U.S. Automated And Closed Cell Therapy Processing Systems Market Size, Share & Trends Analysis Report By Workflow (Separation, Expansion), By Type (Stem Cell Therapy, Non-stem Cell Therapy), By Scale, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-486-1

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

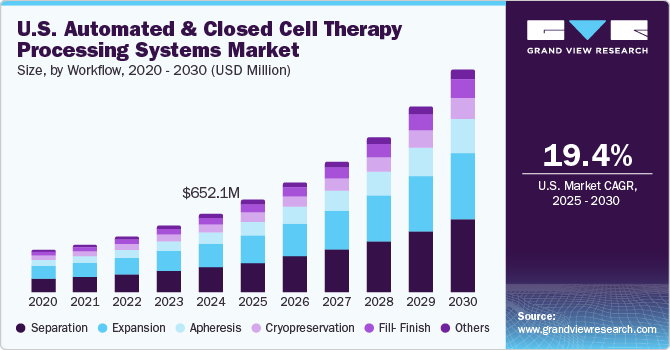

The U.S. automated and closed cell therapy processing systems market size was valued at USD 652.1 million in 2024 and is projected to witness a CAGR of 19.41% from 2025 to 2030. Technological advancements in cell therapy processing, increasing clinical trials, and a growing demand for automation due to its advantages are expected to boost the market. In addition, increasing fundraising activities are expected to contribute to market growth during the forecast period.

Increasing focus on high consistency & procedural effectiveness, reducing cell contamination, and high-volume precision are among the key factors driving the gradual shift toward cell therapy process automation. A typical cell therapy manufacturing process is labor intensive and demands more time for process completion. However, the utilization of automated systems can significantly reduce the cost of production along with high production throughput. For instance, in May 2024, Multiply Labs and Portal Biotechnologies teamed up to merge Multiply Labs’ robotic automation with Portal's advanced cell engineering capabilities. This partnership aims to enhance the development and manufacturing of cell therapies by using automation to speed up timelines and lower costs, making innovative treatments more accessible to patients. Such benefits of automated cell therapy processing systems are expected to propel market growth in the coming years.

Moreover, several key biopharmaceutical companies have identified the enormous potential of regenerative medicine technologies in clinical situations and disease indications where there is an unmet medical need owing to limitations in the standard of care. To overcome this challenge, companies are adopting various strategies, such as mergers & acquisitions in this sector, to expand their product portfolios and rejuvenate & expand their pipelines. Academic institutions and companies across the globe are actively engaged in developing new therapies, which is likely to boost the demand for regenerative medicines and increase the usage of automated systems for therapy manufacturing.

Several companies focus on investments and funding to enhance their capabilities for stem cell therapies and regenerative medicines. For instance, in July 2024, The Marcus Foundation was awarded a USD 2 million grant to support UCLA's research on creating a precision medicine approach to help restore sensation in individuals with spinal cord injuries. Such initiatives are expected to boost market growth.

Furthermore, the need for scalable, reproducible, and economical production of cell & gene therapies generates a significant demand for digital bioprocessing technologies. These technologies will be important to understand the commercial potential of cell & gene therapies in the coming years. They can serve as a tool to improve market access and control the overall cost of therapy. Manufacturers have made tremendous efforts to make cell & gene therapy safe, effective, and persistent in treating patients. Major players in the market are constantly working toward developing innovative technologies. In February 2021, ThermoGenesis Holdings, Inc. launched an automated cell therapy processing system, PXP-LAVARE. Moreover, the company also submitted a letter to the FDA for approval of the new device. The new system is capable of automated and rapid cell washing.

The COVID-19 pandemic had a mixed impact on the U.S. automated and closed cell therapy processing systems market. While it accelerated demand for these technologies due to the urgent need for innovative treatments, supply chain disruptions caused delays in critical components and shortages of raw materials. The focus on immediate COVID-19 treatments also diverted resources from ongoing cell therapy developments, potentially stalling important innovations.

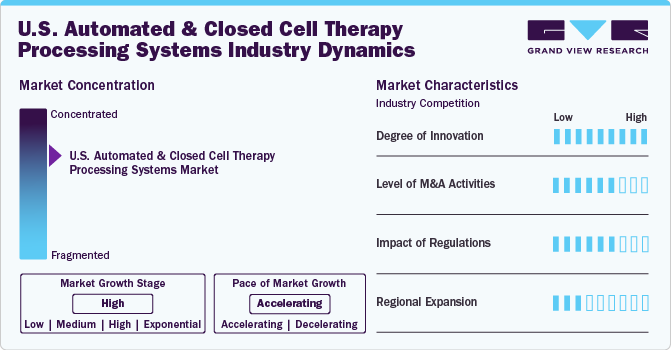

Market Concentration & Characteristics

The degree of innovation in automated and closed cell therapy processing systems has been advancing significantly, driven by the demand for scalability, consistency, and regulatory compliance in cell therapy manufacturing. Innovations are particularly concentrated in automating cell processing stages such as cell isolation, expansion, purification, and cryopreservation. These advancements are largely fueled by the need to streamline labor-intensive processes, minimize contamination risk, and ensure uniformity in cell quality across batches. For instance, automated systems like Cytiva’s FlexFactory and Lonza’s Cocoon Platform have introduced modular, closed systems that enable automated cell isolation and expansion. This automation reduces manual intervention, leading to more reliable and consistent cell yields, crucial for scaling up production to meet clinical and commercial demands.

This sector's level of collaborative activity is high and encompasses partnerships between technology providers, biopharma companies, and research institutions to drive innovation and meet clinical demands. Collaboration and partnerships are vital in the automated and closed-cell therapy processing systems space as companies seek to accelerate development, enhance system integration, and streamline the manufacturing of cell-based therapies. For example, in May 2021, Thermo Fisher Scientific’s partnership with UCSF sought to leverage automated systems in GMP-compliant cell therapy production, focusing on advancing allogeneic therapies.

Regulations significantly impact the development, adoption, and implementation of automated and closed-cell therapy processing systems. Since cell therapy products are used for potentially life-altering medical conditions, the FDA imposes strict standards to ensure the safety, quality, and efficacy of these therapies. Compliance with these regulations is essential for market access but also influences system design, scalability, and cost. For instance, Cytiva’s FlexFactory solutions are designed with full regulatory compliance in mind, focusing on streamlined workflows that meet GMP and FDA standards.

The product expansion for automated and closed cell therapy processing systems has been marked by innovations to enhance scalability, precision, and compliance for cell therapy manufacturing. Major players in the field are advancing their platforms to support new therapeutic modalities, such as CAR-T therapies, NK cells, and stem cells. They are focusing on automated solutions that enable both clinical and commercial-scale production.

Workflow Insights

Based on workflow, the separation segment dominated the market in 2024 with a market share of 31.10% and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the increasing demand for efficient cell isolation and purification techniques in therapeutic applications. Moreover technological advancements further propel the segment growth during the forecast period. For instance, in January 2020, Miltenyi Biotec introduced the world’s first operator-free cell sorting system. This system incorporates microchip-based technology, enabling multiparameter and high-speed cell sorting technology.

The expansion segment is expected to register a significant CAGR over the forecast period. The growth of the automated cell expansion segment is majorly attributed to the benefits automation offers over manual processes. The process of automation can leverage the output yield and efficiency. In addition, automation enhances reproducibility and speed. Moreover, automated cell expansion reduces the risk of sample loss during procedures.

Type Insights

Based on type, the non-stem cell therapy segment dominated the market in 2024 with a share of 61.84% and is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to increasing product launches for non-stem cell therapy applications. Furthermore, the success of CAR-T therapies has directed investment toward non-stem cell therapy development, thereby driving segment revenue.

The stem cell therapy segment is anticipated to grow significantly over the forecast period. A growing number of strategic partnerships and collaborations among market players to develop and supply new therapies will also positively impact segment growth. For instance, in October 2024, A team of researchers from UC Davis Health, led by fetal surgeon Diana Farmer and bioengineer Aijun Wang, received nearly USD 15 million to advance their innovative spina bifida treatment.

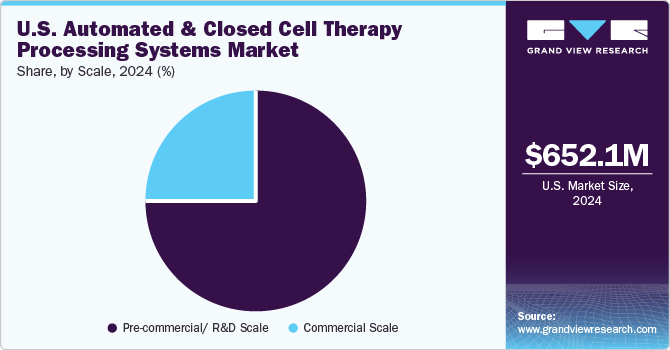

Scale Insights

Based on scale, the pre-commercial/R&D scale segment held the largest share of 74.96% in 2024. These systems are used primarily in early-stage research, process development, and clinical trials. Automated systems at this scale are essential for consistent, reproducible results in small-scale batch processing as therapies progress toward commercialization.

The commercial segment is expected to witness the highest growth rate during the forecast period. Rising investments from market players are expected to enhance the growth of the commercial-scale manufacturing segment during the forecast period. For instance, in May 2024, a USD 380 million agreement between Bristol Myers Squibb and start-up Cellares reflects the growing demand for cell and gene therapy manufacturing

Key U.S. Automated and Closed Cell Therapy Processing Systems Company Insights

The market players are adopting product lunches and approvals to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with collaborations and expansion to enhance production & research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key U.S. Automated and Closed Cell Therapy Processing Systems Companies:

- Thermo Fisher Scientific, Inc.

- Lonza

- MiltenyiBiotec

- Danaher

- Sartorius AG

- Fresenus

- MaxCyte, Inc.

- ThermoGenesis Holdings, Inc.

- Terumo Corporation

- Cellares Inc.

Recent Development

-

In October 2024, Terumo Corporation launched the Reveos Automated Blood Processing System in the U.S. to help blood centers improve blood and platelet supplies and enhance staff efficiency. Carter BloodCare in Texas is set to implement Reveos for producing platelets, red blood cells, and plasma for transfusions.

-

In October 2024, Terumo Corporation collaborated with Charles River Laboratories. It integrated the Terumo BCT’s Finia automated fill-finish system into a complex cell and gene therapy workflow, demonstrating its flexibility for different product volumes while preserving essential cell quality.

-

In October 2023, Molecular Devices, LLC, launched the CellXpress.ai Automated Cell Culture System, a patent-pending, machine learning-powered solution that automates complex feeding and passaging tasks. Its built-in incubator, liquid handler, and imager give scientists more time and independence in the lab.

-

In June 2021, Lonza collaborated with CellPoint and announced its plan to utilize the Cocoon platform to develop T-cell-based therapies. The project is being conducted to provide proof of concept for point-of-care production to optimize the supply chain operations.

U.S. Automated And Closed Cell Therapy Processing Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 773 million |

|

Revenue forecast in 2030 |

USD 1.87 billion |

|

Growth rate |

CAGR of 19.41% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Workflow, type, scale |

|

Country scope |

U.S. |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; Lonza; Miltenyi Biotec; Danaher; Sartorius AG; Fresenius Kabi, MaxCyte, Inc.; ThermoGenesis Holdings, Inc.; Terumo Corporation; and Cellares Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

U.S. Automated And Closed Cell Therapy Processing Systems Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. automated and closed cell therapy processing systems market report based on workflow, type, and scale.

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Separation

-

Expansion

-

Apheresis

-

Fill- Finish

-

Cryopreservation

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stem Cell Therapy

-

Non Stem Cell Therapy

-

-

Scale Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-commercial/ R&D Scale

-

Commercial Scale

-

Frequently Asked Questions About This Report

b. The U.S. automated and closed cell therapy processing systems market size was estimated at USD 652.1 billion in 2024 and is expected to reach USD 773.1 million in 2025.

b. The U.S. automated and closed cell therapy processing systems market is expected to grow at a compound annual growth rate of 19.41% from 2025 to 2030 to reach USD 1.87 billion by 2030.

b. The non-stem cell therapy segment dominated the U.S. automated and closed cell therapy processing systems market in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to increasing product launches for non-stem cell therapy applications.

b. Key players of the market include Thermo Fisher Scientific, Inc.; Lonza; Miltenyi Biotec; Danaher; Sartorius AG; Fresenius Kabi, MaxCyte, Inc.; ThermoGenesis Holdings, Inc.; Terumo Corporation; and Cellares Inc.

b. Technological advancements in cell therapy processing, increasing clinical trials, and a growing demand for automation due to its advantages are expected to boost the market. In addition, increasing fundraising activities are expected to contribute to market growth during the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."