- Home

- »

- Power Generation & Storage

- »

-

U.S. Battery Recycling Market Size, Industry Report, 2030GVR Report cover

![U.S. Battery Recycling Market Size, Share & Trends Report]()

U.S. Battery Recycling Market (2025 - 2030) Size, Share & Trends Analysis Report By Chemistry (Lithium-ion, Lead acid, Nickel, Cobalt, Manganese), By Application (Transportation, Consumer Electronics, Industrial), And Segment Forecasts

- Report ID: GVR-4-68040-220-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Battery Recycling Market Summary

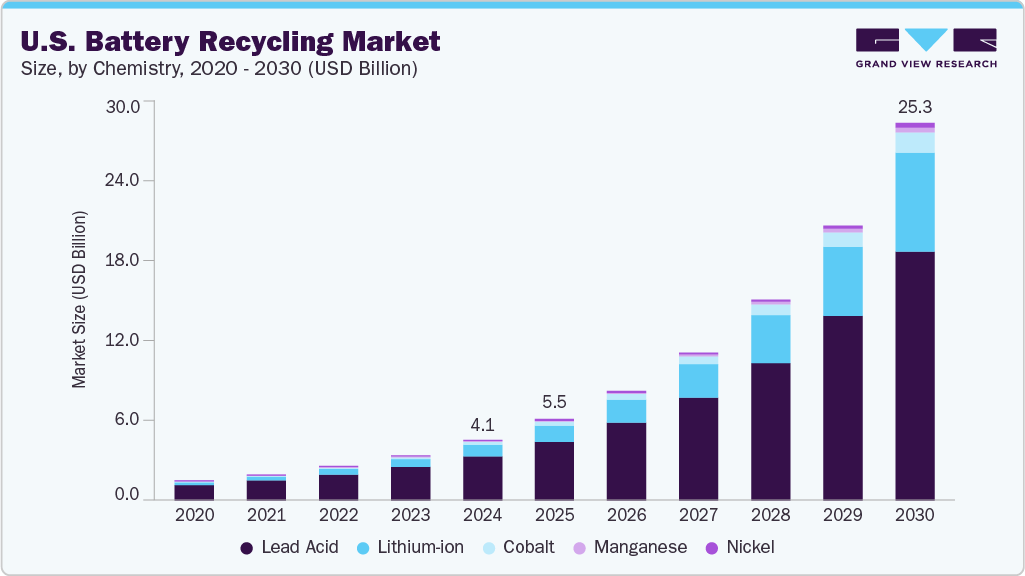

The U.S. battery recycling market size was estimated at approximately USD 4.09 billion in 2024 and is projected to reach around USD 25.30 billion by 2030, registering a CAGR of 35.8% between 2025 to 2030. The market is driven by increasing demand for sustainable management of spent batteries, rising adoption of lithium-based chemistries, and stringent environmental regulations promoting responsible battery disposal and recycling.

Key Market Trends & Insights

- The battery recycling market in the U.S. is expected to grow significantly over the forecast period.

- By chemistry, the lead acid segment held the highest market share of 73.42 % in 2024.

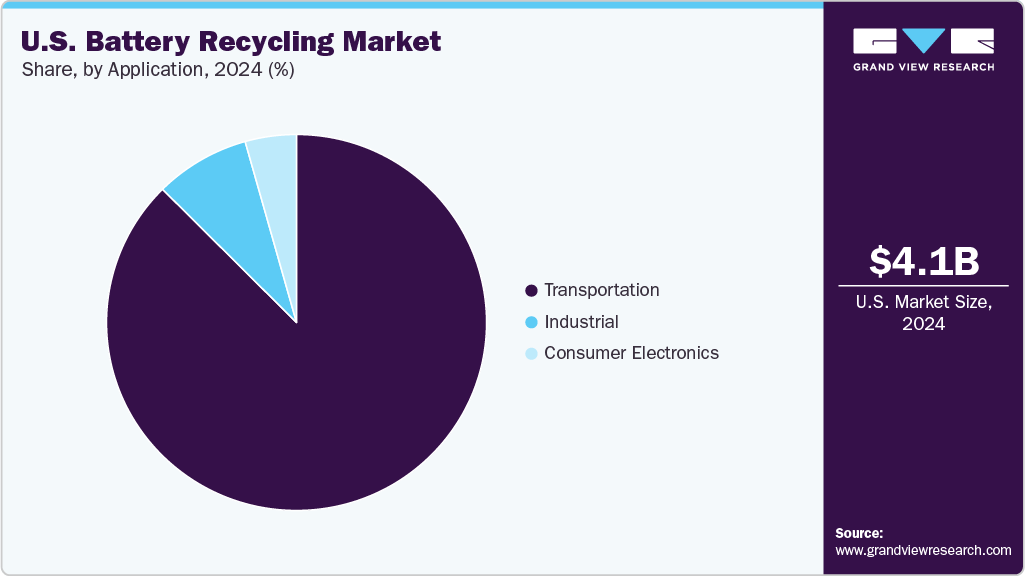

- Based on application, the transportation segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.09 Billion

- 2030 Projected Market Size: USD 25.30 Billion

- CAGR (2025-2030): 35.8%

Growing deployment of lithium thionyl chloride (Li-SOCl₂) batteries in sectors such as utility metering, defense electronics, industrial automation, and remote monitoring further fuels the need for efficient recycling solutions. The transition toward smart infrastructure, autonomous systems, and digital utility networks supports steady market expansion.

Li-SOCl₂ batteries are critical for low-drain, long-duration applications due to their high energy density, extended operational lifespan, and reliability in extreme environmental conditions. Unlike conventional consumer lithium batteries, they are optimized for applications requiring sustained low power consumption, such as smart meters, SCADA systems, environmental sensors, and asset tracking devices. Technological advancements in bobbin and spiral cell configurations have improved battery performance under continuous and pulse load operations, enhancing their suitability for industrial and defense applications. Strong government initiatives, defense sector procurement, and industrial IoT adoption are expected to drive innovation in battery recycling infrastructure, ensuring sustained battery recycling market growth in the U.S. throughout the forecast period.

Drivers, Opportunities & Restraints

The U.S. battery recycling industry is primarily driven by the growing need for reliable, long-lasting, and low-maintenance energy solutions across critical infrastructure, industrial, and defense applications. The widespread deployment of smart meters, remote monitoring systems, and industrial automation equipment fuels lithium thionyl chloride (Li-SOCl₂) batteries, valued for their high energy density, extended shelf life, and robustness in extreme conditions. Utilities, oil & gas operators, and industrial players increasingly rely on these batteries to power low-drain, remote systems with minimal maintenance, ensuring operational efficiency, automation, and uptime.

Opportunities in the market are expanding with advancements in bobbin and spiral cell designs, which support a wider range of applications, from continuous low-power monitoring to high-pulse communication tasks. Growing adoption of IoT devices, miniaturized industrial electronics, and smart infrastructure opens new avenues in smart grid metering, satellite communications, agricultural telemetry, and predictive maintenance systems. However, the U.S. market faces certain constraints. The non-rechargeable nature of Li-SOCl₂ batteries limits their suitability for cycling applications, while strict environmental regulations, hazardous material handling requirements, rising lithium costs, and global supply chain vulnerabilities pose challenges. In addition, competition from advanced rechargeable battery chemistries in high-current or frequently accessed applications may restrict adoption in specific segments.

Chemistry Insights

The lead acid segment held the largest revenue share of 73.42% in 2024, dominating the chemistry category in the U.S. market. Lead-acid batteries continue to be widely recycled due to their mature technology, cost-effectiveness, and high recyclability rate, making them the backbone of automotive, industrial, and backup power applications. Their established recycling infrastructure and straightforward recovery processes allow for efficient collection, processing, and reuse of lead, sulfuric acid, and other components, supporting environmental sustainability and economic viability.

In the U.S., lead-acid batteries are extensively used in automotive starter batteries, uninterruptible power supply (UPS) systems, telecom backup solutions, and industrial motive power applications. The high demand for reliable energy storage in these sectors and stringent environmental regulations promoting responsible disposal and recycling reinforce the segment’s dominance. Technological improvements in battery design, durability, and recycling efficiency further enhance their value proposition. As utilities, industrial players, and automotive manufacturers increasingly prioritize sustainable practices and circular economy models, lead acid batteries will remain the leading chemistry segment in the U.S. market throughout the forecast period.

Application Insights

The transportation segment held the largest revenue share of 87.54% in 2024, dominating the application segment in the U.S. market. This leadership is driven by the widespread use of batteries in automotive starter systems, electric vehicles (EVs), hybrid vehicles, and commercial transport fleets, where reliable, high-performance energy storage is critical. The extensive deployment of lead acid and lithium-based batteries in transportation applications has established a strong recycling ecosystem, enabled efficient recovery of valuable metals and materials while supported environmental sustainability and regulatory compliance.

In the U.S., the transportation sector continues to drive demand for battery recycling due to rising vehicle ownership, growth of EV adoption, and increasing replacement of aging automotive batteries. Batteries used in transportation are often subjected to extreme operating conditions, including high vibrations, temperature variations, and frequent charge-discharge cycles. This underscores the importance of proper recycling and material recovery. In addition, government initiatives promoting EV adoption, emission reduction targets, and circular economy practices are further bolstering the recycling market. As the U.S. focuses on sustainable mobility and low-carbon transport solutions, the transportation segment is expected to maintain its dominant share in the Battery Recycling market throughout the forecast period.

Key U.S. Battery Recycling Company Insights

Some key players operating in the U.S. battery recycling industry include Call2Recycle, Inc., Retriev Technologies, Battery Solutions LLC, among others. These companies focus on the collection, recycling, and repurposing of automotive, industrial, and lithium-based batteries, emphasizing sustainable material recovery, environmental compliance, and efficient recycling processes.

Key U.S. Battery Recycling Companies:

- Call2Recycle, Inc.

- Retriev Technologies

- Battery Solutions LLC

- Redwood Materials, Inc.

- Li-Cycle Corp.

- Exide Technologies

- Johnson Controls International plc

- TES-AMM North America

- Umicore

- Gopher Resource, LLC

Recent Developments

-

In March 2025, Li-Cycle Corp. announced the expansion of its lithium-ion battery recycling facility in Tuscaloosa, Alabama, aimed at increasing processing capacity for spent automotive and industrial batteries. This expansion is expected to significantly enhance the battery recycling market in the U.S. by improving the availability of recovered lithium, cobalt, and nickel for domestic battery manufacturers.

U.S. Battery Recycling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.47 billion

Revenue forecast in 2030

USD 25.30 billion

Growth rate

CAGR of 35.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Tons; Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Chemistry, application

Country scope

U.S.

Key companies profiled

Call2Recycle, Inc.; Retriev Technologies; Battery Solutions LLC; Redwood Materials, Inc.; Li-Cycle Corp.; Exide Technologies; Johnson Controls International plc; TES-AMM North America; Umicore; Gopher Resource, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Battery Recycling Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. battery recycling market report based on chemistry and application:

-

Chemistry Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Lead acid

-

Nickel

-

Cobalt

-

Manganese

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Electric vehicles

-

Others

-

-

Consumer electronics

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. battery recycling market size was estimated at USD 4.09 billion in 2024 and is expected to reach USD 5.47 billion in 2025.

b. The U.S. battery recycling market is expected to grow at a compound annual growth rate of 35.8% from 2025 to 2030 to reach USD 25.30 billion by 2030.

b. Based on the chemistry segment, Lead Acid held the largest revenue share of more than 73.42% in 2024.

b. The key market player in the U.S. battery recycling market includes Call2Recycle; Exide Technologies; Cirba Solutions; American Battery Technology Company; Gopher Resource; East Penn Manufacturing Co.; and Aqua Metals.

b. The key factors driving the U.S. Battery Recycling market include the growing focus on sustainable resource recovery, the rising volume of spent batteries from electric vehicles and consumer electronics, and stringent environmental regulations promoting circular economy practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.