U.S. Ball Sports Goods Market Size, Share & Trends Analysis Report By Sport (Basketball, Football/Soccer, Volleyball, Baseball, Ice Hockey, Cricket, Golf, Lacrosse, Rugby, Softball), By Product, By Price Range, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Ball Sports Goods Market Size & Trends

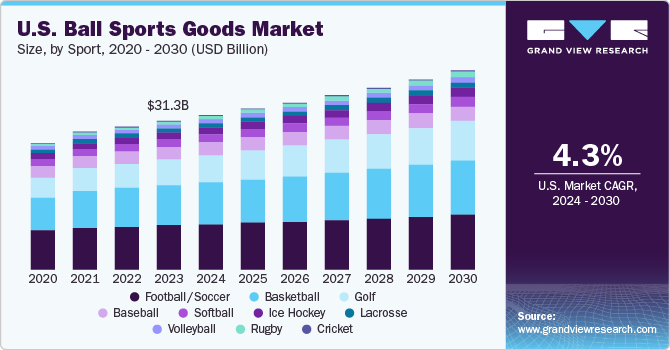

The U.S. ball sports goods market size was estimated at USD 31.35 billion in 2023 and is expected to grow at a CAGR of 4.3% from 2024 to 2030. The origination of ball sports in the U.S. can be traced back to Native Americans and immigrants from Europe. Growing emphasis on health and fitness, with an increasing number of Americans adopting active lifestyles, is positively influencing ball sports participation in the country. This has led to a surge in demand for ball sports equipment and facilities as individuals seek avenues for regular physical activity.

The rise of e-sports and the digitalization of sports content have profoundly impacted the ball sports goods market. Traditional sports are adapting to the changing media landscape with increased streaming options, virtual experiences, and interactive fan engagement. This shift expands the reach of ball sports and opens new revenue streams through partnerships, sponsorships, and digital content creation. For instance, in 2024, ESPN (a subsidiary of The Walt Disney Company), FOX, and Warner Bros. Discovery are collaborating to build an innovative direct-to-consumer (DTC) sports platform.

Social factors, such as inclusivity and diversity, are also influencing the ball sports goods market. Initiatives promoting accessibility and inclusivity in sports have gained momentum, fostering a more diverse and welcoming community. Leagues, teams, and brands recognize the value of promoting diversity in marketing, player recruitment, and overall sports culture.

The importance of sustainability and environmental consciousness is another notable movement in the U.S. ball sports goods market. Consumers increasingly seek eco-friendly and sustainable products, prompting manufacturers to innovate materials and production processes. This trend is evident in the development of eco-friendly sports equipment, stadiums adopting green practices, and leagues promoting environmental responsibility.

Manufacturers are increasingly partnering with professional ball sports players for endorsements and collaborations. This strategic approach leverages the credibility, influence, and popularity of athletes to promote products and drive sales in the ball sporting goods market. For instance, in May 2023, Kenny Beecham's Enjoy Basketball launched a new spring collection in partnership with The ICEE Company. This collaboration introduces a range of co-branded basketballs, apparel, and collector cups. Available exclusively online, the collection is offered through Enjoybball.com.

Market Concentration & Characteristics

The degree of innovation is quite high in this market, driven by technological advancements, consumer demand, and competitive dynamics. Innovations in materials, such as lighter and more durable composites, have improved the performance and safety of sports equipment. Moreover, wearables such as fitness trackers and heart rate monitors provide real-time data on player performance, helping coaches adjust training plans and manage player health.

The U.S. ball sports goods market has witnessed a significant surge in merger and acquisition (M&A) activity in recent years. The proliferation of streaming platforms has expanded the reach of ball sports and generated new revenue streams. Major leagues and teams are actively exploring opportunities to expand their geographical footprint and tap into new demographics.

There are a wide variety of regulations that impact the ball sports market, including anti-trust laws, labor laws, tax laws, health and safety regulations, and environmental regulations. These laws prohibit companies from engaging in unfair or anti-competitive practices.

In the ball sports equipment market, product substitutes can take many forms, and understanding them is crucial for both businesses and consumers. One of the most obvious categories of product substitutes in the ball sports equipment market is the various types of sports balls themselves. Another category of product substitutes in the ball sports equipment market includes equipment that is used in conjunction with sports balls.

End-user concentration encompasses the degree to which sales are concentrated among a small number of end-users versus being spread across a larger, more diverse group of consumers. International brands like Nike, Adidas, Under Armor, and New Balance have established themselves as leaders in the market, leveraging sponsorship deals with professional athletes and successful marketing campaigns. This fosters brand loyalty and influences purchase decisions, particularly among youth and aspiring athletes.

Sport Insights

The football/soccer goods segment accounted for a revenue share of 30.04% in 2023. In the U.S., football/soccer is now ranked fourth in terms of popularity, following basketball, baseball, and football. According to a study by the Sports & Fitness Industry Association and the Sports Marketing Survey, 14.4 million Americans participated in soccer in 2021, up 0.6 million players from the 14-year low that was reached in 2018. Participation in soccer sport has risen for three consecutive years. In addition, more than 800,000 children played on high school soccer teams in 2021 and 2022, placing the sport fourth behind track and field, basketball, and football, according to the National Federation of State High School Associations (NFHS).

The cricket segment is estimated to grow at a CAGR of 15.1% from 2024 to 2030.The growing demand for cricket sports goods in the U.S. can be attributed to the sport's increasing popularity and participation across the country. As more Americans embrace cricket, whether through grassroots leagues, school programs, or international broadcasts, there is a corresponding surge in the need for cricket equipment and gear. This growing interest not only fuels demand among existing players but also attracts newcomers to the sport who require essential gear to participate. Consequently, retailers and manufacturers are responding to this expanding market by offering a wider range of cricket bats, balls, protective gear, and apparel to meet the diverse needs of players at all skill levels, driving growth in the cricket sports goods market in the U.S.

Product Insights

Apparel accounted for a revenue share of 47.86% in 2023. Athletes and sports enthusiasts regularly purchase sportswear, including jerseys, shorts, socks, and shoes, which are essential for both performance and comfort. Major sports apparel brands like Nike, Adidas, Dick’s Sporting Goods, New Balance, and Under Armour have a strong following. Their innovative designs, quality, and marketing efforts attract a large customer base. Moreover, their creative campaigns and targeted advertising strategies for launching ball sports-specific apparel in the U.S. market have opened up new opportunities and avenues for growth. In January 2024, Dick's Sporting Goods expanded its Calia private brand with the launch of Calia Inspire, a collection featuring a new versatile technical fabric. To promote this collection, the company introduced the "Calia Inspire: There’s Beauty in the Burn" campaign. The collection includes a range of activewear pieces such as leggings, bodysuits, dresses, shorts, tank tops, and sports bras.

The footwear for ball sports goods market is expected to grow at a CAGR of 4.6% from 2024 to 2030. Continuous innovation in shoe technology, such as improved cushioning, better support, and enhanced performance features, has driven consumer interest and demand. High-quality sports footwear is crucial for performance and injury prevention. Athletes and recreational players prioritize investing in good footwear to enhance their game and reduce the risk of injuries.

Price Range Insights

The mass priced ball sports goods segment accounted for a revenue share of 72.30% in 2023. The mass pricing segment of the U.S. ball sports goods market is known for its affordability and accessibility, appealing to a wide demographic. These products are specifically crafted to meet the needs of the everyday consumer by providing reasonable prices without compromising quality. Typically, items in this category are produced in larger quantities, allowing for economies of scale that result in more budget-friendly price points. The mass pricing segment is heavily influenced by factors such as price sensitivity, widespread availability, and its appeal to recreational players and families. Retail channels like big-box stores, department stores, and online marketplaces play a crucial role in distributing these products.

The premium priced ball sports goods market is expected to grow at a CAGR of 5.9% from 2024 to 2030. The premium segment is characterized by products that prioritize superior quality, advanced technology, and enhanced performance. Consumers in this category are often enthusiasts, professional athletes, or those seeking top-notch products for an optimal sports experience. Various factors, including continuous innovation, the established reputation of brands, and endorsements from professional athletes, shape the premium pricing segment. Specialized sports stores, exclusive brand outlets, and dedicated online platforms for sports equipment are pivotal in meeting the specific requirements of premium consumers.

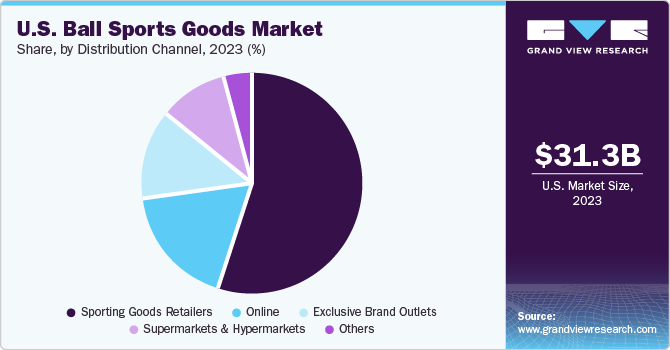

Distribution Channel Insights

The sales of ball sports goods through sporting goods retailers accounted for a revenue share of 55.40% in 2023. Many sporting goods retailers have extensive brick-and-mortar store networks across the country. This physical presence allows customers to see, touch, and try out products before making a purchase, which enhances consumer confidence and satisfaction. These retailers provide a wide variety of ball sporting goods such as equipment, apparel, footwear, and accessories, meeting the diverse preferences and needs of consumers. Additionally, they emphasize offering rental options for their ball sporting goods before customers make a purchase.

In May 2023, Wilson Sporting Goods Co. launched its inaugural retail store in Santa Monica, U.S. The new store features an innovative "Equipment Room," allowing customers to rent specific products for playtesting outside the store before making a purchase. This unique program is available for a wide range of sporting goods including volleyball, tennis, football, pickleball, basketball, and other sports.

The sales of ball sports goods through online channels is expected to grow at a CAGR of 5.6% from 2024 to 2030. This growth is driven by evolving brand strategies that focus on online retail campaigns, emphasizing specific ball sports footwear and apparel to attract customers. Successful sporting goods brands effectively leverage their online marketing strategies to draw new customers to their websites, further fueling this rapid expansion.

In February 2024, DICK'S Sporting Goods launched a new e-commerce ad campaign titled "Click On DICKS.com," featuring actors Will Arnett and Kathryn Hahn. The campaign includes two 30-second spots that highlight the seamless and hassle-free shopping experience on DICKS.com. To achieve this, DICK'S infused humor by leveraging the comedic talents of Arnett and Hahn, who portray relatable characters with unique sporting goods needs. Arnett plays a frazzled father frantically searching for soccer cleats for his daughter, while Hahn embraces her role as a clueless aunt desperately trying to find the right basketball gear for her nephew's tryouts. Such initiatives will play a key role in augmenting the online channel growth during the forecasted period.

Key U.S. Ball Sports Goods Company Insights

Nike, Inc.; Adidas AG; Callaway Golf Company; New Balance Athletics, Inc.; Under Armour, Inc.; and PUMA SE are some of the dominant players operating in the U.S. ball sports goods market. The market is characterized by intense competition. These companies are investing heavily in R&D to develop innovative products by using sustainable materials, design, and advanced manufacturing processes. This includes designs such as minimalist mules, funky styles, chunky sneakers, and footwear with bold colors and patterns, among others. Besides, collaboration with renowned designers, celebrity endorsements, and the integration of cutting-edge technologies are common strategies employed by companies to differentiate themselves and gain market share.

Nike, Inc. and Adidas AG are the prominent players operating in the U.S. camping & hiking gear market.

-

Nike, Inc. is a public company that was founded in 1964 and is headquartered in Oregon, U.S. It designs, manufactures, sells, and distributes sports and casual clothing, footwear, accessories, and equipment. Nike has a strong presence in ball sports, with a wide range of products designed for athletes of all levels. The company offers a variety of basketball shoes, including signature shoes for NBA superstars such as LeBron James, Kevin Durant, and Kyrie Irving. Nike's football division, known as Nike Football, produces a range of products for football players, including cleats, jerseys, and equipment.

-

Adidas AG designs, manufactures, markets, and distributes sports footwear, apparel, golf clubs & balls, and accessories worldwide. The company previously operated through two core brands-Adidas and Reebok. However, in August 2021, Adidas announced that it would sell Reebok to Authentic Brands Group Inc. Adidas produces over 900 million sports and sports lifestyle products with independent manufacturing partners worldwide.

Key U.S. Ball Sports Goods Companies:

- Nike, Inc.

- Adidas AG

- Callaway Golf Company

- New Balance Athletics, Inc

- Under Armour, Inc.

- PUMA SE

- lululemon athletica Inc.

- ANTA Sports Products Limited

- Columbia Sportswear Company

- Mizuno Corporation

Recent Developments

-

In February 2024, Puma entered into a long-term partnership with Bundesliga soccer club RB Leipzig, commencing from the 2024/25 season, to provide equipment for all men's, women's, and youth teams. Puma CEO Arne Freundt acknowledged RB Leipzig's rapid rise to prominence, both domestically and internationally. In addition to supplying kits for the teams, Puma has secured various sponsorship, merchandising, and matchday advertising rights at the Red Bull Arena and RB Leipzig Football Academy.

-

In January 2024, Adidas and Ajax announced the extension of their longstanding partnership until 2031, signifying more than 30 years of cooperation. Since 2000, Adidas has been the primary sporting goods partner of Ajax. This renewed agreement cements their relationship as the Eredivisie's longest-running sporting goods partnership and one of the most enduring in European football history.

-

In January 2024, Nike and the International Hockey Federation (FIH) joined forces in a four-year partnership to support officials and umpires by supplying equipment for events like the FIH Hockey Pro League mini-tournaments and the FIH Hockey Junior World Cups. This collaboration is driven by a shared objective between Nike and FIH: to encourage youth sports involvement and enhance physical activity levels, particularly among girls who currently exhibit the lowest levels of activity.

U.S. Ball Sports Goods Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 31.35 billion |

|

Revenue forecast in 2030 |

USD 41.96 billion |

|

Growth rate |

CAGR of 4.3% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Sport, product, price range, and distribution channel |

|

Key companies profiled |

Nike, Inc.; Adidas AG; PUMA SE; Under Armour, Inc.; Columbia Sportswear Company; lululemon athletica Inc.; New Balance Athletics, Inc.; Mizuno Corporation; Callaway Golf Company; ANTA Sports Products Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Ball Sports Goods Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ball sports goods market report based on sport, product, price range, and distribution channel:

-

Sport Outlook (Revenue, USD Million, 2018 - 2030)

-

Basketball

-

Football/ Soccer

-

Volleyball

-

Baseball

-

Ice Hockey

-

Cricket

-

Golf

-

Lacrosse

-

Rugby

-

Softball

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Footwear

-

Equipment

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. ball sports goods market size was estimated at USD 31.35 billion in 2023 and is expected to reach USD 32.56 billion in 2024.

b. The U.S. ball sports goods market is expected to grow at a compounded growth rate of 4.3% from 2024 to 2030, reaching USD 41.96 billion by 2030.

b. The mass pricing segment dominated the U.S. ball sports goods market with a share of 72.30% in 2023. The mass pricing segment of the U.S. ball sports market is known for its affordability and accessibility, appealing to a wide demographic.

b. Some key players operating in the U.S. ball sports goods market include Nike, Inc.; Adidas AG; PUMA SE; Under Armour, Inc.; Columbia Sportswear Company; lululemon athletica Inc.; and New Balance Athletics, Inc.

b. Growing emphasis on health and fitness, with an increasing number of Americans adopting active lifestyles, is positively influencing ball sports participation in the country. Moreover, the rise of e-sports and the digitalization of sports content have profoundly impacted the ball sports market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."