- Home

- »

- Automotive & Transportation

- »

-

U.S. Automotive Aftermarket Industry Size Report, 2030GVR Report cover

![U.S. Automotive Aftermarket Industry Size, Share & Trends Report]()

U.S. Automotive Aftermarket Industry Size, Share & Trends Analysis Report By Replacement Parts, By Service Channel, By Certification, By Product Pricing, By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-778-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

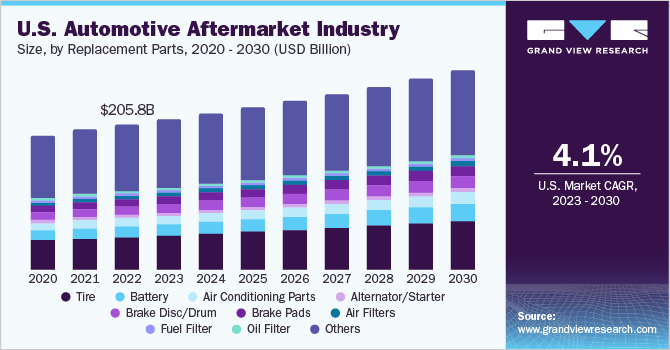

The U.S. automotive aftermarket industry size was estimated at USD 205.81 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. Increasing need for timely maintenance of vehicles and parts has created significant traction in market sales. The automotive aftermarket is driven by stringent emission norms and government regulations related to the heavy-duty vehicles market. Regional regulatory authorities, such as U.S. Environmental Protection Agency and other federal & international agencies, have laid down various regulations pertaining to quality and safety of automotive components, which are anticipated to encourage advancement in the automotive parts industry. Digitization ensures transparency in auto repair and maintenance service delivery.

This enables various stakeholders, including car owners, to spectate repair and part replacement costs. Through online services, car owners prefer ordering custom components, such as mufflers and resonators, from overseas for their peculiar specifications and reduced prices. Furthermore, rapid advancement of digitalized technologies has created opportunities for automakers and service dealers to develop innovative products to remain competitive in the U.S. market. With the advent of internationalization and consolidation in aftermarket trends, auto parts suppliers or distributors are required to work on scale operations to become a significant player in aftermarket industry.

For industry-leading service delivery, parts suppliers should develop their e-commerce strategy and provide an easy-access online system. The adoption of e-commerce is needed in aftermarket industry since most installers go online to gather information on suppliers or distributors. Also, distributors can optimize their operations by focusing on services while outsourcing spare auto parts to logistics experts. National Highway Traffic Safety Administration (NHTSA), a part of U.S. Department of Transportation (DOT), regulates fuel economy standards. Similarly, U.S. Environmental Protection Agency (EPA) regulates the standards pertaining to Greenhouse Gas (GHG) emissions.

A turbocharger enables car manufacturers to produce engines compliant with different emission standards. Use of turbocharged engines reduces CO2 emissions. The dependence of transportation industry on heavy-duty diesel engines is further driving the growth of automotive aftermarket. Moreover, growing online sales of automotive components are estimated to deliver significant demand for the market. Companies are now shifting to digital platforms due to a smoother experience for customers. In January 2020, Continental AG announced its online portal that will contain a portfolio of all of its services and information about its product for automotive aftermarket.

Market Dynamics Insights

Technological advancements have majorly favored the growth of U.S. automotive aftermarket. Stringent production norms aimed at cutting down vehicle production costs have compelled automotive vendors to focus on optimizing their techniques and adopting advanced technologies and innovative products to reduce automobile production costs in cost sensitive markets. Major players in the automotive industry are extensively using modern production technologies, such as 3D printing of automobile parts and robotics and automation, to reduce their emissions footprint and optimize production.

Further, digitization is disrupting traditional auto repair and maintenance service delivery models, transforming the way customized automotive components and maintenance services are delivered Several start-ups, including CarParts.com and U.S. Auto Parts Network, Inc., have surfaced in the U.S. that focus on delivering custom-made automobile components at economical rates. Auto Parts Warehouse, an automotive aftermarket parts distributor, allows users to compare and get components at economical rates with ease and delivers instant quotes for repairs and maintenance. Some component suppliers in the country also provide pickup and drop services from remote locations for repair and replacements.

COVID-19 Impact Insights

COVID-19 pandemic has significantly affected various sectors of the economy, including automotive aftermarket in the U.S. Following are some of notable impacts:

-

Widespread lockdowns, stay-at-home orders, and restrictions on movement during initial stages of the pandemic resulted in a significant decrease in vehicle usage. As people were traveling less, there was reduced wear and tear on vehicles, resulting in lower demand for automotive aftermarket products and services

-

Supply chain disruptions caused by pandemic affected the availability of automotive aftermarket parts and components. Many manufacturers and distributors faced challenges in sourcing raw materials and parts, leading to delays in production and distribution. This resulted in supply shortages and longer lead times for customers

-

Economic impact of the pandemic led to changes in consumer spending habits. Many people prioritized essential items and cut back on discretionary purchases, including aftermarket accessories or non-essential vehicle repairs and vehicle modifications. This shift in consumer behavior affected the overall aftermarket sales.

Replacement Parts Insights

In terms of market size, tire segment dominated the industry in 2022 and accounted for largest share of 22.5% of overall revenue. The segment is anticipated to maintain its dominant position throughout the forecast period on account of the factors, such as frequent replacements of tires compared to their automotive component counterparts. On the other hand, battery replacement part segment is anticipated to register fastest growth rate over the forecast period.

This is due to the potential for Electric Vehicles (EVs) to replace traditional fuel-based vehicles, driven by rising fuel prices and growing environmental concerns. The rising popularity of electric and hybrid vehicles has resulted in high demand for battery replacement parts. Lighting & electronic components (excluding alternator/starter) segment is also estimated to account for a significant industry share in the years to come.

Distribution Channel Insights

Based on distribution channel, the industry is further segmented into retailers and wholesalers & distributors. Retailers segment dominated the overall industry in 2022 and accounted for a share of 50.2% of overall revenue. OEMs are focusing on retail distribution channels due to the increasing digitization and online selling network. Increasing influence of technological advancement is transforming the market towards digitization. On the other hand, wholesale & distribution segment is expected to witness fastest CAGR over the forecast period.

The segment growth can be attributed to the adoption of strategies, such as collaborations with local market participants by several suppliers and distributors, to gain a competitive edge in domestic market. Adoption of modern distribution techniques, such as e-commerce and online catalogs, by vendors has enabled them to add value to their product offerings and distribution network. Manufacturers are rapidly expanding their global and regional presence by catering their products to automobile manufacturers across the globe using online platforms. They are also observed forming alliances with raw material and technology suppliers.

Service Channel Insights

Original equipment segment dominated the market with a share of 55.9% of overall revenue in 2022. The OE (delegating to OEM’s) segment is anticipated to expand further at a steady CAGR maintaining its dominant position throughout the forecast period. DIFM (Do it for Me) segment is also estimated to grow significantly in the years to come. DIFM customers buy parts online but get them installed from a professional workshop. DIY segment is expected to register the fastest growth rate over the forecast period. DIY consumers are technologically competent and inclined toward independently maintaining, repairing, and improving their vehicles.

DIY customers are highly price-sensitive, and the growth of e-commerce has enabled customers to opt for online platforms for making economic purchases, which has led to an increase in the overall sales of aftermarket parts. Moreover, increased adoption of new technologies in the U.S. market has enabled aftermarket players to evaluate their performance and maintain their market position in a rapidly changing environment. This has resulted in the shift of suppliers from traditional platforms to online platforms. While, other prominent e-commerce players, such as eBay and Amazon, continue offering their services through online platforms.

Certification Insights

Genuine parts segment dominated the industry in 2022 and accounted for a share of 53.5% of the overall revenue. Genuine parts segment is anticipated to dominate the market throughout the forecast period. The growth of genuine parts segment can be attributed to accountability and warranty of parts offered by car manufacturers. Genuine replacement parts have greater assurance of quality, are diverse, easy to find, and include a warranty. Certified parts segment is expected to witness relatively fast growth in terms of revenue from 2023 to 2030.

The industry is witnessing a trend of strategic alliances and collaborations between collision repair centers and leading auto insurance companies to gain a competitive edge and capture a significant market share. For instance, Utica Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, and Progressive Casualty Insurance Company have tie-ups with certified automotive repair shops across the U.S. NSF International provides standards for safety and damage criteria for aftermarket auto parts. Furthermore, manufacturers focus on producing certified parts to comply with NSF standards. This is expected to boost the demand for certified parts in the U.S. market.

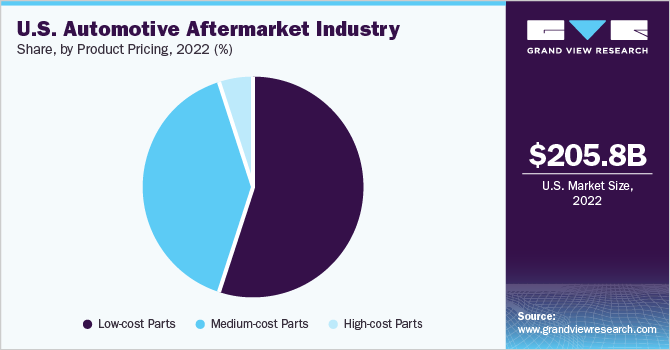

Product Pricing Insights

Low-cost parts segment dominated the market in 2022 and accounted for a share of 54.7% of the overall revenue. Low-cost parts are anticipated to dominate the aftermarket arena in terms of size by 2030. Low-cost aftermarket parts provide an affordable alternative to Original Equipment Manufacturer (OEM) parts. As vehicle ownership costs continue to rise, many consumers seek more economical repair and maintenance options.

Medium-cost parts segment is projected to expand with highest growth rate from 2023 to 2030. The segment accounted for second-largest revenue share in 2022. Retailers prefer to sell medium-cost automotive after-parts owing to better profit margins compared to high-cost after-parts. Advanced technology usage in fabrication of auto parts, a surge in consumer and passenger automobile production & sales, and digitalization of automotive component delivery services are anticipated to spur automotive sales in the U.S.

Key Companies & Market Share Insights

High competition in the market has encouraged key players to gain a competitive edge by focusing on offering high-quality products. Moreover, growing emphasis on strategic initiatives, such as alliances, mergers, and acquisitions, has led to market consolidation. This has enabled companies to increase their brand value and loyalty base along with establishing a global presence. The rising number of domestic players in the country has led to an increased threat to leading players. Key players are adopting mergers and acquisitions with an aim to increase their market share and retain their industry position. For instance, in February 2020, Napa Auto Parts announced a strategic partnership with Wallbox, a global EV charging and energy management solutions provider. The partnership envisaged Napa Auto Parts network expanding its offering of new EV technologies and Wallbox EV products.

Similarly, In August 2022, Cummins Inc. completed the acquisition of Meritor, Inc., enhancing its position as a leading provider of integrated powertrain solutions for both internal combustion and electric applications. By incorporating Meritor's axle and brake technology, Cummins aims to excel in delivering comprehensive solutions. The acquisition accelerates Cummins' electrification efforts and strengthens its global footprint, enabling the company to serve a wide range of sectors, including commercial trucks, trailers, off-highway vehicles, defense, specialty applications, and the aftermarket. Some of the key players in U.S. automotive aftermarket industry include:

-

3M Company

-

Aptiv PLC

-

Continental AG

-

Cooper Tire & Rubber Company

-

Delphi Automotive PLC

-

Denso Corporation

-

HELLA KGaA Hueck & Co.

-

Robert Bosch GmbH

-

Tenneco Inc.

-

Valeo Group

-

ZF Friedrichshafen AG

U.S. Automotive Aftermarket Industry Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 281.98 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Market revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

replacement part, distribution channel, service channel, certification, product pricing

Country scope

U.S.

Key companies profiled

3M Company; Aptiv PLC; Continental AG; Cooper Tire & Rubber Company; Delphi Automotive PLC; Denso Corp.; HELLA KGaA Hueck & Co.; NAPA Auto Parts; Robert Bosch GmbH; Valeo Group; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Automotive Aftermarket Industry Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. automotive aftermarket industry report based on replacement parts, distribution channel, service channel, certification, and product pricing:

-

Replacement Parts Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tire

-

Battery

-

Air Conditioning Parts

-

Alternator/Starter

-

Brake Disc/Drum

-

Brake Pads

-

Air Filters (Including Both Engine And Cabin Filters)

-

Fuel Filter

-

Oil Filter

-

Fuel Pumps

-

Water Pumps

-

Steering Pumps

-

Spark Plugs

-

Shock Absorbers

-

Body Parts

-

Lighting & Electronic Components (Excluding Alternator/Starter)

-

Wheels

-

Exhaust Components

-

Turbochargers

-

Wiper Components (Including Blades, Motor)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retailers

-

Wholesalers & Distributors

-

-

Service Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

DIY (Do It Yourself)

-

DIFM (Do It For Me)

-

OE (Delegating To OEM’s)

-

-

Certification Outlook (Revenue, USD Billion, 2017 - 2030)

-

Genuine Parts

-

Certified Parts

-

Uncertified Parts

-

-

Product Pricing Outlook (Revenue, USD Billion, 2017 - 2030)

-

Low-cost Parts

-

Medium-cost Parts

-

High-cost Parts

-

Frequently Asked Questions About This Report

b. The U.S. automotive aftermarket industry size was estimated at USD 205.81 billion in 2022 and is expected to reach USD 213.39 billion in 2023.

b. The U.S. automotive aftermarket industry is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 281.98 billion by 2030.

b. By Replacement parts, the Tire segment dominated the U.S. automotive aftermarket industry with a share of 22.5% in 2022. This is attributable to factors such as the frequent replacements of tires compared to their automotive component counterparts.

b. Some key players operating in the U.S. automotive aftermarket industry include 3M, Continental AG, Delphi Automotive PLC, Denso Corporation, Cooper Tire & Rubber Company, Robert Bosch GmbH, and Valeo Group

b. Key factors that are driving the market growth include the surge in consumer and passenger automobile production and, increasing stringency of emission & fuel efficiency regulations and engine downsizing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.