U.S. Bathroom And Toilet Assist Devices Market Size, Share & Trends Analysis Report By Product (Bath Lifts, Commodes, Bath Aids), By Distribution Channel (Retail Pharmacy, Online/E-commerce), By Region (Southeast, Midwest), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-270-2

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

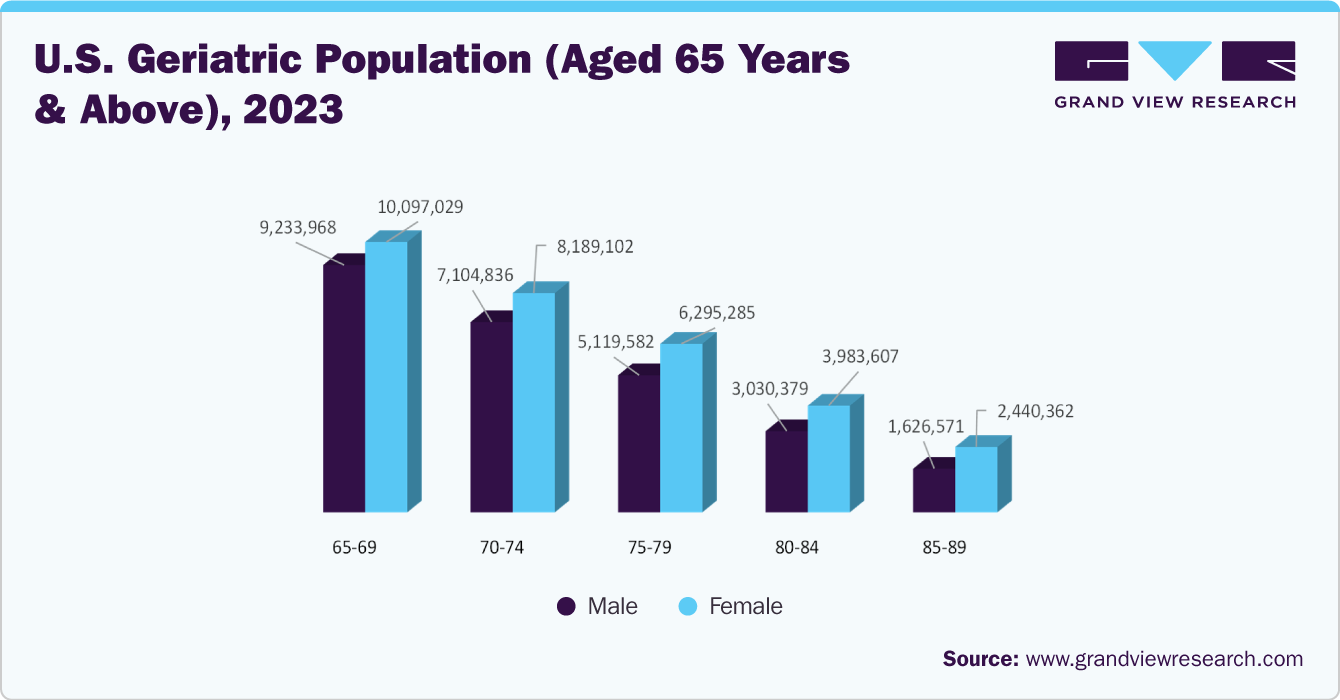

The U.S. bathroom and toilet assist devices market size was estimated at USD 1.43 billion in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030. The growth is attributed to the rising awareness & acceptance of assistive products, growing disabled population, and increasing emphasis on technological advancements to improve patient care. According to the CDC, up to 1 in 4 adults in the U.S. are addressed with some disability. The estimated prevalence was 18.4% for the 18 to 44 years demographic, 26.7% for 45 to 64 years, and 41.6% for 65 years & above.

According to several NCBI studies, individuals aged over 65 years are at a greater risk of developing chronic illnesses and disabilities, such as Parkinson’s disease & nervous system disorders. According to the Johns Hopkins Arthritis Center, U.S., the average annual incidence of rheumatoid arthritis is about 70 per 100,000 annually. Rheumatoid arthritis and osteoporosis are chronic medical conditions that significantly impact an individual’s mobility & quality of life. Rheumatoid arthritis often causes joint pain and stiffness, making it difficult for patients to walk or move freely.

Moreover, neurological disorders, such as Alzheimer’s disease, Parkinson’s disease, and epilepsy, are expected to have the highest incidence over the forecast period. According to data published in the Alzheimer’s Association report, nearly 6.7 million people in the U.S. were diagnosed with Alzheimer’s dementia in 2023. Furthermore, the increasing incidence of paralysis and spinal injuries is anticipated to drive product demand over the forecast period.

The rising number of technologically advanced products in the U.S. is expected to drive market growth over the forecast period. For instance, in September 2023, TIDI Products, LLC launched a wireless toilet sensor to help caregivers prevent falls in the bathroom. The sensor can be paired with an alarm, On Cue PRO. Integrating these devices allows caregivers to respect the patient’s privacy while alerting healthcare providers if a non-compliant patient is trying to exit the toilet.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation. Innovations, such as sensor-equipped fixtures, adjustable-height toilets, remote-controlled devices, and personalized adaptations have driven up the demand for such assistive technologies. For instance, in August 2023, SedMed, a mobility product company, launched SedMed Toilet Lift, a seating device/lift. SedMed Toilet Lift can elevate up to 80% of a patient’s body weight and assists the user in getting on & off the toilet. In addition, the company announced plans to develop a remote patient monitoring tracker to analyze toilet usage and frequency

The U.S. bathroom and toilet assist devices industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Companies within the industry engage in strategic initiatives to strengthen their product portfolios, expand their market presence, and leverage complementary capabilities. For instance, in December 2021, Invacare Corporation revealed its strategic decision to consolidate its Europe and Asia Pacific businesses under a unified leadership structure. This move aims to streamline operations and elevate the overall customer experience

Regulations play a crucial role in shaping the market. The Food and Drug Administration (FDA) regulates medical devices in the U.S., including bathroom and toilet assist devices, to ensure safety & efficacy. The Americans with Disabilities Act (ADA) guidelines specify requirements for the design, dimensions, installation, and accessibility features of bathroom facilities

Product substitutes are a key strategy employed by companies to cater to diverse consumer needs and preferences. Some consumers may opt for DIY solutions, such as installing handrails or using portable shower chairs, instead of purchasing expensive assistive devices from specialized stores. There are various online marketplaces where consumers can compare prices and specifications of different products before making a purchase decision

End-user concentration plays a significant role in shaping competition among manufacturers and suppliers of bathroom and toilet assist devices. End-user can vary based on factors, such as brand loyalty, product features, pricing, and consumer preferences.

Product Insights

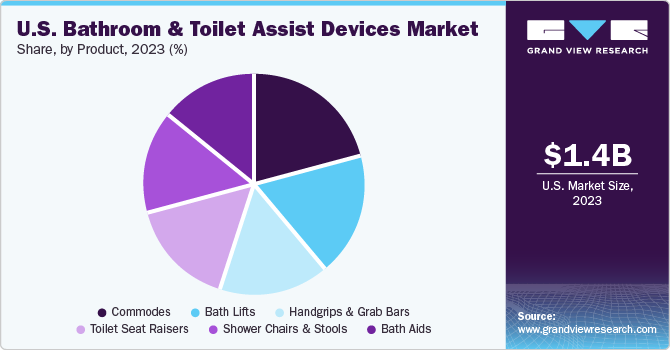

The commodes product segment accounted for the largest market share of 20.9% in 2023. Commodes reduce the need for caregivers or assistance. The product is easy to clean and provides comfort to the disabled and people with reduced mobility. These commodes are flexible & adjustable, hence are helpful for people with reduced mobility. These commodes can be used on the toilet or over the toilet. It can also be used as a shower seat due to its design and functionality. Commodes that are designed as 3-in-1 units often have features that make them suitable for use in the shower.

Furthermore, technological advancements have led to the development of innovative commode features. Smart commodes with sensors, adjustable height settings, and remote-control capabilities cater to the diverse needs of users, providing a more user-friendly and personalized experience. For instance, in May 2023, Casana announced receiving U.S. FDA approval for its Heart Seat to measure heart rate and oxygen saturation (SpO2). The company partnered with researchers to validate the device usage for additional clinical measurements/indications.

The bath lifts segment is expected to grow at the fastest CAGR of 8.0% during the forecast period. People with reduced mobility can face several challenges in bathrooms and bath lifts help as well as provide comfort to such individuals. The user-friendly design of such products is likely to boost the segment’s growth during the forecast period. Bath lifts are available with hydraulic levers, which can be used by disabled or aging people or an attendant. The bath lifts segment is further categorized into fixed, reclining, and lying designs. Reclining devices are expected to be in more demand than others owing to the additional advantages they offer.

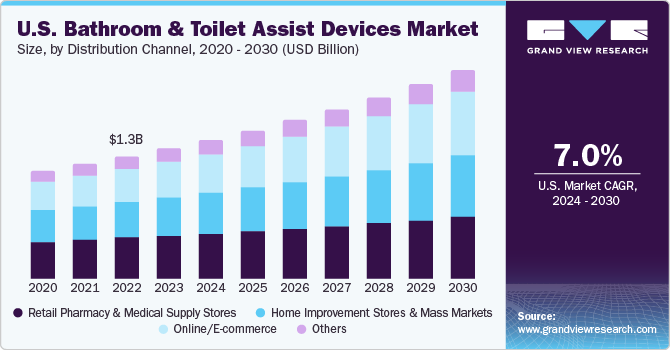

Distribution Channel Insights

The retail pharmacy & medical supply stores segment accounted for the largest share of 33.0% in 2023. The rising need for accessibility & convenience and expertise & trust is driving the segment growth. People, especially seniors who might not be comfortable with online shopping, can browse and purchase what they need on the spot. For instance, brick-and-mortar pharmacies offer immediate access to these devices. According to the Journal of the American Pharmacists Association in November 2022, 61.5% of all pharmacies are retail chains, 38.1% of them are regional pharmacies or independent pharmacies and nearly 0.4% are government pharmacies. Critically, CVS Pharmacy & Walgreens hold a significant share in the overall retail pharmacies space, as they both have nearly 17,000 retail pharmacies (combined).

The online/e-commerce segment is expected to grow at the fastest CAGR of 8.5% during the forecast period. The easy access to shop from the comfort of one’s home, competitive pricing & discounts, and a wide range of product options offered by online platforms drive segment growth. Moreover, the increasing popularity of digital payment methods, such as credit & debit cards and digital wallets, has made online shopping more accessible. This ease of payment processing further enhances the convenience factor for consumers, augmenting the segment demand.

Regional Insights

The Southeast segment held a dominant share of 25.7% in 2023 while the Southwest region is expected to grow at the fastest CAGR of 7.6% over the forecast period. The increasing incidences of self-care disability are the primary reasons driving the demand for toilet & bathroom assist devices in these regions. Self-care disabilities encompass a range of conditions that limit an individual’s ability to perform daily tasks independently and are on the rise due to growing aging population, chronic health conditions, etc.

Key U.S. Bathroom And Toilet Assist Devices Company Insights

The U.S. bathroom and toilet assist devices market is a dynamic and competitive industry with several key players vying for market share. Companies focus on research and development, along with strategic partnerships and product launches. The commitment to advancing care through technological innovations has contributed to a substantial market share.

Key U.S. Bathroom And Toilet Assist Devices Companies:

- ArjoHuntleigh

- Carex

- Medical Depot, Inc./Drive Medical

- Invacare Corporation

- Etac AB

- Handicare Group AB

- Cardinal Health

- GF Health Products, Inc.

- Medline Industries

Recent Developments

-

In December 2023, Arjo obtained Medical Device Regulation (MDR) and the UK Conformity Assessment (UKCA) certifications for its entire product range

-

In November 2022, Etac AB announced a new addition to its bathroom accessory line - a toilet paper holder designed specifically for the Swift Commode and Swift Freestanding toilet seat raiser. This innovative accessory serves as a seamless complement to these toilet aids, enhancing their functionality

-

In September 2022, Graham-Field announced an investment in an advanced 3D Fiber Optic Laser Tube Cutting System. This investment is expected to aid in the company’s progress in local manufacturing

U.S. Bathroom And Toilet Assist Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.53 billion |

|

Revenue forecast in 2030 |

USD 2.30 billion |

|

Growth rate |

CAGR of 7.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

June 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, and region |

|

Region scope |

Southeast; Midwest; West; Northeast; Southwest |

|

Key companies profiled |

ArjoHuntleigh; Carex; Medical Depot, Inc./Drive Medical; Invacare Corp.; Etac AB; Handicare Group AB; Cardinal Health; GF Health Products, Inc.; Medline Industries |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Bathroom And Toilet Assist Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bathroom and toilet assist devices market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shower Chairs And Stools

-

Bath Lifts

-

Fixed Bath Lifts

-

Reclining Bath Lifts

-

Lying Bath Lifts

-

-

Toilet Seat Raisers

-

Commodes

-

Shower & Toilet Commodes

-

Toilet Commodes

-

-

Handgrips & Grab Bars

-

Bath aids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacy & Medical Supply Stores

-

Home Improvement Stores & Mass Markets

-

Online/E-commerce

-

Others

-

-

RegionalOutlook (Revenue, USD Million, 2018 - 2030)

-

Southeast

-

Midwest

-

West

-

Northeast

-

Southwest

-

Frequently Asked Questions About This Report

b. The U.S. bathroom and toilet assist devices market size was valued at USD 1.43 billion in 2023 and is expected to reach USD 1.53 billion in 2024.

b. The U.S. bathroom and toilet assist devices market is projected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030 to reach USD 2.30 billion by 2030.

b. Based on product, the commodes segment dominated the market, accounting for over 19.0% in 2023. Commodes are classified as durable medical equipment under Medicare Part B (Medical Insurance) when prescribed by a physician, a key factor propelling the segment's growth.

b. Some of the key players operating in the U.S. bathroom and toilet assist devices market include Etac AB, Invacare, Arjo Huntleigh, Bischoff Medical Devices, and Dietz Rehab, Drive DeVilbiss Healthcare, Carex Health Brands, and Medline Industries.

b. Bathroom and Toilet assist devices enable individuals to maintain their privacy while using the restroom independently, even after long-term illnesses or accidents. These devices significantly improve the quality of life at a lower cost than hospital beds or motorized wheelchairs and usually have minimal additional maintenance costs. As a result of an increase in sports-related injuries, auto accidents, and chronic neurological impairment, the population is becoming more disabled, which is expected to propel the market in the U.S.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."