- Home

- »

- Medical Devices

- »

-

U.S. Ambulatory Services Market Size, Industry Report 2030GVR Report cover

![U.S. Ambulatory Services Market Size, Share & Trends Report]()

U.S. Ambulatory Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Primary Care Offices, Outpatient Departments, Emergency Departments, Surgical Specialty, Medical Specialty), And Segment Forecasts

- Report ID: GVR-4-68040-267-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Ambulatory Services Market Trends

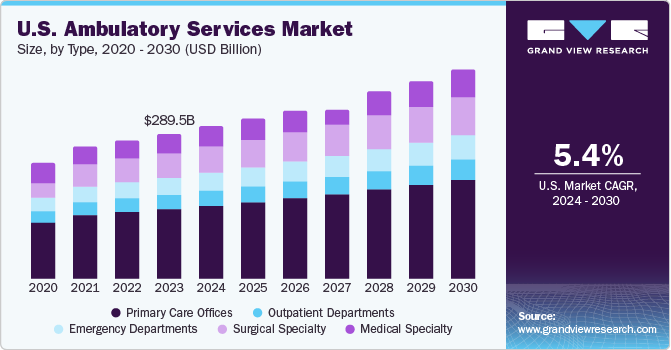

The U.S. ambulatory services market size was estimated at USD 289.5 billion in 2023 and is projected to grow at a CAGR of 5.38% from 2024 to 2030. The rapidly aging population, the rising demand for ambulatory services due to the higher prevalence of chronic diseases, and the need for regular monitoring and treatment are some of the factors driving the market growth. The growing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders require regular monitoring and treatment, which can be effectively managed in outpatient settings that has led to a higher demand for ambulatory services.

There is a growing trend toward providing care in ambulatory settings rather than inpatient facilities, as it is more cost-effective and convenient for patients. This shift reduces healthcare costs and improves access to care for a larger patient population. Advancements in medical technology have enabled the development of more accurate, portable, and user-friendly diagnostic and monitoring devices. These innovations have made it possible to provide a wider range of services in ambulatory settings, further driving market growth. There is a growing emphasis on preventive care and early intervention in healthcare systems worldwide. Ambulatory services play a crucial role in providing preventive care, screening, and early detection of diseases, which in turn fuels the market growth.

According to the National Library of Medicine, in January 2023, out of the total population in the U.S., citizens aged 50 years and older living with at least one chronic disease is estimated to increase by 99.5% from 71.522 million in 2020 to 142.66 million by 2050. At the same time, those with multimorbidity are projected to increase 91.16% from 7.8304 million in 2020 to 14.968 million in 2050.

The COVID-19 pandemic has led to an increased interest among physicians and medical technology companies to invest in or enter the ambulatory care sector. This has led to increased emphasis on the expansion of ambulatory care solutions and technologies, as well as a growing focus by health systems on providing comprehensive care. In addition, new developments and government initiatives are anticipated to drive the demand for ambulatory services. For instance, in 2020 CMS covered 11 new services to the ambulatory surgical centers (ASC), which covers hip substitution processes. These changes are expected to support patients’ health expenditure and the development of less invasive technologies that allow for safety standards.

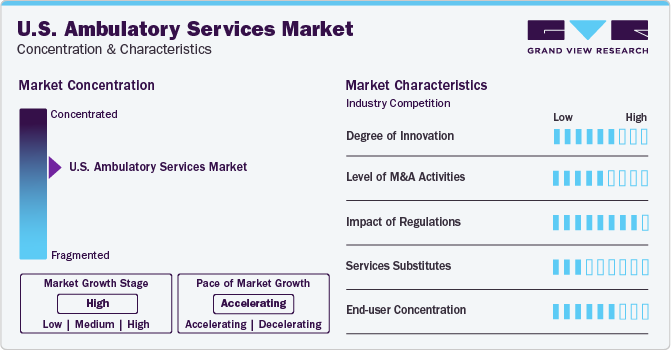

Market Concentration & Characteristics

The U.S. population is aging rapidly, leading to an increased demand for ambulatory services to manage the growing number of chronic diseases and health conditions among older adults. Moreover, the U.S. is known for its rapid adoption of new technologies in healthcare, including the development and implementation of advanced diagnostic and monitoring devices. These innovations have made it possible to provide a wider range of services in ambulatory settings, contributing to market growth.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in November 2020, Behavioral Health Group announced its acquisition of Wellness Ambulatory Care. This acquisition was done with the aim to expand the business and improve the access to care for patients.

The market is also subject to increasing regulatory scrutiny. The U.S. healthcare system is heavily regulated, with numerous federal and state agencies overseeing different aspects of the industry. Ambulatory service providers must navigate complex regulatory frameworks and ensure they adhere to a wide range of rules and guidelines, which can be time-consuming and costly. End-use concentration is a significant factor in the market. The market is characterized by the prevalence of chronic disorders such as diabetes and neurological disorders.

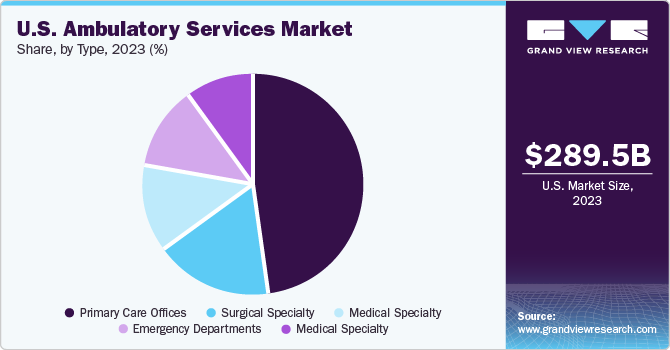

Type Insights

Primary care offices dominated the market and accounted for a share of 48.2% in 2023. The growth is attributed to improved quality of care and application of advanced technologies and increased high-quality primary care services. Primary care offices often have extended hours, walk-in appointments, and are in easily accessible areas, making them convenient for patients to visit. These offer a wide range of services, including preventive care, routine check-ups, diagnosis, and treatment for common health issues.

Moreover, primary care offices often provide cost-effective healthcare services compared to specialized care or emergency room visits. They act as the central point of contact for a patient's healthcare needs, coordinating care with specialists and other healthcare professionals as needed. This coordinated approach helps ensure that patients receive appropriate and timely care, making primary care offices a more preferred choice.

Surgical specialty is projected to grow at the fastest CAGR over the forecast period. Minimally invasive surgical techniques have led to shorter recovery times, reduced complications, and improved patient outcomes. These benefits have made surgical specialties more appealing to patients seeking efficient and effective care. As the population ages and medical advancements continue, there is an increasing demand for specialized care to manage complex health conditions and chronic diseases. Surgical specialties address specific medical needs that may not be adequately addressed through primary care.

Key U.S. Ambulatory Services Company Insights

Some of the key companies operating in the U.S. ambulatory services market include Envision Healthcare Corporation; Surgery Partners, NueHealth (Neuterra Healthcare); and Terveystalo Healthcare

- Envision Healthcare Corporation delivers care for patients at the bedside, in operating rooms and ambulatory surgery centers, in NICUs and in specialties and healthcare settings.

- Surgery Partners is a leading operator of surgical facilities and ancillary services with more than 180 locations nationwide.

Hospital Corporation of America (HCA) Management Services, L.P, Aspen Healthcare, Healthway Medical Group, Medical Facilities Corporation, Inc. are some of the other market participants in the U.S. ambulatory services market.

Key U.S. Ambulatory Services Companies:

- Envision Healthcare Corporation

- Surgery Partners

- NueHealth (Nueterra Healthcare)

- Terveystalo Healthcare

- Hospital Corporation of America (HCA) Management Services, L.P

- Aspen Healthcare

- Healthway Medical Group

- Medical Facilities Corporation

- AQuity Solutions

Recent Developments

-

In January 2023, McLeod Health announced its partnership with Wesmark Ambulatory Surgery Center. This partnership was done with the aim of expanding the hospital systems and offering exceptional multi-specialty ambulatory surgery services to the patients.

-

In May 2022, USA Health announced the start of the construction of USA Health’s ambulatory surgery center in Baldwin County. This resulted in making patients receive outpatient surgery more efficiently.

-

In November 2021, Tampa General Hospital acquired USF Health Ambulatory Surgical Center. This acquisition further expanded the hospital’s reach and resources with the addition of the acclaimed ambulatory surgery center.

-

In July 2020, Stryker launched an ambulatory surgery center- focused business. This launch was aimed at delivering tailored solutions for ambulatory surgical centers.

U.S. Ambulatory Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 303.8 billion

Revenue forecast in 2030

USD 417.8 billion

Growth Rate

CAGR of 5.38% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Envision Healthcare Corporation; Surgery Partners; NueHealth (Nueterra Healthcare); Terveystalo Healthcare; Hospital Corporation of America (HCA) Management Services, L.P; Aspen Healthcare; Healthway Medical Group; Medical Facilities Corporation; AQuity Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ambulatory Services Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ambulatory services market report based on type:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary Care Offices

-

Outpatient Departments

-

Emergency Departments

-

Surgical Specialty

-

Ophthalmology

-

Orthopedics

-

Gastroenterology

-

Pain Management

-

Plastic Surgery

-

Others

-

-

Medical Specialty

-

Frequently Asked Questions About This Report

b. The U.S. ambulatory services market size was valued at USD 289.5 billion in 2023.

b. The U.S. ambulatory services market size is projected to grow at a compound annual growth rate (CAGR) of 5.38% from 2024 to 2030.

b. Primary care offices dominated the market and accounted for a share of 48.2% in 2023 attributed to improved quality of care and application of advanced technologies and increased high-quality primary care services.

b. Some of the key companies operating in the U.S. ambulatory services market include Envision Healthcare Corporation; Surgery Partners, NueHealth (Neuterra Healthcare); Terveystalo Healthcare; Hospital Corporation of America (HCA) Management Services, L.P, Aspen Healthcare, Healthway Medical Group, and Medical Facilities Corporation, Inc.

b. The increase in the rapidly aging population, the rising demand for ambulatory services increases due to the higher prevalence of chronic diseases, and the need for regular monitoring and treatment are some of the factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.