- Home

- »

- Beauty & Personal Care

- »

-

U.S. Beauty And Personal Care Products Market, Report 2030GVR Report cover

![U.S. Beauty And Personal Care Products Market Size, Share & Trends Report]()

U.S. Beauty And Personal Care Products Market Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Oral Care), By End-use (Men, Women), By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-486-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

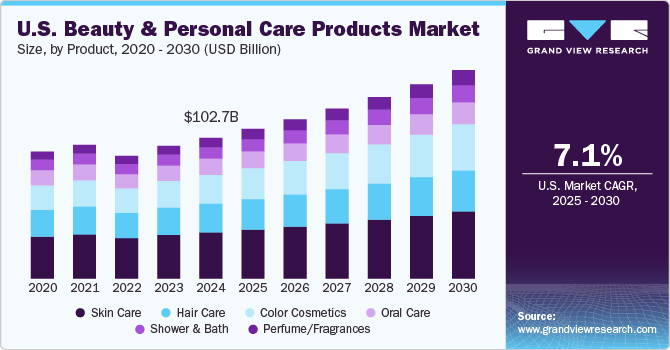

The U.S. beauty and personal care products market size was estimated at USD 102.73 billion in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. A heightened emphasis on self-care, wellness, and product quality is driving consumers toward premium beauty and personal care solutions, particularly in the skincare, color cosmetics, and hair care segments. There is an increasing demand for clean beauty offerings that are free from harmful chemicals and sourced sustainably, leading to the rise of eco-conscious brands. The rise of digital platforms and social media has played a pivotal role in driving demand, as women are exposed to a wide range of beauty products and trends through influencers, tutorials, and targeted advertising.

These platforms also provide opportunities, especially for women, to explore diverse beauty regimes and discover new products.

The U.S. market is experiencing robust growth, driven by a significant increase in consumer spending on beauty and skincare products. A 2023 survey by LendingTree reveals that 75% of Americans regard beauty products as essential, with consumers allocating an average of USD 1,754 annually toward these purchases. This upward trend is particularly pronounced among younger demographics: millennials lead the spending at USD 2,670 per year, followed closely by Gen Z at USD 2,048.

Notably, skincare and hair care represent the largest spending categories, each accounting for approximately 30% of total beauty expenditures. This heightened consumer investment is further underscored by a willingness to prioritize beauty purchases over other expenditures, with 35% of Americans-and notably 52% of millennials and 50% of Gen Z-indicating they would cut back on other costs to allocate more towards beauty products. This strong spending propensity, especially among younger generations, is expected to drive the continued expansion of the U.S. market, supporting product innovation and the broadening of offerings across skincare, hair care, and other categories.

In the U.S., teenagers are increasingly influenced by viral social media trends that promote elaborate skincare routines, mirroring the behaviors observed globally. Many teens are now adopting complex regimens filled with multiple products, often driven by the desire for flawless skin perpetuated by platforms like TikTok. This trend has led to a surge in the demand for high-end skincare products among young people, reflecting a broader societal pressure to meet unrealistic beauty standards. Dermatologists warn that these complex routines may not only be unnecessary but could also harm younger skin, emphasizing the importance of tailored skincare approaches for adolescents.

The clean beauty and cruelty-free trend has gained significant traction within the U.S. market, reflecting a broader consumer shift toward ethical and environmentally responsible practices. This trend is characterized by the formulation of products that prioritize natural, non-toxic ingredients and the avoidance of harmful chemicals, which resonates with an increasingly health-conscious consumer base. Moreover, the cruelty-free aspect aligns with heightened ethical considerations, as consumers increasingly prefer products that are not tested on animals. Regulatory changes and advocacy for animal rights have catalyzed this shift, leading to an expanding array of brands that eschew animal testing.

In the U.S., the rise of direct-to-consumer (DTC) beauty and personal care brands has been significantly influenced by the accessibility of social media and the changing preferences of consumers, especially post-COVID. Prominent brands like Kylie Cosmetics and Fenty Beauty have successfully leveraged celebrity endorsements to capture market attention and establish a strong online presence.

With the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML), e-commerce platforms are offering highly personalized shopping experiences. These technologies analyze consumer preferences, purchase history, and behavior to recommend tailored products, driving higher engagement and satisfaction. The rise of e-commerce has facilitated the growth of direct-to-consumer (D2C) business models, allowing brands to bypass traditional retail intermediaries. This not only enhances profit margins but also enables brands to maintain direct control over customer interactions, brand messaging, and product offerings, thereby fostering stronger brand loyalty.

Product Insights

The skincare products accounted for a market share of 32.61% in 2024. The demand for facial skincare products in the U.S. is on an upward trajectory, propelled by a heightened consumer focus on self-care, wellness, and preventive skincare routines. An increasing awareness of skin health, combined with rising concerns around aging, pollution, and environmental stressors, has led more consumers to invest in targeted facial skincare products that address specific concerns such as hydration, anti-aging, and sun protection. In addition, the widespread influence of social media, beauty influencers, and dermatological advice readily accessible online has made skincare education more prevalent, further driving demand.

In response, manufacturers are catalyzing this market growth by introducing innovative products that align with emerging consumer preferences for efficacy, safety, and sustainability. By leveraging advanced formulations with active ingredients like hyaluronic acid, retinol, and peptides, as well as promoting clean and organic formulations, brands are appealing to increasingly discerning consumers. For instance, in May 2024, Eminence Organic Skin Care introduced its Charcoal & Black Seed Collection, designed to purify and restore skin balance. This new line, characterized by refreshing, earthy scents, includes the Charcoal & Black Seed Clarifying Oil, Charcoal & Black Seed Clay Masque, and Charcoal & Black Seed Pro Desincrustation Gel, each formulated to provide targeted clarifying benefits. Furthermore, companies are expanding product lines to address diverse skin types and concerns, launching solutions for sensitive, acne-prone, and mature skin. This steady pipeline of new product launches not only sustains consumer interest but also plays a pivotal role in market growth.

The demand for color cosmetics is anticipated to grow at a CAGR of 8.7% from 2025 to 2030. The shift towards hybrid beauty products-cosmetics that combine skincare benefits with makeup-has further contributed to the rising demand for face color cosmetics. Many consumers now seek multi-functional products that not only offer coverage and color but also provide additional benefits, such as hydration, sun protection, and anti-aging properties.

The growing emphasis on clean beauty and health-conscious products is also contributing to the increased demand for color cosmetics. As consumers become more mindful of the ingredients in their beauty products, they are seeking color formulations that are free from harmful chemicals and toxins. This shift has led to a rise in the popularity of products such as lipsticks and glosses that are made with natural, organic, and cruelty-free ingredients.

End-use Insights

The women’s demand for beauty and personal care products in the U.S. accounted for a market share of 66.39% in 2024. The demand for beauty products among women is undergoing a transformative shift, heavily shaped by influencer and celebrity-led trends. Prominent figures such as Kylie Jenner, Rihanna, and Selena Gomez have successfully established their beauty lines-Kylie Skin, Fenty Beauty, and Rare Beauty, respectively-demonstrating a growing trend in which celebrities capitalize on their influence to develop personal brands that resonate with consumers and significantly impact market dynamics.

An October 2022 blog by Global Cosmetics Magazine highlighted that 75% of U.S. female consumers expressed heightened interest in purchasing beauty products, a trend fueled by the increasing popularity of social media reels and videos focused on cosmetic routines, especially among younger audiences. Data from TABSanalytics in 2022 further underscores this trend, showing that women aged 25-44 drive 38% of cosmetic product purchases, with the 45-54 age segment contributing another 18% to total sales. This growing interest, led by social media engagement and celebrity endorsements, continues to shape consumer preferences and fuel the U.S. market’s expansion.

The demand for beauty and personal care products among men is expected to grow at a CAGR of 7.9% from 2025 to 2030. The emergence of male beauty influencers and makeup artists has been instrumental in normalizing and popularizing beauty and personal care products among men. This cultural shift is further propelled by strategic product innovations and robust marketing efforts from leading brands focused on catering to men’s specific skincare and cosmetic needs.

The men’s market is witnessing a notable increase in demand, with brands developing products tailored to meet men’s unique grooming preferences. According to an April 2024 survey by Mintel, 72% of U.S. male consumers aged 18 to 34 now use makeup products, reflecting an evolving trend among younger men who incorporate cosmetics into their grooming routines. This shift signals changing perspectives on gender norms and beauty standards, positioning makeup as a tool for personal expression and enhancing appearance. Brands are increasingly responding to this demand with product offerings traditionally marketed to women, such as concealers and foundations, now aimed at male consumers. This evolution points to a growing acceptance of cosmetics within men’s grooming, foreshadowing a transformative shift in the beauty industry.

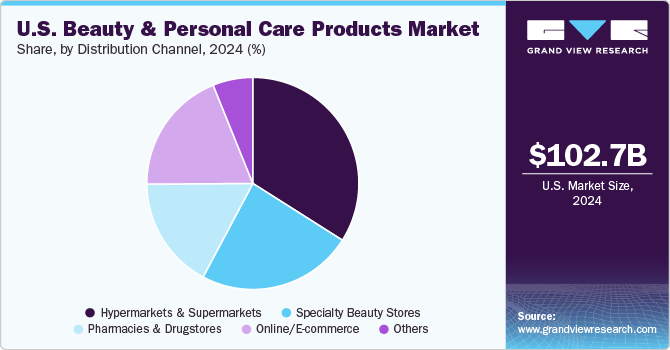

Distribution Channel Insights

The supermarkets and hypermarkets contributed a market share of 33.99% in 2024. The growth in U.S. beauty and personal care product sales through supermarkets and hypermarkets can be attributed to the convenience, variety, and accessibility offered by these stores to consumers. With vast shelf space and high foot traffic, these retail formats present a wide range of brands and product types under one roof, simplifying the shopping experience. This approach appeals to consumers seeking efficient, one-stop shopping and aligns with evolving consumer preferences for convenience-driven purchases. Furthermore, supermarkets and hypermarkets have been enhancing their beauty aisles, integrating prominent displays and dedicated sections for high-demand categories like skincare and haircare, thereby elevating in-store visibility and encouraging impulse purchases. The increase in promotional activities and frequent discounts also attracts budget-conscious consumers, reinforcing these outlets as a preferred choice for beauty and personal care purchases.

The sales through e-commerce/online platforms channels are expected to grow at a CAGR of 8.8% from 2025 to 2030. The online channel's growth as a preferred platform for beauty and personal care products is primarily driven by its convenience, extensive product selection, and customization options. E-commerce platforms and brand websites offer consumers the flexibility to browse, compare, and purchase products from anywhere, often supported by targeted recommendations and virtual try-on technologies. Enhanced by influencer marketing, online tutorials, and user reviews, online platforms provide a highly engaging shopping experience that appeals especially to younger, tech-savvy consumers. In addition, many brands have embraced direct-to-consumer models through their websites, offering exclusive online discounts, subscription services, and tailored recommendations, which strengthen customer loyalty and increase online sales.

Key U.S. Beauty And Personal Care Products Company Insights

The market for beauty and personal care products in the U.S. is characterized by a dynamic and highly competitive landscape driven by both established global brands and innovative emerging players. Major brands leverage strong brand equity, extensive distribution networks, and significant marketing budgets to maintain substantial market shares while continuously adapting to shifting consumer preferences through product innovation and sustainability initiatives. Companies like L’Oréal, Procter & Gamble, and Estée Lauder dominate multiple categories, utilizing advanced R&D capabilities and frequent product launches to address diverse consumer needs, from premium skincare to mass-market cosmetics.

The market has seen a surge of niche and direct-to-consumer brands that are agile in responding to current trends, such as clean beauty, inclusive shade ranges, and gender-neutral offerings. These entrants frequently employ digital-first strategies, targeting specific demographics through social media and influencer partnerships, thus creating strong brand resonance among younger, socially conscious consumers. In addition, increasing demand for personalized and eco-friendly products has spurred innovation across the board, pushing both legacy and indie brands to prioritize transparency, natural ingredients, and sustainable packaging. This competitive dynamic underscores a market where rapid adaptation and brand differentiation are essential for sustained growth.

Key U.S. Beauty And Personal Care Products Companies:

- The Estée Lauder Companies

- L'Oréal S.A.

- Procter & Gamble (P&G) Company

- Unilever plc

- Johnson & Johnson

- Shiseido Co., Ltd.

- Coty Inc.

- Revlon Consumer Products LLC

- Natura&Co

- Kao Corporation

View a comprehensive list of companies in the U.S. Beauty And Personal Care Products Market

Recent Developments

-

In June 2024, The Estée Lauder Companies announced the completion of its acquisition of DECIEM Beauty Group Inc. Having secured majority ownership in 2021, Estée Lauder finalized the acquisition of the remaining shares for approximately USD 860 million as of May 31, 2024. Renowned for its flagship brand, The Ordinary, DECIEM significantly enhances The Estée Lauder Companies’ skincare portfolio, reinforcing its position in the prestige skincare segment, particularly in North America and Europe, where DECIEM has achieved notable market leadership.

-

In April 2023, Coty Inc.'s renowned philosophy brand became an official participant in the Cruelty-Free International Leaping Bunny Programme, signifying that all philosophy products have received the esteemed Leaping Bunny certification. This recognition assures philosophy consumers of the brand's firm commitment to ending animal testing within the cosmetics industry, reinforcing its ethical stance and dedication to cruelty-free practices.

U.S. Beauty And Personal Care Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 109.56 billion

Revenue forecast in 2030

USD 155.44 billion

Growth Rate

CAGR of 7.1% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel

Key companies profiled

The Estée Lauder Companies, L'Oréal S.A., Procter & Gamble (P&G) Company, Unilever plc, Johnson & Johnson, Shiseido Co., Ltd., Coty Inc., Revlon Consumer Products LLC, Natura&Co, and Kao Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Beauty And Personal Care Products MarketReport Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. beauty and personal care products market report based on product, end use, and distribution channel.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skin Care

-

Face Skin Care

-

Lotions, Face Creams, & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Sunscreen/Sun Care

-

Sheet Face Masks

-

Others (Scrub, etc.)

-

-

Body Skin Care

-

Hair Removal Products

-

Lotions, Creams, & Moisturizers

-

Body Sunscreen/Sun Care

-

Body Scrub

-

Others (Serum, Oils, etc.)

-

-

-

Hair Care

-

Shampoo

-

Conditioner

-

Oils

-

Serums

-

Others (Hair Masks, Peels, Etc.)

-

-

Oral Care

-

General Purpose Products

-

Toothpaste

-

Toothbrush

-

Mouthwashes/Rinses

-

Dental Floss

-

Others (Tongue Cleaners, Dental Water Jets, etc.)

-

-

Beauty Oral Care Products

-

Teeth Whitening Products

-

Teeth Glossing Products

-

Breath Freshening Products

-

Tooth Polishing Tools

-

Others (Clear Aligners, etc.)

-

-

-

Color Cosmetics

-

Face Color Cosmetics

-

Foundation

-

Concealer

-

Blush and Bronzer

-

Powder

-

Others (Highlighter, etc.)

-

-

Lip Color Cosmetics

-

Lipstick

-

Lip Liner

-

Lip Gloss

-

Lip Tint

-

Others (Lip Powder, Plummer, etc.)

-

-

Eye Color Cosmetics

-

Eye Shadow

-

Eye Liner

-

Mascara

-

Eye Pencil

-

False Eyelashes

-

Others (Eye Primer, etc.)

-

-

Nail Color Cosmetics

-

-

Shower and Bath

-

Perfume/Fragrances

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Beauty Stores

-

Pharmacies & Drugstores

-

Online/E-commerce

-

Others (Department Stores, etc.)

-

Frequently Asked Questions About This Report

b. The U.S. beauty and personal care products market was estimated at USD 102.73 billion in 2024 and is expected to reach USD 109.56 billion in 2025.

b. The U.S. beauty and personal care products market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030, reaching USD 155.44 billion by 2030.

b. The skincare products accounted for a market share of 32.61% in 2024. The demand for facial skincare products in the U.S. is on an upward trajectory, propelled by a heightened consumer focus on self-care, wellness, and preventive skincare routines.

b. Some of the key players operating in the U.S. beauty and personal care products market are The Estée Lauder Companies, L'Oréal S.A., Procter & Gamble (P&G) Company, Unilever plc, Johnson & Johnson, Shiseido Co., Ltd., Coty Inc., Revlon Consumer Products LLC, Natura&Co, and Kao Corporation.

b. The growth of the U.S. beauty and personal care products market is majorly driven by a heightened emphasis on self-care and wellness, increasing demand for clean beauty offerings that are free from harmful chemicals and sourced sustainably, and the rise of direct-to-consumer (D2C) business models.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."