- Home

- »

- Next Generation Technologies

- »

-

U.S. AI Training Dataset Market Size, Industry Report, 2030GVR Report cover

![U.S. AI Training Dataset Market Size, Share & Trends Report]()

U.S. AI Training Dataset Market Size, Share & Trends Analysis Report By Type (Text, Image/Video, Audio), By Vertical (IT, Automotive, Government, Healthcare, BFSI), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-223-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. AI Training Dataset Market Trends

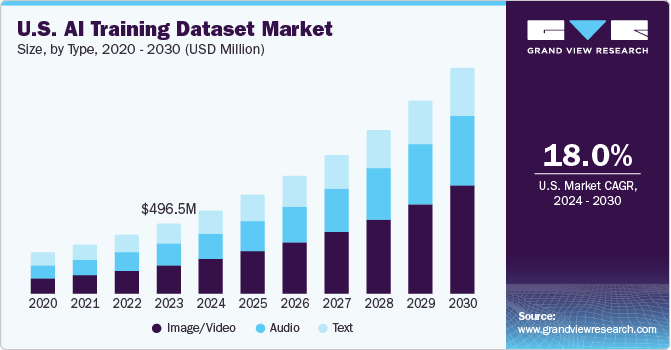

The U.S. AI training dataset market size was valued at USD 496.5 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 18.0% between 2024 and 2030. Technological advancements in the form of image and language-generative AI models have created new avenues for industry leaders. Lately, language processing skills and large language models (LLMs) have gained ground to foster customer service. ChatGPT, an extrapolation of a class of machine learning, Natural Language Processing models known as LLMs, has disrupted the training dataset landscape with a human-like conversation.

The rise of generative AI in the form of ChatGPT led to the release of new generative AI and the scope of their training data, including generative AI models from Google, Microsoft, IBM and Amazon Web Service. The emergence of advanced technologies in the form of image-generative AI models and large language models can propel company performance, innovation capabilities, and learning.

Demand for successful AI model training has prompted industry leaders to inject funds into quality data preparation, model selection, initial training, training validation and testing the model. The American market companies are poised to emphasize the diversity and volume of data. Prominently, the production of massive amounts of data will continue to spur the need for quality data that can be measured on the basis of the accuracy and consistency of labeled data.

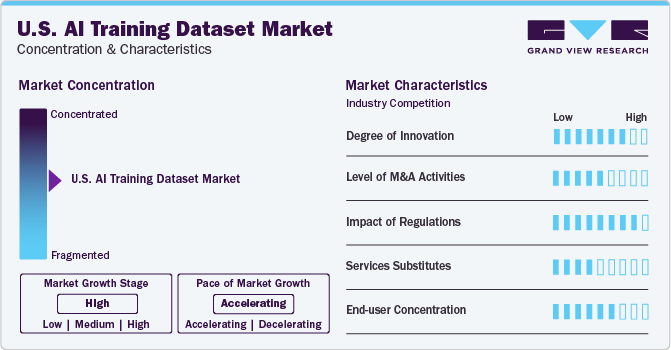

Market Concentration & Characteristics

The world’s top technology firms are counting on innovations amidst the onslaught of data. Stakeholders, including tech companies, researchers, and startups, are ramping up the development of AI solutions to gain a competitive edge in the landscape. The emergence of deep learning models, new AI hardware, and deep reasoning has spurred innovations in the U.S. AI training dataset market.

An influx of data and misuse of personal data have forced U.S. lawmakers to bolster regulations. Moreover, the surging integration of AI in products and processes has led to the suspicion of biased or bad decisions by algorithms. The American government is likely to focus on transparency, fairness and managing algorithms that adapt and learn. In essence, regulators may require the assessment of the impact of AI outcomes on society and may want firms to analyze how the software makes decisions.

The threat of substitutes, one of Porter’s Five Forces, can redefine the market’s competitive structure. The threat of substitutes may be meager as AI and big data are slated to garner prominence in the near term. Meanwhile, a host of alternative technologies can be sought to solve the same issues that AI can solve. For instance, AI-powered chatbots can address customer queries, while traditional players can build AI skills that substitutes may find difficult or impossible to copy.

End-users, including BFSI, retail & e-commerce, IT, automotive, government, and others, have bolstered their positions in the U.S. market. For instance, AI has become highly sought-after in voice-enabled system checkers, answering patient questions, helping with surgeries, and developing new pharmaceuticals. The wave of innovation is likely to be felt across end-use industries.

Type Insights

The image/video segment contributed 40.9% of the U.S. AI training dataset market revenue share in 2023. The growth outlook is partly due to the rising penetration of applications and the introduction of new datasets. Leading giants, such as Google, Microsoft and IBM, have furthered their portfolios to expand their regional footprint. For instance, in October 2022, Google alluded to its work on an AI system- Imagen Video-that can produce video clips from a text prompt.

The audio segment is poised to observe considerable growth on the back of surging demand for AI training in speech recognition, natural language processing and language translation. Prominently, audio datasets are instrumental in developing AI models that can process and understand audio. Of late, voice-controlled gadgets and virtual assistants have gained ground, suggesting the need for AI training datasets to provide more seamless experiences and precise responses.

Vertical Insights

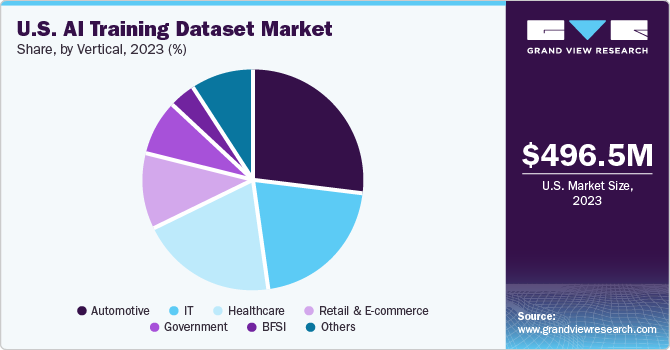

The automotive segment accounted for the largest revenue share in 2023, and it is slated to depict robust growth in the wake of the autonomous vehicle trend. Stakeholders are likely to emphasize the development of qualitative, human-labeled, error-free, and cost-effective AI training data for autonomous vehicles. Moreover, demand for an ML algorithm amidst a surge in labeled training datasets has become pronounced.

The IT segment is slated to contribute notably towards the U.S. AI training dataset market share, partly due to the penetration of ML learning models. In essence, collection and labeling of training data, such as audio, video, images, text, sensor data and 3D point cloud. IT companies have revved up the use of advanced tools to boost annotation quality, speed, and precision to underpin the training and building of AI algorithms.

Key U.S. AI Training Dataset Company Insights

Some of the leading players operating in the market include Appen Limited, Alegion, Microsoft, Google and Scale AI, Inc. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape.

-

In March 2022, Appen announced a minority investment in Mindtech to curate a combination of synthetic and real-world data. Predominantly, Appen has helped train AI models for tech behemoths, such as Meta, Microsoft, Nvidia, Google, Adobe, Apple and Amazon.

-

In January 2023, Microsoft was reported to be contemplating an investment of USD 10 billion in ChatGPT. The text-based generative AI is a natural language processing model and the American giant expects it can provide more advanced search capabilities.

-

In September 2023, SCALE AI announced an infusion of funds of over USD 20 million in 5 AI projects to help companies of all sizes augment their efficiency and productivity.

Some emerging companies, such as Cogito Tech, Samasource Inc. and Deep Vision Data, have fueled their strategies to gain a competitive edge.

-

In November 2021, Sama raised USD 70 million in Series B funding to build the first end-to-end AI platform to help manage the complete AI lifecycle.

-

In September 2021, Deep Vision announced USD 35 million Series B funding for the product development to expedite manufacturing of hardware (for early customers).

Key U.S. AI Training Dataset Companies:

- Google, LLC (Kaggle)

- Appen Limited

- Cogito Tech LLC

- Lionbridge Technologies, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Scale AI Inc.

- Samasource Inc.

- Alegion

- Deep Vision Data

Recent Developments

-

In February 2024, Google struck a deal worth USD 60 million per year with Reddit that will give the former real-time access to the latter’s data and use Google AI to enhance Reddit’s search capabilities.

-

In February 2024, Microsoft announced around USD 2.1 billion investment in Mistral AI to expedite the growth and deployment of large language models. The U.S. giant is expected to underpin Mistral AI with Azure AI supercomputing infrastructure to provide top-notch scale and performance for AI training and inference workloads.

U.S. AI Training Dataset Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 590.4 million

Revenue Forecast in 2030

USD 1.6 billion

Growth Rate

CAGR of 18.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type; vertical

Key Companies Profiled

Google, LLC (Kaggle); Appen Limited; Cogito Tech LLC; Lionbridge Technologies, Inc.; Amazon Web Services, Inc.; Microsoft Corporation; Scale AI; Inc.; Samasource Inc.; Alegion; Deep Vision Data

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AI Training Dataset Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. AI training dataset market report based on type and vertical.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Text

-

Image/Video

-

Audio

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT

-

Automotive

-

Government

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. AI training dataset market size was estimated at USD 496.5 million in 2023 and is expected to reach USD 590.4 million in 2024.

b. The global U.S. AI training dataset market is expected to grow at a compound annual growth rate of 18%% from 2024 to 2030 to reach USD 1.6 billion by 2030.

b. The automotive vertical dominated the U.S. AI training dataset market with a share of 26.6% in 2023. This is attributable to the development of qualitative, human-labeled, error-free, and cost-effective AI training data for autonomous vehicles

b. Some key players operating in the U.S. AI training dataset market include Google, LLC (Kaggle); Appen Limited; Cogito Tech LLC; Lionbridge Technologies, Inc.; Amazon Web Services, Inc.; Microsoft Corporation; Scale AI; Inc.; Samasource Inc.; Alegion; Deep Vision Data

b. Key factors that are driving the market growth include advancements in the image and language-generative AI models and surging integration of AI in products and processes

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."