- Home

- »

- Advanced Interior Materials

- »

-

U.S. Aluminum Extrusion Market Size, Industry Report, 2030GVR Report cover

![U.S. Aluminum Extrusion Market Size, Share & Trends Report]()

U.S. Aluminum Extrusion Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tubes & Pipes, Rods & Bars Shapes), By Application (Building & Construction, Electrical & Energy), And Segment Forecasts

- Report ID: GVR-4-68040-252-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aluminum Extrusion Market Trends

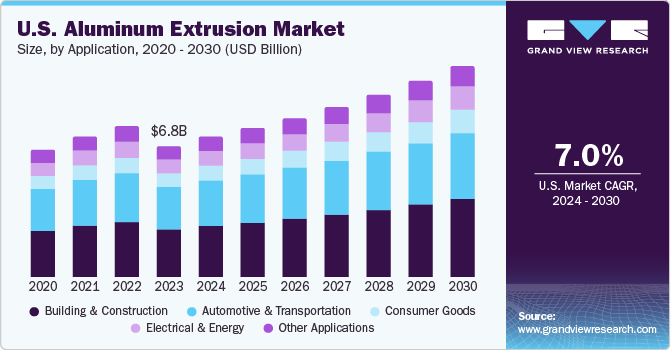

The U.S. aluminum extrusion market was valued at USD 6.78 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. This growth is attributed to a confluence of factors, including the burgeoning demand from the automotive and construction sectors. The market is witnessing a significant upsurge due to the automotive industry’s shift towards lightweight and fuel-efficient vehicles, which extensively utilize aluminum extrusions. Additionally, the construction industry’s trend towards sustainable and energy-efficient building practices has spurred the demand for aluminum extrusions.

Regulatory frameworks significantly shape the trajectory of the U.S. aluminum extrusion market. The stringent standards set by agencies such as the National Highway Traffic Safety Administration (NHTSA), California Air Resource Board (CARB), and the U.S. Environmental Protection Agency (EPA) have a profound impact. These regulations, particularly concerning greenhouse gas emissions, compel auto manufacturers to innovate in vehicle design and materials, often leading to increased utilization of aluminum for its lightweight and performance benefits.

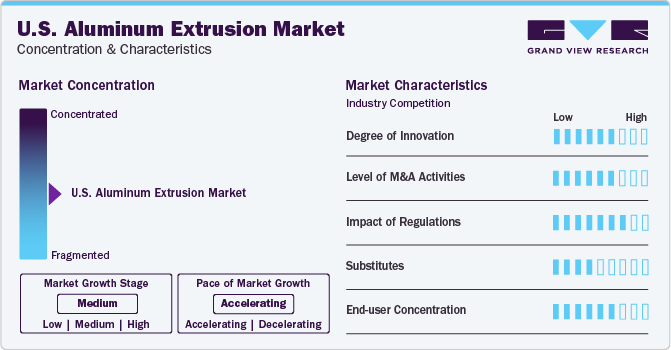

Market Concentration & Characteristics

The market exhibits moderate growth at an accelerating pace, characterized by rising demand for extruded products and their adoption in lightweight parts production, especially in the aerospace, automotive, and construction industries. High levels of mergers and acquisitions indicate a trend toward consolidation. Innovation is a key driver, with emerging technologies like 3D printing, hot extrusion, and nanostructured aluminum shaping the sector’s future. Product innovations and enhanced efficiency in existing facilities are further driving market growth.

Substitute materials such as steel and composites pose competition, offering similar properties at potentially reduced costs. However, aluminum extrusions remain in demand due to their lightweight and corrosion-resistant properties. The building and construction segment is the largest end-user, driven by smart city projects and rapid urbanization. The demand from the automotive & transportation sector is also significant, influenced by the shift towards electric and hybrid vehicles.

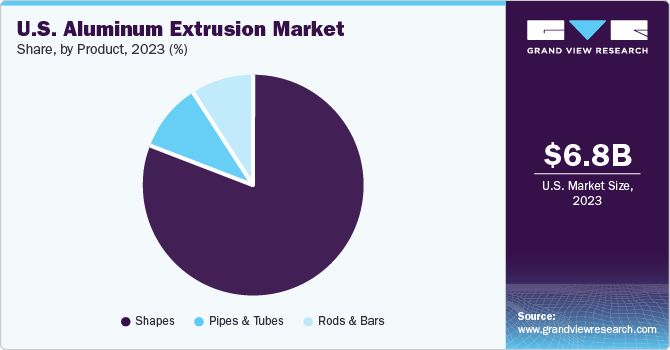

Product Insights

The shapes segment dominated the U.S. market in 2023 with more than 80.0% revenue share. This dominance can be attributed to the extensive use of shape products for building and construction, automotive, machinery, equipment manufacturing, and others. Some of the common shapes products are automotive chassis, profiles for poles, profiles for bridges, profiles for rail tracks, door & window profiles, profiles for heat exchangers, etc.

The pipes & tubes segment is the fastest-growing product segment in the U.S. market with a CAGR of 8.8% from 2024 to 2030. This segment includes products that are used for electrical and energy, mass transport, and others. Some of the common uses of pipes & tube products are found in HVAC systems, tunnels, airports, bridges, etc.

Application Insights

The building & construction segment dominated the U.S. market in 2023 with more than 36.8% revenue share. This segment extensively uses aluminum extrusions due to their durability, lightness, and resistance to corrosion. In 2023, construction activities increased, including mega projects like the Gordie Howe International Bridge, Hudson Tunnel Project, and JFK Airport Expansion. This led to a surge in demand for global aluminum extrusion market.

The automotive & transportation segment had the second-largest revenue share in the U.S. market. The automotive industry has witnessed a rise in the utilization of aluminum in both internal combustion vehicles and electric vehicles in 2023, which was driven by the need to comply with regulatory mandates concerning the environmental footprints of vehicles.

The consumer goods segment is the fastest-growing product segment in terms of revenue in the U.S. aluminum extrusion market with a CAGR of 5.8% from 2024 to 2030 . This growth can be attributed to the increasing demand for consumer goods made from durable and lightweight materials.

Key U.S. Aluminum Extrusion Company Insights

The U.S. aluminum extrusion market is characterized by a moderate level of market concentration. It is neither highly fragmented nor concentrated into a monopoly or duopoly. The market is experiencing accelerating growth and is marked by a significant number of mergers and acquisitions, indicating a trend toward consolidation among leading manufacturers. However, the presence of multiple players and the continuous demand for extruded products across various industries suggest that the market maintains a competitive environment.

Some key players operating in this market include Hindalco Industries Ltd., Norsk Hydro ASA and Arconic Corp.:

-

Hindalco Industries Ltd. has broadened its portfolio of extruded products and amplified its global presence by increasing the count of its production facilities. This expansion has been achieved through strategic investments, collaborations, and partnerships. Additionally, it has realized economies of scale through mass production of aluminum extruded products.

-

Norsk Hydro ASA holds a prominent position in the aluminum extrusion industry. To maintain its market share in this competitive landscape, it has strategically expanded its business footprint across various regions through numerous acquisitions.

Key U.S. Aluminum Extrusion Companies:

- Hindalco Industries Limited

- Norsk Hydro ASA

- Arconic Corporation

- Constellium N.V.

- Kaiser Aluminum

- Alupco

- Gulf Extrusions Co. LLC

- BALEXO

- QALEX

Recent Developments

-

In September 2023, Hindalco Industries Limited entered into a technology partnership with Metra SpA to enhance its production of large-size aluminum extrusion and fabrication technology. This partnership is aimed at developing advanced aluminum rail coaches that can operate at high speeds.

-

In August 2023, Apollo Funds completed its previously announced acquisition of Arconic Corp. With the backing of Apollo Funds’ industry expertise and relationships, Arconic will be able to pursue our long-term strategic goals.

-

In November 2023, Hydro opened a new aluminum recycling plant in Cassopolis, Michigan. This plant is projected to carry out aluminum extrusion production of 120,000 mt/year. This will play a key part in their strategy to double the production of their recycled products.

U.S. Aluminum Extrusion Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.25 billion

Revenue forecast in 2030

USD 10.90 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application

Key companies profiled

Hindalco Industries Limited; Norsk Hydro ASA; Arconic Corporation; Constellium N.V.; Kaiser Aluminum; Alupco; Gulf Extrusions Co LLC; BALEXO; QALEX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aluminum Extrusion Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aluminum extrusion market report based on product and application:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Shapes

-

Rods & Bars

-

Pipes & Tubes

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Consumer Goods

-

Electrical & Energy

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. aluminum extrusion market was valued at USD 6.78 billion in the year 2023 and is expected to reach USD 7.25 billion in 2024.

b. The U.S. aluminum extrusion market is expected to grow at a compound annual growth rate of 7.0% from 2024 to 2030 to reach USD 10.90 billion by 2030.

b. Based on application, building & construction held the largest revenue share of over 37.0% in 2023 of the U.S. aluminum extrusion market.

b. Some of the key players operating in the U.S. aluminum extrusion market include Hindalco Industries Limited, Norsk Hydro ASA, Arconic Corporation, Constellium N.V., Kaiser Aluminum, and Alupco, to name a few.

b. The key factor driving the U.S. aluminum extrusion market the burgeoning demand from the automotive and construction sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.