U.S. Bedroom Furniture Market Size, Share & Trends Analysis Report By Product (Beds, Wardrobe & Storage), By Distribution Channel (Offline, Online), By Price Range (Less than 500, USD 500 - USD 999), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Bedroom Furniture Market Trends

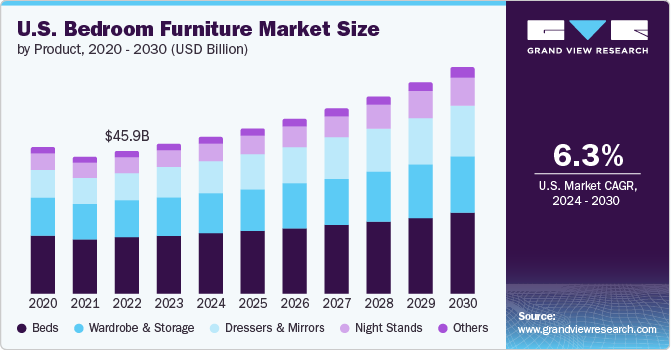

The U.S. bedroom furniture market size was estimated at USD 47.98 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. The growing trend of home improvement and renovation projects is encouraging homeowners to invest in upgrading their bedrooms. This includes replacing old beds, dressers, and nightstands, among others, with newer, more stylish, and functional ones. Moreover, consumers increasingly prioritize comfort, aesthetics, and functionality in their bedrooms, driving the demand for bedroom furniture products tailored to individual preferences and lifestyles.

The trend toward sustainable sourcing is increasing, with many companies seeking certification for responsible forestry practices or using recycled materials to meet environmental standards. With growing awareness of environmental concerns, manufacturers are shifting to materials that have minimal impact on the environment throughout their lifecycle.In May 2023, Williams-Sonoma Inc. launched GreenRow, a new brand focused on sustainability and eco-friendly practices. GreenRow specializes in colorful, vintage-inspired heirloom-quality products across a wide range of categories, including bedroom, living, and dining furniture, as well as rugs, bedding, lighting, bath products, pillows, curtains, throws, table linens, dinnerware, and décor.

Key players are leveraging advertising platforms to enhance their sales through brick-and-mortar outlets. In November 2023, Raymour and Flanigan, the largest furniture and mattress retailer in the Northeast U.S., leveraged Roku's ad platform to drive in-store traffic and connect with younger consumers, such as Millennials and Gen Z-ers, who made up the majority of furniture buyers in early 2023. By targeting their TV streaming campaigns to these demographics, they reached nearly 4.5 million people, resulting in 337,000 store visits after exposure, with 146,000 of those directly linked to Roku media.

In the U.S., a moderate share of homeowners are spending close to USD 2,500 on bedroom renovations. This is likely to drive the demand for bedroom furniture. In a November 2023 blog on Home News Now, it was noted that the bedroom ranked fourth in terms of popularity for renovations in the U.S., encompassing various updates like built-in bookcases and new walk-in closets. Nationally, the term "bedroom" saw 323,297 monthly searches, with New York, Massachusetts, Georgia, Maryland, and New Jersey leading in search volume. When renovating a bedroom, furniture is a common addition, whether it is a bed, dresser, or other traditional pieces. However, the trend also includes adding seating options such as chairs, loveseats, or benches, which can fit anywhere in the room, even in spacious walk-in closets

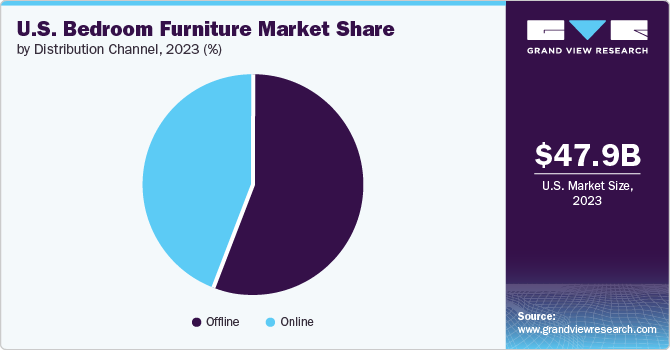

With the increasing prevalence of e-commerce, consumers across the U.S. now have access to a diverse array of bedroom furniture options through digital channels. The shift toward online retail platforms is driven by factors such as convenience, a vast product assortment, and the ability to make informed purchase decisions through reviews and product details. Key players in the market have also witnessed considerable growth in sales through e-commerce channels. For instance, Williams-Sonoma Inc., a prominent player, reported a notable surge in revenue, reaching USD 8.7 billion in fiscal year 2022, witnessing a 6.5% YoY increase.

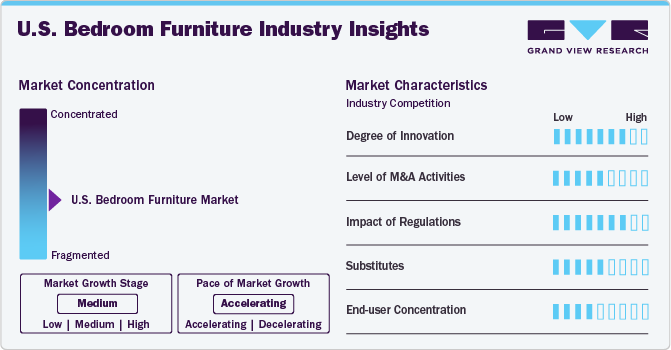

Market Characteristics & Concentration

The U.S. bedroom furniture market is experiencing a high degree of innovation, driven by advancements in sustainable materials, smart furniture integration, and customizable designs. Companies are increasingly adopting eco-friendly practices and leveraging technology to offer smart storage solutions and enhanced user experiences, catering to modern consumer demands for both aesthetics and functionality.

Regulations in the market, such as safety standards, environmental regulations, and import tariffs, significantly impact production costs and market dynamics. Compliance with safety and environmental standards ensures product quality and sustainability, while tariffs on imported furniture can affect pricing and competitiveness.

The availability of substitutes like multifunctional furniture, home decor accessories, and DIY solutions impacts the market by offering consumers alternative options. This can lead to increased competition, driving innovation and price adjustments within the industry to maintain market share.

The market has a diverse end-user concentration, catering to various demographics including millennials, Gen X, and baby boomers. Key segments include urban dwellers seeking compact and multifunctional furniture, suburban homeowners prioritizing style and comfort, and luxury consumers looking for high-end, designer pieces.

Product Insights

Beds held a market share of 38% in 2023.The beds segment includes a variety of options, including full, queen, and king-size beds, single and guest beds, beds with storage units, and bunk beds. The demand for beds across the U.S. is primarily fueled by population growth, ongoing urbanization, and increasing disposable income. Furthermore, the aging population has contributed to the increased need for beds, particularly among older adults who require more comfortable and supportive options due to mobility issues or health conditions. Heightened awareness of the importance of sleep quality and overall well-being has fueled the demand for beds that are designed to promote better sleep and alleviate common sleep-related issues.

The demand for dressers & mirrors is expected to grow at a significant CAGR from 2024 to 2030.consumers seek furniture that reflects their individual tastes and preferences. Dressers with customizable options, such as choice of finishes, hardware, and drawer configurations, allow consumers to tailor their furniture selections to suit their unique style and storage needs. Personalization options resonate with consumers who value uniqueness and seek to create personalized living spaces that reflect their personalities and lifestyles.

Distrbution Channel Insights

Offline channels held a market share of 56% in 2023. One key driver is the tactile experience and ability to physically examine the furniture, which can be particularly important for items like beds and mattresses where comfort and feel are significant factors in the purchasing decision. Offline retailers also often offer services such as delivery, assembly, and removal of old furniture, providing added convenience and value to customers.

The online sales of bedroom furniture are expected to grow at a significant CAGR from 2024 to 2030. This channel has emerged as a dominant force in the retailing of beds. With the proliferation of e-commerce platforms and the increasing prevalence of digital shopping experiences, consumers now have unprecedented access to a vast array of bed furniture options at their fingertips.E-commerce platforms like Amazon, Wayfair, and Overstock have revolutionized the way consumers shop for bed furniture, offering unparalleled convenience, selection, and price transparency. These online marketplaces provide a diverse range of bed frames, bedding sets, and accessories from various brands and retailers, allowing consumers to compare products and prices with ease.

Price Range Insights

Bedroom furniture priced between USD 500 - USD 999 held a market share of 42% in 2023.Bedroom furniture in this price range is most prominent in the market due to its balance of affordability and quality, appealing to a broad range of consumers. This price range offers a variety of styles and durable materials that cater to both budget-conscious buyers and those seeking value for their money. Additionally, it fits well within the spending capacity of middle-class households, which form a significant portion of the market.

The demand for bedroom furniture priced above USD 1,000 is expected to grow at a significant CAGR from 2023 to 2030. As consumers prioritize quality and durability, they are willing to invest more in long-lasting, higher-end pieces. Additionally, the trend towards personalized and luxurious bedroom spaces drives demand for premium furniture. Moreover, as the housing market remains strong, homeowners are more inclined to invest in upscale furnishings to enhance their living spaces, further boosting demand for higher-priced bedroom furniture.

Key U.S. Bedroom Furniture Company Insights

The U.S. bedroom furniture industry is highly competitive, marked by the presence of numerous prominent players.Some of the key players operating in the market include Williams Sonoma, Inc., Inter IKEA Systems B.V., Target Brands, Inc., Ashley Furniture Industries, LLC, Wayfair LLC, Amazon, and Crate and Barrel, among others.

Key U.S. Bedroom Furniture Companies:

- Williams Sonoma, Inc.

- Inter IKEA Systems B.V.

- Amazon

- Target Brands, Inc.

- Wayfair LLC

- Ashley Furniture Industries, LLC

- Crate and Barrel

- Rooms to Go

- Living Spaces

- Restoration Hardware, Inc (RH)

- Raymour & Flanigan

- Herman Miller Inc.

- Article

- THUMA Inc.

Recent Developments

-

In January 2024, Crate and Barrel secured a lease for a fresh retail space spanning 23,400 square feet in Lawrenceville, Georgia (U.S.). With a presence in over nine countries, the company manages a network of over 100 stores and franchise partnerships. The store in Lawrenceville will be among the 15 outlets the company oversees in North America.

-

In November 2023, Herman Miller Inc.’s brands Herman Miller and Design Within Reach unveiled 3D product configurators on their North American retail websites. These configurators allow designers, customers, and trade professionals to utilize a self-service product configuration tool to visualize every possible combination, obtain accurate pricing during the design process, download images at any stage, and effortlessly share their designs with customers. This innovative tool empowers customers to co-create their ideal pieces, enhancing their shopping experience with self-service customization options and interactive features.

-

In September 2023, Williams Sonoma Inc.partnered with Salesforce Professional Services to understand shopper preferences and engagement. The company made use of Salesforce Einstein's generative AI capabilities to distribute highly individualized communications effectively and widely.

U.S. Bedroom Furniture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 50.36 billion |

|

Revenue forecast in 2030 |

USD 72.48 billion |

|

Growth Rate |

CAGR of 6.3% from 2024 to 2030 |

|

Actuals Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, price range, distribution channel. |

|

Country scope |

U.S. |

|

Key companies profiled |

Williams Sonoma, Inc.; Inter IKEA Systems B.V.; Amazon; Target Brands, Inc.; Wayfair LLC; Ashley Furniture Industries, LLC; Crate and Barrel; Rooms to Go; Living Spaces; Restoration Hardware, Inc (RH); Raymour & Flanigan; Herman Miller Inc.; Article; THUMA Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Bedroom Furniture Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bedroom furniture market report based on product, price range, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Beds

-

Wardrobe & Storage

-

Dressers & Mirrors

-

Night Stands

-

Others

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 500

-

USD 500 - USD 999

-

USD 1,000 & Above

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. bedroom furniture market was estimated at USD 47.98 billion in 2023 and is expected to reach USD 50.36 billion in 2024.

b. The U.S. bedroom furniture market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 72.48 billion by 2030.

b. In 2023, the beds accounted for a market share of around 39% in 2023. The demand for beds across the U.S. is primarily fueled by population growth, ongoing urbanization, and increasing disposable income.

b. Some key players operating in the U.S. bedroom furniture market include Williams Sonoma, Inc.; Inter IKEA Systems B.V.; Amazon; Target Brands, Inc.; Wayfair LLC; Ashley Furniture Industries, LLC; Crate and Barrel; Rooms to Go; Living Spaces; Restoration Hardware, Inc (RH); Raymour & Flanigan; Herman Miller Inc.; Article; THUMA Inc.

b. Key factors that are driving the U.S. bedroom furniture market growth include rising consumer spending, increased urbanization, e-commerce growth, and trends towards home aesthetics and functionality.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."