- Home

- »

- Healthcare IT

- »

-

U.S. Ambulance Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Ambulance Services Market Size, Share & Trends Report]()

U.S. Ambulance Services Market Size, Share & Trends Analysis Report, By Transport Vehicle (Ground Ambulance, Air Ambulance, Water Ambulance), By Emergency Services, By Equipment, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

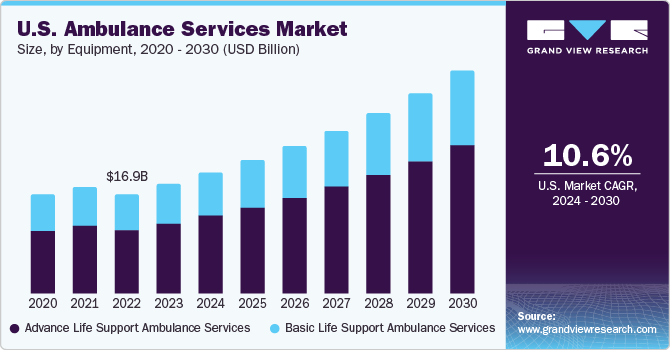

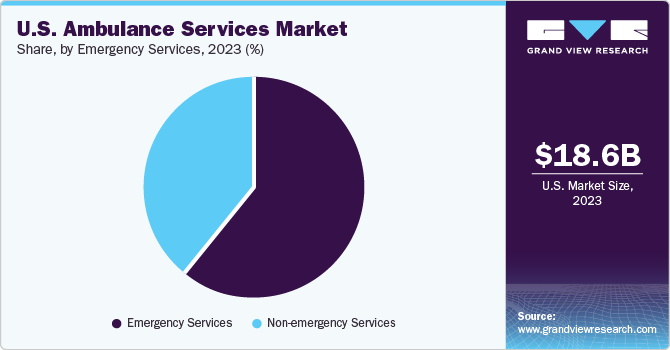

The U.S. ambulance services market size was estimated at USD 18.63 billion in 2023 and is expected to register a CAGR of 10.66% from 2024 to 2030. Major factors fueling this growth include the increasing aging population, a surge in chronic diseases, and a heightened awareness regarding the significance of timely medical intervention in emergency scenarios. Moreover, the rising popularity of medical tourism and favorable reimbursement policies contribute to the expansion and development of the market.

The U.S. accounted for nearly 45% of the global ambulance services market in 2023. The rising birth rates in the U.S. between 2020 and 2021, along with an expanding geriatric population, have contributed to an increased demand for ambulance services, according to a 2022 NCHS Data Brief. This demographic shift leads to a higher requirement for medical assistance and emergency care, consequently driving up the demand for ambulance services nationwide. This trend underscores the importance of a robust and adaptive healthcare system to cater to the evolving needs of diverse population segments.

The United States Census Bureau states that the growing prevalence of cardiovascular diseases, chronic conditions, and other health issues has led to an increased need for more frequent medical interventions and emergency responses. As these health challenges rise, there is a corresponding surge in the demand for ambulance services to deliver prompt and crucial care to individuals facing acute health crises. This heightened demand emphasizes the significance of efficient emergency response systems and accessible healthcare services for the population’s well-being.

The escalating number of road accidents in the country is a significant factor fueling the demand for ambulance services. As road accidents lead to injuries and medical emergencies, the need for rapid and efficient emergency medical response has become paramount. This trend is amplifying the demand for ambulance services to attend to accident victims promptly and provide life-saving interventions on-site.

Market Concentration & Characteristics

The U.S. ambulance services market will witness a double digit growth in next 5-6 years. The presence of large number of companies operating in this space make it very competitive, wherein these players are constantly improving their connectivity and on-board technologies to gain their market share.

The industry growth is accelerating rapidly due to favorable reimbursement policies, new ambulance service providers, rising medical tourism, increasing road accidents, and a growing geriatric population. Moreover, the industry is marked by a high level of innovation, with the adoption of advanced technologies being a significant growth driver throughout the forecast period.

Several industry players are acquiring or merging with smaller players to bolster their position. This strategy allows companies to enhance their capabilities, expand their service offerings, and improve competencies, ultimately boosting their industry presence. By acquiring minor industry players, companies can gain a competitive edge, offer a more diverse range of services, and solidify their position within the industry.

In 2023, the American Hospital Association has highlighted the intricate regulatory landscape affecting ambulatory services and hospitals. This complex regulatory environment requires increased emphasis on compliance, ensuring that healthcare providers adhere to various rules and standards. Simultaneously, the industry must maintain a strong focus on enhancing patient care quality, balancing between regulatory requirements and delivering optimal healthcare services.

The National Association of Emergency Medical Technicians’ nationwide 2023 survey uncovered that numerous Emergency Medical Services (EMS) agencies experienced modifications in their system delivery, deployment, and staffing between 2019 and 2022 to adapt to evolving needs and optimize the efficiency of EMS operations. Thus, the industry is estimated to adopt various service modifications over the forecast period.

The growth of ambulatory services in the country is marked by innovation and expansion in geographical coverage to meet the rising patient demand. A study by the University of Southern Maine revealed that 4.5 million Americans reside in ambulance deserts-areas where people are over 25 minutes away from an ambulance station, and 94.9% of Texas counties are affected by this, highlighting geographic disparities in access to timely emergency services in the U.S. In June 2023, UT Health East Texas EMS expanded its services to cover Panola County, extending its reach to six East Texas counties. This development demonstrates the growth and enhancement of ambulance services in the region, ensuring better access to care for residents across more than 4,600 square miles.

Transport Vehicle Insights

Ground ambulances dominated the market share in 2023, accounting for over 60% of the revenue share generated, owing to the flexibility and availability of comfort and efficient transport. Moreover, apart from transportation, ground ambulances can also offer on-site treatment, eliminating the need to move the patient from their original location to a hospital. This on-the-spot medical assistance can be crucial in stabilizing patients before they are transferred to a medical facility for further care.

According to the FAIR Health Brief released in September 2023, it was observed that average allowed amounts for Advanced Life Support (ALS) ground ambulance services were generally higher than those for Basic Life Support (BLS) services in 2022. However, it is essential to note that these amounts may differ across states due to varying costs and regulatory factors.

Air ambulances are expected to register the fastest growth rate over the forecast period, primarily due to their faster speed, which is crucial for swiftly transporting patients to their required destinations during medical emergencies. In addition, air ambulances have a larger capacity compared to regular charter flights, allowing them to cover longer distances in shorter time frames. This increased capacity enables them to carry essential medical equipment necessary for critical care, further enhancing their utility in emergency situations.

Thus, market players are introducing air ambulatory services to cater to aid market expansion in the country. For instance, in October 2023, Bell Textron Inc. announced that Life Flight Network, the largest not-for-profit air medical program in the U.S., added two Bell 407GXi helicopters and planned to accept a Bell 429 delivery. This expansion made Life Flight Network the largest air medical operator of Bell helicopters in the Pacific Northwest and Intermountain West.

Emergency Services Insights

Emergency services occupied nearly 61% of the revenue in 2023, thus leading the market share. The segment is anticipated to witness the fastest growth over the forecast period, which is attributable to the increasing geriatric population and increasing incidences of emergencies stemming from chronic diseases, cardiovascular disorders, and other medical issues. According to the CDC, approximately 500,000 ambulances face detours in the U.S. annually due to issues like emergency department congestion and insufficient inpatient bed availability, which has impacted the demand for ambulance services and led to market growth.

Non-emergency ambulance services are seen in hospitals, surgery centers, nursing homes, and other facilities and clinics. Patient logistics services, alongside ambulance services, cater to diverse needs, including transporting fragile patients without moving them unnecessarily during recovery. Expertise in medical care is crucial for such transfers. In addition to emergency situations, non-emergency ambulances provide safe and comfortable transportation for long-distance travel, special events, routine medical check-ups, neonatal transfers, and other scenarios. This versatility is expected to drive significant growth in the segment.

Equipment Insights

Advance Life Support (ALS) ambulances led the market in 2023 with 64.5% of the revenue share generated, and is expected to grow at the fastest CAGR over the forecast period. Advanced care ambulances are equipped with state-of-the-art medical equipment, enabling skilled paramedics to perform complex procedures like endotracheal intubation and administer intravenous medications. This enables them to provide immediate and comprehensive care on-site. According to UChicago Medicine, ALS ambulances play a substantial role in emergency care for Medicare patients across the country.

Basic Life Support (BLS) ambulances show promising growth over the forecast period, owing to their importance in both emergency and non-emergency settings. The U.S. Bureau of Labor Statistics recorded the highest employment in ambulatory services in Pennsylvania, New York, Georgia, Illinois, and Texas in 2022. This trend aligns with the rising number of hospitals being constructed and the increasing incidence of diseases in these regions. Recent studies also indicate that BLS ambulances have contributed to a higher survival rate in cases of trauma, assaults, and strokes across the country. As a result, there is an expected rise in demand for BLS ambulances from 2024 to 2030.

Key U.S. Ambulance Services Company Insights

The ambulance services market is fragmented due to the presence of many major companies operating in the country. The competitive landscape includes an analysis of a few international as well as local companies, which hold market shares and are well-known. Babcock International Group PLC; Acadian Ambulance Service; American Air Ambulance; and PHI Air Medical are some prominent companies in the U.S. ambulance services market.

Thedesire for companies to expand service offerings, access new markets, achieve economies of scale, and strengthen competitive positions is high. For instance, in January 2024, Acadian Ambulance Service acquired the assets of SouthernCross Ambulance, an EMS provider in New Braunfels, Texas. This acquisition led to the addition of 12 ambulances, 10 wheelchair vans, and 75 employees.

Key U.S. Ambulance Services Companies:

- Babcock International Group PLC

- Acadian Ambulance Service

- American Air Ambulance

- PHI Air Medical

- Express Air Medical Transport, LLC

- Air Medical Group Holdings, Inc. (Amgh)

- Falck A/S

- American Medical Response

- Rural/Metro Corporation

- Medstar

Recent Developments

-

In September 2023, Acadian Ambulance Service announced the acquisition of St. Landry EMS’s assets. This acquisition added four units and 35-40 employees, enhancing services in Hub City and Central Louisiana.

-

In August 2023, AmeriPro Health acquired American Medical Response’s operations in Lexington, Louisville, and New Albany. This acquisition enhanced AmeriPro Health’s presence in the market as it benefitted communities and partnered with institutions like UK HealthCare and UofL Health.

-

In July 2023, Valley Health and PHI Air Medical formed an enhanced partnership, introducing air medical transport services for healthcare emergencies. Valley Health, with its long-standing medical transport services, expanded its capabilities through this partnership, enhancing patient care in Virginia, West Virginia, and Maryland.

-

In June 2023, the Washington Country Board of Commissioners approved a franchise agreement with American Medical Response to commence providing 9-1-1 emergency medical transportation services in the county, effective August 1st. This decision marked the expansion of AMR, which already served Multnomah and Clackamas Counties.

-

In June 2023, Guardian Flight, a subsidiary of Global Medical Response, introduced a Bell 407GXi helicopter in Grand Rapids, Minnesota, to serve Itasca County. This addition complemented their existing fixed-wing service in the town. Initially, the helicopter operated for 12 hours daily, later transitioning to 24/7 availability.

-

In April 2023, Falck USA, a leading emergency services provider in Alameda County, California, partnered with MD Ally to introduce a virtual care solution for EMS patients. This collaboration enables paramedics and EMTs to connect non-emergency patients with virtual care professionals, providing treatment recommendations, prescriptions, and referrals without requiring hospital visits.

-

In July 2022, AmeriPro Health acquired CareMed EMS, an ambulance service provider in Mississippi and Tennessee, significantly expanding its capabilities and presence in the U.S.

U.S. Ambulance Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.63 billion

Revenue forecast in 2030

USD 37.69 billion

Growth rate

CAGR of 10.66% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Transport vehicle, emergency services, equipment

Country scope

U.S.

Key companies profiled

Babcock International Group PLC; Acadian Ambulance Service; American Air Ambulance; PHI Air Medical; Express Air Medical Transport, LLC; Air Medical Group Holdings, Inc. (Amgh); Falck A/S; American Medical Response; Rural/Metro Corporation; Medstar

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ambulance Services Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ambulance services market report based on transport vehicle, emergency services, and equipment:

-

Transport Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground Ambulance

-

Air Ambulance

-

Water Ambulance

-

-

Emergency Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Services

-

Non-emergency Services

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Advance Life Support Ambulance Services (ALS)

-

Basic Life Support Ambulance Services (BLS)

-

Frequently Asked Questions About This Report

b. The U.S. ambulance services market is expected to grow at a compound annual growth rate of 10.66% from 2024 to 2030 to reach USD 37.69 billion by 2030.

b. The U.S. ambulance services market size was estimated at USD 18.63 billion in 2023 and is expected to reach USD 20.53 billion in 2024.

b. The emergency services segment dominated the U.S. ambulance services market and held the largest revenue share of 60.9% in 2023. The growth of the emergency services segment can be attributed to the prevalence of cardiovascular diseases such as cardiac arrest, stroke, congestive heart failure, and rising cases of COVID-19 across the region.

b. Some key players operating in the U.S. ambulance services market include Air Methods Corporation, Babcock International Group PLC, Acadian Ambulance Service, American Air Ambulance, PHI Air Medical; Express Air Medical Transport, LLC, AIR MEDICAL GROUP HOLDINGS, INC. (AMGH), Falck A/S, AMERICAN MEDICAL RESPONSE

b. Key factors that are driving the market growth include favorable reimbursement policies, increasing number of people suffering from chronic disorders, increasing number of traumatic accidents and increasing geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."