- Home

- »

- Animal Health

- »

-

U.S. Animal Vaccines Market Size, Industry Report, 2030GVR Report cover

![U.S. Animal Vaccines Market Size, Share & Trends Report]()

U.S. Animal Vaccines Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Animal Type (Livestock, Companion), By Route Of Administration (Subcutaneous, Intramuscular), And Segment Forecasts

- Report ID: GVR-4-68040-230-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Animal Vaccines Market Size & Trends

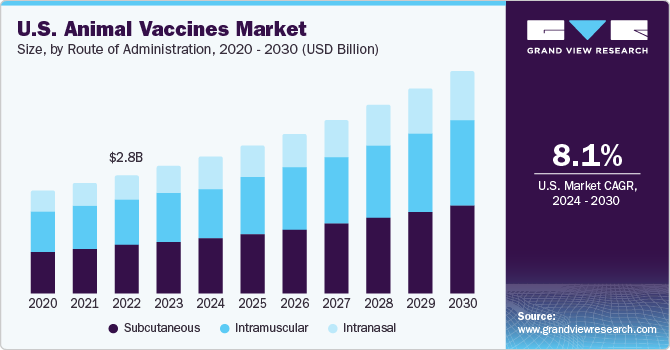

The U.S. animal vaccines market size was estimated at USD 3.03 billion in 2023 and is expected to grow a CAGR of 8.1% from 2024 to 2030. The market is experiencing substantial growth due to heightened demand for protein-rich food and rising global zoonotic and food-borne diseases. This has led to the development of advanced vaccines and pharmaceuticals, as well as increased efforts to control pathogen contamination and food-borne illnesses. Government initiatives promoting animal health products further contribute to market growth.

Over the past decades, this market has experienced significant growth due to advanced vaccine introductions and rising zoonotic and livestock diseases. According to the U.S. Center for Disease Control and Prevention (CDC), top eight infectious diseases that can easily spread from animals to humans are Salmonellosis, Zoonotic Influenza, West Nile Virus, Coronavirus, Plague, Rabies, Lyme Disease, and Brucellosis. To safeguard people against zoonotic diseases globally, the CDC is actively involved in various initiatives aimed at protecting public health from such threats.

The demand for healthy, sustainable, and high-quality meat products has necessitated healthy animal breeding practices, further fueling the market growth. Growing concerns about food security and expansion of animal husbandry are also fueling the demand for animal vaccines in livestock populations. Initiatives for safe healthcare practices in livestock and pets are expected to drive the market growth over the forecast period.

Rising economic stability, disposable income, and increasing companion animal ownership in developing countries are expected to impact the market positively. Government organizations’ guidelines promoting veterinary services will continue contributing to market growth. Moreover, increased funding from government organizations and public-private partnerships contribute to the market’s expansion. In March 2022, the U.S. Department of Agriculture (USDA) National Institute of Food and Agriculture (NIFA) announced that they would be investing USD13 million in research that explores novel therapies and prevention strategies for animal diseases that cost the agricultural industry billions worldwide.

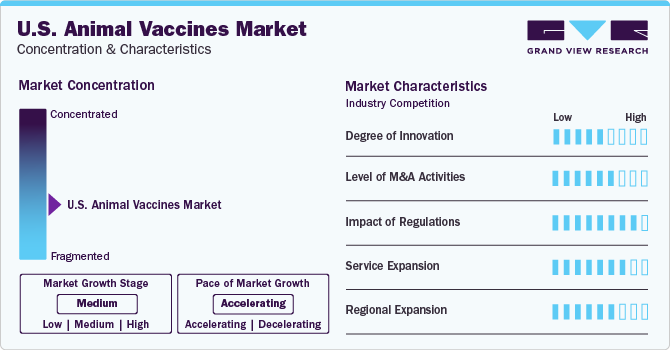

Market Concentration & Characteristics

The U.S. animal vaccines industry, being innovation-driven, holds significant growth opportunities. Advancements in vaccine banks and information management systems, among others, are boosting industry growth. Furthermore, technologies such as gene editing are expected to provide farmers an opportunity to breed animals that are completely resistant to most chronic diseases, which is expected to fuel the demand for novel animal vaccines

Several industry players are employing strategies such as acquisitions to strengthen their position. These moves help companies enhance their capabilities, broaden product portfolios, and improve their overall competencies. Mergers and acquisitions have significantly contributed to the strategic initiatives in the industry.

Government and private organizations are continuously updating guidelines to promote animal health and prevent obesity and other disorders. This proactive approach is anticipated to drive industry growth during the forecast period. For example, the Association for Pet Obesity Prevention has collaborated with veterinary healthcare organizations like the American Academy of Veterinary Nutrition and the American College of Veterinary Internal Medicine to implement standard nomenclature for feline and canine obesity. Such initiatives demonstrate a commitment to improving animal health and well-being in the industry.

Innovation in animal vaccines drives industry participants to implement strategies, enhancing product portfolios and offering diverse, advanced products. MediLabSecure exemplifies this, focusing on a lab network for emerging animal-human viruses. Investing in innovation and collaboration helps meet customer needs and foster the animal vaccines industry’s growth.

Growing investments by vaccine manufacturers and technological advancements to replace antibiotics are further propelling industry growth. For instance, in December 2020, Elanco relocated its global headquarters to Indiana, U.S., which supported its IPP (Innovation, Portfolio, and Productivity) strategy. This move contributed to creating a center of excellence and streamlining the company’s future expansion plans.

Product Insights

Attenuated live vaccines dominated the market in 2023, accounting for nearly 38.0% of the revenue share. Technological advancements have brought about modified live attenuated vaccines for wild animals that are administered through oral routes. Attenuated live vaccines are the oldest form of vaccines used and play a crucial role in boosting active and passive immunities for piglets and pregnant sows, ultimately benefiting the overall health and productivity of the pig population.

DNA vaccines are anticipated to register the highest CAGR during the forecast period due to the faster development and licensing, cost-effectiveness, ease of administration, differentiation of infected from vaccinated animals (DIVA), and several other advantages, as reported by the NCBI. Moreover, advancements in DNA-based vaccines have led to enhanced immunity and the activation of the cell-mediated component of the immune system through the coadministration of these vaccines with specific plasmids.

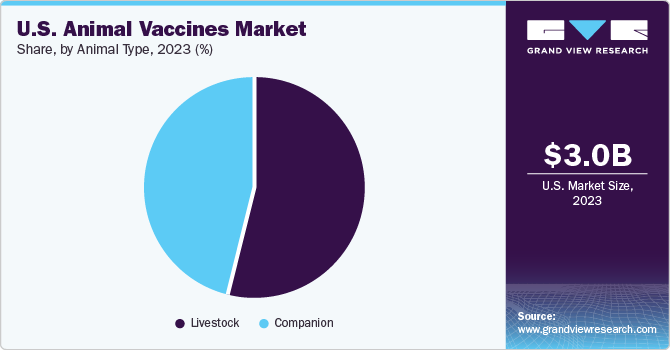

Animal Type Insights

Livestock accounted for over 50.0% of the revenue share in 2023, dominating the market. The rise in livestock population has led to an increased demand for livestock products in the country, consequently raising concerns regarding their health. According to the USDA’s National Agricultural Statistics Service (January 2021), there were 93.6M cattle/calves and 31.2M beef cows in the U.S.

Animal vaccines for companion animals are experiencing increasing demand and are anticipated to grow the fastest from 2024 to 2030. The growing number of pet owners is fueling the demand for vaccinations in companion animals. The 2023-2024 American Pet Products Association Survey reported that 66% of U.S. households, amounting to 86.9 million households, own a pet. Moreover, the increase in research and development activities is expected to contribute to the growth of the animal vaccines market in the coming years. This expanding market caters to the healthcare needs of pets, ensuring their well-being and contributing to overall growth of the pet industry.

Route Of Administration Insights

Subcutaneous vaccines accounted for the largest market share in 2023, generating over 40.0% of the total revenue. In animals, subcutaneous injection sites are favorable due to their slow absorption and ease, impacting market growth positively. Subcutaneous injections are quicker, less painful for animals, and simpler for veterinary professionals to perform compared to other routes like intramuscular. These factors collectively support the market expansion.

Intranasal vaccines are expected to exhibit the fastest growth from 2024 to 2030. A growing incidence of respiratory diseases has been recorded in animals. Thus, market players are increasingly developing better vaccines, which include additional research on intranasal vaccines due to their heightened efficacy in respiratory treatment.

Key U.S. Animal Vaccines Company Insights

The market is fragmented, marked by strategic collaborations and mergers & acquisitions. Prominent market players are undertaking extensive expansion strategies in the U.S.; consequently, this country is dominating the animal vaccines market globally. Some prominent companies in the U.S. animal vaccines market include Zoetis, Virbac Inc. Indian Immunological Limited, Heska Corp., Boehringer Ingelheim, Merck Animal Health and Biogenesis Bago.

Thedesire for companies to expand product offerings, access new markets, achieve economies of scale, and strengthen competitive positions is high. For instance, in August 2020, Merck & Co., Inc. acquired IdentiGEN, which is a leader in DNA-based animal traceability solutions, from MML Growth Capital Partners Ireland. This extended the company’s Livestock and Aquaculture products lineup.

Key U.S. Animal Vaccines Companies:

- Zoetis

- Ceva Santé Animale

- Merck & Co., Inc.

- Vetoquinol S.A.

- Boehringer Ingelheim Gmbh

- Elanco

- Virbac

- Heska

- Dechra Pharmaceuticals Plc

- Idexx Laboratories, Inc.

- Norbrook Inc.

Recent Developments

-

In February 2024, Merck Animal Health acquired Elanco Animal Health’s aqua business for $1.3 billion, expanding its portfolio with innovative aquatic species medicines, vaccines, nutritionals, and supplements.

-

In November 2023, Zoetis Inc. announced the completion of its acquisition of Basepaws, a petcare genetics company offering genetic tests, analytics, and early health risk assessments for pets.

-

In April 2023, Mars, Incorporated announced its acquisition of Heska, an advanced veterinary diagnostic and specialty products, enabling MarsPetcare to expand its diagnostic offerings.

U.S. Animal Vaccines Market Report Scope

Report Attribute

Details

Revenue forecast in 2024

USD 3.27 billion

Revenue forecast in 2030

USD 5.26 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, animal type, route of administration

Country scope

U.S.

Key companies profiled

Zoetis; Ceva Santé Animale; Merck & Co., Inc.; Vetoquinol S.A.; Boehringer Ingelheim Gmbh; Elanco; Virbac; Heska; Dechra Pharmaceuticals Plc; Idexx Laboratories, Inc.; Norbrook Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Animal Vaccines Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. animal vaccines market report based on product, animal type, and route of administration.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Livestock

-

Poultry

-

Aqua

-

Ruminants

-

Swine

-

-

Companion

-

Canine

-

Feline

-

Others

-

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcutaneous

-

Intramuscular

-

Intranasal

-

Frequently Asked Questions About This Report

b. The U.S. animal vaccines market size was estimated at USD 3.03 billion in 2023 and is expected to reach USD 3.27 billion in 20234

b. The U.S. animal vaccines market is expected to grow at a compound annual growth rate of 8.26% from 2024 to 2030 to reach USD 5.26 billion by 2030.

b. The livestock segment dominated the U.S. animal vaccines market with the highest revenue share in 2022. This can be attributed to the factors such as the rising livestock population, supportive government initiatives, and the outbreak of diseases among cattle and sheep.

b. Some key players operating in the U.S. animal vaccines market include Merck & Co., Inc.; Zoetis; Virbac; Elanco; Ceva; Phibro Animal Health Corporation; Neogen Corporation; and Intas Pharmaceuticals Ltd.

b. Key factors that are driving the U.S. animal vaccines market growth include rising livestock population, animal husbandry coupled with commercialization of animal products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.