- Home

- »

- Digital Media

- »

-

U.S. AdTech Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. AdTech Market Size, Share & Trends Report]()

U.S. AdTech Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (DSPs, SSPs, Ad Networks, DMPs, Others), By Advertising Type, By Enterprise Size, By Platform, By Industry Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-251-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. AdTech Market Size & Trends

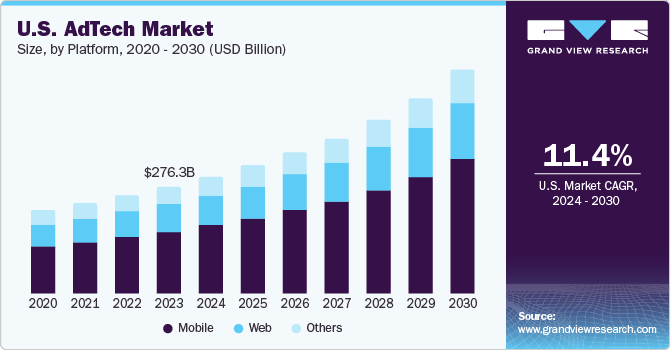

The U.S. AdTech market size was estimated to be USD 276.3 billion in 2023 and is projected to grow at a CAGR of 11.4% from 2024 to 2030. The U.S. market growth expansion is due to its economic power, technological advancements, large consumer base, and favorable regulatory environment, allowing companies to develop and implement advanced advertising technologies and reach their target audience effectively. Several key trends such as the increasing significance of Connected TV (CTV), subtle integration of consumer experiences, and increasing importance of geotargeting, hyper-personalization, and contextual advertising strategies are fueling the market growth.

In 2023, the U.S. accounted for approximately 27.99% share of the global AdTech market. The adoption of Artificial Intelligence (AI) and Machine Learning (ML) has revolutionized the AdTech industry. Predictive analytics is another critical application of AI and ML in AdTech. Predictive analysis allows advertisers to determine the best advertisement placements across various platforms, websites, and devices. AI can analyze historical data to identify where advertisements are most likely to reach the target audience. Moreover, advertisement personalization is significantly enhanced by AI and ML. These technologies enable advertisers to customize advertisement content in real-time based on a users’ past interactions and preferences. Advertisements become more relevant and engaging, fostering a stronger connection between brands and users. Personalization is especially effective in increasing conversion rates and driving user loyalty. This data-driven approach ensures that advertisement content resonates better with the target audience, leading to higher conversion rates, and thereby fueling the market growth.

The widespread usage of smartphones and the rise of high-speed internet connectivity have significantly transformed the AdTech market. Advertisers can now engage directly with consumers on their mobile devices, leveraging features such as location-based targeting and personalized messaging. This level of targeted advertising improves the relevance and effectiveness of advertisements, leading to higher engagement and conversion rates. Another significant impact of smartphone usage and high-speed internet connectivity is the amount of data that can be collected and utilized by AdTech platforms. Smartphones generate huge amounts of user behavior, preferences, and demographic data. Combined with high-speed internet connectivity, this data can be collected in real-time and used for targeted advertising strategies. Advertisers can leverage this data to understand their audience better, optimize advertisement targeting, and deliver more personalized and relevant advertisements, and hence can propel market growth.

Data privacy concerns are a notable restraint for the AdTech market owing to the increasing focus on protecting users' personal information. Data privacy regulations also limit the amount and type of data AdTech companies can collect and use for advertisement targeting. This limitation curtails the industry's ability to create highly personalized and effective advertising campaigns. Obtaining user consent for data processing is another complex issue. Various users hesitate to grant permission for data collection due to privacy concerns. This reluctance hampers the AdTech industry's ability to gather the necessary data to create tailored advertisement experiences for users, reducing the relevance and effectiveness of advertisement campaigns.

Market Concentration & Characteristics

The AdTech industry is witnessing many innovations due to the need for more personalized and efficient advertising strategies. The dependence on first-party data has become more important due to increased privacy regulations and the decline of third-party cookies. Programmatic advertising continues to grow, utilizing data and algorithms for targeted ad delivery. Artificial Intelligence (AI) is increasingly employed to optimize ad campaigns and improve targeting accuracy. There’s also a shift towards cross-media campaigns that span various platforms, enhancing audience reach. Connected TV (CTV) and Over-The-Top (OTT) platforms are innovating rapidly, offering new avenues for targeted advertising. Blockchain technology is being explored for its potential to bring transparency and prevent fraud in ad delivery.

AdTech firms are realizing the importance of strategic alliances, which is leading to several partnerships and collaboration activities in the industry. Ad agencies, tech businesses, and data providers frequently form partnerships that promote a cooperative ecosystem. These partnerships improve data capacities, expedite the advertising process, and produce more all-encompassing solutions. AdTech companies recognize the value of collaborating to address sector issues and capture new possibilities.

The AdTech industry is subject to heavy regulations as the collection, processing, and storage of customer data in AdTech solutions raise concerns about data privacy and security. Weaknesses in data protection measures can expose companies to legal risks. Central Consumer Protection Authority (CCPA) in California is a prominent example of a regulation, which imposes strict rules on how user data should be collected, processed, and stored. The introduction of privacy regulations has influenced the AdTech market positively by necessitating compliance and fostering a focus on user privacy and transparency.

The threat of substitutes in the AdTech market is moderate. While there may not be direct substitutes for comprehensive marketing technology solutions, businesses can still opt for alternative approaches such as manual marketing processes or using multiple standalone tools instead of an all-in-one platform. In addition, technological advancements may introduce new alternatives in the future.

The end-user concentration is high across several industries that utilize advertising technologies. With the exponential growth in smartphone use, various industries are reaching consumers previously who were out of reach. In this endeavor, advertising technology is playing a crucial role in effective advertising across various sectors targeting the precise audience.

Industry Vertical Insights

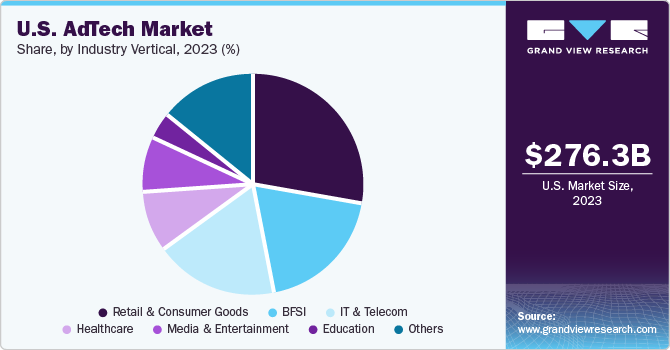

Based on industry vertical, the market is segmented into media & entertainment, BFSI, education, retail & consumer goods, IT & telecom, healthcare, and others. Among these, the retail & consumer goods segment dominated the market with a revenue share of 28.13% in 2023. Retail and consumer goods companies widely adopt AdTech solutions to reach their target audiences, promote products, drive sales, and enhance customer engagement. Moreover, the rising preference for online shopping has led to increased competition among retail and consumer goods companies, promoting them to utilize AdTech platforms for effective online advertising to reach and engage consumers.

The media & entertainment segment is anticipated to register the fastest CAGR of 13.6% over the forecast period. AdTech plays a vital role in this segment by facilitating targeted advertising, content distribution, audience engagement, and revenue generation. The shift to digital platforms for consuming media content has led media and entertainment companies to leverage AdTech to reach audiences across various digital channels and devices. AdTech enables media and entertainment companies to diversify revenue streams through advertising, subscriptions, and pay-per-view models. The AdTech solutions provide data insights based on user behavior, preferences, and content consumption patterns, enabling media companies to create relevant and engaging content.

Solution Insights

In terms of solutions, the market is classified into demand-side platforms (DSPs), supply-side platforms (SSPs), ad networks, data management platforms (DMPs), and others. The demand-side platforms (DSPs) segment dominated the market with a revenue share of 32.97% in 2023. The segment's growth can be attributed to its ability to provide advertisers and agencies with powerful AdTech solutions to manage, optimize, and execute programmatic advertising campaigns, enhance targeting capabilities, and provide data-driven insights to improve campaign performance. DSPs enable the automation of buying ads and placement of ads across various ad exchanges, websites, and platforms. It allows advertisers to manage multiple campaigns from a single interface, saving time and effort compared to traditional manual methods. Furthermore, DSP offers real-time bidding for advertisers, which is an auction-based model that allows advertisers to bid based on their desired audience and the value of the impression, maximizing return on investment (ROI) and further bolstering the demand for DSPs solutions.

The data management platforms (DMPs) segment is anticipated to witness the fastest CAGR of 12.6% over the forecast period. Data management platforms (DMPs) allow businesses to collect, store, and analyze large amounts of data from various sources such as websites, apps, and data partners. s. DMPs enable advertisers, marketers, and publishers to create unified audience profiles, segment audiences based on various attributes, and use these insights to optimize advertising campaigns. DMPs play a crucial role in enhancing audience targeting, personalization, and overall campaign effectiveness by leveraging data-driven insights, further fueling the growth of the segment. The other key factors attributing to the segment's growth within the market include the rise of programmatic advertising, cross-channel advertising campaigns, compliance & privacy, ad fraud prevention capabilities, and improved ROI, among others.

Advertising Type Insights

Based on advertising type, the market is classified into programmatic, search, display, mobile, email marketing, native, and others segments. Among these, the search advertising segment dominated the market in 2023 with a revenue share of 23.67%. The segment growth can be attributed to its high audience engagement. By displaying ads to users actively seeking specific products or services, it maximizes the likelihood of conversions. Hence, businesses and other end-users prefer search advertising as it provides performance metrics ROI measurement, which helps optimize market spending and achieve direct, trackable results. This type of marketing campaign reaches users in real-time and can direct traction to a specific product or service, making it highly effective.

The mobile advertising segment is anticipated to grow at the fastest CAGR of 13.4% over the forecast period. One of the factors attributing to the market growth includes the rising use of smartphones and other mobile devices. Mobile advertising showcased across applications and websites, is strategically tailored for users on mobile internet devices. Technological advancements, including programmatic advertising and beacon technology, are broadening the scope of mobile ad capabilities. Given the personal nature of mobile devices, they serve as rich sources of user data, offering valuable insights into preferences, behaviors, and demographics. This data enables the customization of advertisements consistent with the user interests, thereby driving increased engagement and higher conversion rates. When integrated with other advertising formats like display, search, or video, mobile advertising forms a comprehensive and potent marketing strategy.

Enterprise Size Insights

The large enterprise segment dominated the market with a 65.41% revenue share in 2023. The growth of the segment can be attributed to the vast advertising budgets of large enterprises, the substantial scale of their operations, high revenues, and a solid market presence. Large enterprises require more complex and comprehensive AdTech solutions to manage their multiple campaigns, target various segments, and analyze data on a larger scale. These enterprises use advanced technologies, such as DSPs, DMPs, AI, and ML, to gain insights, predict user behavior, and improve the performance of their ad campaigns. Moreover, large enterprises often require customizable solutions that can be integrated into their existing marketing technology stack and offer higher returns on investments.

The small and medium enterprises (SMEs) segment is anticipated to witness the fastest CAGR of 12.7% over the forecast period. This growth can be attributed to the increasing number of SMEs across various industries utilizing AdTech solutions to enhance their advertising efforts and effectively reach their target audiences, increase brand visibility, and drive business growth. For instance, SMEs in the retail and e-commerce sector often leverage AdTech solutions like Google Ads, Facebook Ads, and Instagram Ads for targeted advertising. They may also utilize retargeting platforms like AdRoll to re-engage website visitors with relevant ads. On the other hand, professional services SMEs, such as legal firms or financial advisory firms, utilize LinkedIn Ads to reach their business-oriented audience and promote their expertise.

Platform Insights

Based on the platform, the market is segmented into mobile, web, and others. Among these, the mobile segment dominated the market with a revenue share of 57.49% in 2023 and it also is anticipated to witness the fastest CAGR of 12.1% over the forecast period. The extensive adoption and rapid growth of the segment can be attributed to the constant connectivity offered by mobile devices, which ensures that users are engaged around the clock and can receive real-time ads. Moreover, the platform's ability to utilize the Global Positioning System (GPS) location data for precise targeting enhances engagement and conversion rates. The popularity of mobile apps has led to a surge in in-app advertising, where ads seamlessly integrate with user experiences. This approach, coupled with innovations in ad formats like interactive media and augmented reality/Virtual Reality (AR/VR), captures user attention and drives brand recall.

The web segment is anticipated to grow at a CAGR of 10.7% over the forecast period. The web-based platform uses the internet and web-based technologies to create, deliver, and target online advertising campaigns. The web platform encompasses web browsers, websites, and web-based apps, that deliver online advertisements to consumers. As users increasingly embrace online content consumption, the web platform's potential for targeted advertising continues to expand. With its diverse features, the web remains a versatile platform for advertisers to create engaging campaigns that resonate with users, maximize engagement, and drive conversions. Advertisers who strategically tap into the web platform's offerings can effectively navigate the digital landscape and utilize the maximum potential of AdTech technologies. Search advertising coupled with other web-based advertisement formats, such as display and video ads, creates better and more comprehensive advertisement campaigns.

Key U.S. AdTech Company Insights

The key players in the market include Adobe, Amazon.com, Inc., Criteo, Meta, Alphabet, and Microsoft Incorporation among others. These companies focus on providing ad platforms to help marketers buy, sell, and deliver digital advertisements.

-

Amazon.com, Inc. is a multinational technological enterprise that primarily delivers online retail shopping solutions. The company operates through three segments, namely North America, International, and Amazon Web Services (AWS). The North America segment orchestrates the retail trade of consumer merchandise, including contributions from sellers and subscriptions, via online platforms and brick-and-mortar establishments within the North American domain. In addition, this segment encompasses overseas sales channeled through digital avenues. Furthermore, the company extends advertising solutions to sellers, vendors, publishers, authors, and various stakeholders via initiatives such as sponsored advertisements, display promotions, and video advertising campaigns.

-

X Corp, formerly known as Twitter Inc. and a subsidiary of X Holdings Inc., serves as a social networking platform designed for individuals to generate and exchange ideas. The organization facilitates open self-expression and dialogue through its platform. Within the company’s assortment of promoted offerings, there are promoted advertisements that empower advertisers to identify their target audience based on the interest graphs of users. Moreover, follower advertisements enable advertisers to cultivate a community of users who share an interest in their business, products, or services. The company operates in North America, Asia Pacific, Oceania, Europe, and Africa.

Adobe and Magnite are some of the emerging companies in the U.S. AdTech industry.

-

Adobe is a multinational computer software company known primarily for its creative products, including Adobe Photoshop, Illustrator, and InDesign. These products are widely used by graphic designers, photographers, and other creative professionals. The company mainly operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Experience segment offers marketing, analytics, and advertising solutions to assist businesses in optimizing their digital marketing efforts. Adobe Experience Cloud, Adobe Advertising Cloud, and Adobe Analytics are among the products available in this segment. The Publishing and Advertising segment offers software and services for developing and publishing print and digital content. Adobe InDesign, Adobe Digital Publishing Suite, and Adobe Technical Communication Suite are available in this segment.

-

Magnite, Inc. is an advertising technology firm that delivers online advertising solutions to web publishers and ad networks. The company also offers ad network optimization services and programs for safeguarding ad quality. With a focus on programmatic Connected Television (CTV) advertising, Magnite, Inc. offers a comprehensive suite of tools for sellers and buyers of digital advertising inventory, enabling intelligent decision-making and automated execution. The company’s clients include prominent digital advertising businesses and its platforms process trillions of ad requests monthly. The company's unified CTV platform, Magnite Streaming, enhances CTV sellers' advertising yield across various inventory types, thanks to features such as advanced curation, brand safety tools, and audience activation.

Key U.S. AdTech Companies:

- Adobe

- Amazon.com, Inc.

- Criteo

- Meta

- Alphabet

- Microsoft Incorporation

- Taboola

- X Corp

- Verizon

- Affinity

Recent Developments

-

In March 2024, Magnite, the largest independent sell-side advertising company, and Mediaocean, the mission-critical platform for omnichannel advertising, announced an exclusive partnership to bring deeper automation and greater supply path efficiency to Mediaocean's Prisma buyers for connected TV (CTV) and online video (OLV). This partnership enables Prisma users to activate streaming campaigns directly with premium video sellers through Magnite’s ClearLine solution. The partnership builds on the 2023 deal to bring Magnite’s streaming inventory into Mediaocean’s ad infrastructure for local TV buyers.

-

In September 2023, Infillion, an advertising technology and solutions company that owns and markets premium AdTech products TrueX, NeXt, and InStadium, along with Martech solutions including Gimbal location technology, Analytiks.ai, and Phonic.ai, announced the acquisition of AdTech pioneer MediaMath. Infillion offers high-impact products, like TrueX, that drive attention and performance via unique ad formats through its direct integration with premium CTV publishers. As the first demand-side platform (DSP) defining programmatic, MediaMath’s history is that of scalable innovation, representing the most advanced marketers, for well over a decade.

U.S. AdTech Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 301.54 billion

Revenue forecast in 2030

USD 576.59 billion

Growth rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical Range

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, advertising type, enterprise size, platform, industry vertical

Country scope

U.S.

Key companies profiled

Adobe; Amazon.com, Inc.; Criteo; Meta; Alphabet; Microsoft Incorporation; Taboola; X Corp; Verizon; Affinity

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. AdTech Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. AdTech market based on solution, advertising type, enterprise size, platform, and industry vertical.

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Demand-Side Platforms (DSPs)

-

Supply-Side Platforms (SSPs)

-

Ad Networks

-

Data Management Platforms (DMPs)

-

Others

-

-

Advertising Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Programmatic Advertising

-

Search Advertising

-

Display Advertising

-

Mobile Advertising

-

Email Marketing

-

Native Advertising

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small and Medium Enterprise (SME)

-

Large Enterprise

-

-

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mobile

-

Web

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

Education

-

Retail & Consumer Goods

-

IT & Telecom

-

Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. AdTech market size was estimated at USD 276.37 billion in 2023 and is expected to reach USD 301.54 billion in 2024.

b. The U.S. AdTech market is expected to grow at a compound annual growth rate of 11.4% from 2024 to 2030 to reach USD 576.59 billion by 2030.

b. The retail & consumer goods segment dominated the U.S. AdTech market with a share of over 28% in 2023.

b. Some key players operating in the U.S. AdTech market include Adobe, Amazon.com, Inc., Criteo, Meta, Alphabet, and Microsoft Incorporation, among others.

b. Key factors driving the market growth include economic power, technological advancements, a large consumer base, and a favorable regulatory environment, allowing companies to develop and implement advanced advertising technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.