U.S. Artificial Intelligence Market Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning, NLP), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-253-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Artificial Intelligence Market Trends

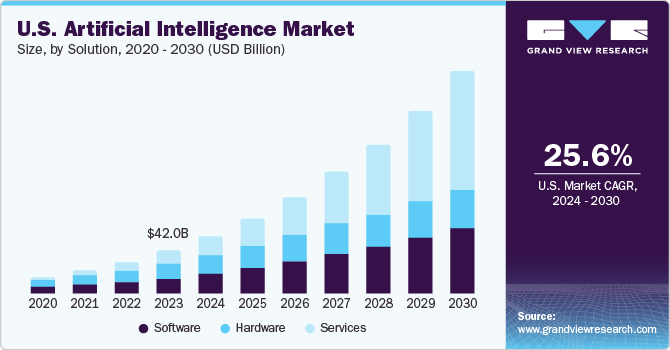

The U.S. artificial intelligence market size was valued at USD 42.0 billion in 2023 and is projected to grow at a CAGR of 25.6% from 2024 and 2030. The trend for multimodality, along with the penetration of natural language processing (NLP), deep learning and machine learning. Moreover, stakeholders have unlocked growth avenues in generative AI and machine vision. These state-of-the-art technologies have reshaped the artificial intelligence (AI) landscape and end-use industries. For instance, AI-powered tools and devices have helped in the accurate diagnosis of diseases, predict patient outcomes and detect diseases at an early age.

AI algorithms brought a paradigm shift in the transportation sector, making vehicles more efficient and safer. To illustrate, AI-powered autonomous vehicles can minimize human-error-led traffic accidents and foster traffic flow. Moreover, virtual assistants help companies interact with customers and clients seamlessly, while chatbots become pivotal for automating responses to similar or repetitive customer queries.

Meanwhile, critics have cited ethical and societal concerns, including biasness, transparency, privacy and accountability of AI systems. In August 2023, a paper from U.K.-based researchers claimed that ChatGPT has a liberal bias, highlighting that AI companies struggle to control the behavior of bots. In February 2024, Google described some responses by its Gemini AI model as “biased” and “completely unacceptable” after it created images of historical figures as people of color.

Stakeholders are expected to emphasize fairness, diversity and unbiased decision-making as the U.S. continues to attract investments in AI.

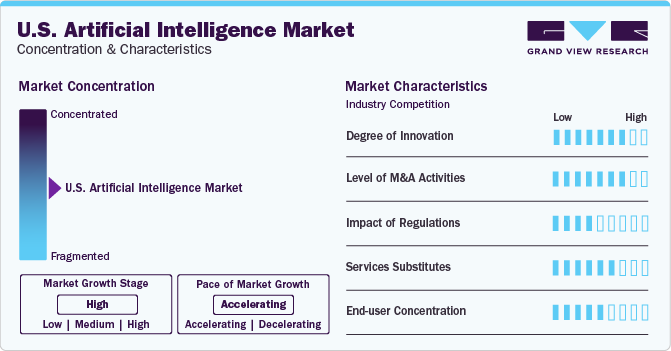

Market Concentration & Characteristics

Innovations have become galore in the AI landscape as leading players gear up to stay cut above the rest. Prominently, text-to-video tools have emerged as the next big thing with the innate ability to turn sentences into moving images with an increased level of accuracy. Furthermore, the prevalence of big data and advancements in machine learning algorithms will remain vital in steering innovations in the landscape.

Stakeholders expect mergers & acquisitions to be pronounced as established companies and startups strive to gain a competitive edge in the industry. For instance, in December 2022, Oracle announced the acquisition of Newmetrix assets from Smartvid.io, while Google acquired Alter during the same year. Predominantly, the democratization of AI has leveraged businesses to explore new ways and invest in mergers & acquisitions activities.

Focus on regulating AI has started in the U.S. as several American states and cities have passed laws confining the use of AI in hiring and police investigations. Stakeholders are emphasizing the privacy rights of individuals, such as the right to opt out of AI systems. In May 2023, Samsung banned ChatGPT and other AI-powered chatbots for its employees amidst concerns about sensitive information being leaked. A legal perspective may be that the use of AI needs to be ethical and fueled by real business needs.

The number of substitutes may be limited, partly due to the expanding footprint of AI across end-use industries. However, automation will continue to transform businesses and contribute to U.S. economic growth. Besides, expert systems and rule-based systems have gained ground, suggesting there are substitutes for AI. The trend for AI is expected to bolster the position of leading players in the global artificial intelligence market.

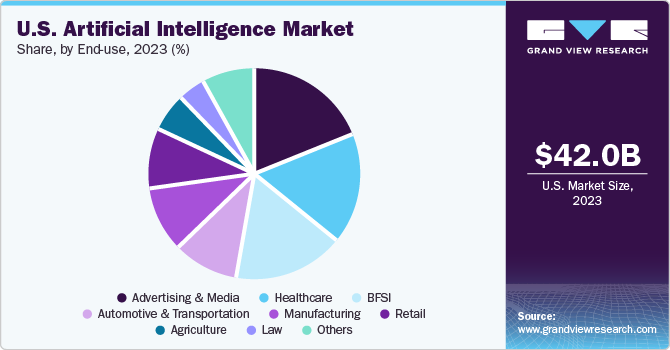

End-users, such as BFSI, healthcare, advertising & media, retail, automotive & transportation and manufacturing, are poised to exhibit heightened demand for AI tools and technologies. Furthermore, cybersecurity, oil & gas, aerospace & defense and education sectors are expected to augment investments in the advanced technology. Prominently, the U.S. government is slated to spur spending on AI and its research in defense and intelligence.

Solution Insights

The software segment led the U.S. market with a revenue share of 35.9% in 2023. The growth is partly due to the innate ability to provide real-time insights, extract data and help in decision-making. For instance, AI software has become sought-after to perform much of the trading on Wall Street. The software has become pivotal to create smart applications and foster deep learning and machine learning.

The hardware segment is likely to exhibit profound demand across end-use applications. Prominently, the rising footfall of virtual assistants that manage facial-recognition programs and homes will bolster the penetration of AI hardware. Moreover, semiconductor companies are poised to witness increased demand following the significance of hardware in AI. The footprint of chipsets, including Graphics Processing Unit (GPU), application-specific integrated circuits (ASIC), CPUs and field-programmable gate arrays (FPGAs) will bode well for the market growth.

Technology Insights

The deep learning segment accounted for the largest revenue share in 2023 and will continue to dominate on the back of surging demand to enhance automation. The trend to perform physical and analytical tasks without human intervention will propel the technology demand. In essence, the need for credit card fraud detection, voice-enabled TV remotes, and digital assistants has encouraged stakeholders to inject funds into deep learning. Stakeholders anticipate generative AI and self-driving cars to boost the regional market.

The Natural Language Processing (NLP) segment is poised to depict robust growth and reshape business operations. The technology has gained ground to save money, time and human effort. Besides, it can structure company data and peruse large volumes of text. To illustrate, OpenAI’s GPT-3 uses statistics and AI to predict the next word in a sentence based on language models. Language models have received an impetus in boosting customer satisfaction by handling complicated customer service communication.

End-use Insights

The advertising & media segment is likely to contribute significantly to the U.S. AI market, largely attributed to the technology demand for data analysis, augmenting return on investment, content generation & creation, automated decision-making and personalization. Predominantly, the advertising and media sector is counting on AI to assess customer behavior to create personalized and targeted campaigns. For instance, Netflix and Amazon Prime recommend content to users (based on their purchasing and viewing history).

The healthcare segment accounted for a notable revenue share in 2023 and it is likely to gain ground during the assessment period. The robust outlook is attributed to the applications of AI in diversifying clinical trials, fostering drug discovery, early detection of diseases, and advancing patient treatment. Specifically, AI and ML have enabled users to quickly assess lab results, electronic medical records, CT scans and MRIs. The use of AI and ML has become noticeable in identifying novel targets and forecasting drug interaction, auguring growth for U.S. market companies.

Key U.S. Artificial Intelligence Company Insights

Some of the leading players operating in the market, such as IBM Watson Health, NVIDIA Corporation, Google LLC and Microsoft, have spurred their strategies to stay ahead of the curve. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape.

-

In November 2023, IBM announced the rollout of a USD 500 million venture fund to inject funds into AI companies. The U.S. giant expects AI to unlock almost USD 16 trillion in productivity by 2030.

-

In February 2024, Figure Robotics, a company developing human-like robots, announced it raised USD 675 million in a funding round from investors, such as Microsoft, NVIDIA and Amazon founder Jeff Bezos at USD 2.6 billion valuation.

-

In December 2023, Silicon Valley-based NVIDIA claimed it had infused funds into “more than two dozen” AI companies. In June 2023, Inflection AI reported a USD 1.3 billion fundraising round led by Nvidia, Microsoft, Bill Gates, and others.

Emerging companies, including Clarifai, Inc, H2O.ai and AiCure are slated to expand their penetration to boost their portfolios.

-

In January 2024, AiCure raised USD 12 million in loan refinancing and raised an additional USD 4 million from its current investors. The AI and advanced data analytics company will reportedly use the funds to expand operations, boost products and services and invest in research and development.

-

In July 2022, Clarifai announced the rollout of Clarifai Community to promote sharing and collaboration in AI. It is also developing AI Lake to collect and centralize all the AI resources and provide tools to share across the enterprise.

Key U.S. Artificial Intelligence Companies:

- AiCure

- Atomwise, Inc.

- Ayasdi AI LLC

- Clarifai, Inc

- Cyrcadia Health

- Enlitic, Inc.

- Google LLC

- H2O.ai.

- HyperVerge, Inc.

- International Business Machines Corporation

- IBM Watson Health

- Intel Corporation

- Microsoft

- NVIDIA Corporation

- Sensely, Inc.

Recent Developments

-

In January 2024, Microsoft became the second company ever to be valued at USD 3 trillion against the backdrop of AI investments and optimism. The announcement of multibillion-dollar infusion of funds into OpenAI in January 2023 has expedited breakthroughs in AI and the American behemoth expects the collaboration to foster cutting-edge AI research and democratize AI.

-

In October 2023, Google reportedly pledged to pour USD 2 billion in OpenAI rival startup Anthropic. In the previous month, the e-commerce giant Amazon announced up to USD 4 billion investment in the startup to bolster its position in generative artificial intelligence.

U.S. Artificial Intelligence Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 55.82 billion |

|

Revenue forecast in 2030 |

USD 219.09 billion |

|

Growth rate |

CAGR of 25.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, technology, end-use |

|

Country scope |

U.S. |

|

Key companies profiled

|

AiCure; Atomwise, Inc.; Ayasdi AI LLC; Clarifai, Inc; Cyrcadia Health; Enlitic, Inc.; Google LLC; H2O.ai.; HyperVerge, Inc.; International Business Machines Corporation; IBM Watson Health; Intel Corporation; Microsoft; NVIDIA Corporation; Sensely, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. artificial intelligence market report into solution, technology, and end-use.

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Healthcare

-

BFSI

-

Law

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Agriculture

-

Manufacturing

-

Others (Oil & Gas, Education, Aerospace & Defense, Cybersecurity)

-

Frequently Asked Questions About This Report

b. The U.S. artificial intelligence market size was estimated at USD 42.0 billion in 2023 and is expected to reach USD 55.82 billion in 2024.

b. The U.S. artificial intelligence market is expected to grow at a compound annual growth rate of 25.6% from 2024 to 2030 to reach USD 219.09 billion by 2030.

b. Healthcare in end-use segment dominated the U.S AI market with a share of 17.5% in 2023. The robust outlook is attributed to the applications of AI in diversifying clinical trials, fostering drug discovery, early detection of diseases, and advancing patient treatment.

b. Some key players operating in the U.S. artificial intelligence market include AiCure; Atomwise, Inc.; Ayasdi AI LLC; Clarifai, Inc; Cyrcadia Health; Enlitic, Inc.; Google LLC; H2O.ai.; HyperVerge, Inc.; International Business Machines Corporation; IBM Watson Health; Intel Corporation; Microsoft; NVIDIA Corporation; Sensely, Inc.

b. Key factors that are driving the market growth include the trend for multimodality, along with the penetration of natural language processing (NLP), deep learning and machine learning.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."