U.S. Automated Parking System Market Size, Share & Trends Analysis Report By Component, By Structure Type, By Platform, By Automation Level, By End-use And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-314-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

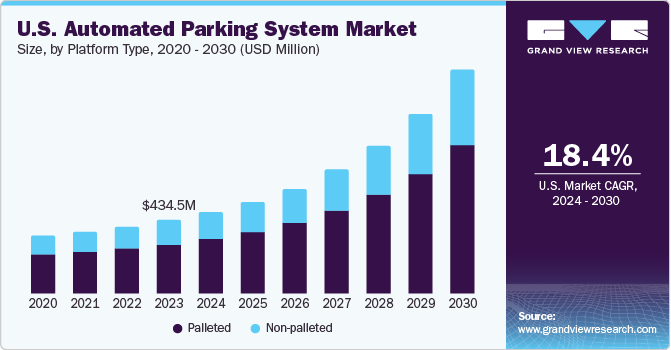

The U.S. automated parking system market size was estimated at USD 434.5 million in 2023 and is projected to grow at a CAGR of 18.4% from 2024 to 2030. The U.S. APS market is driven by several factors, such as technological advancements, urbanization, and growing demand for vehicles with safety features. Robotic technology and Internet of Things (IoT) integration transform automated parking, with robots like AGVs using sensors and machine learning to navigate, identify spots, and park vehicles accurately. IoT devices facilitate communication between robots, parking systems, and users' mobile devices, enabling real-time updates and payment transactions. This integration optimizes parking space use, reduces traffic, and enhances user convenience in urban environments. Robotic arms and AGVs autonomously manage vehicle movement within parking facilities, revolutionizing parking efficiency and sustainability. Advanced sensors and cameras help robots navigate spaces and safely maneuver vehicles into designated slots, improving parking precision.

Urbanization is one of the leading factors for automated parking systems, as cities become more densely populated the demand for efficient use of limited space increases making automated parking systems important. As land is becoming scarcer and more expensive in urban areas, there is an increasing demand for automated parking system as it efficiently utilize parking space.

Additionally, automated parking systems can enhance safety by reducing the risk of accidents and theft related to traditional ways of parking, with fewer vehicles moving around and less human interaction during parking reduces the chances of accidents. In July 2021, Westfalia Technologies, Inc., an automated parking solutions provider, announced an all-in-one parking application that is expected to increase safety, accessibility, and convenience in automated parking solutions. The COVID-19 pandemic led to a decline in the U.S. automated parking system market, with the halt in the parking construction and reduction in consumer spending. With the recovery of the economy in 2022, the demand for touchless solutions increased.

Market Concentration & Characteristics

Industry growth stage is high, industry growth is accelerating. The degree of innovation in the US automated parking system industry is high due to new technology developments to improve efficiency, user safety and experience. Innovations include advanced sensor technology for precise vehicle positioning, software for seamless integration with mobile applications and payment system, environment friendly designs such as automated electric vehicle charging stations integrated into parking system.

Government agencies establish safety standards and guidelines for design, operation and maintenance of automated parking facilities aimed to reduce vehicle traffic and environmental impact in urban areas. Automated parking system offers advantage over traditional parking lots system. It utilizes vertical stacking, maximizing use of limited parking space.

End-user concentration varies depending on location factors and industry demand. In densely populated states such as New Jersey, California, and Massachusetts, where parking spaces are limited, there is a higher concentration of end users availing of automated parking systems. Industries, such as hospitals, retail, and office spaces are more likely to adopt automated parking solutions. Texas, California, and Florida have dense populations, which is driving the adoption of automated parking systems in the healthcare and retail industries.

Component Insights

Hardware held the largest market share of 83.7% in 2023. Hardware refers to physical components such as sensors, gates, cameras, and robotics that enable automated parking operations and are incorporated into the necessary physical infrastructure for automated parking. With reliable hardware components, the system can efficiently detect vehicles, navigating them for parking spots.

Software, which includes algorithms, applications and interfaces facilitating smooth interaction between users and the system which offers intuitive interfaces for convenient access and efficient utilization, is expected to grow at the fastest CAGR over the forecast period. By effectively managing and coordinating hardware functionalities, the software contributes to optimizing system performance, enhancing reliability, and ensuring a seamless parking experience for users.

Structure Type Insights

The tower system held the largest market share in 2023. This type of automated parking system involves stacking vehicles vertically in a tower-like structure. It consists of multiple levels where cars are lifted, thereby maximizing space efficiency and allowing more vehicles to be parked in small areas. In July 2023, Ultron introduced a cutting-edge slide system, which is a conveyor automated parking solution. This innovative system involves stationary conveyors that move vehicles stored on pallets in multiple dimensions, showcasing a remarkable advancement in parking technology.

Puzzle System is expected to grow at the fastest CAGR over the forecast period. This system operates on the principle of puzzle-like optimization, where vehicles are strategically placed. The puzzle system represents a cutting-edge approach to automated parking, leveraging advanced software algorithms to solve the complex challenge of space optimization and enhance the efficiency of parking operations.

Platform Type Insights

The palleted system held the largest market share in 2023. This system utilizes predesigned pallets to transport vehicles, which offers efficient and organized storage. Due to maximum space utilization and increased overall efficiency, palleted systems have more demand. According to CNBC news published in November 2022, New York is rapidly growing with luxurious and modified apartments which offers a robotic-parking garage. In addition, the robotic parking provides facilities including charging plugs for electric vehicles, and maximum space for parking.

Non palleted system is expected to grow at the fastest CAGR over the forecast period. In these systems, advanced technology, such as sensors and cameras, is often utilized to accurately detect and navigate vehicles within the parking facility. This allows for more flexibility in terms of parking layout and design, as there is no need for fixed pallets or platforms, and vehicles can be parked in a variety of configurations.

Automation Level Insights

Fully automated parking system held the largest market share. It involves minimum human interaction when vehicle being parked and retrieved automatically by robotic systems often preferred for their speed. They offer complete driverless experience providing seamless parking experience.

Semi-automated parking systems require some level of human intervention such as driver guidance while parking the vehicle, less efficient than fully automated parking systems. They offer benefits such as improved parking precision and reduced driver effort compared to manual parking,

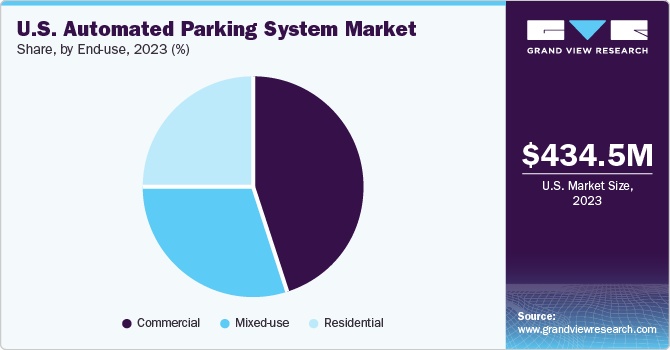

End-use Insights

The commercial segment held the highest market share in forecasted period. This segment refers to businesses and organizations that utilize automated parking systems, such as offices, hotels, shopping centers, and airports. They require efficient parking solutions to accommodate a high volume of visitors, due to seamless parking experience. It helps to enhance customer satisfaction and eventually helps to generate additional revenue through parking fees.

The residential segment is expected to grow at the fastest CAGR due to increasing urbanization and population density in many states. As residential buildings are often constrained by limited land area, there is a growing need to maximize the efficiency of parking facilities.

Key U.S. Automated Parking System Company Insights

Some of the key companies operating in U.S. automated parking system market are: Westfalia Technologies, Robotic Parking Systems, Inc.

-

Westfalia Technologies designs and manufactures fully automated parking systems that utilize advanced robotic technology to park and retrieve cars within a secure garage. Westfalia offers a range of automated parking solutions designed to maximize parking capacity for both commercial and residential applications. These solutions include ParkMatic, ParkVia, and AutoPark. These systems are flexible, modular, and uniquely designed for mixed-use, residential, and commercial parking.

-

Robotic Parking Systems, Inc., is in the development of high-capacity, scalable automated parking garages. The company specializes in high-speed automated parking structures that use half the space of traditional garages; Robotic Parking Systems is renowned for its expertise in automated parking technology. The company's innovative solutions address parking challenges by maximizing space efficiency and offering reliable automated parking options.

U.S. Automated Parking System Companies:

- AutoMotion Parking Syatem

- AUTOParkit

- CityLift parking

- Harding Stee

- Hyundai Mobis

- Parkhub

- ParkPlus

- ParkWhiz

- Robotic Parking Systems Inc.

- Westfalia technologies Inc.

Recent Developments

-

In March 2023 AUTOParkit proposed a high-tech parking structure for Dilon town. This is a valet system without an actual valet, car is deposited in loading bay and gets racked to a parking lot. It provides users with a seamless driverless parking experience. For delivery of vehicles mobile application is being developed, for safety reasons only the authorized person can schedule delivery.

-

In January 2023 AUTOParkit implemented a virtual product called Digital Twin to enhance development and to smoothen physical operations. It will help to improve the system from the design phase to actual implementation phase. Implementation helped virtual planning based on simulations and helped for process optimization.

-

Westfalia Parking conducted a webinar in November 2021 to educate on Automated Parking Demystified. During the event, they discussed an automated parking system designed for user safety and convenience, especially in the context of COVID-19. This system allows users to park and retrieve their cars in a contactless manner. Additionally, the webinar provided insights on how architects and developers can connect with automated parking vendors for their projects.

-

In September 2023, Hyundai Mobis developed one-touch technology for automated parking through a self-learned path called a Memory Parking Assistance (MPA) technology. It learns the driving route and processes the parking by using ultrasonic technology and an environment monitor camera. This gave Hyundai a competitive advantage over others. This technology is a combination of video-based sensors and driver assistance system.

U.S. Automated Parking System Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 1,332 million |

|

Growth rate |

CAGR of 18.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, structure type, platform type, automation level, end-use |

|

Key companies profiled |

AutoMotion Parking System; AUTOParkit; CityLift parking; Harding Stee; Hyundai Mobis; Parkhub; ParkPlus; Parkwhiz; Robotic Parking Systems Inc.; Westfalia technologies Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Automated Parking System Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automated parking system market report based on component, structure type, platform type, automation level, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Structure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

AGV System

-

Silo System

-

Tower System

-

Puzzle System

-

Rotary System

-

-

Platform Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Palleted

-

Non-palleted

-

-

Automation Level Outlook (Revenue, USD Million, 2018 - 2030)

-

Fully Automated

-

Semi-automated

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Mixed-use

-

Frequently Asked Questions About This Report

b. The U.S. automated parking system market size was estimated at USD 434.5 million in 2023 and is expected to reach USD 482.6 million in 2024.

b. The U.S. automated parking system market is expected to grow at a compound annual growth rate of 18.4% from 2024 to 2030 to reach USD 1,332 million by 2030

b. The hardware segment held the largest market share of 83.7% in 2023. Hardware refers to physical components such as sensors, gates, cameras, and robotics that enable automated parking operations as it contributes to physical infrastructure necessary for automated parking.

b. Some key players operating in the U.S. automated parking system market include AutoMotion Parking System, AUTOParkit, CityLift parking, Harding Stee, Hyundai, Mobis, Parkhub, ParkPlus, Parkwhiz, Robotic Parking Systems, Inc., Westfalia technologies, Inc.

b. The U.S. automated parking system market is driven by several factors such as technological advancements, urbanization and growing demand for vehicles with safety features.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."