U.S. Air Quality Analyzers Market Size, Share & Trends Analysis Report By Product (Fixed, Portable), By Pollutant (Chemical, Physical), By Application (Industrial, Commercial), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-622-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

U.S. Air Quality Analyzers Market Trends

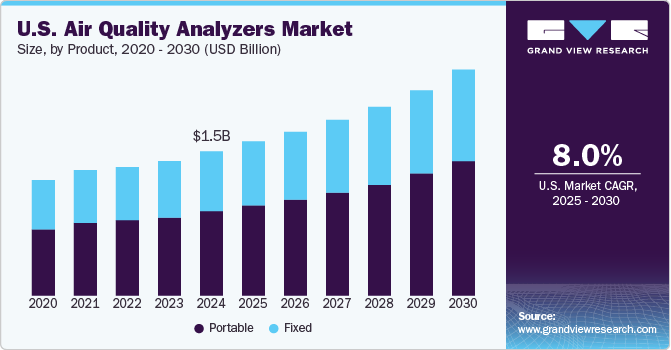

The U.S. air quality analyzers market size was valued at USD 1.45 billion in 2024 and is projected to grow at a CAGR of 8.0% from 2025 to 2030. This growth is driven by increasing awareness of the health impacts of air pollution is a significant driver, as poor air quality has been linked to respiratory issues, cardiovascular diseases, and other health problems. Technological advancements in air quality analyzers, including the development of portable and real-time monitoring systems, have made these devices more accessible and effective. The COVID-19 pandemic has also underscored the importance of indoor air quality, leading to increased demand for air quality analyzers to detect biological contaminants. Finally, the ongoing industrialization and urbanization in the U.S. contribute to air pollution, necessitating robust air quality monitoring solutions.

The U.S. air quality analyzers market is shaped by several key regulations and initiatives to reduce air pollution and ensure public health. The Clean Air Act (CAA) is one of the most significant pieces of legislation mandating the monitoring and controlling of air pollutants. Under the CAA, the Environmental Protection Agency (EPA) sets National Ambient Air Quality Standards (NAAQS) for ozone, particulate matter, and nitrogen oxides2. Title 40 of the Code of Federal Regulations (CFR) outlines specific requirements for air quality monitoring, including 40 CFR Part 50 for ozone standards, 40 CFR Part 53 for quality assurance guidelines, and 40 CFR Part 58 for air monitoring data certification.

Product Insights

The portable segment accounted for the largest share of 58.4% in the U.S. air quality analyzers market in 2024. This significant market share is attributed to the increasing demand for flexible, easy-to-use air quality monitoring solutions. Portable air quality analyzers offer the advantage of mobility, allowing users to conduct on-site measurements in various locations, which is particularly useful for environmental assessments, occupational health and safety evaluations, and emergency response situations. These devices are equipped with advanced sensors and real-time data transmission capabilities, enabling immediate analysis and decision-making. The growing awareness of indoor air quality and the need for periodic monitoring in residential, commercial, and industrial settings further drive the demand for portable air quality analyzers.

The fixed segment is projected to grow at a CAGR of 7.6% from 2025 to 2030. Fixed air quality analyzers are essential for the continuous monitoring of air pollutants in specific locations, such as urban areas, industrial sites, and research institutions. These systems are often integrated into larger air quality monitoring networks, providing consistent and reliable data for regulatory compliance and public health assessments. The growth of the fixed segment is driven by stringent government regulations and standards that require continuous monitoring of air pollutants to ensure compliance with environmental laws. In addition, advancements in sensor technology and data analytics enhance the accuracy and efficiency of fixed air quality monitoring systems, contributing to their increasing adoption. The expanding industrial activities and urbanization in the U.S. also necessitate the use of fixed air quality analyzers to monitor and mitigate air pollution effectively.

Pollutant Insights

The chemical segment accounted for the largest revenue share of the U.S. air quality analyzers market in 2024. This segment includes analyzers that monitor pollutants such as ammonia, sulfur dioxide, carbon monoxide, nitrogen oxides, sulfur oxides, and volatile organic compounds (VOCs). The demand for chemical analyzers is driven by stringent environmental regulations and standards that require continuous monitoring of these pollutants to ensure compliance and protect public health. The increasing industrial activities and urbanization contribute to higher emissions of chemical pollutants, necessitating robust monitoring solutions. Technological advancements in sensor accuracy and data analysis further support the growth of this segment.

The biological segment is anticipated to grow at a CAGR of 8.2% over the forecast period. This segment includes analyzers that detect biological contaminants such as molds, viruses, bacteria, mildew, and pollen grains. The COVID-19 pandemic has significantly increased the demand for biological analyzers due to the heightened awareness of indoor air quality and the need to detect airborne pathogens. The growing emphasis on health and safety in workplaces, schools, and homes drives the demand for these analyzers. In addition, the rising prevalence of allergies and respiratory issues caused by biological pollutants further fuels the market growth. Innovations in real-time monitoring systems and the integration of advanced technologies enhance the effectiveness of biological analyzers, contributing to their increasing adoption.

Application Insights

The commercial segment dominated the U.S. air quality analyzers market in 2024, primarily due to the growing emphasis on maintaining optimal indoor air quality in commercial spaces such as office buildings, shopping malls, hotels, and healthcare facilities. Businesses increasingly recognize the importance of air quality for the health and productivity of employees and visitors, driving the demand for advanced air quality monitoring systems. Regulatory requirements and standards, such as those set by the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA), mandate regular monitoring and reporting of indoor air quality, further propelling the adoption of air quality analyzers in the commercial sector.

The educational institutions segment is projected to grow the fastest over the forecast period. Ensuring a safe and healthy learning environment is paramount, as poor indoor air quality can affect students' cognitive function, concentration, and overall well-being. Many educational institutions are now prioritizing the installation of air quality analyzers to monitor and manage pollutants, allergens, and pathogens in classrooms, lecture halls, and dormitories. Government initiatives and funding programs aimed at improving school infrastructure and indoor environments further support the growth of this segment. The integration of smart technologies and real-time monitoring systems in educational settings enhances the efficiency and effectiveness of air quality management, driving the rapid expansion of the market in this sector.

Key U.S. Air Quality Analyzers Company Insights

Some of the key companies in the U.S. air quality analyzers market include 3M, DuPont, Cintas Corporation, Kimberly-Clark Corporation, Williamson-Dickie Mfg. Co., Ansell Ltd., Helly Hansen, and others.

-

Xinxiang Shinco Protective Garments Co., Ltd. is a prominent manufacturer of Air Quality Analyzers in the U.S. The company specializes in producing fixedly flame-retardant clothing, which is essential for worker safety in industries such as petrochemical, electrical, and utility sectors.

-

Xinke Protective is a leading manufacturer of flame-retardant workwear in the U.S. The company produces a wide range of protective clothing, including flame-resistant overalls, anti-static clothing, and anti-acid-alkaline clothing.

Key U.S. Air Quality Analyzers Companies:

- Siemens

- TSI

- Emerson Electric Co.

- Aeroqual

- Thermo Fisher Scientific Inc.

- IQAir

- Honeywell International Inc.

- Camfil

- 3M

- Koninklijke Philips N.V.

U.S. Air Quality Analyzers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.54 billion |

|

Revenue forecast in 2030 |

USD 2.27 billion |

|

Growth rate |

CAGR of 8.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, pollutant, application |

|

Key companies profiled |

Siemens, TSI, Emerson Electric Co., Aeroqual; Thermo Fisher Scientific Inc., IQAir, Honeywell International Inc., Camfil, 3M, Koninklijke Philips N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Air Quality Analyzers Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. air quality analyzers market report based on product, pollutant, and application:

-

Product Outlook (USD Million, 2018 - 2030)

-

Fixed

-

Portable

-

-

Pollutant Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Physical

-

Biological

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Educational Institutions

-

Commercial

-

Residential

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."