- Home

- »

- Beauty & Personal Care

- »

-

U.S. Beauty Subscription Box Market Size, Report, 2030GVR Report cover

![U.S. Beauty Subscription Box Market Size, Share & Trend Report]()

U.S. Beauty Subscription Box Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Skincare, Haircare, Makeup, Fragrance, Nail Care), By Price Range (Budget, Moderate, Premium), And Segment Forecasts

- Report ID: GVR-4-68040-485-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

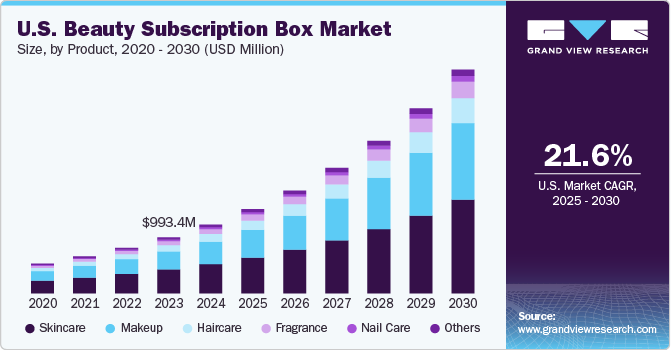

The U.S. beauty subscription box market size was estimated at USD 1.22 billion in 2024 and is expected to grow at a CAGR of 21.6% from 2025 to 2030. This growth is attributed to the increasing demand for personalized beauty experiences, where consumers seek customized products tailored to their preferences. Brands utilize quizzes and data analytics to curate personalized offerings, enhancing consumer satisfaction and loyalty. Additionally, social media influencer partnerships have fueled subscriber growth by leveraging high-profile collaborations, leading to higher conversion rates and brand engagement.

The growing consumer demand for personalized beauty experiences is a key growth driver for the U.S. beauty box market, as individuals increasingly seek tailored products that suit their unique needs. Brands like Ipsy and Birchbox use quizzes and data analytics to curate customized offerings, fostering stronger connections with subscribers and boosting loyalty. This trend is supported by rising consumer spending on subscription services and significant venture capital investment in the sector, emphasizing the importance of personalization in driving market growth and enhancing the overall customer experience.

The market has grown through personalized experiences, convenience, exclusive product access, and social media influence. Brands like Allure Beauty Box and Deck of Scarlet have successfully leveraged influencer collaborations to tap into new audiences, boost conversion rates, and increase subscriber growth. Allure's co-curated boxes achieved a 400% higher conversion rate, while Deck of Scarlet’s influencer-led makeup palettes foster strong consumer engagement through social media and word-of-mouth marketing, driving loyalty and maintaining market relevance.

Opportunities in the U.S. market for beauty subscription box are driven by flexibility, personalization, and a variety of products that encourage customers to try new brands, leading to cross-sell potential. The market saw strong growth in 2020, with beauty brands experiencing a rise in average order value (AOV), customer lifetime value (LTV), and subscriber growth. Word-of-mouth marketing and influencer promotions are key drivers, with seasonal opportunities, like holiday-themed boxes, further boosting subscriptions. For example, FabFitFun’s Holiday Luxe Box leverages exclusive products to attract customers during the gift-giving season.

Product Insights

Skincare subscription box sales accounted for a revenue share of over 42% in 2024, driven by increased self-awareness regarding personal care, and the growing importance of maintaining skincare routines. The convenience of receiving curated skincare products directly at home has attracted consumers, particularly millennials and Gen Z, who prioritize self skincare. Companies like IPSY and Birchbox have capitalized on this trend by offering personalized skincare products tailored to individual needs, such as acne-specific solutions. Social media influencers and technological advancements have further fueled demand, driving growth as consumers seek exclusive, affordable, and tailored skincare solutions.

Makeup subscription box sales is projected to grow at a CAGR of 22.5% from 2025 to 2030, driven by evolving consumer lifestyles, increased social media influence, and the rise of e-commerce. With the convenience of doorstep delivery, especially accelerated during the COVID-19 pandemic, consumers have become more comfortable with purchasing beauty products online. This trend aligns with the increasing popularity of social media platforms like Instagram and TikTok, where influencers and beauty enthusiasts regularly showcase makeup tutorials and product reviews, driving consumer interest and purchase behavior.

Celebrities launching their own makeup brands, such as Rihanna’s Fenty Beauty and Selena Gomez's Rare Beauty, have further fueled demand, as celebrity fans are drawn to products endorsed by their favorite personalities.

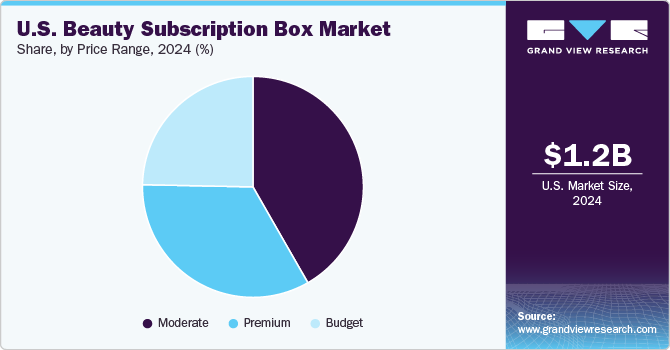

Price Range Insights

Moderately priced beauty box sales accounted for a share of over 41% in 2024 due to their balance of affordability and quality, appealing to price-sensitive consumers. These boxes allow users, especially first-time buyers and young beauty enthusiasts, to explore new brands and product samples at an accessible cost. Personalization based on user preferences enhances the appeal, while social media and celebrity endorsements further drive interest, encouraging consumers to discover new products and brands through tailored, affordable subscription experiences.

The demand for premium beauty subscription boxes is projected to grow at a CAGR of 22.7% from 2025 to 2030, driven by the growing demand for high-quality, exclusive products and luxury experiences. In the U.S., brands like BoxyCharm Premium and Ipsy Glam Bag X cater to this trend by offering full-sized, high-end beauty products from sought-after brands such as Fenty Beauty, Huda Beauty, and Anastasia Beverly Hills. These boxes provide personalized experiences, often curated by celebrity influencers or beauty experts, enhancing their appeal. The rise of social media and influencer-driven trends also propels premium subscriptions, as consumers look for unique, luxury beauty products that deliver both value and status.

Key U.S. Beauty Subscription Box Company Insights

The U.S. beauty subscription box market is fragmented. Ipsy, Birchbox, Allure Beauty Box, FabFitFun, and GlossyBox are some of the leading market players in the U.S. While, some of the emerging players in the U.S. include Petit Vour LLC, Beachly, and SCENTBIRD. Leading market players focus on using data to customize beauty product selections, boosting, customer satisfaction and loyalty.

For instance, Ipsy is a beauty box subscription service in the U.S. known for its personalized approach to delivering beauty products to a wide range of customers. Ipsy operates on a monthly subscription model, offering its members a selection of customized beauty products based on their unique preferences. Each subscriber completes a detailed beauty quiz, which helps the company tailor their monthly Glam Bag with five beauty samples or full-sized items.

Key U.S. Beauty Subscription Box Companies:

- Ipsy

- Birchbox

- Allure Beauty Box

- FabFitFun

- GlossyBox

- Petit Vour LLC

- Beachly (Retention Brands WV, LLC)

- SCENTBIRD

- Klever Beauty Box

- Chic Beauty Inc.

- Beauty Heroes

- GQ Box

Recent Developments

-

In February 2023, Ipsy announced a merger with BoxyCharm, combining their beauty subscription services to create a unified membership offering. This collaboration aims to enhance members' beauty experiences by merging the best aspects of both brands. The new, consolidated membership offers a wider selection of beauty products, exclusive perks, and greater flexibility. The combined service features personalized product recommendations, increased access to premium brands, and more choices for subscribers, marking a significant step in the evolution of beauty subscription services.

-

In June 2023, FabFitFun announced the launch of a new drop-shipping program to expand its product offerings. This initiative allows the company to offer a wider assortment of items, including beauty, fashion, home, and wellness products, directly from partner brands. Through drop-shipping, FabFitFun enhanced its member experience by providing more variety without holding additional inventory while also enabling partner brands to reach a broader audience. This move is part of the company's efforts to grow its e-commerce presence and offer a more diverse selection to its subscribers.

-

In October 2023, Ipsy company announced a collaboration with world-renowned makeup artist Pat McGrath for the latest edition of its Icon Box. As the curator for this special collection, McGrath celebrated her influential role in the beauty industry and hand-selected a range of premium makeup and skincare products. The November Icon Box featured some of her top beauty essentials, offering Ipsy subscribers a curated experience with luxurious items valued at up to USD 350.

U.S. Beauty Subscription Box Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.49 billion

Revenue forecast in 2030

USD 3.97 billion

Growth rate

CAGR of 21.6% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, price range

Country scope

U.S.

Key companies profiled

Ipsy; Birchbox; Allure Beauty Box; FabFitFun; GlossyBox; Petit Vour LLC; Beachly (Retention Brands WV, LLC); SCENTBIRD; Klever Beauty Box; Chic Beauty Inc.; Beauty Heroes, GQ Box

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Beauty Subscription Box Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. beauty subscription box market report based on product and price range:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Facial Skincare

-

Lotions, Face Creams, & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Face Masks

-

Sunscreen/Sun Care

-

Others

-

-

Body Skincare

-

Hair Removal Products

-

Lotions, Creams, & Moisturizers

-

Body Sunscreen/Sun Care

-

Body Scrub

-

Others

-

-

-

Haircare

-

Shampoo

-

Conditioner

-

Oils

-

Serums

-

Others

-

-

Makeup

-

Fragrance

-

Nail Care

-

Others

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Budget

-

Moderate

-

Premium

-

Frequently Asked Questions About This Report

b. The U.S. beauty subscription box market was valued at USD 1.22 billion in 2024 and is expected to reach USD 1.49 billion in 2025.

b. The U.S. beauty subscription box market is expected to grow at a CAGR of 21.6% from 2025 to 2030 to reach USD 3.97 billion by 2030.

b. Skincare subscription box sales accounted for a share of over 42% in 2024, driven by increased self-awareness regarding personal care, and the growing importance of maintaining skincare routines.

b. Ipsy, Birchbox, Allure Beauty Box, FabFitFun, and GlossyBox are some of the leading market players in the U.S. While some of the emerging players in the U.S. include Petit Vour LLC, Beachly, and SCENTBIRD.

b. Key drivers include the increasing demand for personalized beauty experiences, where consumers seek customized products tailored to their preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.