- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Aerosol Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Aerosol Market Size, Share & Trends Report]()

U.S. Aerosol Market Size, Share & Trends Analysis Report Material (Steel, Aluminum), By Type (Bag-in-Valve, Standard), By Application (Personal Care, Household, Automotive & Industrial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-324-0

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Aerosol Market Size & Trends

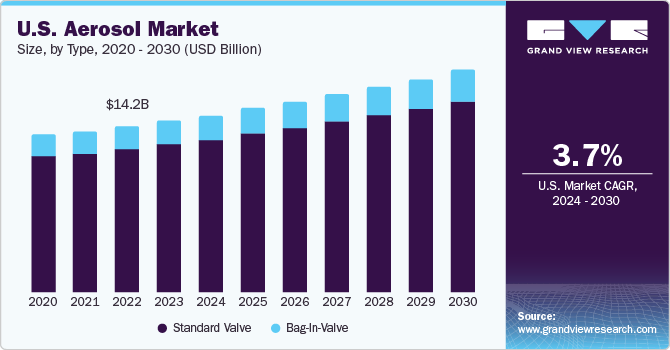

The U.S. aerosol market size was estimated at USD 14.6 billion in 2023 and is expected to grow at a CAGR of 3.7% from 2024 to 2030. This growth is attributed to the rising demand for personal care products, such as deodorants and hair care products, in the country. In addition, the growth is driven by the new prospects of the aerosol industry due to demographic shifts, increased sales of personal care goods, and technological breakthroughs in packaging. Furthermore, new pharmaceutical aerosol products, such as metered dose inhalers, are becoming increasingly popular, thereby driving the growth of the U.S. market.

The U.S. aerosol market accounted for a share of 17.6% of the global aerosol market revenue in 2023. Aerosol is a flexible technology with precise application and effectiveness and is used in various sectors. Aerosols, such as coatings, degreasers, and lubricants, make maintenance jobs more accessible in the industrial setting. They improve household cleaning, vehicle maintenance, and creative projects for the do-it-yourself market. In addition, aerosols are helpful in the healthcare industry due to their effectiveness in administering medications, sanitizing surfaces, and supporting first-aid procedures. Furthermore, aerosols also help the environment by cutting emissions and waste, substantially contributing to environmental sustainability, health, and safety.

Type Insights

The standard valve-type segment dominated the market in 2023. This dominance is attributed to the increased use of standard valves in various industries, including food products, technical products, and homecare items like pesticides, rodenticides, and decorative products. In addition, the demand is also being driven by the standardization of valves for particular personal care items, such as upscale scents and deodorants. Furthermore, the effective distribution of uniform doses in pharmaceutical applications, air fresheners, and insecticides makes these valves the preferred choice, thereby growing their demand in the market.

The bag-in-valve segment is expected to grow rapidly in the coming years owing to its ability to provide a convenient, safe, and efficient way to dispense various items, such as liquids, creams, gels, and highly viscous materials. By maintaining the product's separation from the propellant, this innovative packaging method protects it from external contamination and eliminates the need for additional preservatives. In addition, bag-in-valve technology is becoming increasingly popular in the aerosol market as consumers seek creative and dependable dispensing solutions.

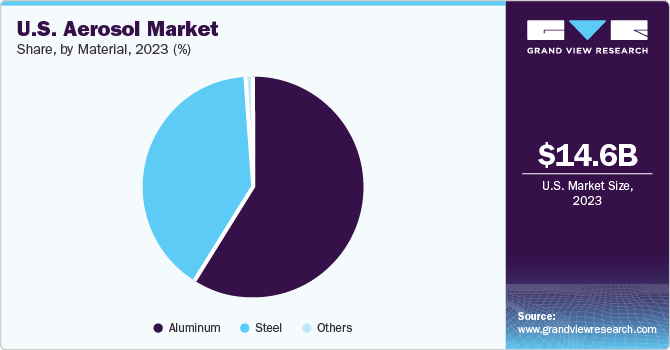

Material Insights

Aluminum led the market and accounted for the largest share of 58.6% in 2023. This growth is attributed to its strength, low weight, corrosion resistance, and recycling capacity. In addition, the market is witnessing a rise in demand for aluminum materials as manufacturers provide lightweight aluminum aerosol cans to preserve cost benefits and implement sustainable techniques to lessen environmental effects while abiding by regulations.

Steel is anticipated to grow rapidly in the coming years owing to corrosion resistance, solderability, strength, and weldability of tin-plated steel. In addition, the market participants' preference for environmentally friendly steel solutions is also being driven by the growing emphasis on sustainability, which is further driving the growth of the steel segment.

Application Insights

The personal care application dominated the market and accounted for the largest market share of 29.5% in 2023. This growth is attributed to the growing popularity of natural and organic personal care products, male grooming product demand, and the convenience and ease of use of aerosol packaging. A further benefit of aerosol packaging for personal care items is its ability to stop content evaporation, driving the segment's growth.

The household segment is expected to grow rapidly in the coming years due to aerosol products' advantages, such as their easy application, minimal waste, and lack of leakage. The wide variety of household goods that use aerosols, such as air fresheners, cleaning solutions, and stain removers, are further contributing to the segment’s growth in the market.

Key U.S. Aerosol Company Insights

Key businesses undertake various strategic initiatives, including partnerships, capacity expansions, new product launches, and collaborations, to increase their market share.

-

S. C. Johnson & Son, Inc. manufactures a variety of domestic cleaning supplies and consumer chemicals. The company works with various brands for applications, including air care, house cleaning, pest control, home storage, shoe care, auto care, lifestyle, and other professional items

Key U.S. Aerosol Companies:

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Colep Consumer Products

- Estée Lauder Inc.

- Honeywell International Inc.

- Ball Corporation

- Crown Holdings Inc.

- Crabtree & Evelyn

- PLZ Corp

- Trivium Packaging

Recent Developments

-

In March 2024, Procter & Gamble presented an aerosol package design that uses adsorbent materials as propellants to keep the pressure inside the package constant for the period of the package. To offer pressure constancy, the design includes a bag, container, and valve with an adsorption matrix of carbon dioxide and a Metal-Organic Framework (MOF)

-

In July 2023, Honeywell announced the use of their Solstice Propellant in a newly manufactured Mineral SPF 50 Clinical Sunscreen Continuous Spray by myDerm. Solstice Propellant is a readily available, non-ozone-depleting hydrofluoroolefin (HFO) solution with an ultra-low climate change potential. When compared to other materials frequently utilized in aerosol goods, it also aids in a 99% decrease in greenhouse gas (GHG) emissions

-

In April 2023, S. C. Johnson & Son, Inc. introduced the FamilyGuard brand of disinfectants. Sprays, aerosols, and cleaners under the FamilyGuard Brand are 99.9% germ-killing and also eliminate the H1N1 virus and COVID-19-causing bacteria. The purpose of these products is to clean hard, non-porous surfaces used for play by children and pets

U.S. Aerosol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.1 billion

Revenue forecast in 2030

USD 18.9 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, material, application

Key companies profiled

S. C. Johnson & Son, Inc.; Procter & Gamble; Colep Consumer Products; Estée Lauder Inc.; Honeywell International Inc.; Ball Corp.; Crown Holdings Inc.; Crabtree & Evelyn; PLZ Corp; Trivium Packaging

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aerosol Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aerosol market report based on type, material, and application:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bag-In-Valve

-

Standard Valve

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Food

-

Paints

-

Medical

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. aerosol market was estimated at USD 14.6 billion in 2023 and is expected to reach USD 15.1 billion in 2024.

b. The U.S. aerosol market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030, reaching USD 18.9 billion by 2030.

b. Aluminum led the market and accounted for the largest share, 58.6%, in 2023. This growth is attributed to its strength, low weight, corrosion resistance, and recycling capacity.

b. The key players in the aerosol market include Henkel AG & Co., KGaA; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Honeywell International Inc.; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc.; and Oriflame Cosmetics Global SA.

b. The U.S. aerosol market is anticipated to be driven by the rising demand for personal care products, such as deodorants and hair care products, in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."