- Home

- »

- Medical Devices

- »

-

U.S. Aesthetic Medicine Market Size, Industry Report, 2030GVR Report cover

![U.S. Aesthetic Medicine Market Size, Share & Trends Report]()

U.S. Aesthetic Medicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Procedure Type (Invasive Procedures, Non-invasive Procedures), By Age (19 And Under, 20-29, 30-39, 40-54, 55-69, 70+), By Metropolitan Cities, And Segment Forecasts

- Report ID: GVR-4-68040-299-6

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

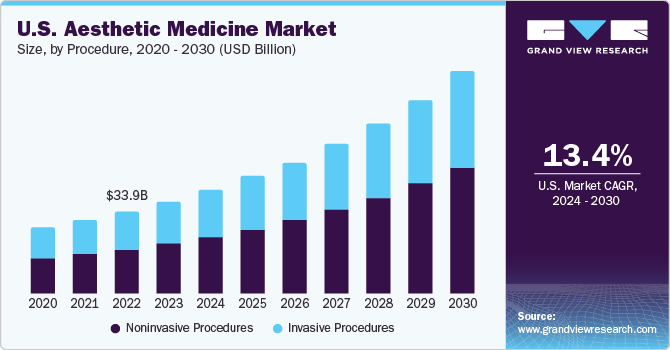

The U.S. aesthetic medicine market size was estimated at USD 37.94 billion in 2023 and is projected to grow at a CAGR of 13.4% from 2024 to 2030. The surging societal focus on appearance is propelling the desire for aesthetic procedures, driving market growth. This shift in cultural norms, combined with the growing awareness of the diverse cosmetic solutions now accessible, has played a pivotal role in facilitating growth. Moreover, the growing acknowledgment & acceptance of various cosmetic interventions and the increasing geriatric population are other major factors expected to drive the demand for aesthetic medicines in the U.S.

The increasing geriatric population in the U.S. is expected to drive the aesthetic medicine market. Major economies are undergoing a demographic shift due to a rapidly aging population, and the demand for cosmetic solutions is growing to combat the visible signs of aging & maintain a youthful appearance. This has improved the demand for aesthetic medicine that effectively reduces wrinkles, fine lines, and other age-related concerns. Moreover, this demographic shift is expected to promote the development of innovative procedures, such as aesthetic medicines, which cater to the needs of the rapidly aging population. This trend is expected to create a favorable environment for the market.

Social media plays a vital role in influencing the purchasing decisions of millennials. However, peer recommendations have a significant impact. According to HubSpot statistics from 2019, around 71% of individuals are more inclined to buy a product or service online when others promote it. In addition, a few influencers control the majority of social media referral branding. Hence, ongoing client interaction is essential when a business advertises its products on social media.

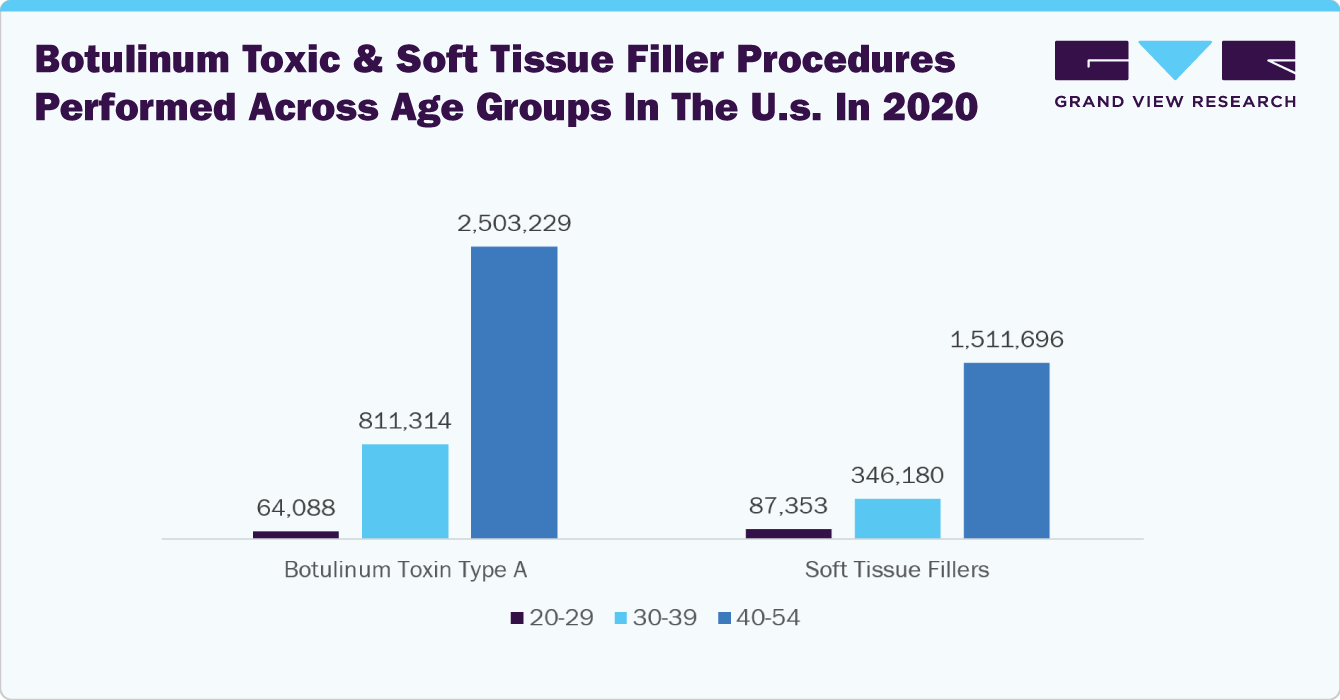

Furthermore, a shift from invasive to minimally invasive procedures is being observed, which is expected to fuel market growth over the forecast period. According to the American Society of Aesthetic Plastic Surgeons (ASPS), in 2022, around 23,672,269 cosmetic minimally invasive procedures were performed in the U.S. Moreover, more people are opting for permanent procedures, such as fat grafting, fillers, and lip advancements. According to the same source, botulinum toxin & hyaluronic acid fillers, skin resurfacing, and laser skin treatments are some of the common & in-demand noninvasive aesthetic procedures in the U.S.

The most popular procedures are fillers, as the risk associated with these treatments is very low. Fillers such as hyaluronic acid, which are FDA-approved, are easily accepted by the body, causing minimal adverse effects & allergic reactions. The growing popularity of nonsurgical skincare treatment options is one of the primary factors responsible for an increase in the number of patients seeking plastic surgery services. Hence, the increased demand for nonsurgical cosmetic procedures can be attributed to the rising awareness of the risks & complications associated with invasive surgical procedures, such as delayed healing, incision scars, and adverse reactions to anesthesia. According to the American Society for Dermatologic Surgery (ASDS) 2019 report, specialists performed around 12.5 million cosmetic & medically necessary procedures in 2018, representing a 7.5% growth from 2017 and a 60% increase since 2012.

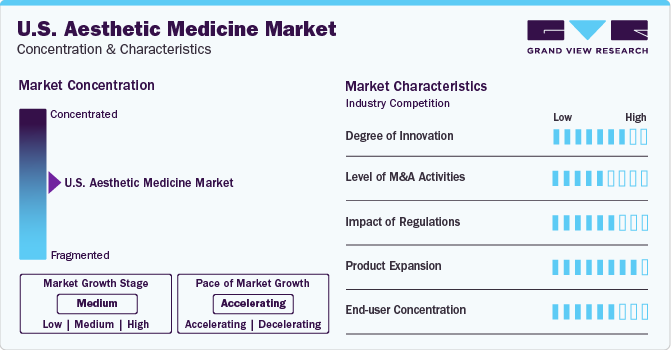

Market Concentration & Characteristics

The industry growth stage is high, and the pace of the market growth is accelerating. The U.S. aesthetic medicine industry is characterized by a high degree of innovation, driven by advancements in technology, research, and the development of new products. Companies are constantly striving to introduce novel products and delivery methods to meet the evolving needs and preferences of consumers. Technological innovations have led to the development of more advanced solutions to enhance accessibility, safety, and convenience for individuals with mobility impairments, including the elderly population. The increasing popularity of liposuction can be attributed to several factors, including the growing acceptance of cosmetic procedures, advancements in technology, and the rise of social media. The procedure offers patients a way to achieve a more toned and sculpted appearance, which can improve their self-confidence and overall quality of life. As consumer awareness grows and technology advances, the demand for liposuction & other body contouring procedures is expected to remain strong in the U.S. aesthetic medicine market.

The U.S. aesthetic medicine industry is characterized by a moderate level of merger and acquisition activity by the leading players. Companies within the industry are engaging in strategic partnerships, acquisitions, and collaborations to strengthen their product portfolios, expand their market presence, & leverage complementary capabilities. For instance, in April 2024, Hahn & Company acquired Cynosure and is now planning to integrate Cynosure & Lutronic. This merger is anticipated to unite two leading global providers of energy-based medical aesthetic treatment systems under the parent company Cynosure Lutronic, Inc. The merger is expected to lead to new avenues for the aesthetics industry, with Cynosure Lutronic set to raise global aesthetic standards, united by a commitment to innovation, excellence, and safety.

Regulations play a crucial role in shaping the market. Devices such as lasers and ultrasound systems used during aesthetic procedures utilize radiation. Hence, these devices are highly regulated, as radiation is associated with various risks, such as burns, bruises, and tissue damage. Laser device manufacturers are required to comply with the Federal Food, Drug, and Cosmetic Act (FFDCA) in the U.S. In addition, manufacturers of surgical lasers must comply with radiation safety performance standards in the Title 21 Code of Federal Regulations-Performance standards for electronic products: General, 1040.10 - Lasers & Products Incorporating Lasers and 1040.11 - Specific Purpose Laser Products.

Product expansion is a key strategy employed by companies operating in the market to cater to diverse consumer needs and preferences. Companies such as Allergan, AbbVie, and Galderma are at the forefront of this expansion, introducing a wide range of products such as Botox injections, soft tissue fillers, & chemical peels, which cater to the growing demand for enhancing physical appearance. These products offer less invasive alternatives with reduced pain, cost-effectiveness, and impressive results, making them increasingly popular among consumers seeking aesthetic enhancements. In the U.S., end-user concentration can vary based on factors such as demographics, preferences, and access to services. In the context of aesthetic medicine, end-user concentration may be influenced by various factors, including age groups seeking cosmetic procedures, geographic location of consumers, income levels affecting affordability of treatments, and cultural norms impacting the demand for aesthetic services.

Procedure Insights

The noninvasive procedures segment accounted for the largest market share of 54.9% in 2023. The growing popularity of noninvasive procedures can be attributed to several factors, including the demand for quick & easy treatments, the desire to avoid downtime, and the need for more natural-looking results. As consumer awareness continues to grow and technology continues to advance, the demand for noninvasive procedures is expected to remain strong. Moreover, in 2021, over 5.5 million nonsurgical cosmetic treatments, including toxin and fillers, were administered in the U.S. One of the most popular noninvasive procedures is Botox, which is used to reduce the appearance of wrinkles and fine lines. In 2021, over 4.4 million Botox procedures were performed, making it the most popular noninvasive procedure in the U.S. Other popular noninvasive procedures were soft tissue fillers, chemical peels, laser hair removal, and microdermabrasion.

The invasive procedures segment is expected to grow at a CAGR of 12.6% during the forecast period. Invasive procedures such as liposuction, breast augmentation, and nose reshaping are some of the popular aesthetic procedures. The growing focus on physical appearance has increased the demand for these invasive procedures. In the U.S. market, invasive procedures have become significantly popular since 2019, with the pandemic seemingly having little impact on the demand for these treatments. Liposuction, a procedure aimed at removing stubborn fat deposits, led the segment with a remarkable 325,669 procedures performed in 2022, representing a 23% increase since 2019. This suggests a growing acceptance and desire for body contouring procedures as individuals seek to achieve their desired physique.

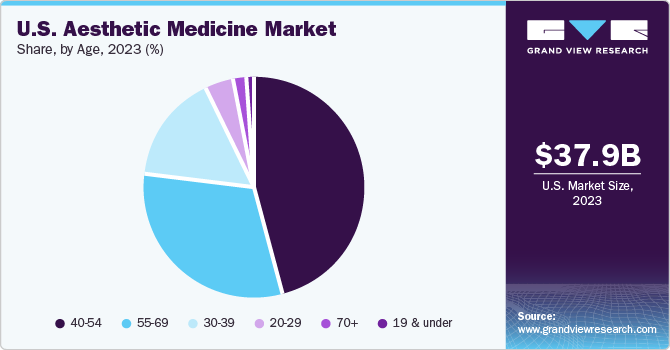

Age Insights

The 40 to 54 age segment accounted for the largest market share of 46.1% in 2023 and is expected to grow at the fastest CAGR of 13.9% during the forecast period. The rising number of people seeking treatments to maintain their youthful appearance and address aging concerns is driving growth. According to ASPS, in 2022, individuals aged 40 to 54 accounted for 44% of all liposuction procedures, 25% of forehead lifts, 20% of neck lifts, and a staggering 57% of all neuromodulator injections, such as Botox, Dysport, Xeomin, and Jeuveau.

This trend is driven by the desire for self-improvement, the growing acceptance of aesthetic procedures, and the influence of social media. Moreover, there has been a growing trend of nonsurgical body contouring treatments, such as CoolSculpting and EMsculpt, which are popular among individuals in this age group who want to improve their body shape without undergoing surgery.

Metropolitan Cities Insights

Others segment accounted for the largest market share of 71.62% in 2023 and is expected to grow at the fastest CAGR of 13.8% during the forecast period.Indianapolis, Denver, and Columbus have a robust medical infrastructure, strong research base, and a high concentration of healthcare professionals. Moreover, these cities may have a higher demand for aesthetic procedures due to various factors, such as rapid population growth, increasing awareness, and a higher standard of living. Nashville, Oklahoma City, and Seattle in the Southwest are also emerging as significant cities in the aesthetic medicine market. Jacksonville, Florida, and San Jose, California, in the West, are also showing strong growth in demand for aesthetic medicine. These cities share common trends, such as an increase in healthcare expenditure, a growing number of dermatologists & aesthetic clinics, and a rising demand for aesthetic treatments, including nonsurgical face rejuvenation, body contouring, & skin resurfacing.

Key U.S. Aesthetic Medicine Company Insights

-

Some of the key players operating in the market are the Cosmetic Clinic, Therapie Clinic, SKINovative, and Shea Aesthetic Clinic.

-

Cosmetic Clinic aims to offer a comprehensive range of treatments designed to enhance and rejuvenate various aspects of a person’s appearance. Its offerings cater to both men and women seeking to address various cosmetic concerns, including signs of aging, skin imperfections, and body contouring. The Cosmetic Clinic provides an array of options, such as Botox and dermal fillers (e.g., Juvederm, Restylane) for smoothing out wrinkles & fine lines.

-

Shea Aesthetic Clinic specializes in advanced skincare treatments, including facials, microneedling, and customized skincare regimens tailored to individual needs. The clinic’s team of experienced aesthetic professionals ensures personalized care and attention to detail for each client, guiding them through their aesthetic journey with expertise and compassion.The clinic provides cutting-edge cosmetic procedures such as Botox injections, dermal fillers, laser treatments, chemical peels, and microdermabrasion to address various skin concerns & signs of aging.

Key U.S. Aesthetic Medicine Companies:

- The Cosmetic Clinic

- Therapie Clinic

- SKINovative

- Shea Aesthetic Clinic

- Rejuv Medical

- AnewSkin Medspa

- R+H Medicine

- Manhattan Aesthetics

- SkinLab Clinic

Recent Developments

-

In February 2023, Therapie Clinics announced that it is making its mark in New York City with the opening of its first aesthetics clinic. The move followed a successful year with revenue surpassing €100 million in 2022, signaling the group's strategic focus on expanding its presence in the U.S. market.

-

In July 2023, SmileDirectClub collaborated with Therapie Clinic, a top medical aesthetic provider, to broaden its SmileShop network in the UK and Ireland. This partnership aims to enhance accessibility to SmileDirectClub's innovative aligner therapy across the regions.

-

In 2022, R+H attained the Diamond Status with the Allergan Partner Privileges Partnership program, showcasing its pursuit of excellence. In addition, the company was listed among the top 500 Allergan accounts, reflecting its commitment to providing top-notch services and products.

-

In September 2023, Therapie Clinic expanded its presence in Edinburgh with the launch of its second clinic at St James Quarter. This move highlighted the clinic's commitment to providing aesthetic services in the capital of Scotland.

U.S. Aesthetic Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.63 billion

Revenue forecast in 2030

USD 90.82 billion

Growth rate

CAGR of 13.4% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure, age, metropolitan cities

Country scope

New York; Los Angeles; Chicago; Dallas; Houston; Washington; Miami; Philadelphia; Atlanta; Phoenix; Others

Key companies profiled

The Cosmetic Clinic; Therapie Clinic; SKINovative; Shea Aesthetic Clinic; Rejuv Medical; AnewSkin Medspa; R+H Medicine; Manhattan Aesthetics; SkinLab Clinic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aesthetic Medicine Market Report Segmentation

This report forecasts revenue growth at country and city levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aesthetic medicine market report based on procedure, age, and metropolitan cities.

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Invasive Procedures

-

Breast augmentation

-

Liposuction

-

Nose reshaping

-

Eyelid Surgery

-

Tummy tuck

-

Others

-

-

Noninvasive Procedures

-

Botox injections

-

Soft tissue fillers

-

Chemical peel

-

Laser hair removal

-

Microdermabrasion

-

Others

-

-

-

Age Outlook (Revenue, USD Million, 2018 - 2030)

-

19 and under

-

20-29

-

30-39

-

40-54

-

55-69

-

70+

-

-

Metropolitan Cities Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

New York

-

Los Angeles

-

Chicago

-

Dallas

-

Houston

-

Washington

-

Miami

-

Philadelphia

-

Atlanta

-

Phoenix

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. aesthetic medicine market size was estimated at USD 37.94 billion in 2023 and is expected to reach USD 42.63 billion in 2024.

b. The U.S. aesthetic medicine market is expected to grow at a compound annual growth rate of 13.4% from 2024 to 2030 to reach USD 90.82 billion by 2030.

b. Non-invasive procedures dominated the U.S. aesthetic medicine market with a share of 54.9% in 2023. This is attributable to the growing popularity of noninvasive procedures which can be attributed to several factors, including the desire for quick & easy treatments, and the desire to avoid downtime.

b. Some of the players operating in this market are The Cosmetic Clinic, Therapie Clinic, SKINovative, Shea Aesthetic Clinic, Rejuv Medical, AnewSkin Medspa, R+H Medicine, Manhattan Aesthetics, and SkinLab Clinic.

b. Key factors that are driving the U.S. aesthetic medicine market growth include the increasing demand for minimally invasive and non-invasive procedures, which often have shorter recovery times and lower risks compared to surgical options. Furthermore, the growing acceptance of aesthetic procedures in mainstream culture and the increasing availability of financing options have contributed to the market expansion

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.