- Home

- »

- Healthcare IT

- »

-

U.S. Behavioral Health EHR Market, Industry Report, 2030GVR Report cover

![U.S. Behavioral Health EHR Market Size, Share & Trends Report]()

U.S. Behavioral Health EHR Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Web/Cloud-based EHR, On-premise EHR), By End-use (Government Owned, Private), And Segment Forecasts

- Report ID: GVR-4-68039-922-4

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Behavioral Health EHR Market Trends

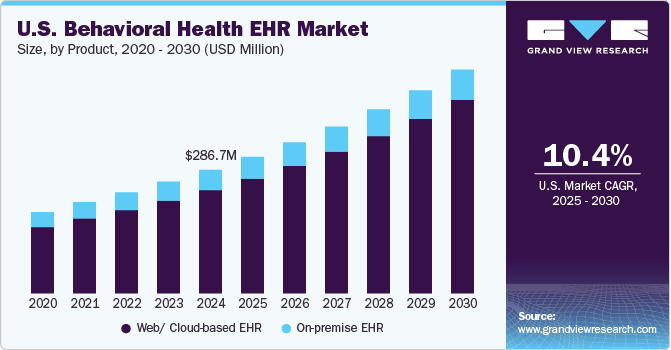

The U.S. behavioral health EHR market size was estimated at USD 286.74 million in 2024 and is expected to grow at a CAGR of 10.37% from 2025 to 2030. Increasing government efforts to boost healthcare IT adoption among healthcare facilities and rising awareness among mental health professionals about the benefits of EHR are primary factors driving the market. With the advent of technological advancement, physicians use the same EHR software for storing patient data and telehealth, e-prescribing, clinical assessment documentation, & other clinical & administrative work. This, coupled with specific needs for behavioral health practices, is expected to propel market growth over the forecast period.

Rising awareness about substance abuse management is driving market growth. According to the United States National Survey on Drug Use and Health (NSDUH), in 2023, around 48.5 million people in the U.S. were suffering from substance abuse disorders. Of these, only 23% received treatment. This highlights the significant opportunity to enhance behavioral healthcare delivery. According to the U.S. Department of Health and Human Services, the healthcare budget for drug control was estimated to be around USD 11.9 billion in 2024.

EHR utilization is crucial for advancing drug abuse treatment by fostering better care coordination and improving the quality of clinical care. Effective health information technology systems help organize and optimize clinical data, benefiting patients, healthcare providers, and health system leaders by supporting treatment coordination, collaborative decision-making, and quality improvement initiatives.

Moreover, the increasing government initiatives to promote EHR adoption in behavioral health fuel market growth. The behavioral health sector was excluded from the healthcare technology boom for a long time since the government aimed to boost health IT adoption, which primarily targeted physicians. EHR technology utilization has quickly become the industry standard, regardless of specialty. However, this scenario is changing due to various factors, and EHR adoption and behavioral health are expected to grow. For instance, approximately 60% of psychiatrists employ EHR technology in their practices. The following are some government initiatives contributing to the increased adoption of EHR technology in behavioral health.

-

H.R. 3331 bill - It amends a section of the Social Security Act to encourage the testing of government incentive payments to behavioral health practitioners who employ Certified EHR Technology (CEHRT). This bill aims to eliminate any existing digital division between behavioral healthcare and other care fields, such as primary care, wherein EHR use, health data interchange, and health data analytics are more prevalent and valued.

-

The Senate passed the S.1732 bill in May 2018, allowing CMS to reward providers for using behavioral health EHRs. The Act provides financial assistance to providers who are not eligible for EHR Incentive Program.

Case Studies

Case Study 1: Turning Point Family CARE: Behavioral Health

Turning Point Family CARE (TPFC) is a critical behavioral health agency that provides comprehensive mental health and substance abuse services across Wake, Durham, and Johnson Counties. This case study explores TPFC's operational improvements following the implementation of Patagonia Health's electronic health records (EHR) system.

Background:

Turning Point Family CARE serves over 2,200 clients, including children, adolescents, and adults. The agency recognized the need for a scalable EHR, practice management, and billing system to support its growth and improve operational efficiency. After extensive research and vendor demonstrations, TPFC chose Patagonia Health EHR due to its customizable features aligned with the agency's operational needs.

Challenges:

TPFC faced significant challenges in effectively managing patient records and billing processes. The existing systems were cumbersome, requiring multiple logins for different insurance portals, which hindered timely claims submissions and increased administrative burdens. The agency needed a solution to streamline these processes while accommodating future growth.

Solution:

The implementation of Patagonia Health’s EHR system brought about significant improvements:

-

Enhanced Efficiency: The new system improved the timely submission of clinical notes from 76% to 96% by providing better tracking and reporting tools for staff.

-

Streamlined Billing: The integrated billing software enabled TPFC to submit claims through a single portal, drastically reducing the time required to process payments from various insurance companies. Denial rates fell to less than 1% due to built-in data checks that flagged errors before submission.

-

Improved Communication:

A calendar widget allowed staff to monitor patient appointments in real-time across multiple locations, facilitating seamless client interactions regardless of which office they contacted.

Outcomes:

The transition to Patagonia Health's EHR has positioned Turning Point Family CARE for continued growth while enhancing the quality of care provided to clients. By improving operational efficiencies and streamlining communication, TPFC can focus more on delivering compassionate mental health services tailored to individual client needs.

Case Study 2: Valant helped MDUSD Counseling Services to enhance the billing process.

Background

The Mount Diablo Unified School District (MDUSD) offers a comprehensive school counseling program through its Counseling Services. It supports students across 60 educational institutions, ranging from elementary to high school levels, within Contra Costa County, California. The initiative employs 35 clinical professionals who deliver mental health services across seven distinct programs, catering to students and their parents within the district.

Challenge

MDUSD Counseling Services relied on paper-based systems for billing, clinical documentation, and patient records, leading to inefficiencies and frequent errors.

-

The manual billing process caused lost reimbursements and late payments, while clinical documentation was time-consuming, often requiring corrections and re-approvals.

-

Clinicians faced delays in updating records, blocking out days for catch-up.

-

In addition, generating productivity reports took around 70 hours monthly, further straining staff and reducing time spent with students.

Solution

MDUSD collaborated with Valant to address its challenges by customizing the EHR system. A task force worked closely with clinicians to create custom forms, including progress notes and productivity reports, and implemented a quick-change response process.

Valant's solution also streamlined billing by automating data transfer from clinical notes to the Medi-Cal system, eliminating manual tasks and improving workflow efficiency. This resulted in reduced paperwork and faster, more accurate billing.

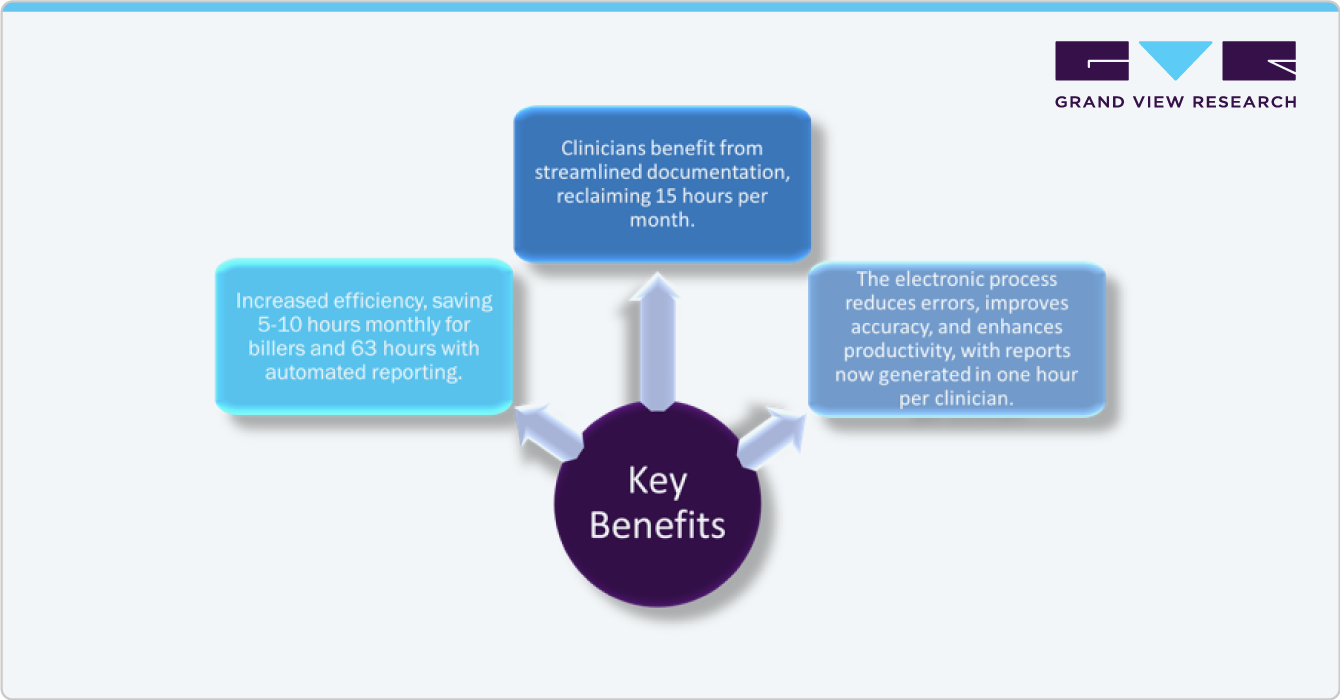

Outcome

Key benefits include:

Valant’s all-in-one system has transformed billing and clinical workflows, delivering substantial time savings across the board.

Market Concentration & Characteristics

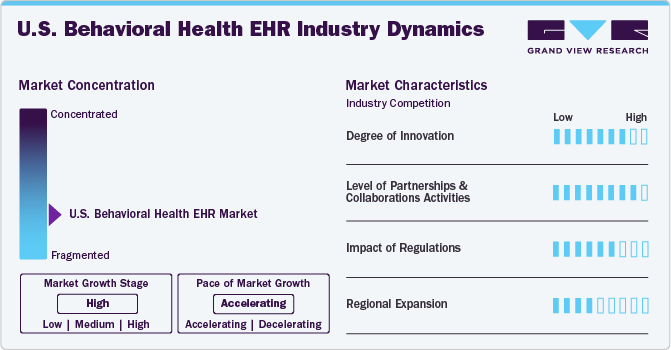

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including the impact of regulations, degree of innovation, industry competition, regional expansion, and level of partnerships & collaboration activities. The market is fragmented, with many providers dominating it.

The degree of innovation in the industry is high. AI is becoming integral in behavioral health EHR systems, offering predictive analytics to identify patient patterns and forecast treatment outcomes. This capability allows for earlier interventions and more tailored treatment plans, particularly beneficial for chronic mental health conditions. For instance, NextGen Healthcare launched NextGen Ambient Assist in April 2024. It has features like transcribing patient-provider conversations in real-time, summarizing meetings within 60 seconds, saving up to 2 hours of documentation daily, and seamlessly integrating into the NextGen Enterprise EHR.

The industry's level of partnerships & collaborations is moderate to high. Key players in the behavioral health sector are increasingly focusing on partnerships & collaborations to enhance the adoption of EHR in the U.S. For instance, in July 2023, Universal Health Services (UHS) is expanding its use of Oracle Health's EHR across its behavioral health facilities. This initiative aims to integrate physical and behavioral healthcare, enhancing patient safety and care decisions. UHS plans to roll out this unified EHR across more than 200 facilities, facilitating better information sharing among care teams and providing patients with a portable health record that includes physical and behavioral health data.

Regulations have a high impact on the market. Behavioral health EHRs are governed by a complex framework of federal and state regulations that protect sensitive patient information. Key regulations include HIPAA, the HITECH Act, and 42 C.F.R. Part 2. Understanding these regulations is crucial for compliance and effective practice management in behavioral health settings.

The industry's regional expansion level is moderate to high, owing to the increasing demand for mental health services and regulatory initiatives promoting EHR adoption. For instance, in May 2020, Holmusk acquired USD 21.5 million in Series A funding led by Health Catalyst Capital (HCC) and Optum Ventures (OV), which can help Holmusk expand its U.S. operations in New York City and invest in its proprietary technology.

Product Insights

Based on product, the web/cloud-based EHR segment held the largest revenue share of over 83.52% in 2024 and is anticipated to grow at the fastest growth rate over the forecast year. Web-based EHR systems specifically designed for behavioral health are increasingly vital in U.S. healthcare. These platforms cater to the unique needs of mental health and substance use treatment, enhancing care delivery, improving patient outcomes, and facilitating integrated care across various settings. The increasing adoption of web/cloud-based EHR solutions and the availability of technologically advanced solutions contribute to market growth. For instance, in May 2023, NorthSight Recovery, a behavioral health agency in Arizona, adopted a cloud-based EHR system to enhance data usage for improving patient outcomes. The agency emphasizes the importance of technology in addressing the U.S. mental health crisis, particularly amidst rising opioid addiction rates.

"Implementing the cloud-based EHR technology allows us to successfully work toward whole-person health and increasingly accountable care models as behavioral health faces growing scrutiny and potential financial penalties for underperformance and underreporting."

- Jeremy Bloom, CEO of NorthSight Recovery

The on-premises EHR segment is anticipated to grow significantly over the forecast year. On-premises systems allow for greater customization tailored to the specific workflows of behavioral health settings. In addition, efficient storage of large volumes of patient health data is a key factor boosting the segment. In addition, data accessibility on-premises EHRs is better than others, which can positively impact the market.

End-use Insights

Based on end use, the private segment held the largest revenue share in 2024 and is anticipated to grow fastest from 2025 to 2030. Private facilities have gradually advanced their technology to serve mental care patients better by providing high-quality infrastructure and clinical services. An initiative in the U.S. targeting Behavioral EHR is primarily driven by a collaboration between the Substance Abuse and Mental Health Services Administration (SAMHSA) and the Office of the National Coordinator for Health Information Technology (ONC) in February 2024. This initiative, known as the Behavioral Health Information Technology (BHIT) Initiative, aims to enhance health information technology in behavioral health settings with an investment of over USD 20 million over the next three years. Such initiatives are anticipated to drive the segment growth over the forecast period.

Government owned segment is anticipated to grow significantly over the forecast year. An increase in behavioral health coverage and a rise in government expenditure on behavioral health is expected to drive the adoption of management software solutions in the coming years in state-owned hospitals. The new government initiatives are anticipated to accelerate the adoption of behavioral health EHRs nationwide. For instance, in August 2023, Lawmakers proposed a new bill that, if approved, would provide funding for EHRs and other technologies to support behavioral health providers. The Behavioral Health Information Technology Coordination Act proposes USD 20 million annually in grant funding over five years (2025 to 2029) to support behavioral health providers acquiring or upgrading EHR systems. This bill is co-sponsored by Ron Estes (R-Kan.) in the House, Reps. Sharice Davids (D-Kan.,) Catherine Cortez Masto (D-Nev.) in the Senate, Senators Markwayne Mullin (R-Okla.)

Key U.S. Behavioral Health EHR Company Insights

The market is highly fragmented, with a large number of small- & medium-sized EHR providers. Qualifacts Systems, Inc., Welligent, and Netsmart Technologies, Inc. are some of the leading players in the market. Netsmart Technologies, Inc. holds the leading position in the market.

Key U.S. Behavioral Health EHR Companies:

- Core Solutions, Inc.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualtrics

- Welligent

- Valant

- TherapyNotes, LLC.

- NextStep Solutions

- Oracle (Cerner Corporation)

- TheraNest

- ICANotes

- Streamline Healthcare Solutions

- Practice Fusion, Inc.

- Opus Behavioral Health Inc.

Recent Developments

-

In April 2024, Core Solutions, Inc. launched the Core Clinician Assist: Symptom Tracking, the newest addition to its suite of innovative behavioral health AI solutions. This advanced tool leverages AI to analyze large datasets, identify behavioral health symptoms, and link them to relevant diagnoses. It enables providers to track patient care over time and apply evidence-based, actionable insights to improve treatment outcomes.

"We know that organizations need ways to identify and engage effectively with individuals who would benefit from behavioral health support and treatment, which is why we developed Core Clinician Assist: Symptom Tracking. It's a powerful tool that delivers timely and accurate intelligence. This strengthens access to care and supports preventive interventions, empowering organizations to better target their behavioral health Continuous Positive Airway Pressure (CPAP) Devices Marketengagement efforts. Adopters of Symptom Tracking achieve a significant return on investment, making the adding the solution even more beneficial."

- Michael Lardieri, Core Senior Vice President of Strategy, LCSW

-

In January 2024, Spectrum Healthcare, one of Arizona's largest nonprofit healthcare providers, partnered with NextGen Healthcare to tackle the state's primary and behavioral health resources shortage. This collaboration aims to enhance access to integrated care for underserved communities across Arizona.

“According to the Arizona Department of Health Services, 82 areas across the state are medically underserved. Additionally, over 2.8 million Arizona residents live in a community with a shortage of mental health professionals.”

-According to NAMI Arizona, an affiliate of The National Alliance on Mental Illness

-

In June 2023, Holmusk and Streamline Healthcare Solutions announced a strategic partnership to introduce a behavioral health predictive analytics tool to the U.S. market.

“We look forward to the continued partnership with Streamline Healthcare Solutions, and the new collaboration with Mental Health Partners as we expand MaST’s presence in the U.S.

“We have seen how valuable this tool has been for health systems in the UK, and we are excited to see similar results for our U.S. partners.”

- Nawal Roy, Holmusk’s Founder and CEO-

In February 2022, Holmusk collaborated with Metrocare Services on the utilization of real-world data to lead to the creation of mental health care improvement tools. Metrocare Services is North Texas's leading provider of developmental disability and mental health services, serving more than 55,000 people and children annually.

"Metrocare and Holmusk share a vision that to achieve the most effective mental health intervention of our time requires robust analytics that drive outcomes.

“As the largest provider of behavioral health care in NorthTexas, predictive analytics allows us to be even more proactive in responding to our community’s needs and prioritizing patient care.”

- Dr. John W. Burruss, Chief Executive Officer, Metrocare

U.S. Behavioral Health EHR Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 316.95 million

Revenue forecast in 2030

USD 518.98 million

Growth rate

CAGR of 10.37% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

Core Solutions, Inc.; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualtrics; Welligent; Valant; TherapyNotes, LLC.; NextStep Solutions; Oracle (Cerner Corporation); TheraNest; ICANotes; Streamline Healthcare Solutions; Practice Fusion, Inc.; Opus Behavioral Health Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Behavioral Health EHR Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. behavioral health EHR market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Web/ cloud-based EHR

-

On-premise EHR

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government Owned

-

Private

-

Frequently Asked Questions About This Report

b. The global U.S. behavioral health EHR market size was estimated at USD 286.74 million in 2024 and is expected to reach USD 316.95 million in 2025.

b. The global U.S. behavioral health EHR market is expected to grow at a compound annual growth rate of 10.37% from 2025 to 2030 to reach USD 518.98 million by 2030.

b. The web/cloud-based segment dominated the U.S. behavioral health EHR market with a share of 83.52% in 2024. This is attributable to the unique needs of mental health and substance use treatment, enhancing care delivery, improving patient outcomes, and facilitating integrated care across various settings. In addition, the increasing adoption of web/cloud-based HER solutions and the availability of technologically advanced solutions contribute to market growth.

b. Some key players operating in the U.S. behavioral health EHR market include Core Solutions, Inc.; Meditab; Holmusk; Netsmart Technologies, Inc.; Qualtrics; Welligent; Valant; TherapyNotes, LLC.; NextStep Solutions; Oracle (Cerner Corporation); TheraNest; ICANotes; Streamline Healthcare Solutions; Practice Fusion, Inc.; Opus Behavioral Health Inc.

b. Key factors that are driving the U.S. behavioral health EHR market growth include rising demand for EHR among physicians and strong support from the government to boost the EHR adoption among behavioral health providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.