- Home

- »

- Biotechnology

- »

-

U.S. Antisense & RNAi Therapeutics Market, Industry Report, 2030GVR Report cover

![U.S. Antisense And RNAi Therapeutics Market Size, Share & Trends Report]()

U.S. Antisense And RNAi Therapeutics Market Size, Share & Trends Analysis Report By Technology (RNA Interference, Antisense RNA), By Application (Ocular, Genetic), By Route Of Administration, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-245-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

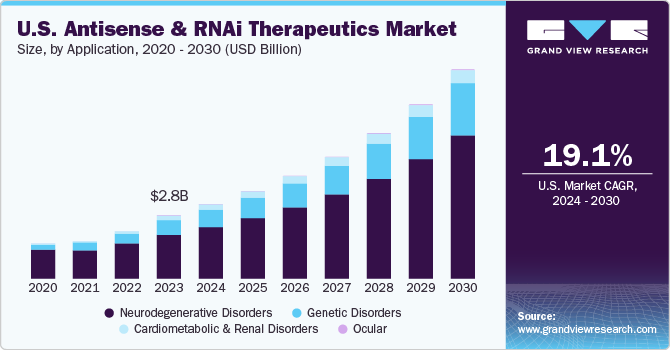

The U.S. antisense and RNAi therapeutics market size was estimated at USD 2.76 billion in 2023 and is expected to grow at a CAGR of 19.10% from 2024 to 2030. Multidisciplinary applications of antisense technology in various diseases, growing cancer prevalence, and favorable government initiatives and funding drive market growth. Moreover, increasing partnerships by key companies to develop RNAi therapeutics are anticipated to accelerate growth. In 2023, U.S. accounted for 63.0% share in the global antisense and RNAi therapeutics market. Incraesing governments efforts and funding in R&D activities support the growth of biopharmaceutical companies. These government initiatives intend to escalate awareness and trigger the manufacturing of antisense and RNAi therapeutics in the market. Additionally, the provision of external grants promotes the launch of novel therapies in the market and the development of drugs for reducing the disease burden in the country. These trends further accelerate the growth opportunities in the market.

The high dominance of cancer has become a significant cause of death in the United States, resulting in a potential healthcare burden. For example, as per data released by the American Cancer Society, there were 1,958,310 new cases of cancer and 609,820 cancer-related deaths in the U.S. in 2023. RNAi therapeutics play a significant role in controlling the number of cancer incidences. According to the article published by PubMed, RNAi therapies have been considered as an emerging alternative for treating cancer. RNAi-based therapeutics target cancer stem cells and thereby cease the normal to cancer cell transition, signifying its role in the cancer cure. This feature of RNAi therapeutics is likely to escalate its demand in the market.

Furthermore, numerous companies and research institutions are adopting collaboration and conducting clinical studies to enhance the development of innovative antisense and RNAi-based products to fulfill the unmet needs of the market and to reduce the burden of diseases thereby increasing patient. For instance, in August 2023, Sirnomics announced the successful results of RNAi therapeutics for multiple solid tumors through Phase I clinical study outcomes.

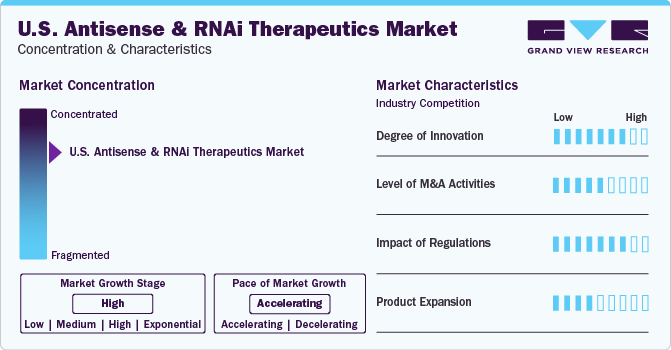

Market Concentration & Characteristics

The presence of dominant companies in the U.S. antisense and RNAi therapeutics market contributed to its concentrated nature. Moreover, technological advancements like improved delivery systems, personalized medicine strategies, and increased target precision fuel market expansion. Advances in nanoparticle formulations, CRISPR technologies, and AI-based drug development influence industry growth.

Companies increasingly focus on launching new technologies to maintain their leadership positions and strengthen their market presence. By introducing innovative antisense and RNAi techniques, companies can attract customers, drive revenue growth, and enhance patient outcomes.

Companies are actively acquiring smaller companies to expand their market presence, enhance their capabilities, diversify their product portfolios, and strengthen their competencies. This strategic approach allows firms to leverage the strengths of acquired companies, tap into new markets, and drive growth effectively.

Regulatory agencies like the US FDA are developing guidelines for advanced antisense and RNAi therapeutics to assess clinical trials, focusing on off-target effects, unintended consequences, and long-term safety. The FDA's

Center for Drug Evaluation & Research (CDER) and Center for Biologics Evaluation & Research (CBER) evaluate and approve drugs and biologics, ensuring compliance with Good Manufacturing Practice regulations for RNAi production. NIH provides guidelines for nucleic acid research, including siRNAs, which researchers and NIH-funded institutions must follow. These regulatory criteria support overall industry growth.

Increasing focus on regional expansion by key manufacturers serves a wide range of customers and capitalizes on geographical industry growth opportunities. This approach allows companies to strengthen their presence in different regions, adapt to local market needs, and enhance their market share by targeting diverse customer segments.

Route of Administration Insights

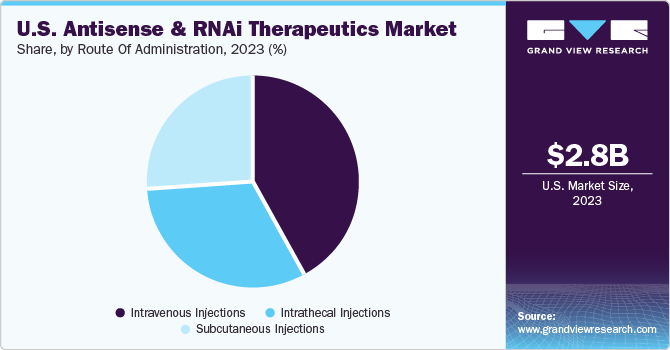

The largest market share in 2023 was held by the intravenous injections segment, which was attributed to the favorable pharmacokinetics and high bioavailability of this route of administration. Intravenous injections ensure rapid delivery of antisense and RNAi therapeutics throughout the body by avoiding gastrointestinal and liver barriers. IV-administered antisense & RNAi therapeutics offer improved penetration into tumor tissues and allow selective accumulation within tumor microenvironments. Enhancing their efficacy against cancer cells while minimizing systemic toxicity. These trends further elevate the demand for IV injections, supporting the segment’s growth.

The subcutaneous injection segment is anticipated to expand at the fastest CAGR from 2024 to 2030. This is a convenient and pain-free route of administration, offering long-term therapeutic effects. Moreover, this route provides stability, solubility, & tissue-specific targeting of advanced antisense and RNAi therapeutics, such as lipid nanoparticles and polymer-based carriers in patients.

Technology Insights

Based on technology, antisense technology dominated this market with the highest share of 70% in 2023. This technology regulates protein and gene expression, helping treat chronic cardiovascular, respiratory, and neurological diseases. The factors driving the growth include growing healthcare investments and M&A activities performed by key companies. For instance, in 2022, Wave Life Sciences Ltd. partnered with GSK to escalate Wave's PRISM platform by advancing RNA-based modalities. Such initiatives are expected to boost the market growth.

The RNA interference (RNAi) segment is expected to grow fastest from 2024 to 2030. RNAi is a promising technology offering a gene regulation mechanism, enabling the blocking of disease-causing genes. RNAi is becoming increasingly popular as a therapeutic option for different illnesses, including viral infections, cancer, and inflammatory disorders. Additionally, this industry's growth is fueled by government grants and incentives.

Application Insights

Based on applications, the neurodegenerative disorder segment held the largest share with 70.0% in 2023. This growth can be attributed to high prevalence of neurodegenerative disorders in this country. This includes disorders such as Alzheimer's disease and Parkinson's disease. According to the "National Institute of Environmental Science," approximately 6.2 million US residents are estimated to have Alzheimer's disease in 2022. Furthermore, about a million people have had Parkinson's disease in the U.S. lately. The burden of these disorders can be reduced using Antisense & RNAi therapeutics through targeted approaches. Thus, the wide applications of antisense and RNAi technology in treating neurodegenerative disorders fuel the segment's growth.

The genetic disorders segment is projected to grow at a CAGR of 20.0% from 2024 to 2030 owing to the significance of RNAi therapeutics in genetic disorders cure. RNAi therapy is capable of treating genetic diseases with high efficiency and specificity. With the help of single nucleotide polymorphism, it keeps track of disease-specific genetic variants. Moreover, nucleic acid research advancements and target delivery will likely accelerate the segment's growth over the forecast period.

Key U.S. Antisense And RNAi Therapeutics Company Insights

The key companies operating in the market include Moderna, Ionis Pharmaceuticals, Inc., Benitec Biopharma, Inc., Arbutus Biopharma, and Alnylam Pharmaceuticals, Inc..

These companies serve a comprehensive range of high-quality custom oligonucleotides focusing on customer-centric services. This helps in leveraging a diverse portfolio, including RNA-based products and therapies. Moreover, mergers and acquisitions, partnerships, and regulatory approvals support the growth opportunities in the market.

Key U.S. Antisense And RNAi Therapeutics Companies:

- Sarepta Therapeutics, Inc.

- Ionis Pharmaceuticals, Inc.

- Benitec Biopharma, Inc.

- Arbutus Biopharma

- Alnylam Pharmaceuticals, Inc.

- Microsynth AG

- Aragen Bioscience

- Moderna

- Nutcracker Therapeutics

- Deep Genomics

Recent Developments

- In March 2023, Alnylam Pharmaceuticals, Inc. announced the expansion with Medison Pharma to introduce innovative therapies for patients in international markets, along with the expansion of their existing partnership to a multi-regional agreement that includes Poland, Czech Republic, Hungary, Slovakia, Lithuania, Estonia, and Latvia, in addition to Israel.

U.S. Antisense and RNAi Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.76 billion

Revenue Forecast in 2030

USD 9.22 billion

Growth rate

CAGR of 19.10% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, route of administration

Country scope

U.S.

Key companies profiled

Sarepta Therapeutics, Inc; Ionis Pharmaceuticals, Inc; Benitec Biopharma, Inc; Arbutus Biopharma; Alnylam Pharmaceuticals, Inc.; Microsynth AG; Aragen Bioscience

Moderna; Nutcracker Therapeutics;Deep Genomics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Antisense And RNAi Therapeutics Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. antisense and RNAi therapeutics market report based on technology, application, and route of administration:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RNA Interference

-

Antisense RNA

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ocular

-

Cardiometabolic & Renal Disorders

-

Neurodegenerative Disorders

-

Genetic Disorders

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous Injections

-

Intrathecal Injections

-

Subcutaneous Injections

-

Frequently Asked Questions About This Report

b. The U.S. antisense and RNAi therapeutics market size was estimated at USD 2.76 billion in 2023

b. The U.S. antisense and RNAi therapeutics market is expected to grow at a compound annual growth rate of 19.10% from 2024 to 2030 to reach USD 9.22 billion by 2030.

b. Based on technology, antisense technology dominated the market with the highest share of 70% in 2023.

b. Some of the key players in the market are Sarepta Therapeutics, Inc; Ionis Pharmaceuticals, Inc; Benitec Biopharma, Inc; Arbutus Biopharma; Alnylam Pharmaceuticals, Inc.; Microsynth AG; Aragen Bioscience; Moderna; Nutcracker Therapeutics; and Deep Genomics.

b. Some of the key factors driving the market include technological advancements in drug delivery mechanisms, increasing investments and collaborations between drug companies to accelerate new product development in this space.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."