- Home

- »

- Medical Devices

- »

-

U.S. Banking Solutions For Healthcare Payers And Providers Market, Report, 2030GVR Report cover

![U.S. Banking Solutions For Healthcare Payers And Providers Market Size, Share & Trends Report]()

U.S. Banking Solutions For Healthcare Payers And Providers Market Size, Share & Trends Analysis Report By Solution (Services, Software), By Application (Credit & Financing, Financial Management), By End Use (Provider, Payer), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-373-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

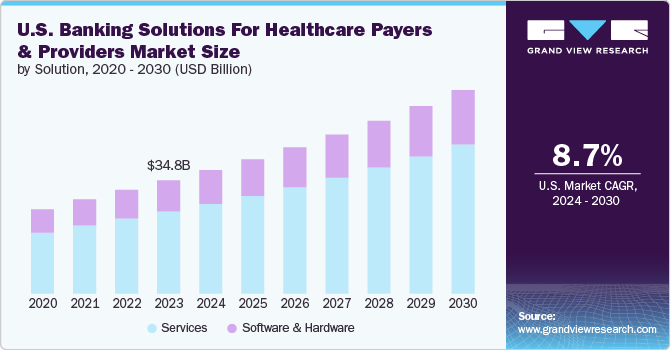

The U.S. banking solutions for healthcare payers and providers market was estimated at USD 34.8 billion in 2023 and is expected to grow at a CAGR of 8.7% from 2024 to 2030. The market is primarily driven by the need for regulatory compliance, given the stringent healthcare regulations such as Medicare Access and CHIP Reauthorization Act (MACRA) that mandate data security & privacy. In addition, the need to optimize operations is another key driver, as healthcare payers and providers leverage technology to streamline administrative processes, cut costs, and improve operational efficiency.

Regulatory compliance drives the demand for banking solutions among healthcare payers and providers in the U.S. Stringent regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), mandate rigorous financial reporting, data security, and transparency. These regulations require healthcare organizations to maintain accurate and comprehensive financial records, necessitating advanced banking solutions.

Integrated financial management platforms ensure compliance by automating financial processes, reducing the risk of errors, and providing real-time reporting capabilities. Moreover, these solutions help meet audit requirements and avoid costly penalties associated with non-compliance. As regulatory frameworks evolve, the demand for robust banking solutions that are capable of adapting to new compliance standards is expected to increase, contributing to the market growth. For instance, in March 2023, Comerica Bank and Ameriprise Financial, Inc. agreed for Ameriprise to take over as the new investment program provider for Comerica. Comerica's financial advisors will gain access to Ameriprise Financials' integrated technology, comprehensive investment solutions, exceptional service capabilities, marketing support, and renowned learning & development programs.

“We conducted thorough due diligence to find the right partner to elevate Comerica’s securities offering. Ameriprise has the technology, research capabilities, products, services, financial strength, and practice management expertise to help us raise the bar on the experience we provide our clients. Their culture is a natural fit for our financial advisors, as Ameriprise shares our passion for providing tailored advice that helps clients achieve their financial goals.”

- Executive Vice President and Executive Director of Wealth Management at ComericaThe COVID-19 pandemic significantly impacted the healthcare payers and providers industry, driving the adoption of banking solutions and influencing various financial operations and priorities. The increase in telehealth services prompted healthcare providers and payers to invest in digital financial platforms and technologies, allowing them to manage transactions remotely and alleviate the burden on physical, financial processes. The pandemic led to fluctuations in financial activities, marked by a decline in non-COVID-related transactions and a surge in COVID-19-related financial claims.

Moreover, changes in how people access healthcare due to the pandemic led healthcare providers and payers to implement digital banking tools and platforms to keep financial operations efficient and transparent. Data analytics and predictive modeling became increasingly vital for identifying financial trends, predicting cash flow needs, and efficiently allocating financial resources.

Industry Dynamics

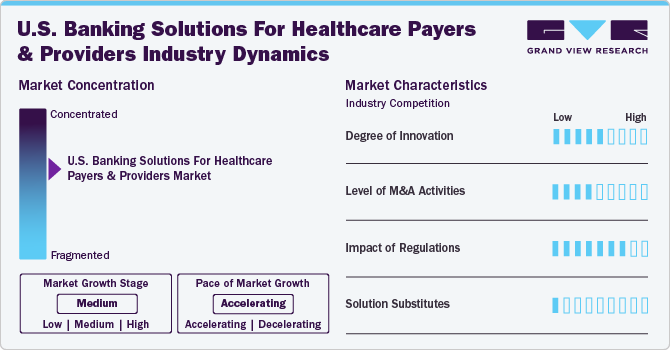

The U.S. banking solutions for healthcare payers and providers market is characterized by continuous innovation in digital banking technologies, AI-driven analytics, and integrated financial management platforms. Banks are investing heavily in developing cutting-edge solutions to enhance operational efficiency, security, and compliance.

Regulatory compliance is driving the adoption of banking solutions. Stringent regulations, including HIPAA, and other financial regulations, require healthcare payers and providers to maintain rigorous financial reporting and data security standards.

The specialized nature of banking solutions for healthcare payers and providers means there are few direct substitutes. While some healthcare organizations may opt for in-house financial management systems, the complexity and regulatory requirements make external banking solutions more attractive.

Solution Insights

The services segment dominated the market and accounted for the largest share of 72.58% in 2023 and is anticipated to witness fastest growth over the forecast period. The growth is attributed to increasing reliance on outsourced financial services to reduce operational costs and improve efficiency. Services like consultancy, financial advisory, and outsourcing of financial processes are widely adopted due to their flexibility and ability to address specific needs. Moreover, banks provide specialized services that may be beyond the expertise of in-house teams. The aforementioned factors are anticipated to fuel the segment growth over the forecast period.

The software and hardware devices segment is expected to grow significantly over the forecast period, owing to the increasing investment in technology to streamline financial operations. by healthcare providers and payers. Furthermore, increasing integration of advanced software solutions for automation, data analytics, and cybersecurity is also driving the demand for technologically advanced software and hardware. For instance, in August 2021, Commerce Bancshares, Inc. announced the optimization of patient financing options by integrating Health Services Financing (HSF) with Epic MyChart. This integration aims to expedite patient enrollment in HSF, thereby enhancing the patient experience and saving the provider's valuable time. Through the HSF Patient Enrollment app available in the Epic App Orchard, healthcare providers can seamlessly offer the HSF program via patients' MyChart accounts. The patient enrollment process is now entirely self-service, facilitating smoother transactions for all parties involved.

Application Insights

The financial management segment dominated the market growth in 2023, with a share of 44.83%. The adoption rate of financial management solutions is high among healthcare organizations due to the necessity of managing complex financial operations. These solutions integrate various financial functions such as budgeting, accounting, and financial reporting, providing a comprehensive view of an organization's financial health. The trend is moving towards using holistic financial management platforms that streamline these processes, enhancing efficiency and accuracy. Moreover, these platforms help in compliance with regulatory requirements and reduce the risk of financial discrepancies. For instance, in September 2022, Commerce Bancshares, Inc. partnered with FISPAN, a fintech company, to offer embedded commerce financing solutions. The new platform offers improved banking and treasury functionalities, including streamlined features such as account reconciliation, payment initiation, & remittance advice. It is compatible with leading accounting platforms like QuickBooks Online and Sage Intacct, which enhances overall financial management capabilities.

The analytics segment is anticipated to showcase the fastest growth from 2024 to 2030. Advanced analytics and AI solutions provide actionable insights, predictive financial modeling, and risk management, enabling organizations to anticipate trends and mitigate risks proactively. Thus, the increasing demand for improved financial planning, efficiency, and strategic decision-making, is fueling the demand for analytics solutions among healthcare payers and providers.

End Use Insights

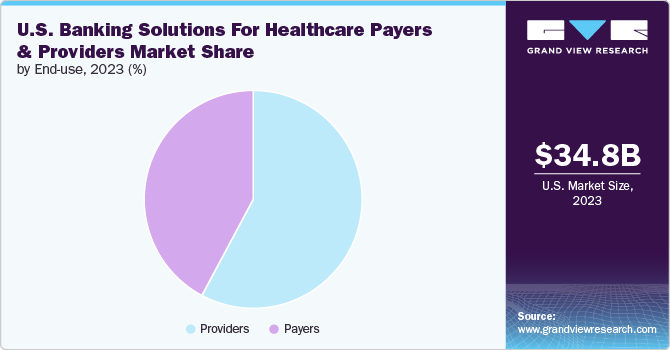

The providers segment dominated the market with a market share of 57.81% in 2023. Healthcare providers increasingly adopt banking solutions to manage their extensive financial operations efficiently. High adoption rates are driven by the need for robust revenue cycle management, encompassing billing, payments, and reimbursements. Integrated financial management platforms offer providers a holistic view of their financial health, aiding in better resource allocation and strategic planning. Thus, market players are launching solutions capable of catering to this rising demand. For instance, in May 2021, JP Morgan Chase launched Morgan Health, a business unit that enhances employer-sponsored healthcare's quality, efficiency, and equity. Morgan Health will collaborate with various healthcare experts and partners, including provider groups, employers, and organizations dedicated to improving the healthcare system.

The payers segment is anticipated to witness fastest growth from 2024 to 2030. The segment growth is attributed to the ability of these solutions to streamline claims processing, reducing turnaround times and enhancing customer satisfaction. Advanced analytics and automation tools provide critical insights for efficient financial management and risk assessment, helping payers mitigate potential financial risks.

Key U.S. Banking Solutions For Healthcare Payers And Providers Company Insights

Financial institutions are adopting diverse strategies to strengthen relationships with healthcare payers and providers, including acquisitions, partnerships, product launches, & collaborations. For example, in April 2020, Madaket Health, a cloud-based healthcare platform facilitating administrative data exchange between payers and providers, announced a collaboration with PNC Healthcare. This partnership earned PNC the prestigious Celent Model Bank 2020 Award for Commercial Payments, recognizing the positive impact of Madaket’s initiative with PNC Healthcare to automate enrollment processes for electronic funds transfer and electronic remittance advice. The collaboration has streamlined and simplified administrative data exchange between payers & providers, enhancing overall efficiency and improving the experience for healthcare consumers.

Key U.S. Banking Solutions For Healthcare Payers And Providers Companies:

- PNC Bank

- Bank of America

- JP Morgan Chase

- US Bank

- Wells Fargo

- KeyBank

- Fifth Third Bank

- Truist Bank

- Citizens Bank

- Regions Bank

- Comerica Bank

- M&T Bank

- Commerce Bancshares, Inc.

Recent Developments

-

In May 2023, Fifth Third Bancorp announced the acquisition of Big Data LLC, a technology solutions provider specializing in healthcare payments and remittances. This acquisition enhances Fifth Third's national healthcare revenue cycle capabilities, addressing clients' complex needs in this sector and aligning with the bank's vision of digital innovation & focus on healthcare.

-

In January 2023, Citizens Financial Group, Inc.’s Citizens M&A Advisory became the sole financial advisor for Springboard Healthcare Staffing and Education during its acquisition by Ingenovis Health, supported by Trilantic North America and Cornell Capital.

-

In June 2022, Bank of America announced a USD 40 million investment to expand access to primary healthcare. This financing initiative extended the reach of the company’s Signature Health Initiative, supporting the establishment and growth of primary care facilities.

-

In January 2021, PNC Bank N.A. acquired Tempus Technologies, Inc., a prominent payment gateway provider specializing in secure and innovative payment-processing solutions for businesses. This acquisition was expected to enhance PNC Treasury Management's comprehensive payments platform, offering corporate clients streamlined management of payables and receivables across various payment channels.

U.S. Banking Solutions For Healthcare Payers And Providers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.9 billion

Revenue forecast in 2030

USD 62.5 billion

Growth Rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, end use

Country scope

U.S.

Key companies profiled

PNC Bank; Bank of America; JP Morgan Chase; US Bank; Wells Fargo; KeyBank; Fifth Third Bank; Truist Bank; Citizens Bank; Regions Bank; Comerica Bank; M&T Bank; Commerce Bancshares, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Banking Solutions For Healthcare Payers And Providers Market Report Segmentation

This report forecasts revenue growth and provides country level analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. banking solutions for healthcare payers and providers market report based on solution, application, and end use:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Services

-

Software and Hardware

-

-

Application Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Credit & Financing

-

Financial Management

-

Analytics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Frequently Asked Questions About This Report

b. The U.S. banking solutions for healthcare payers and providers market size was estimated at USD 34.8 billion in 2023 and is expected to reach USD 37.9 billion in 2024.

b. The U.S. banking solutions for healthcare payers and providers market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 62.5 billion by 2030.

b. Services segment dominated the U.S. banking solutions for healthcare payers and providers market with a share of 72.58% in 2023. This is attributable to increasing reliance on outsourced financial services to reduce operational costs and improve efficiency.

b. Some key players operating in the U.S. banking solutions for healthcare payers and providers market include PNC Bank, Bank of America, JP Morgan Chase, US Bank, Wells Fargo, KeyBank, Fifth Third Bank, Truist Bank, Citizens Bank, Regions Bank, Comerica Bank, M&T Bank, and Commerce Bancshares, Inc.

b. Key factors that are driving the market growth include the need for regulatory compliance and optimize operations by leveraging technology to streamline administrative processes, cut costs, and improve operational efficiency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."