U.S. 3D Bioprinting Market Size, Share & Trends Analysis Report By Technology (Magnetic Levitation, Inkjet, Syringe, Laser based), By Application (Medical, Dental, Biosensors, Bioinks, Tissue & Organ Generation), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-221-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. 3D Bioprinting Market Size & Trends

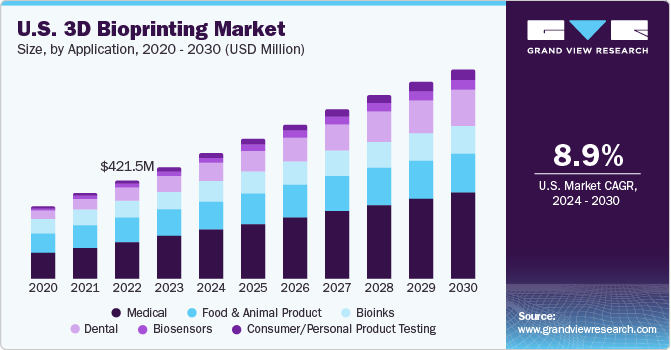

The U.S. 3D bioprinting market size was estimated at USD 479.1 million in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. This growth is attributed to several factors, including a limited number of organ donors and an increasing elderly population facing chronic respiratory conditions. Key drivers for market expansion also encompass heightened investment in research and development, technological advancements, and a rising prevalence of chronic illnesses. Amid the COVID-19 crisis, the 3D printing sector has stepped up, committing to aid in the manufacture of essential medical equipment for hospitals battling the pandemic. For instance, Formlabs company based in Massachusetts, U.S. manufactured 100,000 nasal swabs for COVID-19 testing each day.

The U.S. 3D printing market accounted for over 20.6% of the global 3D bioprinting market in 2023. The demand for personalized medicine plays a significant role in driving the industry's growth to meet individualized healthcare needs. Additionally, urgency for effective 3D bioprinting solutions has been emphasized by the prevalence of chronic diseases like heart and kidney failures, further fueled by the demographic shift towards an aging population. With organ shortages due to a limited number of donors, 3D bioprinting has emerged as a crucial solution. Stem cell research, receiving increased financing from both private and public sectors, has been a focal point in regenerative medicine R&D. Adoption of 3D bioprinting technology is a key driver, showcasing the industry's commitment to innovation in addressing critical healthcare challenges.

The advancement of drug and vaccine testing has been expedited, with scientists utilizing new technology for safety testing in patients following the completion of preclinical trials. Furthermore, as the medical world is also dealing with a shortage of respirators and ventilators, 3D bioprinting technology is being employed to manufacture these devices to address this shortage. Recently, CLECELL, a 3D bioprinting company, has developed a respiratory epithelium model using their proprietary 3D printer U-FAB, in conjunction with other bioprinting technologies. The respiratory epithelium is a type of tissue that lines most of the respiratory tract, acting as a barrier to pathogens and foreign particles. It also prevents infection and tissue injury with the aid of the mucociliary elevator. With the increasing demand for this respiratory epithelium model, the market for 3D bioprinting is expected to grow. Such innovations are anticipated to drive higher market growth over the forecast period.

Many biotherapeutic companies are leveraging 3D bioprinting technology to expedite research and development. For instance, Viscient Biosciences utilized 3D bioprinting to create lung tissue for viral infectivity research and the search for effective therapies. The market growth is further propelled by advancements in technology, increasing demand for organ transplants, and the need for accurate and rapid drug testing. Additionally, growing attention from academicians and several start-ups focusing on commercializing 3D bioprinting technology contribute to the market's expansion.

Market Concentration & Characteristics

Companies in the U.S. 3D bioprinting sector are actively engaged in activities such as product innovation, mergers and acquisitions, and regional expansion to solidify their positions. The industry is highly competitive, marked by the presence of large global companies like Organovo, Stratasys, and CELLINK, each boasting robust distribution networks. The capacity of manufacturers to invest heavily in research and development (R&D) activities, as well as the launch of new products, is poised to propel industry growth. Innovations, proprietary bioinks, collaborations, and mergers & acquisitions are expected to further drive industry expansion.

Technological advancements have catalyzed a revolution in the healthcare and pharmaceutical industries, propelling the 3D bioprinting sector forward. A heightened focus on research and development (R&D) activities has spurred increased investments, fostering innovation and progress. Notably, regenerative medicine, particularly advancements in tissue engineering, has played a pivotal role in shaping the industry landscape. For instance, in March 2022, CELLINK launched the third generation of LUMEN X to meet the needs of researchers and scientists requiring high-resolution bioprinting capabilities.

Collaborations among various stakeholders, including research institutions, biotech companies, and healthcare providers, have cultivated a culture of innovation and knowledge sharing, further fueling industry growth. Several companies are strategically acquiring smaller players to strengthen their positions. This strategy enables companies to enhance their capabilities, expand product portfolios, and improve competencies. For instance, in May 2021, 3D Systems, a provider of 3D printers and materials headquartered in Rock Hill, South Carolina, acquired Allevi, Inc., with expectations to expand their regenerative medicine initiatives.

In the production of 3D bio-printed drugs for clinical applications, it’s crucial for the manufacturer to comply with Current Good Manufacturing Practices (cGMP) regulations. This ensures consistent quality control in product manufacturing. If the 3D bioprinting process involves living cells or tissues, it might fall under the jurisdiction of the Centre for Biologics Evaluation and Research (CBER), which oversees biological products. If this process is used to create bio-printed tissues or organs for transplantation or clinical use, the manufacturer might need to submit a Biologic License Approval (BLA) to FDA. This is a comprehensive application for the approval of biological products. As a result, 3D printing manufacturers consider Intellectual Property (IP) rights and patents vital for maintaining control over the developed product or service.

Product diversification is a key strategy for businesses aiming to grow in the industry. This approach involves launching new products or enhancing existing ones to meet changing consumer demands, boost sales, and secure a competitive advantage. By broadening their product range, businesses can attract new clientele, expand their presence, and stimulate revenue growth. For instance, in February 2023, CELLINK and Nanyang Technological University jointly inaugurated an R&D lab focused on bioprinting in critical use cases like drug discovery and regenerative medicine.

Geographic expansion is a strategic move that not only broadens a company's industry reach but also offers numerous benefits, including increased revenue, competitive advantage, diversification, brand recognition, risk mitigation, and opportunities for innovation and growth. For example, in July 2023, Inventia Life Science Pty Ltd. strengthened its position in the Indian industry for RASTRUM with Biotron Healthcare through a distribution agreement.

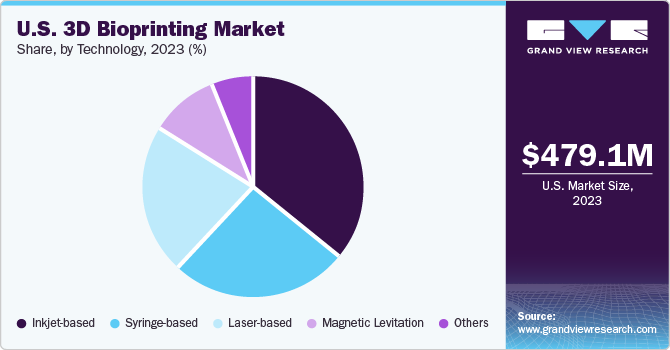

Technology Insights

Inkjet-based held the largest revenue share of 35.9% in 2023. The 3D bioprinting process, reliant on inkjet technology, is significantly influenced by the specific hardware and bioinks employed. Widely adopted by scholars and researchers, inkjet-based bioprinters facilitate efficient and large-scale production of biological materials. The key element in this technology is bio inks, and their continuous development is predicted to be a driving force for market growth. Notably, inkjet-based bioprinters, being more affordable than their laser-based counterparts, are often the preferred choice. Their extensive use in medicine is expected to contribute substantially to the segment growth. Furthermore, inkjet printing is increasingly recognized as a viable technology for applications in tissue engineering and drug delivery systems, further propelling its demand and reliability. This recognition is anticipated to lead to significant growth in the foreseeable future.

Magnetic levitation is expected to grow at the fastest CAGR of 10.0% over the forecast period. This growth is attributed to the cost-efficiency associated with technology. It is anticipated that magnetic levitation will address over 80.0% of inaccuracies in 3D bioprinting due to its advanced capabilities, increased speed, and precision. Applications of these bioprinters encompass toxicity screening, vascular muscle printing, and human cell regeneration. For instance, BioAssay has successfully created tissue-like structures using devices based on magnetic levitation. Widely employed in drug discovery, toxicology testing, and the creation of various in vitro animal models during preclinical studies, this technology is poised for significant growth in the future, fueled by increased research and development activities in the biotech sector.

Application Insights

Medical held the largest revenue share of 38.5% in 2023. The market is experiencing significant growth due to the extensive use of medical pills in treating a variety of chronic diseases. The escalating demand for medicines and cost-effective production of bio-drugs using 3D bioprinting technology are further propelling this market. As the pharmaceutical industry expands with more participants, demand for medical pills is on rise. Given the vast amount of people regularly consume capsules and medicinal pills, the market is anticipated to see substantial growth in the future.

Consumer/personal product testing is anticipated to grow at the fastest CAGR of 15.0% during the forecast period. 3D bio-printed tissues have potential applications in consumer or personal products, particularly in cosmetic testing. This technology is anticipated to overcome the challenges associated with animal testing. Businesses are optimistic about this method of product testing as it is relatively cost-effective and simpler. For instance, L’Oreal, a leading cosmetics company, has partnered with Organovo to create 3D-printed skin tissue. L’Oreal plans to use these skin tissue models for the development, production, testing, evaluation, and sale of over-the-counter nutraceutical supplements, skincare products, dermatological, beauty, and cosmetic products. Furthermore, benefits of using 3D bioprinting for personal product testing include the ability to expedite and reduce the cost of prototyping, a crucial step in research and development processes.

Key U.S. 3D Bioprinting Company Insights

U.S. 3D bioprinting market is highly competitive. Key companies are focusing on various strategic initiatives that include partnerships, product and service expansion, mergers & acquisitions and investing in R&D to create advanced applications for a competitive advantage. For instance, in November 2019, CELLINK developed Bio X6, a sophisticated 3D bioprinter, and Lumen X for vascular structures. In addition, Fluicell, a Swedish company, introduced Biopixlar, a high-resolution bioprinting technology in both 3D and 2D. Companies are also pursuing mergers, partnerships, and acquisitions to enhance their manufacturing capabilities and application portfolios. Around the same time, BASF GmbH announced the acquisition of Sculpteo which is a 3D printing service provider. This acquisition is expected to aid BASF GmbH in the market and develop new industrial 3D printing materials more quickly.

Key U.S. 3D Bioprinting Companies:

- EnvisionTEC, Inc.

- Organovo Holdings, Inc.

- Inventia Life Science PTY LTD

- Allevi, Inc. (3D Systems)

- Cellink Global

- Stratasys

- Vivax Bio, LLC

Recent Developments

-

In July 2023, CELLINK and AXT joined forces to expand access to innovative bioprinting technologies in Oceania. This partnership aims to propel the fields of regenerative medicine, tissue engineering, and drug discovery forward by utilizing CELLINK’s cutting-edge bio inks and bioprinters. CELLINK’s strategic collaboration with AXT underscores their dedication to broadening their global footprint and fostering advancements in bioprinting.

-

In May 2023, CELLINK launched the third generation of LUMEN X to meet the needs of researchers and scientists who require high-resolution bioprinting capabilities. The LUMEN X Gen 3 offers substantial enhancements in the printer's resolution. It is equipped with sophisticated features such as constructs of multiple stiffness and microfluidic systems, specifically engineered for cell printing.

-

In September 2021, Inventia Life Science Pty Ltd. partnered with Xylyx Bio to develop tissue-specific, digitally printed bioinks for drug discovery. This partnership is aimed at improving drug discovery by enhancing 3D cell cultures for more accurate and scalable models. Their goal is to incorporate components specific to the liver’s extracellular matrix (ECM) to produce sturdy 3D bioprinted tissue models, further advancing the fields of drug development and biomedical research.

U.S. 3D Bioprinting Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 538.2 million |

|

Revenue forecast in 2030 |

USD 895.4 million |

|

Growth rate |

CAGR of 8.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application |

|

Country scope |

U.S. |

|

Key companies profiled |

EnvisionTEC, Inc.; Organovo Holdings, Inc.; Inventia Life Science PTY LTD; Allevi, Inc. (3D Sysytems); Cellink Global; Stratasys; Vivax Bio, LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. 3D Bioprinting Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. 3D bioprinting market based on technology, and application:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Magnetic Levitation

-

Inkjet-based

-

Syringe-based

-

Laser-based

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Tissue And Organ Generation

-

Medical Pills

-

Prosthetics And Implants

-

Others

-

-

Dental

-

Biosensors

-

Consumer/Personal Product Testing

-

Bioinks

-

Food And Animal Product

-

Frequently Asked Questions About This Report

b. The U.S. 3D bioprinting market size was estimated at USD 479.1 million in 2023 and is expected to reach USD 538.2 million in 2024.

b. The U.S. 3D bioprinting market is growing at a CAGR of 8.9% from 2024 to 2030 to reach USD 895.4 million by 2030.

b. Inkjet-based held the largest revenue share of 35.9% in 2023. The 3D bioprinting process, reliant on inkjet technology, is significantly influenced by the specific hardware and bioinks employed.

b. Some prominent companies in the U.S. 3D bioprinting market include EnvisionTEC, Inc., Organovo Holdings, Inc., Inventia Life Science PTY LTD, Allevi, Inc. (3D Systems), Cellink Global, Stratasys, Vivax Bio, LLC.

b. Key drivers for market expansion also encompass heightened investment in research and development, technological advancements, and a rising prevalence of chronic illnesses.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."