- Home

- »

- Advanced Interior Materials

- »

-

U.S. Automotive Metal Market Size, Industry Report, 2030GVR Report cover

![U.S. Automotive Metal Market Size, Share & Trends Report]()

U.S. Automotive Metal Market Size, Share & Trends Analysis Report By Product (Aluminum, Steel), By Vehicle-type (Passenger, LCV, HCV), By Application (Body Structure, Power Train), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-231-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

U.S. Automotive Metal Market Size & Trends

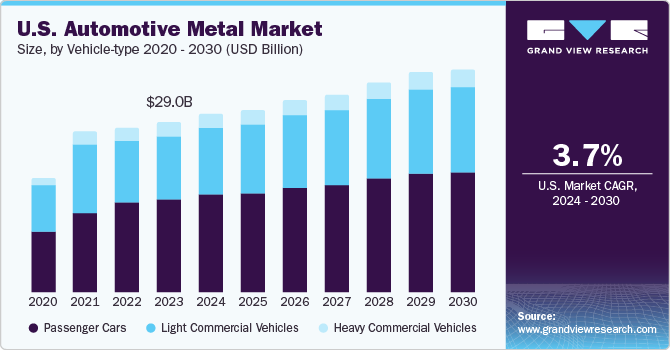

The U.S. automotive metal market size was estimated at USD 29.04 billion in 2023 and is projected to grow at a CAGR of 3.7% from 2024 to 2030. Automotive metals are anticipated to witness significant growth over the coming years on account of rising demand for vehicles in the U.S. Furthermore, rising demand in the country is attributed to the early industrialization and adoption of new trends. In addition, initiatives undertaken by the government to increase vehicle fuel efficiency and reduce carbon dioxide emissions are expected to open new opportunities for the market over the coming years.

Globally, the demand for lightweight vehicles has increased, which is expected to positively impact the global automotive metal market over the coming years.The automotive industry has been witnessing development in terms of type of vehicles being produced. While passenger cars and pickup trucks are the mostly used vehicles, introduction of high-quality compact SUVs have positively influenced the automotive sales in the U.S. Magnesium is being adopted by numerous original equipment manufacturers (OEMs) and is expected to replace steel sheets at a very fast pace. It is also being used in screws for internal power train attachments and electrical applications as these due not produce debris.

The government has been taking initiatives to develop less expensive and more energy efficient methods to produce magnesium for vehicles. In addition, ARPA-E, a part of the U.S. Department of Energy, has been funding projects for research & development on cost effective methods for production of aluminium and titanium for vehicles. These factors are likely to have a positive affect on the demand for metals over the next eight years. However, manufacturers in the U.S. are focusing on development of lightweight materials. Hence, numerous powertrain components are being replaced with plastics. This is likely to obstruct the growth of metals in powertrain application.

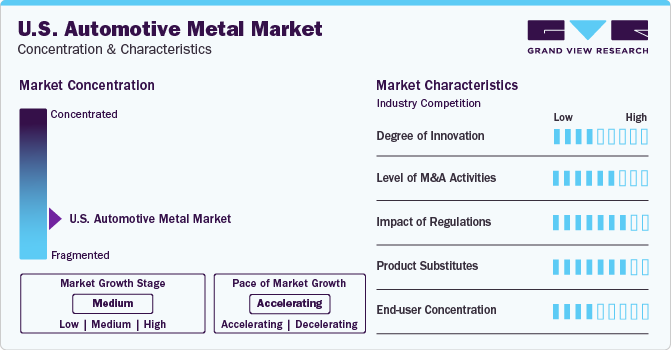

Market Characteristics & Concentration

The presence of a large number of manufacturers and rising demand for highly efficient grades of metals make the market fragmented in nature. Market players cater to the demand for a particular metal used in the automotive sector.High capital cost coupled with extensive research & development associated with manufacturing of automotive metals is expected to increase the barriers for new entrants.

The degree of innovation is moderate to high. Manufacturers have been trying to develop new advanced high-strength steel (AHSS) grades, innovative processing methods, and optimization techniques in order to reduce the weight of steel and achieve cost effectiveness in the manufacturing process.

The market is highly regulated since the process of metal extraction to refining to finished goods is not very environment friendly. For instance, the use of aluminium parts requires a metal finishing or coating process that produces wastewater deemed to be hazardous. Thus, the impact of regulation is high on the market growth.

Metals are increasingly being replaced with plastics in various applications such as exterior furnishings, interior furnishing, power train, and under the hood components. Polyvinyl chloride (PVC), polycarbonate (PC), PMMA, and polypropylene (PP) are some of the fastest growing plastics in the automotive industry. High rate of replacement of metals is expected to result in high threat of substitutes over the coming years.

Product Insights

Steel dominates the U.S. automotive metal industry with a revenue share of 59% in 2023 on account of its wide application in the manufacturing of parts such as vehicle body structure, panels, doors, closures, engine blocks, gears, wheels, steering parts, braking systems, and more. It accounts for about 900 kg of an average vehicle weight. The high strength and cost-effectiveness of steel is likely to increase its utilization in the automotive sector over the coming years. The market has been witnessing increased utilization of lightweight steels, including Advanced High-Strength Steels (AHSS). This product reduces the weight of the vehicle structure, enhances safety, and improves the fuel efficiency of the vehicles.

Magnesium segment is expected to witness the fastest CAGR of 10.8% during the forecast period. The light weight of the material facilitated its utilization in racing cars to add a competitive advantage for the racers. Commercial vehicles, including Volkswagen Beetle, contained about 20kg of magnesium. It is being used in gearbox, steering column, air bag housing, steering wheels, seat frames, and fuel tank covers. Increasing focus onenvironmental issues coupled with increased fuel efficiency, performance, and sustainability is expected to propel the utilization of the product over the forecast years.

Vehicle-type Insights

The passenger cars segment held a revenue share of over 54.0% in the market in 2023. High demand for passenger cars in the U.S. is anticipated to increase at a rapid pace on account of growing consumer disposable income and changing consumer lifestyles. Consumers are increasingly willing to pay for all vehicles in order to obtain better quality and durability on the market. Consequently, manufacturers are working on the development of new innovative products with premium features at a low cost. The demand for metal in passenger vehicles is likely to be stimulated by these factors.

The light commercial vehicle segment is expected to grow at the fastest CAGR of 4.0% during the forecast period. Low operation and maintenance costs facilitate an increase in the use of these vehicles for commercial purposes. Increasing demand for commercial transportation services, including taxis are expected to propel the demand for light commercial vehicles over the forecast period, thereby resulting in increased demand for automotive metals.

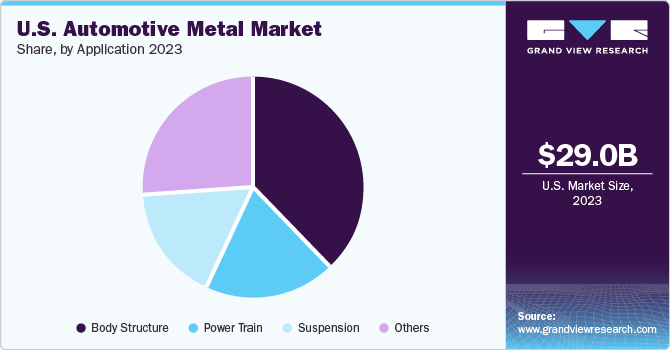

Application Insights

The body structure segment dominated the market with a revenue share of over 37.0% during the forecast period. One of the main factors boosting the demand for metals in vehicle body structures is the ease of maintenance and repair along with the high recyclability compared to plastics and composites.The body structure includes frames, panels, doors, bonnets, and trunk closures. These are usually produced from steel for gaining robustness and providing crash energy absorption to the structure. The casted aluminium products and hot-stamped steel products provide a high level of safety for the body structure compared to plastic materials. This is likely to augment the utilization of lightweight metals in the body structure over the coming years.

The suspension segment is expected to witness the fastest growth during the forecast period. Numerous manufacturers are shifting towards lightweight metals such as aluminium and magnesium in order to reduce vehicle weight. In addition, specialized applications like military vehicles are also utilizing titanium alloys for manufacturing of suspension for armoured vehicles. Low rigidity and strength of plastics as compared to metals is likely to augment the market growth in suspension application over the coming years.

Key U.S. Automotive Metal Company Insights

The market is competitive due to the presence of numerous players across the industry. As a result of changing consumer trends, various companies are launching new products to expand their product offerings and put up with the competition in the market.In addition, the market requires high level of technical know-how, which is further expected to increase the barriers for new entrants.

Key U.S. Automotive Metal Companies:

- Alcoa Corporation

- Allegheny Technologies

- ArcelorMittal

- Hyundai Steel Co., Ltd.

- Kaiser Aluminum

- Nippon Steel Corporation

- Novelis

- ThyssenKrupp AG

- United States Steel Corporation

- voestalpine AG.

Recent Development

-

In December 2023, Nippon announced the acquisition of U.S. Steel Corporation. This acquisition is both the companies together aim to become the ‘best steelmaker with world-leading capabilities.

-

In February 2024, Schaeffler announced expansion plans for its operations in the U.S. The company will invest USD 230 million in a new greenfield manufacturing facility in Ohio, along with future expansions until 2032.

U.S. Automotive Metal Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 37.84 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million/billion,volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, vehicle-type, application

Country scope

U.S.

Key companies profiled

Alcoa Corporation; Allegheny Technologies; ArcelorMittal; Essar Steel; Hyundai Steel Co., Ltd.; Kaiser Aluminum; Nippon Steel Corporation; Novelis; ThyssenKrupp AG; United States Steel Corporation; voestalpine AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Metal Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive metal market report based on product, vehicle-type, application, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminium

-

Steel

-

Magnesium

-

Others

-

-

Vehicle-type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Light Commercial Vehicles

-

Heavy Commercial Vehicles

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Body Structure

-

Power Train

-

Suspension

- Others

-

Frequently Asked Questions About This Report

b. The U.S. automotive metal market was valued at USD 29.04 billion in the year 2023 and is expected to reach USD 30.38 billion in 2024.

b. The U.S. automotive metal market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 37.84 billion by 2030.

b. Based on product segment, steel dominated the market with a revenue share of nearly 60.0% in 2023.

b. Some of the key market players in the U.S. automotive metal market includes Alcoa Corporation; Allegheny Technologies; ArcelorMittal; Essar Steel; Hyundai Steel Co., Ltd.; Kaiser Aluminum; Nippon Steel Corporation; Novelis; ThyssenKrupp AG; United States Steel Corporation; voestalpine AG.

b. Growing sales of passenger cars and pickup trucks in the U.S. is one of the key growth drivers for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."