- Home

- »

- Pharmaceuticals

- »

-

Urinary Incontinence Therapeutics Market Size Report, 2030GVR Report cover

![Urinary Incontinence Therapeutics Market Size, Share & Trends Report]()

Urinary Incontinence Therapeutics Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Stress Incontinence, Urge Incontinence), By Drug Class, By Gender, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-366-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Urinary Incontinence Therapeutics Market Summary

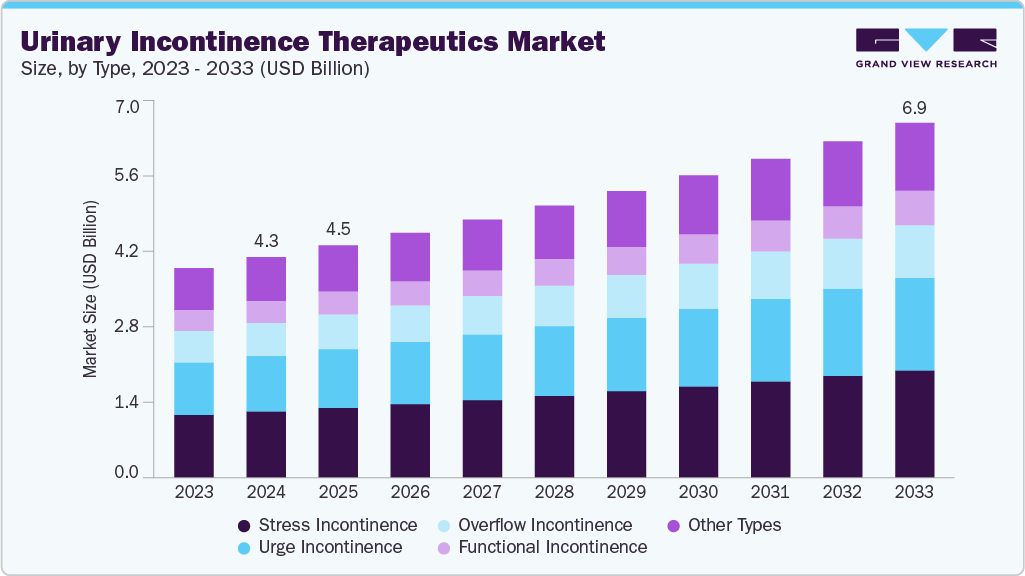

The global urinary incontinence therapeutics market size was estimated at USD 4.32 billion in 2024 and is projected to reach USD 6.95 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. This growth is primarily driven by the increasing prevalence of urinary incontinence among aging populations and the growing demand for effective therapeutic interventions that address bladder dysfunction.

Key Market Trends & Insights

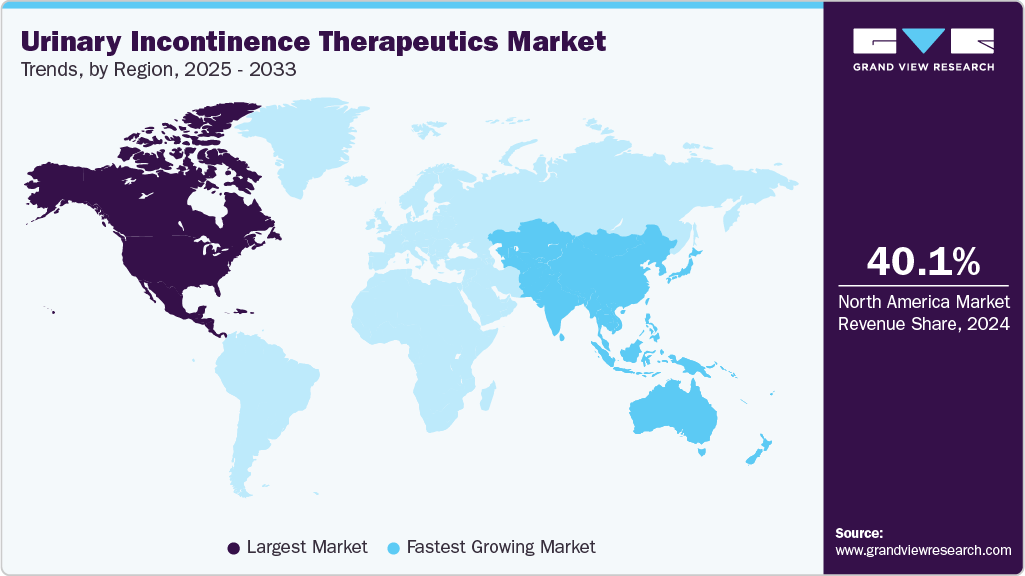

- North America urinary incontinence therapeutics market held the largest share of 40.08% of the global market in 2024.

- The urinary incontinence therapeutics industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the stress incontinence segment held the largest market share of 30.05% in 2024.

- By drug class, the anticholinergics segment held the largest market share in 2024.

- By gender, the female segment held the largest market share in 2024.

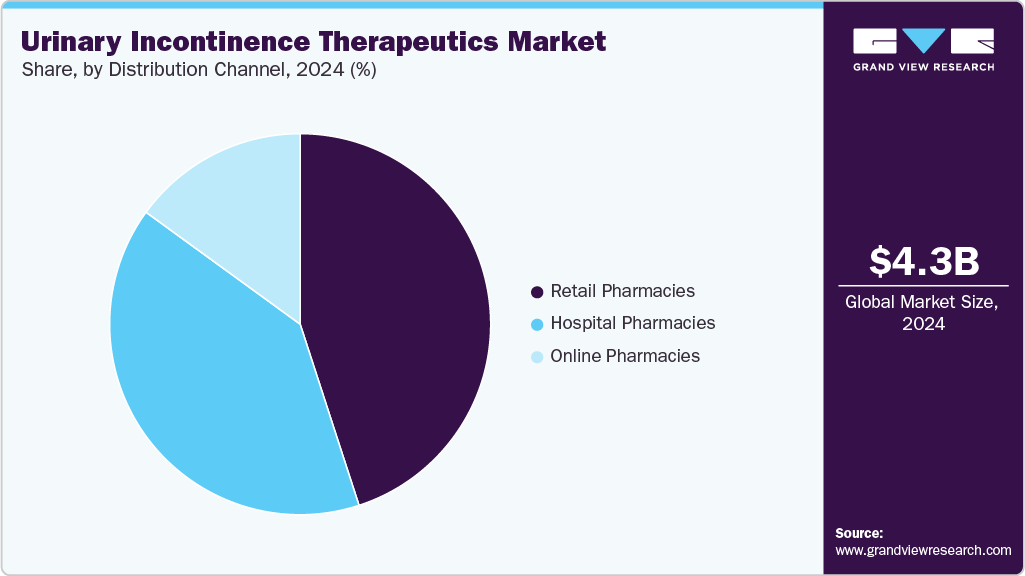

- By distribution channel, the retail pharmacies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.32 Billion

- 2033 Projected Market Size: USD 6.95 Billion

- CAGR (2025-2033): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to a May 2023 report by Dovepress, the prevalence of female urinary incontinence was found to be 24.8%, with stress incontinence accounting for 12.7%, mixed incontinence for 8.0%, and urgency incontinence for 4.1%. The study indicated that prevalence increased progressively with age and body mass index, emphasizing the need for early diagnosis and effective therapy. Rising awareness among patients and healthcare providers has improved diagnosis and management rates, supporting higher treatment adoption. Advancements in β3-adrenoceptor agonists and antimuscarinic agents are improving outcomes across patient groups, while wider access to oral and non-invasive options is enhancing adherence. Expanding retail and online pharmacy networks are ensuring consistent medication availability, reinforcing market performance across regions.The market is expanding as pharmaceutical companies focus on developing targeted and safer therapies addressing persistent unmet needs. For instance, in April 2024, Lupin Ltd introduced Mirabegron, a generic alternative to Myrbetriq, aimed at managing overactive bladder in the U.S. The introduction of such generics and novel mechanisms of action is diversifying treatment options and improving accessibility. Investments in research programs to enhance efficacy and minimize side effects are creating opportunities for the development of differentiated therapies. The presence of branded and generic drugs ensures cost flexibility, improving treatment compliance. Strategic collaborations between leading players and research organizations are accelerating development timelines and expanding the therapeutic pipeline. Continuous lifecycle management and post-approval studies are reinforcing product positioning, sustaining long-term competitiveness, and revenue stability.

Market expansion is further supported by rising healthcare expenditures and increasing access to urology and women’s health services across both developed and emerging regions. For instance, in October 2025, global data showed that the number of people aged 60 and older is projected to double from 1 billion in 2020 to 2.1 billion by 2050. As this population segment grows, the burden of urinary incontinence and related geriatric conditions is expected to rise, driving demand for effective and accessible treatment options. Healthcare providers are prioritizing the quality of life of older adults through improved disease management, which is stimulating innovation in therapeutic strategies. Advancements in drug delivery technologies are improving treatment precision and convenience, while expanded clinical research in overactive bladder and mixed incontinence is driving the evolution of combination regimens. Sustained innovation, efficient distribution systems, and growing clinical adoption are expected to maintain a stable growth trajectory for the urinary incontinence therapeutics market through the forecast period.

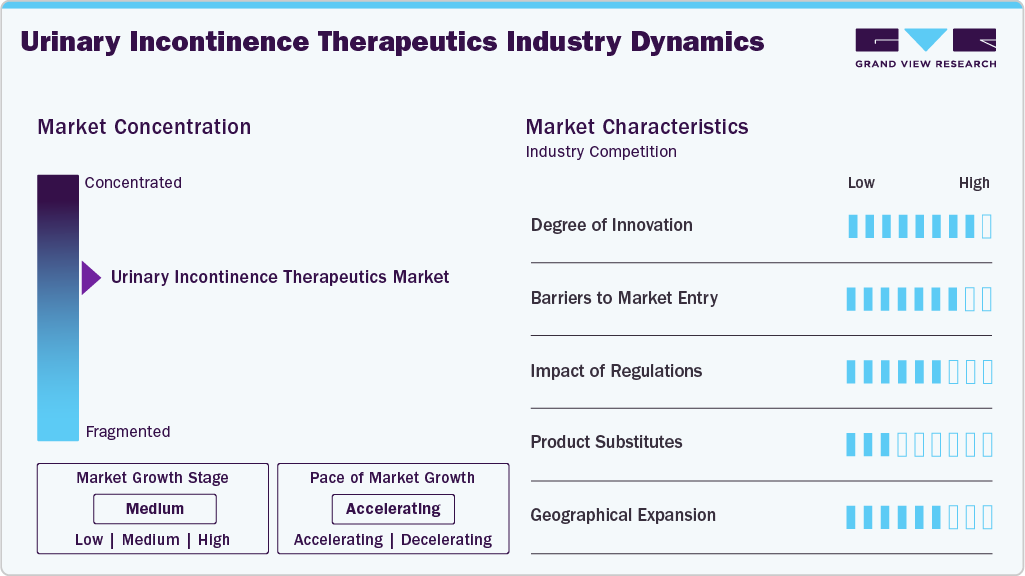

Market Concentration & Characteristics

The urinary incontinence therapeutics industry demonstrates moderate to high innovation, driven by ongoing advancements in β3-adrenoceptor agonists, antimuscarinic combinations, and sustained-release formulations. Research efforts focus on improving safety, tolerability, and patient adherence through novel mechanisms of action and precision-targeted therapies. Pharmaceutical companies are emphasizing data-driven development and validating real-world outcomes. Digital health integration and formulation enhancements are creating differentiation within established drug classes. Innovation remains a key competitive factor supporting long-term therapeutic evolution.

The market presents moderate entry barriers due to high R&D costs, lengthy clinical validation, and complex regulatory requirements. Established players possess significant brand recognition and distribution strength, making market penetration challenging for new entrants. Intellectual property protection further limits generic competition for newer molecules. Achieving physician trust and patient acceptance requires substantial clinical evidence and marketing investment. Capital intensity and compliance obligations restrict smaller firms from large-scale commercialization.

Regulatory frameworks emphasize stringent clinical evaluation, pharmacovigilance, and quality assurance throughout the product lifecycle. Compliance with safety and efficacy standards from authorities such as the FDA and EMA extends approval timelines and development costs. Post-marketing surveillance requirements ensure consistent monitoring of therapeutic performance. Regulatory harmonization across regions is promoting transparency and standardization in product quality. Companies with established regulatory expertise maintain a competitive advantage through timely approvals and efficient documentation processes.

Product substitution is limited due to the clinical specificity of urinary incontinence therapies, though non-pharmacological options present mild competitive pressure. Behavioral therapies, pelvic floor exercises, and neuromodulation treatments serve as adjuncts rather than direct alternatives. Patient adherence to pharmacological interventions remains higher due to the convenience and the measurable symptom control they provide. Technological innovations in devices continue to complement, rather than replace, therapeutic drugs. Substitutes influence treatment selection primarily in early-stage or mild cases.

Geographical expansion within the market is advancing through targeted regional strategies and partnerships. North America and Europe dominate due to high diagnosis rates and established healthcare infrastructure. Asia Pacific and Latin America present rising opportunities driven by growing awareness and healthcare access. Companies are focusing on adapting pricing models and distribution networks to align with local affordability and regulatory conditions. Expansion into emerging markets is enhancing global revenue diversity and patient reach.

Type Insights

The stress incontinence segment dominated the market, accounting for the largest revenue share of 30.05% in 2024, driven by its high prevalence among women and the aging population. According to the Cleveland Clinic, stress incontinence is the most common type of urinary incontinence, primarily affecting individuals assigned female at birth, with up to one in three experiencing it during their lifetime. An August 2023 NIH report indicated that 24% to 45% of women over 30 experience stress urinary incontinence, often due to pelvic floor weakening from aging, pregnancy, and childbirth. Expanding awareness and improved diagnosis are increasing treatment demand. Advancements in pharmacologic and non-surgical therapies are enhancing symptom control and adherence. Hospitals and specialty clinics are expanding access, supporting sustained segment dominance.

The urge incontinence segment is projected to grow at the fastest CAGR of 5.8% over the forecast period, due to increasing recognition of overactive bladder as a major clinical concern. According to an NIH report from August 2023, urge urinary incontinence affects 9% of women aged 40 to 44 years, 31% of women over 75 years, and 42% of men over 75 years. Lifestyle factors such as caffeine and alcohol consumption can aggravate symptoms, further increasing the need for therapeutic intervention. Growing acceptance of β3-adrenoceptor agonists has improved treatment outcomes for patients experiencing urge-related symptoms. Continuous innovation in drug delivery systems is enhancing efficacy and duration of relief. Improved awareness, accurate diagnosis, and advanced therapies are fueling demand across age groups. Expansion of treatment access through retail and online pharmacies supports faster adoption and sustained market growth.

Drug Class Insights

The anticholinergics segment dominated the market with the largest revenue share of 33.05% in 2024, driven by extensive clinical experience and widespread physician familiarity. These agents remain the first-line pharmacologic choice in managing bladder muscle overactivity. Generic availability across multiple formulations supports broad patient accessibility. Improved awareness of dosing adjustments and side effect management has enhanced adherence. Market penetration remains high in both developed and emerging economies. Healthcare providers continue to rely on these agents due to their established safety and affordability. Ongoing research to optimize tolerability and reduce discontinuation rates is further strengthening their utilization.

The Beta-3 adrenoceptor agonists segment is projected to grow at the fastest CAGR of 6.5% over the forecast period, due to strong clinical acceptance and superior safety profiles. According to a report published in March 2022, beta-3 agonists have demonstrated significant improvements in urodynamic parameters and self-reported outcomes related to urinary incontinence. These agents relax bladder muscles, increasing bladder capacity and reducing involuntary contractions that cause leakage. The positive clinical findings are driving wider adoption among healthcare providers seeking effective and well-tolerated treatment options. Expanding use among elderly patients is boosting prescription frequency, supported by strong real-world efficacy and safety data. Pharmaceutical manufacturers are focusing on novel formulations and fixed-dose combinations. Continuous R&D efforts and rising patient preference for quality-of-life improvements are expected to strengthen this segment’s market contribution.

Gender Insights

The female segment dominated the market, accounting for the largest revenue share of 60.11% in 2024, driven by higher disease prevalence and improved diagnosis rates. According to StatPearls Publishing in August 2024, approximately 24% to 45% of women in the U.S. experienced urinary incontinence. Among those aged 20-39, the range was 7% to 37%, and in women over 60, about 9% to 39% reported daily symptoms. Of adult women (~80 million), over 60% had some degree of incontinence, with one-third experiencing leakage at least monthly. Stress incontinence was the most common, at 37.5%, followed by mixed at 31.3% and urge at 22%. Gynecology centers enhanced early detection through routine screenings, while targeted therapies, increased awareness programs, and expanding access to specialized care reinforced the segment’s dominance.

The male segment is projected to grow at the fastest CAGR of 5.2% over the forecast period. This growth is primarily driven by the increasing incidence of urinary symptoms linked to prostate enlargement and post-surgical complications. According to a report from August 2022, urinary incontinence affects older men aged 65 and above, with prevalence rates ranging from 11% to 34%, and daily incontinence rates between 2% and 11%. Neurological conditions such as stroke, Parkinson’s disease, and spinal cord injuries further disrupt bladder control, intensifying the condition. Advancements in β3-adrenoceptor agonists are improving tolerability and treatment outcomes for male patients. Growing awareness and expanding diagnostic capabilities are encouraging the initiation of early therapy. Broader access to prescription medications through hospital and retail channels continues to strengthen market growth among male demographics.

Distribution Channel Insights

The retail pharmacies segment dominated the market, accounting for the largest revenue share of 44.81% in 2024, driven by the wide availability of prescription and over-the-counter medications. Convenient access and established patient trust are supporting consistent sales volumes. Pharmacists play an active role in guiding therapy adherence and dosage management. Strong relationships with healthcare providers enhance the distribution efficiency. The expansion of physical pharmacy networks in urban and semi-urban areas is improving patient access. Availability of generic options through retail outlets is increasing affordability and continuity of care. High repeat purchase rates are sustaining dominance within the distribution landscape.

The online pharmacies segment is projected to grow at the fastest CAGR of 6.3% over the forecast period. This growth is primarily spurred by the increasing adoption of digital health and a preference for home delivery services. Expanding e-commerce platforms are improving access to prescription medications in remote locations. Rising comfort with online consultations is facilitating continuous adherence to therapy. Competitive pricing and subscription-based delivery models are attracting recurring customers. Digital pharmacies are enhancing patient engagement through reminders and virtual support. The growing penetration of smartphones and the increasing adoption of secure payment systems are creating a favorable environment for sustained online pharmacy growth.

Regional Insights

The North America urinary incontinence therapeutics industry held the largest share in 2024, accounting for 40.08% of global revenue, supported by high disease prevalence and strong clinical adoption. The region benefits from a well-established healthcare infrastructure and early access to advanced pharmacologic therapies. Major pharmaceutical companies are expanding their regional presence through strategic partnerships and targeted product launches, thereby expanding their presence in key regions. Increasing awareness of bladder health among aging populations is leading to improved diagnosis and treatment uptake. High healthcare expenditure supports the use of branded and specialty drugs. Continuous innovation in β3-adrenoceptor agonists and combination regimens is reinforcing market leadership.

U.S. Urinary Incontinence Therapeutics Market Trends

The U.S. urinary incontinence therapeutics industry accounted for the largest share within North America due to the widespread availability of prescription therapies and strong clinical awareness. The rising incidence of overactive bladder and stress incontinence among women is expanding treatment demand. Pharmaceutical manufacturers are prioritizing the U.S. for new product approvals and lifecycle extensions. Growing use of digital health tools is improving adherence and monitoring outcomes. Retail and online pharmacy penetration ensures consistent access to therapies. Continuous marketing and patient education initiatives are further supporting long-term growth.

Europe Urinary Incontinence Therapeutics Market Trends

The urinary incontinence therapeutics industry in Europe held a substantial share in 2024, supported by strong clinical practice standards and high treatment awareness. Broad access to urology specialists is facilitating early diagnosis and consistent follow-up care. The expansion of generic drug availability is increasing affordability across multiple countries. Pharmaceutical firms are focusing on novel formulations and safer alternatives to improve compliance. The growing emphasis on female health and aging demographics is contributing to a steady demand. Research collaboration among regional institutions continues to strengthen therapeutic advancements.

The UK urinary incontinence therapeutics industry is growing steadily, driven by increasing diagnosis rates and a focus on women’s health. Rising clinical recognition of bladder disorders among the elderly is expanding prescription volumes. Healthcare providers are adopting evidence-based treatment protocols to improve patient outcomes. Pharmaceutical companies are emphasizing adherence programs and collecting real-world data. Retail pharmacy expansion is supporting wider access to established therapies. Growing use of β3-adrenoceptor agonists is enhancing patient satisfaction and persistence with therapy.

The urinary incontinence therapeutics industry in Germany represents a significant share within the European market due to its strong clinical infrastructure and extensive urology network. High awareness among both physicians and patients promotes early intervention and consistent follow-up. Demand for innovative oral therapies is supported by advanced diagnostic capabilities. The presence of major pharmaceutical firms ensures the regular introduction of improved drug formulations. Aging demographics are contributing to higher patient volumes and repeat prescriptions. A concerted effort on clinical education is maintaining robust market performance.

The France urinary incontinence therapeutics industry remains an important market with a well-established healthcare infrastructure and structured clinical management pathways. The rising prevalence among elderly women is increasing demand for pharmacologic interventions. Physicians are adopting β3-adrenoceptor agonists and combination therapies to improve symptom control. The availability of generic drugs is enhancing affordability and continuity of care. Hospitals and retail pharmacies are ensuring widespread access to prescribed medications. A continuous emphasis on patient adherence and safety monitoring is supporting steady market performance.

Asia Pacific Urinary Incontinence Therapeutics Market Trends

The urinary incontinence therapeutics industry in the Asia Pacific is expected to register a significant CAGR of 6.7% over the forecast period, driven by rising awareness and growing healthcare access. The expansion of middle-class populations and improved diagnostic services is increasing treatment uptake. Pharmaceutical companies are expanding their distribution networks to efficiently address regional demand. Aging populations in Japan, China, and South Korea are contributing to higher patient counts. The growing presence of local generic manufacturers is enhancing the affordability of medications. Strategic collaborations between global and regional players are improving therapeutic availability and adoption.

The Japan urinary incontinence therapeutics industry maintains a strong position in the Asia Pacific region with advanced clinical infrastructure and research focus. High prevalence of incontinence among elderly women supports strong demand for prescription therapies. Pharmaceutical firms are emphasizing innovative molecules with improved safety profiles. Integration of pharmacologic and lifestyle management approaches promotes long-term adherence. Widespread physician awareness and regular screening programs encourage early treatment. Continuous introduction of improved formulations ensures sustained therapeutic progress.

The urinary incontinence therapeutics industry in China is expanding rapidly due to rising disease awareness and urban healthcare development. Increasing clinical focus on overactive bladder management is driving prescription growth. Broader access to branded and generic medications is improving affordability. Pharmaceutical firms are strengthening local partnerships to enhance supply chain efficiency. A growing elderly population is generating consistent therapy demand. Continuous clinical training and patient education efforts are improving treatment adherence and outcomes.

Latin America Urinary Incontinence Therapeutics Market Trends

The urinary incontinence therapeutics industry in Latin America is expanding due to improving diagnosis and growing awareness of bladder disorders. Urbanization and lifestyle changes are contributing to higher incidence rates across major economies. Pharmaceutical companies are strengthening regional supply chains to improve drug accessibility. Generic formulations are supporting market affordability and treatment adherence. Retail pharmacy growth is enhancing patient convenience and medication availability. Rising clinical focus on women’s health and elderly care is sustaining market growth.

The Brazil urinary incontinence therapeutics industry accounts for a major share of the Latin American market, supported by increasing healthcare access and awareness. Higher prevalence of urinary disorders among women and older adults is driving prescription volumes. Pharmaceutical companies are expanding their product portfolios through branded and generic therapies. Retail and hospital pharmacies are facilitating strong distribution coverage across urban regions. Clinical professionals are prioritizing evidence-based pharmacologic management for better outcomes. Continuous patient education initiatives are improving long-term adherence and treatment success.

Middle East & Africa Urinary Incontinence Therapeutics Market Trends

The urinary incontinence therapeutics industry in the Middle East & Africa is developing steadily with expanding healthcare infrastructure and rising awareness of bladder disorders. Increasing focus on women’s health is improving diagnosis and access to treatments. International pharmaceutical companies are enhancing their regional presence through distribution partnerships. Urbanization and lifestyle changes are contributing to a gradual rise in patient volumes. Retail pharmacy expansion supports greater availability of prescription and over-the-counter medications. Growing education among healthcare professionals is strengthening treatment outcomes.

The Saudi Arabia urinary incontinence therapeutics industry is growing due to increased healthcare spending and rising awareness of urological conditions. Expanding access to specialized care facilities is improving diagnosis rates. Pharmaceutical companies are strengthening distribution networks to meet growing patient demand. Lifestyle changes and aging populations are elevating the incidence of bladder disorders. Increased participation of women in health programs is supporting early intervention. Focusing on patient counseling and medication adherence enhances treatment success.

Key Urinary Incontinence Therapeutics Company Insights

Pfizer Inc. holds an effective position in the market for urinary incontinence therapeutics, with its urology-focused portfolio and ongoing innovation in β3-adrenoceptor agonists. AbbVie Inc. and Astellas Pharma Inc. sustain growth through established brands and strategic collaborations. Johnson & Johnson and Viatris Inc. expand reach with diversified women’s health solutions. Teva Pharmaceutical Industries Ltd. and Sanofi S.A. enhance accessibility through generics and biosimilars. GlaxoSmithKline plc and Boehringer Ingelheim advance next-generation therapies improving efficacy and adherence, while Bayer AG and Ferring Pharmaceuticals drive precision and hormone-based innovations. Rising awareness, R&D investment, and aging populations are propelling sustained market expansion globally.

Key Urinary Incontinence Therapeutics Companies:

The following are the leading companies in the urinary incontinence therapeutics market. These companies collectively hold the largest Market share and dictate industry trends.

- Pfizer Inc.

- AbbVie Inc.

- Astellas Pharma Inc.

- Johnson & Johnson

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sanofi S.A.

- GlaxoSmithKline plc

- Boehringer Ingelheim Pharmaceuticals, Inc.

- Bayer AG

- Ferring Pharmaceuticals

Recent Developments

-

In October 2025, AbbVie Inc. reported that in the U.S., the Phase 2 ELATE trial of onabotulinumtoxinA (BOTOX) achieved a matched primary endpoint with a reduction in the Tremor Disability Scale‑Revised (TREDS‑R) total unilateral score of -2.61 versus -1.61 for placebo (p = 0.029); all six secondary endpoints were also met, and the most common adverse event, muscular weakness, occurred in 24.5% of the treated group versus 2.3% of the placebo group.

-

In March 2024, Sumitomo Pharma America announced that the FDA accepted a supplemental new drug application for vibegron. This application seeks approval for treating men with overactive bladder (OAB) symptoms who are already undergoing pharmacological treatment for benign prostatic hyperplasia (BPH).

-

In April 2024, Zydus Lifesciences introduced a generic medication for overactive bladder in the US, addressing symptoms such as urge urinary incontinence, urgency, and urinary frequency. The drug will be produced at Zydus group's formulation manufacturing facility located in India.

Urinary Incontinence Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.55 billion

Revenue forecast in 2033

USD 6.95 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, drug class, gender, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Pfizer Inc.; AbbVie Inc.; Astellas Pharma Inc.; Johnson & Johnson; Viatris Inc.; Teva Pharmaceutical Industries Ltd.; Sanofi S.A.; GlaxoSmithKline plc; Boehringer Ingelheim Pharmaceuticals, Inc.; Bayer AG; Ferring Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urinary Incontinence Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global urinary incontinence therapeutics market report based on type, drug class, gender, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Stress Incontinence

-

Urge Incontinence

-

Overflow Incontinence

-

Functional Incontinence

-

Other Types

-

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Anticholinergics

-

Beta-3 Adrenoceptor Agonists

-

Alpha Blockers

-

Estrogen

-

Desmopressin

-

Tricyclic Antidepressants

-

Other Drug Classes

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

-

Distribution ChannelOutlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global urinary incontinence therapeutics market size was valued at USD 4.32 billion in 2024 and is expected to reach USD 4.55 billion in 2025.

b. The global urinary incontinence therapeutics market is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2033 to reach USD 6.95 billion by 2033.

b. The stress incontinence segment held the largest share of 30.05% in 2024. Key drivers include the increasing elderly population and the prevalence of stress incontinence among pregnant and postpartum women

b. Some key players operating in the urinary incontinence therapeutics market include Pfizer Inc.; AbbVie Inc.; Astellas Pharma Inc.; Johnson & Johnson; Viatris Inc.; Teva Pharmaceutical Industries Ltd.; Sanofi S.A.; GlaxoSmithKline plc; Boehringer Ingelheim Pharmaceuticals, Inc.; Bayer AG; Ferring Pharmaceuticals

b. Key factors that are driving the market growth include the increasing prevalence of urinary incontinence (UI) among aging populations and the rising awareness about available treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.