- Home

- »

- Next Generation Technologies

- »

-

U.S. Agriculture Drone Market Size & Share, Report, 2030GVR Report cover

![U.S. Agriculture Drone Market Size, Share & Trends Report]()

U.S. Agriculture Drone Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fixed Wing, Rotary Wing), By Component, By Farming Environment, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-103-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 -2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Agriculture Drone Market Size & Trends

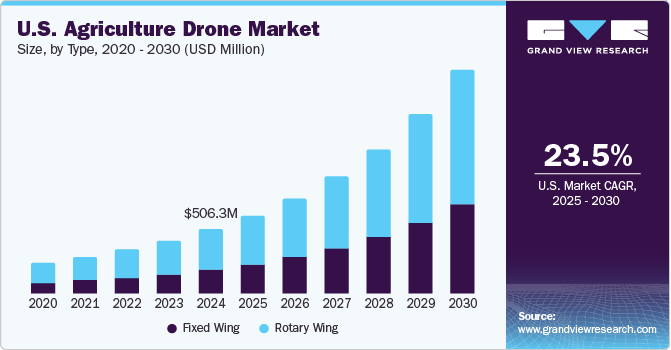

The U.S. agriculture drone market size was estimated at USD 506.3 million in 2024 and is projected to grow at a CAGR of 23.5% from 2025 to 2030. Government support and investment in agricultural technology drive market growth. Various federal and state-level programs encourage the adoption of drones and other smart farming technologies through subsidies, grants, and research initiatives. For instance, the U.S. Department of Agriculture (USDA) has funded several projects integrating drone technology into farming operations. These programs aim to increase technology adoption in farming, promote research, and improve crop management.

Government backing is helping to lower the barriers to entry for smaller farms that may not have previously had the financial resources to invest in drone technology. For instance, in October 2024, the U.S. Department of Agriculture (USDA) announced up to USD 7.7 billion in aid for fiscal year 2025 to support agricultural and forestry producers in implementing conservation practices on working lands. This amount, more than double that of 2023, represents the largest conservation funding ever provided in U.S. history for USDA conservation programs. The funding aims to maximize climate benefits nationwide while offering significant conservation and operational advantages, including economic opportunities for producers, improved soil productivity, cleaner water and air, healthier wildlife habitats, enhanced connectivity, and the preservation of natural resources for future generations.

The evolving regulatory environment surrounding drone usage in the U.S. drives the adoption of agricultural drones. The Federal Aviation Administration (FAA) gradually relaxed restrictions on using drones for commercial purposes, including agriculture. FAA regulations allow for greater flexibility in drone usage, such as beyond visual line-of-sight (BVLOS) operations, night flights, and flying overpopulated areas, which were previously restricted. These regulatory updates are making it easier for farmers to integrate drones into their daily operations, as they no longer face as many logistical hurdles. As drone regulations continue to evolve, the adoption of drones in the agricultural sector is expected to accelerate further.

In addition, the U.S. agriculture sector faces increasing pressure to meet the growing demand for high-yield crops, driven by population growth and food security concerns. As a result, farmers are seeking ways to maximize their crop outputs without expanding land usage. Drones are crucial in increasing crop yields by providing precise, actionable data that enables farmers to optimize their planting and fertilizing strategies. By identifying problem areas in fields early on, such as pest infestations or nutrient deficiencies, drones help farmers take corrective action promptly, improving overall crop health and yield. The need for higher crop yields is a key factor driving the adoption of drones in the U.S. agriculture market.

Furthermore, the emergence of drone service providers is also contributing to the growth of the U.S. agriculture drone market. Many farmers, particularly those with limited technical expertise or financial resources, may not invest in drones directly. However, drone service providers offer a solution by providing drone services on a contractual basis. These providers conduct aerial surveys, crop health assessments, and precision spraying services without requiring farmers to purchase equipment. This service model lowers the barrier to entry for farmers, allowing them to benefit from drone technology without the associated costs and complexities of ownership. As the number of drone service providers increases, so does the accessibility of drone technology for the agricultural sector.

Type Insights

Based on type, the market is segmented into fixed wing and rotary wing. The rotary wing segment dominated the market with a revenue share of 62.2% in 2024. The growing popularity of precision irrigation is driving the adoption of rotary wing drones in the agriculture sector. With water scarcity becoming increasingly pressing, efficient water management has become a priority for many farmers. Drones equipped with thermal imaging sensors assess soil moisture levels and identify areas that require irrigation. By providing precise data, drones enable farmers to apply water only where needed, reducing waste and conserving resources. This targeted approach leads to cost savings and contributes to sustainable water management practices, aligning with broader environmental goals.

The fixed wing segment is anticipated to register significant growth from 2025 to 2030. The rise of precision livestock farming contributes to the growth of the fixed-wing segment in agriculture. While fixed wing drones are primarily associated with crop management, their applications in monitoring livestock health and movement are gaining traction. Drones are utilized to survey grazing patterns, assess pasture conditions, and track herd locations, providing farmers with valuable insights into their livestock operations. Integrating drone technology into livestock management adds another utility layer for fixed wing drones, encouraging their adoption across a broader spectrum of agricultural activities.

Component Insights

Based on component, the market is segmented into hardware, software, and services. The hardware segment dominated the market with a revenue share of 50.1% in 2024. The rise of vertical integration within the agricultural sector is influencing the hardware segment of the drone market. As agricultural producers, processors, and retailers seek to optimize their supply chains and enhance traceability, drones with advanced hardware are essential for monitoring agricultural processes from farm to table. Drones track crop growth, monitor supply chain logistics, and ensure compliance with food safety standards. This need for end-to-end visibility in agriculture drives the demand for sophisticated drone hardware capable of providing comprehensive data throughout the supply chain.

The services segment is expected to register the highest growth over the forecast period. The growing trend of outsourcing specialized agricultural tasks drives market growth. Many farmers, particularly those managing large operations, may not have the expertise or resources to operate drones and analyze the data effectively. Consequently, they increasingly turn to third-party service providers offering drone services. These providers deliver expertise in aerial imaging, data interpretation, and targeted interventions, allowing farmers to benefit from advanced technology without investing in equipment or training. This trend towards outsourcing is fueling the growth of the services segment as farmers seek to leverage specialized knowledge to enhance their operations.

Farming Environment Insights

Based on farming environment, the market is divided into indoor farming and outdoor farming. The outdoor farming segment dominated the market with a revenue share of 82.3% in 2024. The rise of agribusinesses and cooperative organizations offering drone services is also influencing outdoor farming. Many farmers may not have the resources or expertise to operate drones effectively, leading them to seek third-party providers specializing in agricultural drone applications. These service providers offer a range of solutions, including aerial imaging, crop monitoring, and precision spraying, enabling farmers to access advanced technology without significant investment in equipment or training. The availability of these services is driving the growth of the outdoor farming segment as more farmers turn to external experts to enhance their operations.

The indoor farming segment is expected to emerge as the fastest-growing segment over the forecast period. With the rise of specialty crops and niche markets, farmers are increasingly interested in tailoring their growing practices to meet specific consumer demands. Drones can facilitate this customization by providing detailed data on crop performance, allowing farmers to experiment with different growing conditions, varieties, and cultivation techniques. This flexibility to adapt growing practices based on real-time data enhances the ability to cater to unique market demands and drives the integration of drones in indoor farming operations. In August 2024, The U.S. Department of Agriculture allocated USD 598,000 for New Mexico through the Specialty Crop Block Grant Program (SCBGP). The New Mexico Department of Agriculture plans to utilize this funding to implement projects focused on improving the state's specialty crop industry through education, marketing, and research initiatives. The funding supports farmers cultivating specialty crops and nursery crops. The USDA's investment aims to bolster specialty crop production in the U.S., expand market opportunities, and ensure a plentiful and affordable supply of specialty crops.

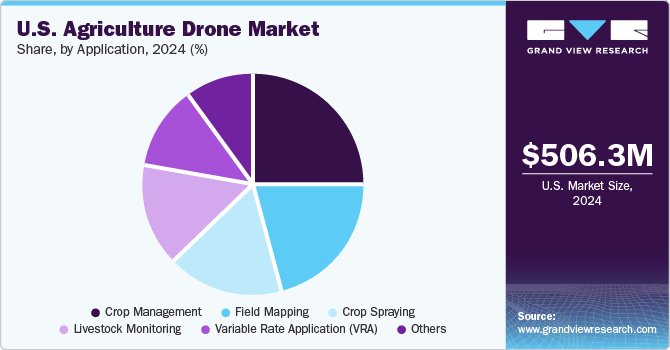

Application Insights

Based on application, the market is segmented into crop management, field mapping, crop spraying, livestock monitoring, variable rate application (VRA), and others. The crop management segment dominated the market with a revenue share of 24.7% in 2024. The advent of advanced imaging and sensing technologies is driving the growth of the crop management segment. Drones with multispectral and thermal cameras can more accurately assess crop health than traditional methods. For example, these technologies can detect water stress, nutrient deficiencies, and pest infestations early, allowing for timely intervention. Monitoring crops using advanced imaging capabilities enhances farmers’ ability to manage their fields effectively, driving the adoption of drones in crop management.

The field mapping segment is expected to grow significantly, with a CAGR of over 24% over the forecast period. The need for climate change adaptation in agriculture drives the demand for field mapping solutions. As climate variability affects weather patterns, soil moisture, and pest populations, farmers must adopt more resilient farming practices. Drones help monitor these changes and provide insights into how fields respond to varying conditions, enabling farmers to adjust their practices accordingly. For instance, by using drone data to analyze how crops perform under different climate scenarios, farmers make informed decisions about crop selection and management strategies that align with sustainable farming practices.

Key U.S. Agriculture Drone Company Insights

Some of the key players operating in the market include DJI, Sentera, and Trimble Inc., among others.

-

Trimble Inc. is a U.S. technology company that provides advanced solutions to transform the world's work by applying technology to various industries. Trimble offers hardware, software, and services for multiple sectors, including agriculture, construction, geospatial, transportation, and logistics. Trimble's integration of drones into its precision agriculture solutions is a natural extension of its expertise in positioning technologies. Drones provide aerial insights that are difficult to capture from the ground, offering farmers a unique perspective on their fields. Equipped with advanced sensors, Trimble's agricultural drones collect data on plant health, soil conditions, and moisture levels. When combined with Trimble's powerful analytics platforms, this data allows farmers to gain detailed insights into the condition of their crops, identify problem areas such as pests or diseases, and take timely action to mitigate potential losses.

Parrot Drone SAS Lab and DroneDeploy are some of the emerging market participants in the target market.

-

DroneDeploy is a provider of cloud-based drone software solutions. The company specializes in automating drone flight and data collection processes. It serves sectors such as construction, agriculture, mining, and real estate by offering tools that allow users to easily capture, analyze, and share aerial imagery and 3D models. DroneDeploy's platform provides users with comprehensive features to enhance productivity and data accuracy. The software lets users plan drone flights, capture high-resolution images, and process data into detailed maps and models.

Key U.S. Agriculture Drone Companies:

- DJI

- Parrot Drone SAS

- AgEagle Aerial Systems Inc.

- AeroVironment, Inc.

- PrecisionHawk

- Trimble Inc.

- DroneDeploy

- Autel Robotics

- Draganfly Inc.

- Pix4D SA

- Sky-Drones Technologies Ltd

- Sentera

Recent Developments

-

In May 2024, Sentera partnered with Drone Nerds to combine their strengths. This collaboration merges Drone Nerds' expertise with the advanced aerial imaging technology of Sentera sensors and the PHX fixed-wing drone, offering businesses in various sectors unparalleled solutions. The Sentera PHX is engineered to transform data collection and analysis in agriculture, construction, environmental monitoring, and infrastructure. This partnership paves the way for Sentera's innovative technology to be delivered to customers throughout the Americas.

-

In December 2022, Sentera launched its 65R Sensor integration with the Direct Georeferencing (DGR) System, facilitating seamless connectivity to agricultural drones. This integration revolutionized the industry by swiftly enhancing high-resolution aerial imagery with unparalleled precision in location accuracy, delivering a game-changing solution for the farming sector.

U.S. Agriculture Drone Market Report Scope

Report Attribute

Details

Market size in 2025

USD 614.7 million

Revenue forecast in 2030

USD 1,763.6 million

Growth rate

CAGR of 23.5% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, farming environment, and application

Key Companies Profiled

DJI; Parrot Drone SAS; AgEagle Aerial Systems Inc; AeroVironment, Inc.; PrecisionHawk; Trimble Inc.; DroneDeploy; Autel Robotics; Draganfly Inc; Pix4D SA; Sky-Drones Technologies Ltd; Sentera

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Agriculture Drone Market Report Segmentation

This report forecasts revenue growths at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. agriculture drone market based on type, component, farming environment, and application:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Fixed Wing

-

Rotary Wing

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Frames

-

Flight Control Systems

-

Navigation Systems

-

Propulsion Systems

-

Cameras

-

Sensors

-

Others

-

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Farming Environment Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor Farming

-

Outdoor Farming

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Crop Management

-

Field Mapping

-

Crop Spraying

-

Livestock Monitoring

-

Variable Rate Application (VRA)

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. agriculture drone market size was estimated at USD 506.3 million in 2024 and is expected to reach USD 614.7 million in 2025.

b. The U.S. agriculture drone market is expected to grow at a compound annual growth rate of 23.5% from 2025 to 2030 to reach USD 1,763.6 million by 2030.

b. The hardware segment dominated the market with a revenue share of 50.1% in 2024. The rise of vertical integration within the agricultural sector is influencing the hardware segment of the drone market. As agricultural producers, processors, and retailers seek to optimize their supply chains and enhance traceability, drones with advanced hardware are essential for monitoring agricultural processes from farm to table.

b. Major players operating in the target market include AeroVironment, Inc.; AgEagle Aerial Systems Inc; DJI (SZ DJI Technology Co., Ltd); Parrot Drone SAS; PrecisionHawk; Trimble Inc.; DroneDeploy; Sentera; Sky Drones Technologies LTD; Draganfly Inc.; Pix4D SA; and Autel Robotics.

b. The major factors attributing to the growth of the market are increasing awareness of benefits associated with agriculture drones; and the growing popularity of precision farming. In addition, the aspects such as the favorable government initiatives to encourage agriculture drones adoption is further bolstering the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.