U.S. Animal Health Market Size, Share & Trends Analysis Report By Animal Type (Production Animal, Companion Animal), By Product, By Type Of Vaccine, By Disease, By Route Of Administration, By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-492-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Animal Health Market Size & Trends

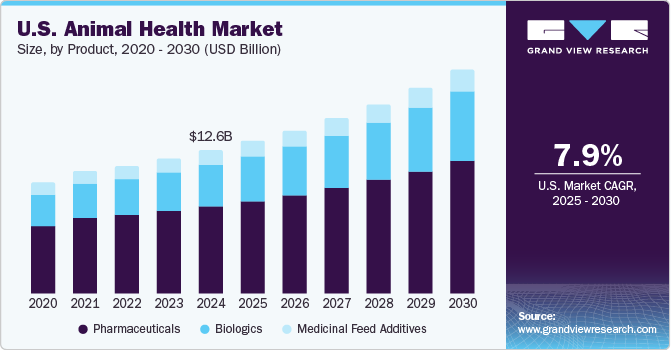

The U.S. animal health market size was valued at USD 12.65 billion in 2024 and is expected to grow at a CAGR of 7.97% from 2025 to 2030. The growth is believed to be a consequence of rising innovations around companion animal pharmaceuticals, increasing adoption rate of pets by millennials, growing livestock population & production in developing countries, and increasing meat or milk consumption rates coupled with rising concerns about food-borne diseases.

Additionally, cancer, heartworm, parvovirus, rabies, kennel cough, ringworm, and diabetes are among the diseases that are commonly observed in dogs, according to the American Society for the Prevention of Cruelty to Animals. Diabetes mellitus is a chronic illness that can cause severe problems like cataracts, UTIs, seizures, renal failure, and liver enlargement in both humans and pets.

Diabetes must be diagnosed and treated timely to avoid such potentially fatal situations. Thus, the industry is anticipated to be driven by the estimated significantly larger number of dogs and cats who have developed diabetes mellitus in recent years. For instance, according to an article published in Phoenix Dog Cat Bird Hospital in November 2024, In the United States, 1 in 230 cats and 1 in 300 adult dogs suffer from pet diabetes.

Furthermore, pet owners utilize pet insurance to manage the expenses related to their pet's medical treatment, according to the AVMA. The State of the Industry (SOI) 2024 report from the North American Pet Health Insurance Association (NAPHIA) states that the GWP has grown significantly between 2019 and 2023, rising by almost 35%. The gross written premium (GWP) increased from over USD 1.5 billion in 2019 to over USD 3.9 billion in 2023. This demonstrates the tremendous need for reliable insurance plans to cover veterinary bills among pet owners in the country. Furthermore, the staggering number of disbursed dog insurance claims further emphasizes the need. The largest insurance claim amounts for dogs and cats in 2023 ranged from USD 20,000 to USD 60,000, according to NAPHIA SOI statistics. These figures demonstrate how escalating veterinarian care expenses push pet owners to purchase insurance.

The industry is expected to grow at a significant pace over the forecast period, driven by advancements in veterinary medicine, increasing demand for early disease detection and personalized treatment options in pets, and the presence of a large number of key players in the region. Additionally, growing investments from nonprofit organizations, veterinary institutions, and industry leaders, such as Petco Love and Blue Buffalo, for funding cancer research and treatment advancements are expected to contribute to market growth. For instance, in May 2024, Petco Love and Blue Buffalo renewed their 14-year partnership to combat pet cancer with an additional $1 million investment, bringing their total commitment to $20 million. This funding supports 12 university veterinary oncology programs in the U.S., enhances research, and provides treatment grants, addressing the country's leading disease-related cause of death for dogs and cats.

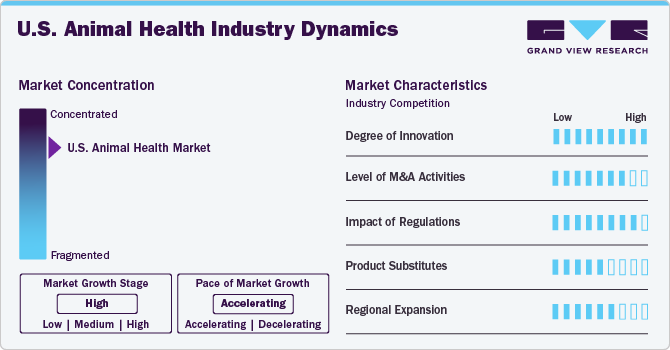

Market Concentration & Characteristics

The U.S. animal health industry is highly concentrated, with many small and medium-sized players. The market is characterized by the increasing adoption of advanced therapies, a growing prevalence of chronic pet diseases, and an expanding number of product approvals from USDA to strengthen the market position.

The market is characterized by a high degree of innovation driven by advancements in targeted therapies and precision medicine. The growing availability of canine and feline medicines and a strong R&D pipeline are estimated to propel market growth in the coming years. For instance, in September 2024, Elanco Animal Health launched Zenrelia, a once-daily oral JAK inhibitor approved by the FDA for managing allergic and atopic dermatitis in dogs. The introduction of Zenrelia reflects Elanco's commitment to expanding treatment options in veterinary medicine, enhancing the well-being of pets and their owners. Similarly, Dechra in September 2024 introduced Furosoral, a new diuretic for cats and dogs, designed to treat fluid retention associated with conditions like hydrothorax, hydropericardium, ascites, and edema, particularly in cases related to cardiac and renal issues.

The market has seen a significant increase in M&A activities, with numerous acquisitions aimed at expanding capabilities and market reach. Market players adopt this strategy to acquire product portfolios to boost their market position & revenue. These initiatives may be implemented to expand regionally or widen the global network to reach more customers. For instance, in October 2024, Phibro Animal Health Corporation completed the acquisition of Zoetis’ medicated feed additive and certain water-soluble products. This addition enhances Phibro’s portfolio across cattle, swine, and poultry, expanding its product range and global presence.

Regulations in the U.S. significantly impact the approval and availability of new treatments. Regulatory agencies ensure that products meet safety, efficacy, and quality standards, which provides assurance to consumers and promotes trust in animal health products. In the U.S., the FDA and other bodies, such as the United States Department of Agriculture (USDA), regulate the animal health market. For instance, in March 2024, the FDA approved Dechra’s DuOtic under the New Animal Drug Applications for treating otitis externa in dogs. In March 2024, the FDA also approved CONTRASED by Parnell Technologies Pty. Ltd. under the Abbreviated New Animal Drug Application (ANADA) process for the reversal of the sedative and analgesic effects of medetomidine hydrochloride and dexmedetomidine hydrochloride in dogs.

The presence of product substitutes in the industry increases competitive pressure, often driving down prices and reducing market share for established products. Substitutes like nutraceuticals, homeopathic remedies, or generic drugs appeal to cost-conscious or alternative-focused consumers. This can impact innovation as companies balance R&D investments against potential losses to substitutes.

Key players in the market, such as Zoetis Inc., Elanco Animal Health, and Merck Animal Health, are expanding regionally by enhancing their distribution networks and investing in new facilities. These expansions aim to improve access to advanced veterinary treatments and meet the growing demand for veterinary care across different states. For instance, in March 2023, VetStem, Inc. purchased three new GMP manufacturing and R&D facilities in the San Diego Biopharma sector to support the company's rapid expansion.

Product Insights

Based on product, the pharmaceuticals segment accounted for the highest revenue share of 61.21% in 2024. The field of veterinary medicine has seen significant advancements, leading to the development of new and improved pharmaceuticals for animals. These innovations include medications for preventive care, chronic conditions, and specialized treatments, contributing to the overall growth in pharmaceutical demand. For instance, in November 2024, Bimeda launched MoxiSolv Injection (moxidectin), an FDA-approved parasiticide for beef and non-lactating dairy cattle, available in a convenient, non-shattering 500 mL plastic bottle.

However, the biologics segment is anticipated to grow at the fastest CAGR of 9.36% over the forecast period due to increasing animal health expenditure, availability of veterinary medicines, R&D activities, and growing product launches by key companies. For instance, in July 2024, ELIAS Animal Health launched a clinical study to evaluate its ELIAS Cancer Immunotherapy (ECI) in combination with an innovative adjuvant as a limb-sparing treatment for large-breed dogs with appendicular osteosarcoma. This study was funded by the Morris Animal Foundation to assess the safety and efficacy of this approach, which could provide alternatives to amputation for eligible breeds, offering hope for improved quality of life for affected dogs.

Animal Type Insights

Based on type, the production animal segment held the largest share of 56.38% in 2024 owing to rising incidences of zoonotic diseases, increased livestock population, growing focus on preventive care, and increase in animal expenditure. The livestock population has increased in the U.S., with significant growth in cattle, sheep, pigs, and poultry being raised for meat production. For instance, as of January 2024, the U.S. had 87.8 million cattle and 74.97 million swine stock, according to the U.S. Foreign Agricultural Service's Livestock and Poultry: World Markets and Trade report. This substantial livestock population necessitates comprehensive veterinary care and medical interventions to maintain health and productivity.

However, the companion animals segment is anticipated to grow at the fastest CAGR of 8.54% from 2025 to 2030. This can be attributed to the steady rise in the population of pet dogs & cats in key markets. According to the American Pet Products Association 2023-2024 survey, as of 2024, approximately 66% of households in the U.S., totaling 86.9 million homes, have a pet. Dogs are the most common pets in the country, with 65.1 million households owning a dog, followed by cats, owned by 46.5 million households.

Type Of Vaccines Insights

Based on the type of vaccine, the cattle vaccine segment dominated the market with a 41.60% share in 2024, and is expected to grow at the fastest CAGR of 9.52% over the forecast period. The increasing focus on livestock health and disease prevention can contribute to this dominance. The growth of this segment aligns with the rising cattle population in the U.S., which reached more than 94.4 million head of cattle, according to the U.S. Department of Agriculture.

In addition, the economic significance of the cattle industry, which contributes over USD 70 billion annually, has driven stakeholders to prioritize health management to mitigate potential losses due to diseases. The rising consumer demand for high-quality beef and dairy products and growing awareness of sustainable farming practices have also played a crucial role in adopting health management solutions for cattle.

Route Of Administration Insights

The oral segment dominated the market with a share of 44.52% in 2024. Oral veterinary medicine is studied according to powdered drugs and tablets. This growth can be attributed to new product launches such as chewable tablets by the industry players. The introduction of micro methods and increased demand for advanced veterinary care are fueling the market growth. The increasing incidence of chronic conditions in pets, such as diabetes & liver diseases, further increases the demand for advancements in this segment. The industry players are undertaking product launches, mergers, and collaborations to gain more market share.

The topical segment is anticipated to grow at the fastest CAGR of 9.13% over the forecast period. Topicals are used for treatment of the skin, controlling external & internal parasites, & transdermal delivery of specific therapeutic agents. The topical dosage forms that are available to treat animals include solids; semisolids, such as gels, ointments, creams, & pastes; and liquids, such as suspension concentrates, solutions, paints, tinctures, emulsifiable concentrates, & suspoemulsions.

Distribution Channel Insights

The hospital/clinic pharmacy segment held the largest share in 2024. The substantial share can be attributed to high accessibility and affordability. The segment is expected to grow constantly due to the increasing prevalence of chronic diseases. Furthermore, hospitals provide advanced treatment products, which are likely to contribute to the overall growth of the hospital segment. The rise in the adoption of companion pets worldwide is driving the segment growth.

E-commerce/online pharmacies are anticipated to grow exponentially throughout the forecast period. This can be attributed to various advantages, such as increased convenience for patients not willing to purchase medicines from retail or hospital pharmacies. Moreover, these also facilitate a consistent supply of drugs, as medications can be preordered. Benefits such as these are anticipated to accentuate the demand for e-commerce throughout the forecast period.

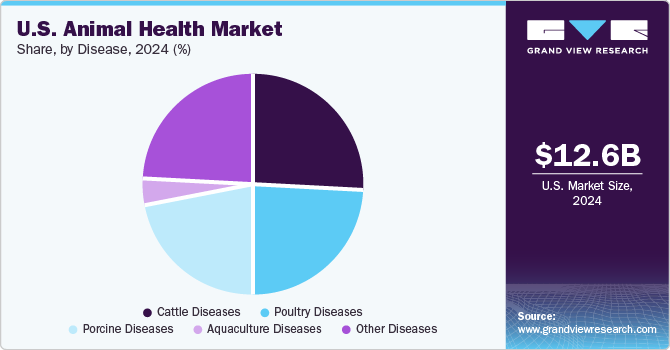

Disease Insights

The cattle diseases segment dominated the market, holding a majority share of 26.0% in 2024 due to the ongoing need to manage diseases that significantly impact cattle health and productivity. Diseases such as bovine respiratory disease (BRD), bovine viral diarrhea (BVD), and mastitis continue to pose substantial challenges to the industry. In 2023, BRD accounted for over 75% of all feedlot cattle deaths in the U.S., underscoring its major impact on cattle health and the economic stability of the sector.

The other diseases segment in the U.S. animal health market is expected to grow at the fastest CAGR of 9.44% over the forecast period, driven by the increasing prevalence of emerging diseases and the need for advanced treatment solutions. This growth is partly attributed to the rising concerns over zoonotic diseases, which can be transmitted between animals and humans, and the expanding scope of veterinary care for non-traditional pets, such as exotic and companion animals.

Key U.S. Animal Health Company Insights

Major players in the market are actively engaged in competitive and moderately fragmented market dynamics. These companies emphasize R&D and introduce new products to enhance their market presence. Furthermore, they frequently collaborate with veterinary clinics, research institutions, and academic organizations to boost R&D efforts and expand the availability of innovative and effective animal therapies. They are also expanding globally to tap into emerging markets and influence the increasing awareness of veterinary cancer care.

Key U.S. Animal Health Companies:

- Zoetis Inc.

- Ceva Santé Animale

- Merck & Co., Inc.

- Vetoquinol S.A.

- Boehringer Ingelheim Gmbh

- Elanco Animal Health Incorporated

- Virbac

- Phibro Animal Health Corporation

- Dechra Pharmaceuticals Plc

- Bimeda, Inc.

- Cargill, Incorporated.

- Aurora Pharmaceutical, Inc.

- Calier

Recent Developments

-

In November 2024, Bimeda launched MoxiSolv Injection (moxidectin), an FDA-approved parasiticide for beef and non-lactating dairy cattle, available in a convenient, non-shattering 500 mL plastic bottle.

-

In September 2024, Merck Animal Health expanded its NOBIVAC NXT vaccine platform by introducing NOBIVAC NXT FeLV, the first RNA-particle technology vaccine for feline leukemia virus (FeLV). This innovative vaccine offers optimized protection against FeLV, a common feline infectious disease, and is expected to be available at veterinary clinics nationwide.

-

In January 2024, ELIAS Animal Health announced that its ECI therapy for treating canine osteosarcoma had shown reasonable efficacy according to USDA trials, paving the way for its licensure and expected commercial launch in late 2024. This adoptive cell therapy trains the immune system to target cancer cells, offering a promising new approach to canine cancer treatment.

U.S. Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.47 billion |

|

Revenue Forecast in 2030 |

USD 19.77 billion |

|

Growth Rate |

CAGR of 7.97% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Animal type, product, type of vaccine, disease, route of administration, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Zoetis Inc., Ceva Santé Animale, Merck & Co., Inc., Vetoquinol S.A., Boehringer Ingelheim Gmbh, Elanco Animal Health Incorporated, Virbac, Phibro Animal Health Corporation, Dechra Pharmaceuticals Plc, Bimeda, Inc., Cargill, Incorporated., Aurora Pharmaceutical, Inc., Calier |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Animal Health Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. animal health market report based on animal type, product, type of vaccine, disease, route of administration, and distribution channel:

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologics

-

Vaccines

-

Attenuated Live Vaccines

-

Inactivated Vaccines

-

Subunit Vaccines

-

DNA Vaccines

-

Recombinant Vaccines

-

Autogenous Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

-

Type of Vaccine Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle Vaccine

-

Porcine Vaccine

-

Poultry Vaccine

-

Aquaculture Vaccine

-

Other Vaccines

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Porcine Diseases

-

Poultry Diseases

-

Cattle Diseases

-

Aquaculture Diseases

-

Other Diseases

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Subcutaneous

-

Intramuscular

-

-

Intravenous

-

Topical

-

Other Routes (Intranasal, Otic)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

Frequently Asked Questions About This Report

b. The U.S. animal health market size was estimated at USD 12.65 billion in 2024 and is expected to reach USD 13.47 billion in 2025.

b. The U.S. animal health market is expected to grow at a compound annual growth rate of 7.97% from 2025 to 2030 to reach USD 19.77 billion by 2030.

b. Based on product, the pharmaceuticals segment accounted for the highest revenue share of 61.21% in 2024. The field of veterinary medicine has seen significant advancements, leading to the development of new and improved pharmaceuticals for animals. These innovations include medications for preventive care, chronic conditions, and specialized treatments, contributing to the overall growth in pharmaceutical demand.

b. Some key players operating in the U.S. animal health market include Zoetis Inc., Ceva Santé Animale, Merck & Co., Inc., Vetoquinol S.A., Boehringer Ingelheim Gmbh, Elanco Animal Health Incorporated, Virbac, Phibro Animal Health Corporation, Dechra Pharmaceuticals Plc, Bimeda, Inc., Cargill, Incorporated., Aurora Pharmaceutical, Inc., Calier

b. Key factors that are driving the market growth include rising innovations around companion animal pharmaceuticals, increasing adoption rate of pets by millennials, growing livestock population & production, and increasing meat or milk consumption rates coupled with rising concerns about food-borne diseases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."