stricter regulations on plastic use worldwide. These materials offer a more sustainable alternative to traditional petroleum-based TPUs, combining the performance characteristics of conventional thermoplastic polyurethanes with improved environmental credentials. Moreover, the rising focusing on R&D can develop next-generation materials that meet evolving customer expectations and regulatory standards is expected to further boost the market growth

Key U.S. Bio-Based, Biodegradable Thermoplastic Urethanes System Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include BASF, Covestro AG, HEXPOL AB, Huntsman Corporation, and Trinseo. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key U.S. Bio-Based, Biodegradable Thermoplastic Urethanes System Companies:

- BASF

- Huntsman Corporation

- The Lubrizol Corporation

- Trinseo

- Covestro AG

- HEXPOL AB

Recent Developments

-

In September 2024, Avient Corporation announced plans to expand its production capacity for medical thermoplastic polyurethane (TPU) at its facility in Suzhou, China. This initiative aims to enhance the NEU Custom Capabilities and NEUSoft TPU production specifically for catheter applications, responding to the growing demand for medical materials.

-

In April 2024, BASF announced a significant innovation in sustainable footwear by introducing 100% fully recyclable concept shoes made from Elastollan thermoplastic polyurethane (TPU), co-created with the renowned Chinese sports brand Li-Ning.

-

In September 2023, Nike introduced a groundbreaking sustainable shoe design called the ISPA Link Axis, marking its first foray into creating a fully circular shoe. This innovative design prioritizes recyclability and sustainability, aligning with Nike's commitment to environmental responsibility. The upper part of the shoe was crafted from 100% recycled polyester Flyknit, while the tooling is made from 100% recycled TPU, including materials sourced from scrap airbags. Additionally, a 20% recycled TPU cage enhanced its structure.

Bio-Based, Biodegradable Thermoplastic Urethanes System Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 336.21 million

|

|

Revenue forecast in 2030

|

USD 424.83 million

|

|

Growth rate

|

CAGR of 4.8% from 2025 to 2030

|

|

Historical data

|

2018 - 2023

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, competitive landscape, growth factors and trends

|

|

Segments covered

|

Product, end use

|

|

Key companies profiled

|

BASF; Huntsman Corporation; The Lubrizol Corporation; Trinseo; Covestro AG; HEXPOL AB

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Bio-Based, Biodegradable Thermoplastic Urethanes System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented U.S. bio-based, biodegradable thermoplastic urethanes system market report on the basis of product, and end use:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)