- Home

- »

- Medical Devices

- »

-

U.S. ADHD And Autism Clinics Market, Industry Report, 2030GVR Report cover

![U.S. ADHD And Autism Clinics Market Size, Share & Trends Report]()

U.S. ADHD And Autism Clinics Market (2024 - 2030) Size, Share & Trends Analysis Report By Condition (Attention Deficit Hyperactivity Disorder (ADHD), Autism Spectrum Disorder (ASD)), By Service, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-387-4

- Number of Report Pages: 84

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. ADHD And Autism Clinics Market Trends

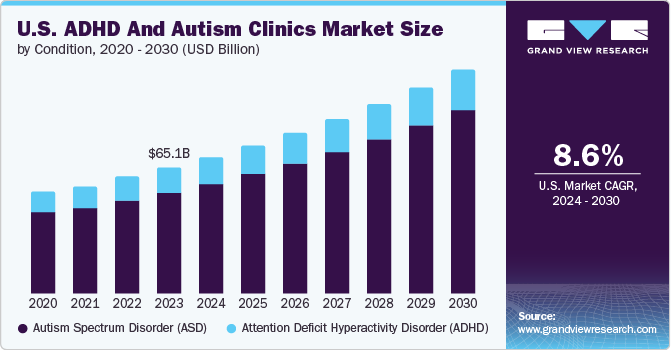

The U.S. ADHD and autism clinics market size was estimated at USD 65.13 billion in 2023 and is projected to grow at a CAGR of 8.56% from 2024 to 2030. This is attributed to the rising prevalence of attention deficit hyperactivity disorder (ADHD) and autism diagnoses. The CDC reported a continuous increase in the number of children identified with ADHD and autism spectrum disorders, which is expected to boost the demand for specialized care and intervention services. This growing demand is contributing to the steady growth of clinics and support services dedicated to these conditions.

Changes in insurance coverage and government funding are contributing to the market growth. The government is taking initiatives to push insurance plans to cover ADHD and autism-related treatments, including behavioral therapies, which are crucial for many patients. Furthermore, federal and state programs have provided additional funding to support clinics and research initiatives, aiming to enhance the quality and accessibility of care. Many states have implemented mandates requiring health insurance plans to provide coverage for ASD. These mandates outline the specific coverage requirements and vary from state to state. For instance, Alabama requires health insurance plans to provide coverage for screening, diagnosis, and treatment of autism spectrum disorder (ASD) for individuals aged 18 or younger. This mandate applies to employers with at least 51 employees for a minimum of 50% of the preceding calendar year

Technological advancements, including teletherapy and digital behavioral interventions, are becoming standard, enabling access to services even in underserved areas. Integrating technology into ADHD and autism care allows for more individualized, data-driven treatment plans. By enabling earlier diagnosis, expanding treatment modalities, increasing access, and allowing for personalization, these technologies are driving the growth in the market. For instance, in September 2023, Marcus Autism Center, a subsidiary of Children's Healthcare of Atlanta, developed a novel eye-tracking technology, EarliPoint Evaluation, to assist in diagnosing autism spectrum disorder (ASD) in young children. This innovative tool authorized for use in children aged 16 to 30 months, incorporates biomarkers to enhance the accuracy and efficiency of the diagnostic process. Such innovations in the market are expected to boost the demand for the market.

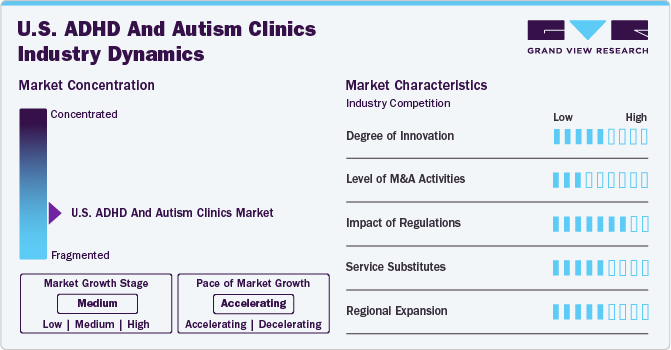

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, impact of regulations, and regional expansion. The industry is highly fragmented, with many providers offering treatment & therapies for ADHD & ASD. The degree of innovation is moderate, and the impact of regulations on the industry is high. The level of mergers & acquisitions activities is low, impact of service substitutes is high, and the regional expansion of the industry is moderate.

The degree of innovation in the U.S. ADHD & autism clinics market is moderate. This growth is supported by a broader understanding of neurodiversity and a shift towards personalized, holistic care models that cater to the unique needs of individuals with ADHD and Autism Spectrum Disorders (ASD). Clinics are adopting multidisciplinary approaches, integrating behavioral therapies, medication management, educational support, and family counseling to provide comprehensive care.

The impact of regulations on the market is expected to remain high. Stringent regulatory frameworks designed to ensure the safety and efficacy of treatments have led clinics to adopt higher standards of care, driving innovation in therapeutic approaches and patient management. However, compliance with these regulations also imposes significant operational and financial burdens on clinics, potentially limiting the accessibility of services for some population segments.

The market's level of mergers & acquisitions is low. The market is growing and is expected to witness interest from private-equity firms. Hence, the market is expected to witness surge in M&A activities is driven by the desire of larger healthcare entities and investment firms to tap into the growing demand for specialized ADHD and autism treatment services.

Service substitutes in the market are high and is expected to remain the same over the forecast period. Beyond traditional clinic-based interventions, there is a growing alternative that patients and families are shifting toward. These include online therapy and counseling platforms, mobile apps for behavior modification and skills development, and various educational and support programs offered by schools and community organizations.

The market is expanding regionally with a strategic emphasis on reaching beyond urban areas. Regional expansion is particularly high in underserved areas, where there is a significant demand for specialized ADHD and autism services. This trend is attributed to the establishment of new clinics, scaling of existing ones, and partnerships with local healthcare providers to enhance service accessibility.

Condition Insights

Autism Spectrum Disorder (ASD) segment dominated the market with a revenue share of 80.19% in 2023 and is expected to witness fastest CAGR from 2024-2030. This is attributed to rising prevalence, demand for effective treatments, and ongoing innovations in treatment modalities. According to the CDC statistics, in 2020, one in 36 children aged eight years was estimated to suffer from ASD. Moreover, the market is characterized by diverse treatment options, including behavioral therapies such as Applied Behavior Analysis (ABA), pharmacological treatments, and supportive services. ABA therapy has been recognized for its effectiveness in treating ASD symptoms, maintaining a substantial market share.

The ADHD segment is expected to witness significant growth over the forecast period. There is a growing awareness of ADHD among healthcare professionals and the public, which is expected to enhance diagnosis and treatment rates. According to the article published in the National Library of Medicine in 2023, Approximately 10.08% to 10.47% of children and adolescents aged 4 to 17 years were reported to have a diagnosis of ADHD from 2017 to 2022, based on data from the National Health Interview Survey (NHIS). Moreover, initiatives by organizations such as the National Institute for Children's Health Quality and CHADD are promoting better understanding and management of ADHD, further driving market growth.

Service Insights

The treatment and therapy segment held the largest market share of 36.53%. This is attributed to the effectiveness of behavioral therapies such as Applied Behavior Analysis (ABA). ABA is recognized for its success in improving social and communication skills among individuals with autism, contributing significantly to the segment's growth. The growing awareness of ADHD and ASD has led to an increased demand for diverse treatment options, including medication management, speech therapy, and occupational therapy. These therapies are essential for addressing the varied symptoms associated with both conditions, further contributing to the segment's dominance in the market.

The family/caregiver counseling segment is experiencing the fastest growth due to the increasing recognition of the importance of support systems for families managing ADHD and autism. Counseling services provide essential resources, coping strategies, and emotional support, critical for families navigating these challenges. The growing demand for counseling services is driven by increasing awareness of the psychological and emotional impacts of ADHD and autism on families. As more families seek comprehensive care that includes caregiver support, this segment is expected to witness significant growth.

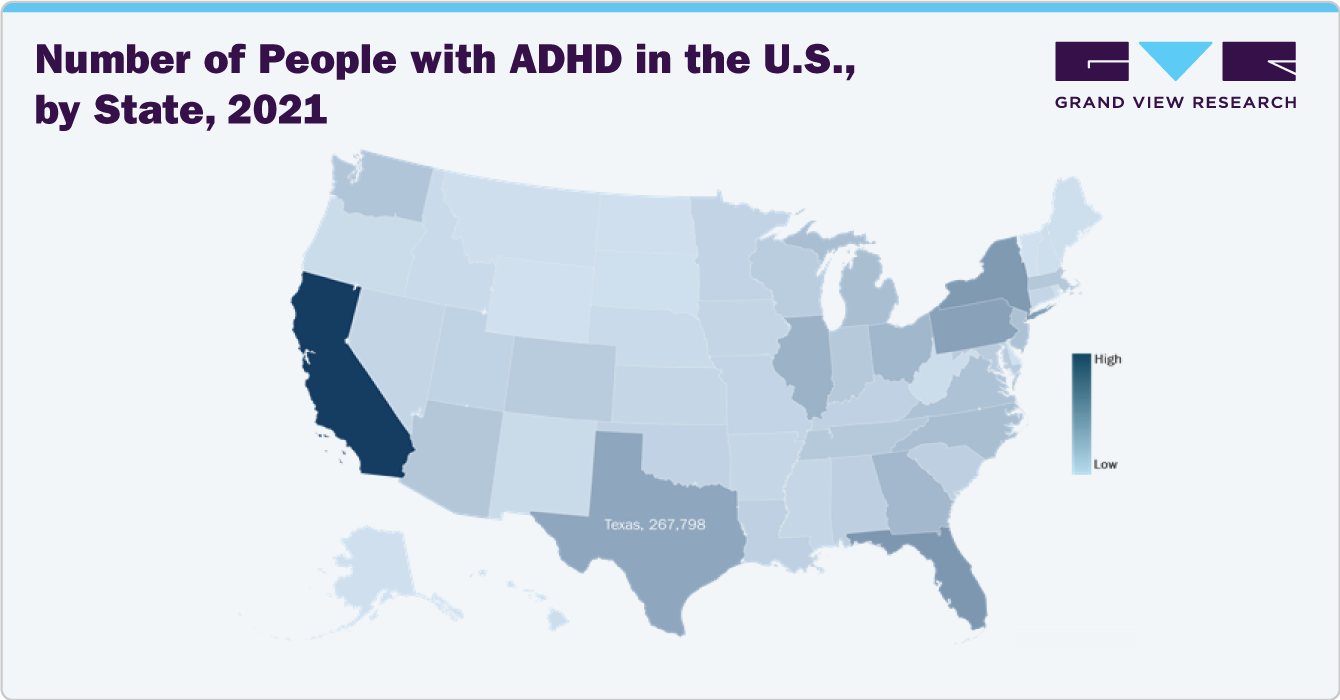

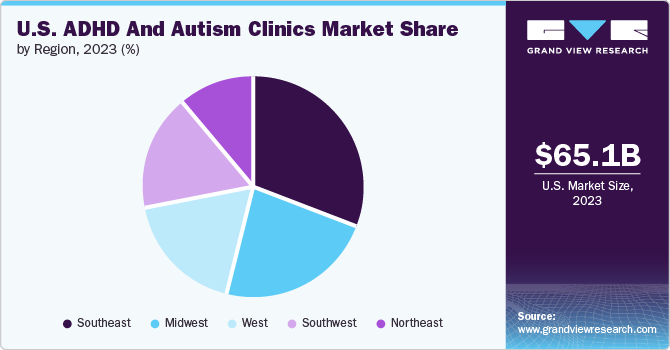

Country Insights

The southeast region held the largest market share of 31.40% in 2023. The region is home to many clinics and treatment centers, providing comprehensive services for ADHD and autism. These centers offer a range of treatments, including behavioral therapies, medication management, and occupational therapy, which are essential for managing the symptoms associated with these disorders. The southeast region also benefits from a high concentration of specialized healthcare providers, including psychiatrists, psychologists, and other professionals trained in diagnosing and treating ADHD and autism. This availability of qualified professionals and comprehensive treatment options has contributed significantly to the region's dominance in the market.

The northeast region is expected to witness the fastest growth over the forecast period. This growth can be attributed to several factors, including increased awareness and diagnosis rates, advancements in treatment technologies, and expanding healthcare services. The northeast region has seen a surge in telehealth services, making it easier for patients to access treatment from the comfort of their homes.

Additionally, the region has experienced a rise in specialized clinics and treatment centers, offering a wider range of services, including cognitive behavioral therapy, mindfulness-based interventions, and executive function training. These developments have expanded the treatment options available and improved the accessibility and affordability of care, leading to rapid growth in the northeast region.

Key U.S. ADHD And Autism Clinics Company Insights

The market is fragmented, with numerous players competing for market share. Major players in the market include specialized clinics that focus on behavioral therapies and medication management. These companies are expanding their service offerings and geographical presence to enhance accessibility and cater to the growing demand for effective therapies. For instance, few clinics integrate digital health solutions, such as telehealth services and mobile applications, to reach a broader patient base and provide more flexible treatment options.

Key U.S. ADHD And Autism Clinics Companies:

- Brown Clinic for Attention & Related Disorders

- Center for ADHA & Autism Support

- ADHD & Autism Psychological Services and Advocacy

- Sachs Center

- The Drake Institute of Neurophysical Medicine

- Center for Autism & Neurodevelopmental Disorders.

- Child Mind Institute, Inc.

- The Nemours Foundation.

- Meliora Health

- Autism Treatment Center of America (The Option Institute)

Recent Developments

-

In February 2024, Unlocked Potential, a new clinic in Fairmont, West Virginia, was commenced to provide early treatment for ADHD and autism in children. The facility aims to offer comprehensive services, including behavioral therapy and assessments, to support young patients and their families.

-

In April 2024, Children’s Mercy Kansas City launched the Autism and Neurodevelopment Continuity Clinic (ANDCC), a pilot program aimed at supporting families of children aged three and younger who have recently received an Autism Spectrum Disorder (ASD) diagnosis. The program offers autism-specific guidance, helps families navigate therapies and community resources, and provides emotional support through regular check-ins.

-

In April 2024, ABS Kids opened a new ABA center in Provo, Utah, marking its 12th location in the state, with services starting on May 6. The center will provide autism diagnosis and ABA therapy, expanding the company's reach to more families needing high-quality care.

U.S. ADHD And Autism Clinics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 70.57 billion

Revenue forecast in 2030

USD 115.55 billion

Growth rate

CAGR of 8.56% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Condition, service, region

Country scope

U.S.

Brown Clinic for Attention & Related Disorders; Center for ADHA & Autism Support; ADHD & Autism Psychological Services and Advocacy; Sachs Center; The Drake Institute of Neurophysical Medicine; Center for Autism & Neurodevelopmental Disorders; Child Mind Institute, Inc.; The Nemours Foundation; Meliora Health; Autism Treatment Center of America (The Option Institute)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. ADHD And Autism Clinics Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ADHD & autism clinics market report based on condition, service, and region.

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Attention Deficit Hyperactivity Disorder (ADHD)

-

Autism Spectrum Disorder (ASD)

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Consultation and Testing

-

Treatment & Therapy

-

Medication Management

-

Family/Caregiver Counselling

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. ADHD and autism clinics market size was estimated at USD 65.13 billion in 2023 and is expected to reach USD 70.57 billion in 2024.

b. The U.S. ADHD and autism clinics market is expected to grow at a compound annual growth rate of 8.56% from 2024 to 2030 to reach USD 115.55 billion by 2030.

b. Southeast region dominated the U.S. ADHD and autism clinics market with a share of 31.40% in 2022, owing to the presence many clinics and treatment centers, providing comprehensive services for ADHD and autism.

b. Some key players operating in the U.S. ADHD and autism clinics market include Brown Clinic for Attention & Related Disorders, Center for ADHA & Autism Support, ADHD & Autism Psychological Services and Advocacy, Sachs Center, The Drake Institute of Neurophysical Medicine, Center for Autism & Neurodevelopmental Disorders, Child Mind Institute, Inc., The Nemours Foundation, and Meliora Health, Autism Treatment Center of America (The Option Institute).

b. Key factors that are driving the U.S. ADHD & Autism clinics market growth include increasing prevalence of ADHD & ASD, advancements in treatment options, and growing government support & funding.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.