- Home

- »

- Homecare & Decor

- »

-

U.S. Bakeware Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Bakeware Market Size, Share & Trends Report]()

U.S. Bakeware Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Molds, Cups, Rolling Pin), By Material (Aluminum, Stainless Steel), By End-use (Commercial, Household), And Segment Forecasts

- Report ID: GVR-4-68040-482-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bakeware Market Size & Trends

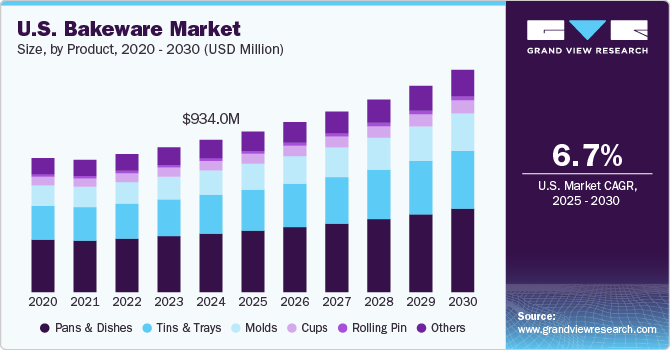

The U.S. bakeware market size was estimated at USD 934.0 million in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. This is primarily attributed to the increased baking activity during the holiday season, the rise of home baking since the pandemic, and the influence of social media in the U.S. Consumers, especially millennials, are showing greater interest in baking, with trends like themed bakeware collections and unique color options contributing to market growth. Furthermore, global consumer demand for eco-friendly solutions drives a shift toward sustainability and non-toxic products.

Integrating advanced and modern technologies in bakeware tools and equipment has also gained momentum. Manufacturers in the U.S. market are focused on developing innovative products that enhance baking experiences. Smart bakeware with temperature sensors and nonstick technologies are a few examples. In August 2023, Farberware, a U.S.-based cookware brand, introduced its Easy Solutions Nonstick Bakeware, addressing common baking challenges with innovative features.

The collection includes cookie pans with easy placement spots, loaf and cake pans with slice guides, and muffin pans with fill marks for even baking. Made from heavy-duty steel to resist warping, the bakeware has a durable two-layered nonstick coating for easy cleaning and effortless food release. The wide pan edges ensure convenient handling, and the unique markings on cake pan rims provide guidelines for even slicing. The new collection is available online at FarberwareCookware.com, Walmart.com, Amazon.com, JCPenney.com, and Wayfair.com.

The increased interest in home baking, triggered by the COVID-19 lockdown and sustained by changing consumer preferences, is a key driver of the U.S. bakeware market. According to the International Houseware Association, the lockdown during the COVID-19 pandemic created a significant surge in baking activities, driving companies into the bakeware market. With people spending more time at home due to the lockdown and in the post-COVID-19 period, there has been a noticeable increase in home baking. More individuals are experimenting with new recipes and techniques, leading to a higher demand for bakeware products in the U.S.

In response, companies are creating collections that cater to this growing trend, providing a comprehensive range of products that support home baking endeavors. In October 2022, Browne USA introduced its new Betty Crocker bakeware and kitchen tools collection. This collection, licensed under the well-known Betty Crocker brand, is designed to appeal to a wide range of home cooks and bakers, from beginners to experts. The focus is on performance, durability, and usability, aligning with the evolving needs of consumers increasingly engaging in home baking activities. The collection features a variety of bakeware, silicone tools, and baking accessories such as baking sheets, pans, spatulas, whisks, and even oven mitts, all created to meet the demands of home cooks and bakers.

According to the International Houseware Association, in 2020, bakeware, cookware, and kitchenware categories experienced positive sales trends at retail. The increased demand for these products in physical and online stores has created a sustainable market for established and new companies to introduce innovative bakeware products in the U.S.

The emerging trend of home baking is not just about creating enjoyable treats, it is also considered therapeutic, offering stress relief and emotional well-being. According to a study published in the Journal of Positive Psychology in late 2016, engaging in creative activities like baking can improve mood and provide therapeutic benefits. Jack Hazan, a New York City-based therapist and baker, uses baking techniques in his practice to help clients cope with stress, anxiety, and other mental health challenges.

Product Insights

Pans and dishes held a market share of about 38.5 % in 2024. The demand for pans and dishes is driven by their versatility and suitability for a wide range of baking and cooking applications. Their ability to accommodate both sweet and savory dishes makes them essential for home bakers and cooks who enjoy preparing casseroles, lasagnas, pies, and baked desserts, often in large quantities for family gatherings and holiday celebrations. In March 2024, Our Place, a cookware brand, expanded its bakeware line. The products include a mini griddle pan. The product offers warp-resistant durability and is ideal for baking, brunches, and roasting. The nonstick ceramic coating is toxin-free, avoiding potentially harmful materials like PFAS, lead, and cadmium. With ergonomic side handles that are easy to grip and spacious enough for oven mitts, this pan is both convenient and safe to use.

The demand for molds is expected to grow at a CAGR of 7.8% from 2025 to 2030. Baking molds, essential in various food preparation techniques, play a vital role in shaping finished dishes. They come in different types, including cake molds (like muffin tins and Bundt pans), springform pans, gelatin dessert molds, and molds for ice cream, mousse, and butter. Maison Demarle, a French brand, introduced its Flexipan flexible non-stick silicone and fiberglass molds to the American market in February 2024. These molds, developed in collaboration with pastry chefs, are renowned for their quality and durability in professional kitchens.

Material Insights

Aluminum bakeware accounted for a market share of about 34% in 2024. Aluminum bakeware is highly favored and preferred for several reasons. Its excellent thermal conductivity and ability to distribute heat evenly ensure perfect cooking, making it ideal for preparing pizzas, focaccias, and yeast-leavened products. Aluminum pans can be used in both static and ventilated ovens and placed on any shelf to achieve the desired crust texture. Aluminum is also easily workable, allowing for the creation of trays in various shapes, sizes, and thicknesses.

The demand for carbon steel bakeware is expected to grow at a CAGR of 7.8% from 2025 to 2030. Carbon steel bakeware is prized for its durability, heat conductivity, and natural non-stick properties. Pressed from raw, heavy-gauge steel, it is stronger and more durable than aluminum. Carbon steel baking pans heat evenly, preventing hot spots and ensuring perfectly baked goods. They also cool down quickly once out of the oven, keeping cakes moist and flavorful. The material's versatility allows it to achieve and maintain both low and high temperatures, offering greater control over the baking process.

End-use Insights

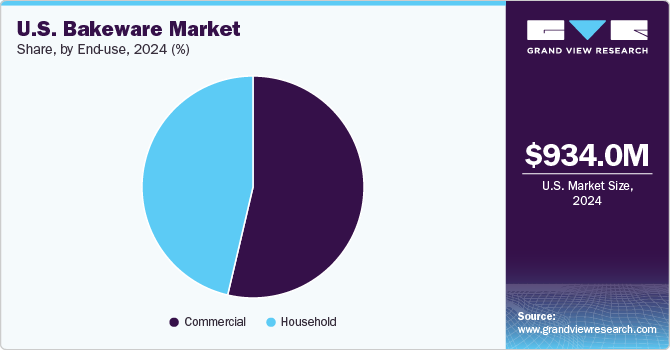

The demand for bakeware in commercial end use accounted for a share of about 53.7% in 2024. This is due to the rapid expansion of the bakery and food service industries, driven by increasing consumer demand for fresh, artisanal baked goods and convenience foods. As more cafes, restaurants, and bakeries diversify their product offerings to cater to trends like gluten-free, vegan, and organic options, the need for high-quality, durable bakeware rises. In addition, the rise of meal delivery services and baking franchises also contributes to the increased commercial use of bakeware as businesses seek efficient tools to meet large-scale production needs.

Demand for bakeware in household is expected to rise at a CAGR of 7.0% from 2025 to 2030. Bakeware use is expected to rise as more consumers embrace home baking, fueled by health-conscious eating habits and the popularity of at-home cooking trends inspired by social media and cooking shows. With a growing interest in experimenting with different recipes, from sourdough bread to specialty pastries, U.S. households are investing in diverse bakeware products. Moreover, the rise of DIY baking kits and the desire for eco-friendly and aesthetically pleasing kitchen tools drive demand for bakeware in the residential market.

Key U.S. Bakeware Company Insights

The market is fragmented and characterized by diverse players, from large multinational corporations to smaller regional/local manufacturers. Groupe SEB, Newell Brands Inc., Wilton Brands LLC, Nordic Ware, USA Pan, Le Creuset, and more are leading players in the market.

Key U.S. Bakeware Companies:

- Groupe SEB

- Newell Brands Inc.

- Wilton Brands LLC

- Nordic Ware

- USA Pan

- Le Creuset

- Werhahn Group (ZWILLING- Staub)

- Meyer Corporation U.S.

- Caraway

- Emile Henry USA

Recent Developments

-

In May 2024, Meyer Corporation, under its Farberware brand, launched three new collections inspired by Mickey Mouse as part of the Disney Home range: Monochrome cookware, Bake with Mickey bakeware, and Bon Voyage Mickey and Minnie Mouse-themed cookware. These durable, nonstick baking pans are available in red and classic black variants. They are manufactured using heavy gauge steel to prevent warping and bending. The bakeware is designed for ease of use and quick cleaning. It features imprints of Mickey Mouse's silhouette on the interior nonstick surface. These products offer both functionality and whimsical charm.

-

In March 2024, Nordic Ware introduced new additions to its cookware and bakeware lines at the Inspired Home Show. It included products within its Basalt and Verde collections. One notable addition was the Swirl Bundt Baking Set, an expansion of an existing high-design product. This set includes a Swirl Bundt pan featuring a nonstick interior made from formed aluminum, capable of holding eight to ten cups of batter. The pan comes with a specially designed keeper, developed to preserve the delicate design of baked cakes during transport or storage. The keeper features a twist-to-lock mechanism for secure closure and is certified BPA- and melamine-free.

-

In September 2023, Wilton Brands LLC launched a new Halloween collection featuring four additional products to enhance its seasonal offerings. These additions complemented the existing range of holiday bakeware, tools, decorating kits, candy melts, icing, sprinkles, and edible decorations.

U.S. Bakeware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 985.2 million

Revenue forecast in 2030

USD 1.37 billion

Growth rate (revenue)

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use

Country scope

U.S.

Key companies profiled

Groupe SEB; Wilton Brands LLC; Newell Brands Inc.; Meyer Corporation U.S.; Emile Henry USA; Werhahn Group (ZWILLING- Staub); USA Pan; Le Creuset; Nordic Ware; Caraway

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bakeware Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. bakeware market report based on product, material, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Aluminum

-

Stoneware

-

Carbon steel

-

Glass

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Household

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.