U.S. Argan Oil Market Size & Trends

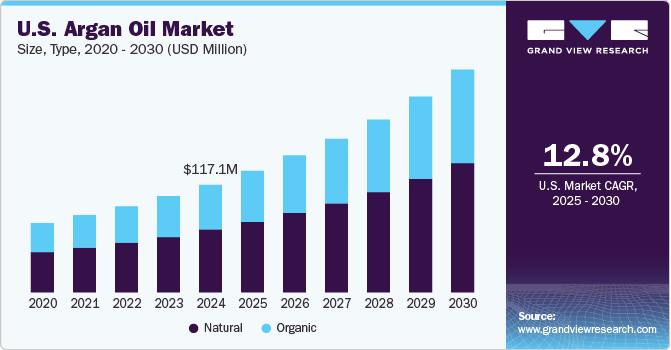

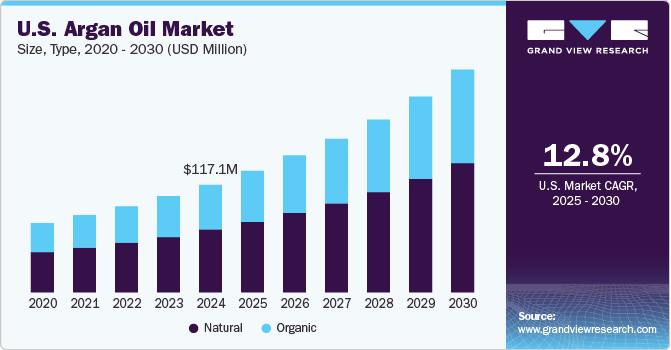

The U.S. argan oil market size was estimated at USD 117.1 million in 2024 and is projected to grow at a CAGR of 12.8% from 2025 to 2030. Primary drivers for market growth include the significant demand within the cosmetics and personal care sector, which constitutes its largest consumer base. This upsurge can be attributed to a growing consumer inclination towards natural products, perceived as safer and more effective. The increasing recognition of argan oil’s benefits for various skin and hair concerns further accelerates this trend.

Foremost among these is the surging demand in the cosmetics and personal care industry, which represents the largest consumer segment for argan oil within the U.S. This trend is largely influenced by a growing consumer preference for natural products, which are perceived as safer and more effective than synthetic alternatives. The heightened awareness of the benefits of argan oil in addressing various skin and hair issues - ranging from acne and dermatitis to signs of aging - is catalyzing its adoption among consumers seeking premium personal care solutions.

With social media shopping projected to rise from 106.8 million users in 2023 to 118 million by 2027, companies committed to sustainable practices can foster greater brand loyalty among environmentally conscious consumers. Argan oil's therapeutic benefits and nutritional profile, along with advancements in extraction technology and FDA validation, position it as a premium ingredient in cosmetic and medicinal applications.

The rise of direct-to-consumer sales models has streamlined access to argan oil products, empowering consumers to make informed purchasing decisions. Moreover, the emphasis on sustainability, coupled with the demand for ethically sourced products, has led to the development of certifications for sustainable argan oil production, aligning consumer preferences with responsible business practices.

Type Insights

Natural argan oil held the largest revenue share of 58.4% in 2024. Consumers increasingly favor natural products for their perceived safety and effectiveness in skin care and hair care. This trend, influenced by heightened health consciousness, highlights a preference for cost-effective options such as argan oil, which offers quality benefits without the higher price associated with organic certifications and limited availability.

Organic argan oil is expected to grow at the fastest CAGR of 12.9% over the forecast period. Organic argan oil, derived from trees cultivated without synthetic pesticides or fertilizers, is viewed as safer and of higher quality. Consumers are increasingly willing to invest in organic products, motivated by the demand for sustainable and ethically sourced ingredients. Rising certifications such as USDA Organic further enhance trust and appeal in the cosmetics market.

Form Insights

Argan oil, in absolute form, dominated the market with a revenue share of 58.6% in 2024, owing to its purity and concentration, which appeals to consumers seeking effective natural solutions. Its versatility across applications, including cosmetics, aromatherapy, and medical uses, coupled with the growing preference for premium, bio-based products, underscores the escalating demand for quality and efficacy in this segment.

The concentrated form segment is expected to witness significant growth over the forecast period. Concentrated argan oil is rich in antioxidants and flavonoids, appealing to consumers focused on specific skin health benefits. Its versatility across a range of personal care products adds to its allure. The rising consumer demand for natural and effective beauty solutions propels growth, as individuals increasingly seek high-quality ingredients that provide visible results in their skincare regimens.

Application Insights

Application of argan oil in personal care and cosmetics led the market in 2024, accounting for 53.4% of the total revenue generated. Known for its richness in antioxidants, fatty acids, and vitamin E, argan oil effectively nourishes skin and hair, appealing to health-conscious consumers. The growing demand for natural and organic ingredients further boosts market interest.

The aromatherapy segment is expected to witness the fastest growth of 14.2% over the forecast period. The rich composition of argan oil, including fatty acids and vitamin E, enhances the effectiveness of aromatherapy by promoting relaxation and skin nourishment. This aligns with the increasing consumer demand for natural wellness solutions and holistic health practices

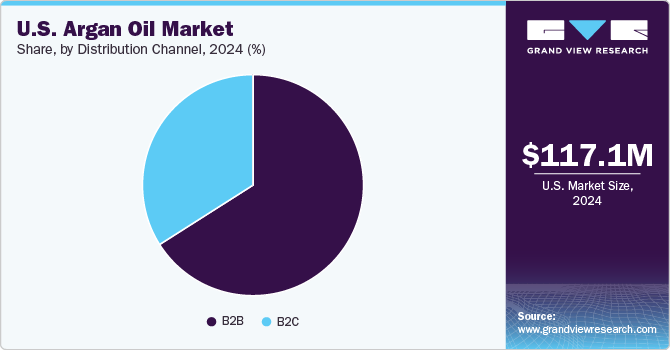

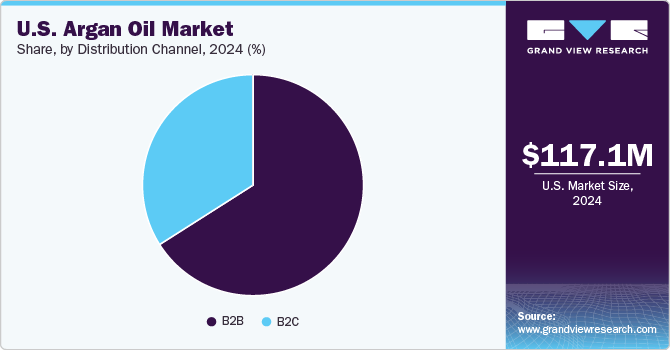

Distribution Channel Insights

B2B distribution led the market with a revenue share of 65.6% in 2024. As businesses prioritize high-quality, natural ingredients, partnerships with wholesalers and distributors enhance access to argan oil. The growth of e-commerce also streamlines supply chains, enabling companies to meet increasing consumer demand. Furthermore, a commitment to sustainability and ethical sourcing strengthens B2B relationships, aligning with consumer preferences for responsibly sourced products.

B2C distribution channels, including supermarkets, specialty retailers, and online platforms, are expected to experience increased demand during the forecast period. Direct purchasing through these avenues enhances consumer access to quality products while fostering awareness of their benefits, particularly as interest in natural and organic personal care ingredients continues to rise.

Key U.S. Argan Oil Company Insights

Some key companies operating in the market include Argan Oil Inc.; Aura Cacia; Josie Maran; MOROCCANOIL; SHEA TERRA ORGANICS; among others. Companies are entering untapped markets and diversifying their portfolios to meet the increasing demand in the cosmetics and personal care sectors, fueled by consumer preference for natural ingredients.

-

Bulk Apothecary provides a diverse selection of essential and carrier oils, including argan oil, for use in personal care and cosmetic formulations.

-

Elma & Sana LLC specializes in natural skincare products, prominently incorporating argan oil as a principal ingredient in their offerings.

Key U.S. Argan Oil Companies:

- Argan Oil Inc.

- Aura Cacia

- Josie Maran

- MOROCCANOIL

- SHEA TERRA ORGANICS

- Texas Natural Supply

- W.S. Badger Company

- L’Or D’Afrique Inc

- Bulk Apothecary

- Elma & Sana, LLC

- PURA D’OR

- Artnaturals

Recent Developments

-

In July 2024, IBG Brand Incubator collaborated with Family Dollar to launch the Crown Hair Society line, featuring nine luxury haircare products priced affordably, enhancing accessible salon-quality experiences for consumers.

-

In February 2024, Josie Maran relaunched her brand, introducing sustainable packaging and fragrances under “The Remix,” reflecting her commitment to eco-friendly and high-quality beauty products developed from her industry insights.

-

In September 2023, Moroccanoil launched its Frizz Shield Spray, utilizing HydroResist Technology and natural ingredients, including argan oil, while emphasizing sustainable packaging made from 100% post-consumer recycled plastic.

U.S. Argan Oil Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 131.5 million

|

|

Revenue forecast in 2030

|

USD 240.8 million

|

|

Growth rate

|

CAGR of 12.8% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in tons, revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, form, application, distribution channel

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Argan Oil Inc.; Aura Cacia; Josie Maran; MOROCCANOIL; SHEA TERRA ORGANICS; Texas Natural Supply; W.S. Badger Company; L’Or D’Afrique Inc; Bulk Apothecary; Elma & Sana, LLC; PURA D’OR; Artnaturals

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Argan Oil Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. argan oil market report based on type, form, application, and distribution channel:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Absolute

-

Blend

-

Concentrate

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Supermarket/Hypermarket

-

Specialty Retailer

-

Online

-

Others