- Home

- »

- Next Generation Technologies

- »

-

U.S. AI Trust, Risk And Security Management Market, Industry Report, 2030GVR Report cover

![U.S. AI Trust, Risk And Security Management Market Size, Share & Trends Report]()

U.S. AI Trust, Risk And Security Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Type, By Deployment, By Enterprise Size, By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-252-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI TRiSM Market Size & Trends

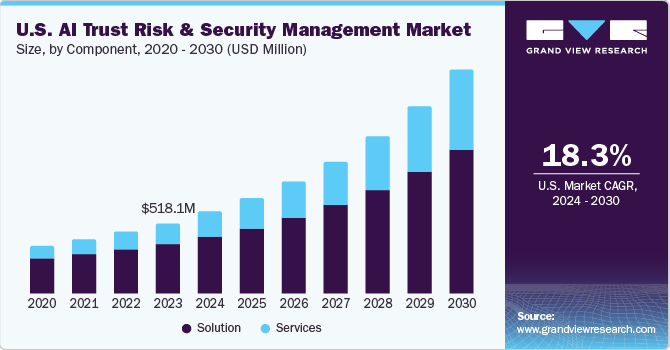

The U.S. AI trust, risk and security management market was valued at USD 518.1 million in 2023 and is projected to grow at a CAGR of 18.3% between 2024 and 2030. The need to promote transparency, efficacy, fairness, data protection and reliability has underscored the significance of trust, risk and security management of artificial intelligence. A spike in AI adoption has prompted industry leaders to seek trustworthy companies to integrate AI into their projects and IT systems.

Robust governance of AI operations will leverage companies to imbibe the practices, ethos and tools that complement trust, risk and security management (TRiSM) principles. A surge in digital transformation and the penetration of IoT, cloud, big data, automation and cybersecurity have furthered the demand to invest in governance goals. While the growing footfall of Industry 4.0 and hyper-automation has come on the back of bullish AI integration, the prevalence of cyber-attacks and an emphasis on environmental, social and governance (ESG) have encouraged stakeholders to invest in trust, risk and security management.

An uptick in data and algorithm biases has spurred the demand for ethics and transparency, suggesting the need for AI TRiSM. Predominantly, cyberattacks on AI systems have alluded to embedding AI TRiSM programs. In January 2024, Britain’s GCHQ spy agency alerted that surging deployment of AI tools would foster cyberattacks and reduce the barrier of entry for less sophisticated hackers. Furthermore, computer scientists from the National Institute of Standards and Technology (NIST) and their collaborators warned that adversaries can confuse or even poison AI systems to make them malfunction.

In January 2024, the American organization released a publication titled “Adversarial Machine Learning: A Taxonomy and Terminology of Attacks and Mitigations (NIST.AI.100-2)” to underpin the growth of trustworthy AI and help the AI Risk Management Framework of NIST put into practice.

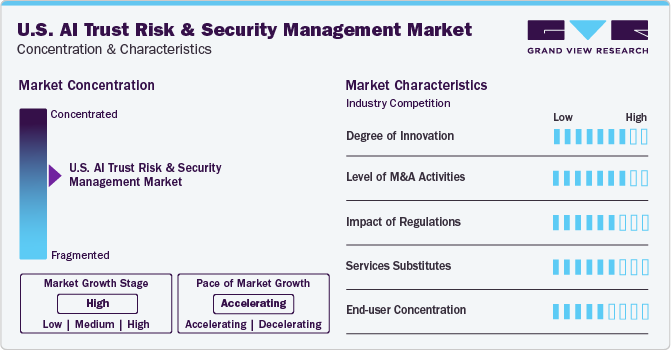

Market Concentration & Characteristics

The year 2023 was replete with innovations as organizations have geared up to boost transparency and emphasize decision intelligence, predictions and recommendations. Stakeholders are focusing on proactive detection, recovery and remediation from Adversarial AI system attacks, AI model thefts, data poisoning, LLM prompt injections and Backdoor AI model attacks. Prevalence of business impact analyses, risk taxonomies, business continuity plan (BCP), Incident Response Systems and communication protocols will steer innovation in the U.S. market.

The level of mergers & acquisitions could be pronounced as leading companies are expected to bolster their position in the landscape. Acquirers and investors are keeping up with the trends and technological advancements to comply with regulations. Prominently, the establishment of ethical AI guidelines has influenced mergers and acquisitions strategies. Entities are expected to form an ecosystem addressing issues pertaining to privacy, accountability and fairness.

Regulations have become pronounced as risks and fallouts of AI have compelled watchdogs and other stakeholders to invest in ensuring accountability, inclusivity, accessibility, and eradicating irresponsible usage. For instance, AI TRiSM principles have been incorporated into regulatory frameworks, including NIST’s guidelines for responsible AI. Google, Meta, and Microsoft are pushing for AI regulations as demand for transparent, inclusive, ethical, and secure AI continues to soar. In essence, restrictions and bans on ChatGPT and other generative AI tools have fueled the impact on regulations. In October 2023, the U.S. issued an executive order on regulating AI and fostering an ethos of secure, safe, and trustworthy AI.

A low threat from substitutes is likely to be witnessed in the regional landscape. While traditional security solutions, including in-house development and firewalls, could be noticeable, the latter demands significant investments and expertise. Besides, open-source alternatives may lack comprehensiveness and development maturity vis-à-vis commercial offerings.

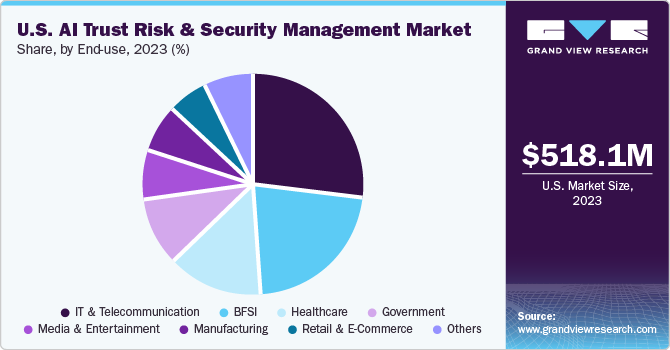

End-users, including BFSI, IT & telecommunication, healthcare, government, manufacturing, and media & entertainment, are expected to rely on the trust, risk, and security management of AI. Soaring adoption of AI has spurred the demand for AI TRiSM tools and services for a secure and effective implementation of AI technologies. Stakeholders expect an uptick in the integration of AI solutions for robust AI governance to bode well for the regional forecast.

Component Insights

The solution segment spearheaded the U.S. AI Trust Risk and Security Management (TRiSM) market, accounting for 70.5% revenue share in 2023. The trend for software solutions that enable software developers and ML practitioners to interpret, assess, monitor, and offer insights on the number of ML models will bode well for the industry's growth. These bespoke solutions ensure the quality of the model, offer analytics on model performance and streamline complex logic into actionable insights. Furthermore, the innate ability to communicate model predictions to stakeholders will spur investments in the landscape.

The services segment will depict notable growth on the back of surging penetration of managed and professional services. Vendors are providing post-sale services, such as consultation over audio, video or email. A gradual rise in the usage of AI TRiSM solutions and the integration with the existing system has compelled vendors to provide implementation and deployment services at moderate costs.

Type Insights

The explainability segment accounted for the largest revenue share in 2023 and will continue to witness an upward trend on the back of making AI models more transparent. The need to build trust in AI systems across finance, healthcare and automotive sectors has mustered up the confidence of stakeholders. Moreover, explainability will also propel trust and help in regulatory compliance with responsible AI usage. Industry leaders are likely to bank on explainability to comprehend the intricacy of AI ethics and governance, boost accountability and reduce risks.

The ModelOps segment will observe promising growth against the backdrop of the demand to maintain the infrastructure and environment, including cloud resources. The integration of ML models into business processes and the growing complexity of AI models have reinforced the need for ModelOps solutions. Incumbent market companies expect an uptake in the number of deployed AI models to bode well for the business outlook.

Application Insights

The security & anomaly detection segment contributed significantly to the U.S. market in 2023 and it is poised to depict a robust growth during the forecast period. The prevalence of security breaches and the need to safeguard sensitive data have alluded to the significance of security and anomaly detection. The use of TRiSM solutions and services can help in developing measures and security protocols for tampering and unauthorized access.

The governance and compliance segment will depict considerable growth due to the expanding footfall of AI across end-use industries and the subsequent need for governance and compliance frameworks. Some aspects, including the evolving regulatory landscape, bias and security vulnerabilities and soaring public scrutiny, have prompted industry leaders to inject funds into robust governance and compliance.

Deployment Insights

The on-premises segment spearheaded the U.S. market revenue share in 2023 and it will continue to surge on the heels of the innate ability to help companies retain direct control over their infrastructure. Lately, organizations have sought the deployment model to customize and manage security measures in line with regulatory needs. End-use industries, including healthcare and finance, are likely to seek on-premises deployment as rigorous regulations warrant unparalleled control and oversight over security protocols and data handling.

The cloud segment will depict a considerable rise as enterprises seek to access AI TRiSM capabilities remotely and foster real-time monitoring and collaboration. Leading companies with a U.S. footprint are expected to seek the cloud to centralize governance functions and security management seamlessly. Organizations are poised to seek a pay-as-you-go model to do away with upfront infrastructure costs and utilize the upsides of AI TRiSM solutions.

Enterprise Size Insights

The large enterprise segment exhibited considerable revenue share in 2023 and will witness robust growth due to a notable trend for AI. The prevalence of the technology across industries has underscored the demand for AI TRiSM solutions. Investments in trust, risk and management have become pronounced to boost regulatory compliance, foster model explainability and manage data privacy.

The Small & Medium Enterprise (SME) segment is slated to witness an upward trend as these organizations exhibit a commitment to ethical AI practices and robust security measures. SMEs expect the adoption of TRiSM solutions to help build trust among customers, regulatory authorities and partners. With the technology gaining ground U.S.ly, American SMEs are likely to witness an increased adoption of AI TRiSM solutions and services.

End-use Insights

The IT & telecommunication segment accounted for the largest revenue share in 2023; the trend is likely to be witnessed during the assessment period. The growth is largely attributed to the trend for AI to automate IT infrastructure, provide personalized customer experience, enhance business productivity, perform real-time analytics and improve data management. Meanwhile, rampant cyberattacks, data breaches, and malicious attacks have underscored the demand for regulatory solutions to monitor AI-powered solutions.

The healthcare segment will exhibit a notable growth trajectory on the back of soaring demand for AI to underpin clinical decision-making, automate administrative operations, forecast disease outbreaks and interpret medical data. Predominantly, in 2023, the U.S. FDA announced the list of AI-enabled medical devices approved for use in U.S. hospitals. The list included several medical devices developed by companies, including Brainomix Limited, GE Healthcare, Ad Sonio and Edwards Lifesciences, LLC among others. Most of the devices were reportedly developed for applications in radiology, followed by cardiovascular and neurology.

Key U.S. AI Trust, Risk And Security Management Company Insights

Some of the leading players operating in the market include SAS Institute Inc., Hewlett Packard Enterprise Development LP and IBM. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape.

-

In October 2023, IBM rolled out AI-powered threat detection and response services that reportedly include automated remediation, 24x7 monitoring, and investigation of security alerts across the client's hybrid cloud environments. The managed detection and response service offerings will have the ability to escalate or close up to 85% of alerts automatically.

-

In May 2023, SAS announced an infusion of USD 1 billion to bolster advanced analytics solutions to keep up with the needs of specific industries. The company claims its industry solutions can help business analysts better detect and prevent fraud.

-

In January 2024, HP asserted that 2024 would be the year of regulation and that manufacturers could shift to a secure-by-design mentality.

Some emerging companies, such as TruEra Inc. and ServiceNow Inc are likely to augment their strategies to gain a competitive edge.

-

In June 2023, TruEra Inc. rolled out an AI quality monitoring solution TruEra Monitoring that improves the company's existing model evaluation tool, TruEra Diagnostics.

-

In May 2023, ServiceNow announced an investment of USD 1 billion by 2026 to bolster enterprise software innovation and solve future customer problems.

Key U.S. AI Trust Risk And Security Management Companies:

- AT&T Inc.

- International Business Machines Corporation

- LogicManager, Inc.

- Moody's Analytics, Inc.

- RSA Security LLC.

- SAP SE

- SAS Institute Inc.

- ServiceNow Inc.

- Hewlett Packard Enterprise Development LP

Recent Developments

-

In February 2024, IBM exhorted that it added AI-enhanced data resilience capabilities to help detect ransomware and other threats with high accuracy.

-

In February 2024, AT&T rolled out a security product to overcome possible threats before they reach a customer’s network.

U.S. AI Trust Risk And Security Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 602.0 million

Revenue forecast in 2030

USD 1.64 billion

Growth rate

CAGR of 18.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, type, application, deployment, enterprise size, end-use

Key Companies Profiled

AT&T Inc.; International Business Machines Corporation; LogicManager, Inc.; Moody's Analytics, Inc.; RSA Security LLC.; SAP SE; SAS Institute Inc.; ServiceNow Inc.; Hewlett Packard Enterprise Development LP

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI Trust Risk And Security Management Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. AI trust risk and security management (TRiSM) market on the basis of component, type, application, deployment, enterprise size and end-use.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Explainability

-

ModelOps

-

Data Anomaly Detection

-

Data Protection

-

AI Application Security

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Governance & Compliance

-

Bias Detection & Mitigation

-

Security & Anomaly Detection

-

Privacy Management

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprise

-

Small & Medium Enterprise

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecommunication

-

BFSI

-

Manufacturing

-

Retail & E-Commerce

-

Healthcare

-

Government

-

Media & Entertainment

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. AI trust, risk and security management market size was estimated at USD 518.1 million in 2023 and is expected to reach USD 602.0 million in 2024.

b. The global U.S. AI trust, risk and security management market is expected to grow at a compound annual growth rate of 18.3% from 2024 to 2030 to reach USD 1.64 billion by 2030.

b. IT & Telecommunication segment dominated the U.S. AI TRiSM market with a share of 27.2% in 2023. This is attributable to the trend for AI to automate IT infrastructure, provide personalized customer experience, enhance business productivity, perform real-time analytics and improve data management

b. Some key players operating in the U.S. AI trust, risk and security management market include AT&T Inc.; International Business Machines Corporation; LogicManager, Inc.; Moody's Analytics, Inc.; RSA Security LLC.; SAP SE; SAS Institute Inc.; ServiceNow Inc.; Hewlett Packard Enterprise Development LP

b. Key factors that are driving the market growth include the need to promote transparency, efficacy, fairness, data protection and reliability pf AI systems, surge in digital transformation and the penetration of IoT, automation and cybersecurity

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.