U.S. Bio-Based, Biodegradable A/B Polyurethane System Market Size, Share & Trends Analysis Report By Product, By End-use (Industrial, Military, Footwear & Apparel, Furniture & Bedding), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-489-1

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

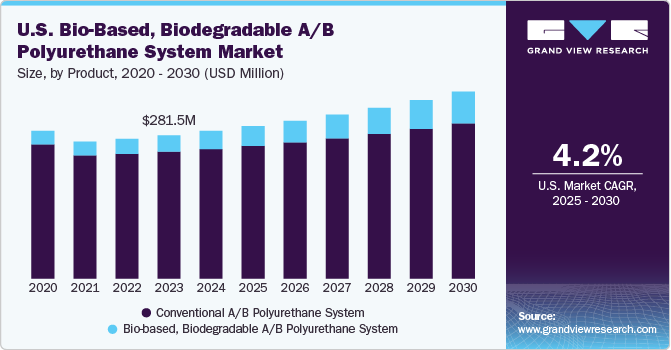

The U.S. bio-based, biodegradable A/B polyurethane system market size was estimated at USD 289.86 million in 2024 and is expected to grow at a CAGR of 4.2% from 2025 to 2030. The growing adoption of biodegradable A/B polyurethanes by several packaging manufacturers across the U.S. is likely to fuel the market growth.

The U.S. bio-based and biodegradable A/B polyurethane (PU) system market is undergoing rapid technological advancements, driven by growing demand for sustainable solutions across industries. A key development is the increasing use of bio-based polyols, which are derived from renewable sources such as vegetable oils, soybeans, and castor oil.

Drivers, Opportunities & Restraints

The bio-based and biodegradable A/B polyurethane system market is rapidly evolving due to increasing environmental concerns and the demand for sustainable materials. These systems are made from renewable resources, such as plant-based oils and starches, which reduce reliance on fossil fuels. This market is driven by innovations in formulation technologies that enhance the performance characteristics of these polyurethanes, making them suitable for a wide range of applications including coatings, adhesives, foams, and elastomers.

The U.S. market for bio-based, biodegradable A/B polyurethane systems offers a variety of growth opportunities fueled by changing consumer preferences, advancements in technology, and policies that prioritize sustainability. As consumer awareness rises and the demand for eco-friendly products increases, there are expanding opportunities for bio-based, biodegradable polyurethane systems in sectors such as furniture, footwear, electronics, and household products.

The market for bio-based, biodegradable A/B polyurethane systems in the U.S. is set for expansion, yet it encounters significant challenges. The transition to bio-based and biodegradable A/B polyurethanes requires significant research and development investments, which can be a deterrent for companies already entrenched in conventional systems. While there is growing consumer demand for sustainable alternatives, companies need clear, quantifiable data to justify the shift to bio-based materials. This includes evidence of performance parity, lifecycle cost analysis, and long-term benefits associated with reduced environmental impact.

Product Insights

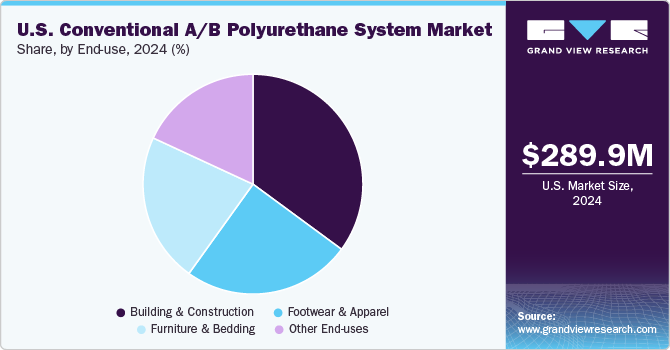

Based on product, the market has been segmented into conventional and bioplastics. The conventional segment accounted for the largest revenue share of 87.80% in 2024. Polyurethanes created from conventional A/B systems are used in products like insulation, furniture, automotive parts, coatings, adhesives, and elastomers due to their customizable properties. In these polyurethane systems, both the isocyanates and polyols are typically derived from petrochemical sources, which are non-renewable.

The biobased, biodegradable segment is expected to grow at the fastest CAGR during the forecast period. One of the key drivers for the adoption of bio-based and biodegradable A/B polyurethane systems is the growing emphasis on sustainability across industries. Companies are increasingly looking for eco-friendly materials that comply with global environmental regulations and consumer demand for greener products.

End use Insights

The industrial segment dominated the U.S. bioplastics TPU market, accounting for 87.02% in 2023 and is expected to grow at a significant CAGR over the forecast period. In the industrial sector, automotive applications are driving substantial demand for bio-based and biodegradable AB polyurethane systems. As the U.S. automotive industry shifts its focus toward fuel-efficient and EVs, there is a growing need for high-performance materials in the manufacturing of automotive components. This transition has fueled the adoption of bio-based and biodegradable A/B polyurethanes, which offer a sustainable and lightweight alternative to traditional metals and alloys used in vehicles, helping to reduce overall vehicle weight and improve fuel efficiency.

The building and construction industry is another significant market for the U.S. bio-based, Biodegradable AB polyurethane. Growing concerns about global warming and climate change, largely driven by greenhouse gas emissions, have led the world to seek renewable and cleaner energy sources, such as solar and wind power. This shift is expected to significantly impact industries like building and construction.

The footwear and apparel segment dominated the conventional TPU market, accounting for over 24% in 2023 and is expected to grow at a significant CAGR over the forecast period. The global expansion of internet connectivity has significantly boosted the e-commerce market, which is set to experience rapid growth in the coming years. As more consumers shift to online shopping, the demand for footwear and apparel has surged.

Furniture and bedding are also likely to present lucrative opportunities for conventional AB polyurethane market growth in the coming years. PUs is also applied as coatings on furniture surfaces, offering a protective layer that enhances durability and resistance to wear and tear. This helps furniture retain its appearance and extend its lifespan.

Country Insights

U.S. Bio-based, Biodegradable A/B Polyurethane System Market Trends

The U.S. bio-based and biodegradable A/B polyurethane system market is experiencing significant growth. The country is a hub for technological innovations across key industries such as automotive, healthcare, and electronics. This well-established technological infrastructure fosters significant research and development (R&D) activities, driving the adoption of conventional A/B polyurethane systems in various advanced applications. For instance, the growing demand for electric vehicles (EVs) in the U.S. is creating opportunities for polyurethane materials in electronic components, including insulation and sealants for various electronic components such as batteries and wiring harnesses.

Key U.S. Bio-Based, Biodegradable A/B Polyurethane System Company Insights

The U.S. bio-based, biodegradable A/B polyurethane system market is highly competitive, with several key players dominating the landscape. Major companies include Huntsman Corporation, 3M, Bostik, and DuPont, among others. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key U.S. Bio-Based, Biodegradable A/B Polyurethane System Companies:

- Huntsman Corporation

- 3M

- Henkel Balti OÜ

- DINOL GmbH

- XUCHUAN CHEMICAL(SUZHOU) CO., LTD

- Qingdao Exceed Fine Chemicals Co., Ltd

- Redwood

- Bostik

- Silpak, Inc.

- DuPont

Recent Developments

-

In March 2023, Pecora Corporation introduced a new product, DynaTrol II-SL, in its Urethane Sealant line. This two-component, self-leveling polyurethane joint sealant is designed for sealing traffic-bearing expansion joints in various applications including parking decks, highways, and industrial flooring.

U.S. Bio-Based, Biodegradable A/B Polyurethane System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 299.34 million |

|

Revenue forecast in 2030 |

USD 367.19 million |

|

Growth rate |

CAGR of 4.2% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, end use |

|

Country Scope |

U.S. |

|

Key companies profiled |

Huntsman Corporation; 3M; Henkel Balti OÜ; DINOL GmbH; XUCHUAN CHEMICAL(SUZHOU) CO., LTD; Qingdao Exceed Fine Chemicals Co., Ltd; Redwood; Bostik; Silpak, Inc.; DuPont |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Bio-Based, Biodegradable A/B Polyurethane System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented U.S. bio-based, biodegradable A/B polyurethane system market report on the basis of product, and end use:

-

Product Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Conventional A/B Polyurethane System

-

Bio-based, Biodegradable A/B Polyurethane System

-

-

End use Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

U.S. Bio-based, Biodegradable A/B Polyurethane System

-

Industrial

-

Automotive

-

Building & Construction

-

Packaging

-

Other End uses

-

-

Military

-

-

U.S. Conventional A/B Polyurethane System

-

Footwear & Apparel

-

Furniture & Bedding

-

Building & Construction

-

Other End uses

-

-

-

Country Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

U.S.

-

Frequently Asked Questions About This Report

b. The U.S. bio-based, biodegradable A/B polyurethane system market size was estimated at USD 289.86 million in 2024 and is expected to reach USD 299.34 million in 2025.

b. The U.S. bio-based, biodegradable A/B polyurethane system market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 367.19 million by 2030.

b. The conventional segment held the largest share, accumulating 87.80% market share in 2024. This can be attributed to its cost-effectiveness and high performance attributes.

b. Some key players operating in the U.S. bio-based, biodegradable A/B polyurethane system market include Huntsman Corporation; 3M; Henkel Balti OÜ; DINOL GmbH; XUCHUAN CHEMICAL(SUZHOU) CO., LTD; and Qingdao Exceed Fine Chemicals Co., Ltd, among others.

b. The growing adoption of biodegradable A/B polyurethanes by several packaging manufacturers across the U.S. is likely to fuel the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."