- Home

- »

- Clinical Diagnostics

- »

-

Urinalysis Market Size And Share, Industry Report, 2030GVR Report cover

![Urinalysis Market Size, Share & Trends Report]()

Urinalysis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Application (UTI Screening, Diabetes), By End Use (Hospitals, Clinical Laboratories), By Region, And Segment Forecasts

- Report ID: 978-1-68038-817-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Urinalysis Market Summary

The global urinalysis market size was estimated at USD 4.37 billion in 2024 and is projected to reach USD 6.85 billion by 2030, growing at a CAGR of 7.83% from 2025 to 2030. The market is witnessing growth due to factors including the rising incidence of diseases such as Urinary Tract Infections (UTIs), diabetes, and kidney diseases.

Key Market Trends & Insights

- In terms of region, North America dominated the market and accounted for the largest revenue share of 37.9% in 2024.

- The urinalysis market in the U.S. is expected to grow over the forecast period.

- In terms of product, the consumables segment held the dominant revenue share of 78.56% in terms of revenue in 2024.

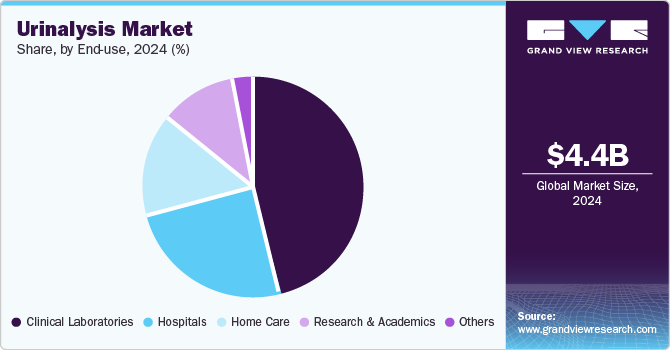

- In terms of end use, the clinical laboratories segment accounted for the highest revenue share of around 45.88% in 2024.

- In terms of application, the urinary tract infection screening segment dominated the market and accounted for a revenue share of 24.07% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.37 Billion

- 2030 Projected Market Size: USD 6.85 Billion

- CAGR (2025-2030): 7.83%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the National Diabetes Statistics Report, 2024, around 38.0 million people had diabetes in the U.S., which accounted for 11.6% population of the country. The report also mentioned that around 8.7 million adults were unaware of having diabetes. Also, according to the WHO’s data, published in November 2024, number of people living with diabetes has increased over 800 million globally.

The study conducted by the NCD Risk Factor Collaboration along with WHO found that the prevalence of diabetes in adults has risen from 7% to 14% within the last 3 decades. About one-third of diabetic people have kidney-related comorbidities due to high blood sugar and blood pressure. Urinalysis is an informative and noninvasive diagnostic tool accessible to clinicians to diagnose kidney diseases. Hence, the rising prevalence of kidney ailments is anticipated to increase demand for products used in urinalysis, thereby driving market growth.

Technological advancements in urinalysis devices are significantly driving the growth of the urinalysis market by enhancing the accuracy, efficiency, and accessibility of diagnostic testing. Innovations such as automated urine analyzers and point-of-care testing (POCT) devices have revolutionized traditional urinalysis by reducing manual errors and delivering faster results. Additionally, the integration of digital microscopy, machine learning algorithms, and cloud-based data management systems has improved the precision of detecting abnormalities in urine samples and enabled remote monitoring of patients.

Companies such as Siemens Healthineers, Sysmex Corporation, and Beckman Coulter have launched automated platforms capable of analyzing large sample volumes with minimal human intervention, addressing the rising demand for streamlined diagnostics in hospitals and laboratories. For instance, in December 2023, Siemens Healthineers AG introduced “Atellica UAS 60 Analyzer,” a compact solution for urine sediment analysis that has digitized urine microscopy. It generates high-resolution digital images followed by neural network-based post-processing to identify the sediment particles. These advancements not only enhance workflow efficiency but also support early disease detection, especially for chronic conditions such as diabetes, kidney disorders, and urinary tract infections (UTIs), further propelling market growth.

As UTIs are among the most common outpatient infections worldwide, affecting 150 million people annually, particularly women, who have a lifetime incidence rate of 50-60%. Thus, due to high need for addressing such critical healthcare need, many companies have come forward to invest, innovate and provide home-based urine testing kits for disease diagnosis and make the urinalysis process more convenient for patients. For instance, in January 2024, Vivoo launched at-home digital UTI test that enables users to complete a urine test in two minutes, with results available instantly via a smartphone app. This innovation eliminates the need for lab visits, reduces bureaucratic delays, and enhances user convenience by offering digitalized data and cater to the growing consumer demand for personalized, point-of-care diagnostics, driving the adoption of urinalysis products and expanding access to timely and accurate healthcare solutions.

However, the high cost associated with advanced diagnostic technologies, such as automated analyzers, which can limit their accessibility, particularly in low- and middle-income regions, is one of the major factors restraining the growth of the market. While technological advancements improve testing efficiency, the high prices of advanced analyzers can restrict the adoption in small healthcare facilities and low-resource settings. Additionally, the lack of standardized testing protocols and inconsistent reimbursement policies in some regions pose challenges to market adoption.

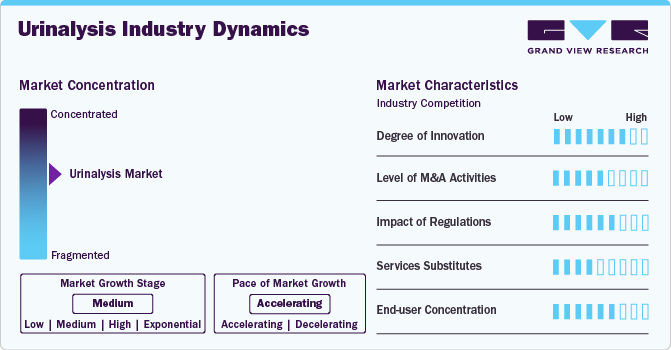

Market Concentration & Characteristics

The degree of innovation in the market is high, driven by advancements in automation, digitalization, and the use of artificial intelligence (AI). Modern urinalysis systems, such as automated urine sediment analyzers and point-of-care testing (POCT) devices, have significantly improved diagnostic accuracy and efficiency. Additionally, smartphone-enabled solutions, such as Vivoo’s at-home UTI testing and similar app-based platforms, are revolutionizing consumer accessibility by offering real-time, convenient results that depict the trend toward digital and personalized diagnostics.

The urinalysis market has witnessed a moderate level of merger and acquisition (M&A) activity as key players aim to expand their product portfolios, strengthen market presence, and integrate advanced technologies. For example, Siemens Healthineers and Sysmex Corporation have engaged in collaborations to expand the adoption of urine testing solutions.

The impact of regulation is high, as regulatory bodies like the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) play a critical role in ensuring the safety and effectiveness of diagnostic tests. Stringent regulatory requirements can both encourage innovation, by setting high standards and delay the introduction of new products due to the lengthy approval process.

The threat for product substitutes in the urinalysis market is moderate due to the availability of alternative diagnostic methods such as blood tests, imaging techniques (e.g., ultrasounds for kidney analysis), and advanced biomarker detection technologies. While these substitutes offer valuable diagnostic insights, urinalysis remains the preferred choice for detecting urinary tract infections (UTIs), kidney disorders, and diabetes due to its non-invasive nature, cost-effectiveness, and ease of use.

End User concentration is medium, with hospitals and diagnostic laboratories being the primary users of these diagnostic tests. While these institutions account for the majority of the demand, an increasing number of point-of-care testing devices are being used in clinics and even at home, broadening the customer base. The growing focus on personalized healthcare and at-home diagnostics may slightly reduce the concentration of end-users in hospitals, but healthcare institutions will continue to dominate overall demand.

Product Insights

The consumables segment held the dominant revenue share of 78.56% in terms of revenue in 2024. This dominance can be attributed to the increasing demand and frequent purchases of reagents and dipsticks by clinical and hospital laboratories. Reagents are the most common type of consumable in urinalysis, accounting for the largest share of the market. Many major providers, such as Siemens Healthcare GmBH, Abbott, and Roche, provide high-quality consumables for urinalysis testing, which is expected to boost segment growth. For instance, Siemens Healthineers GmBH offers Multistix 10 SG Reagent Strips to diagnose UTI, diabetes, and kidney diseases. In December 2024, Copan Diagnostics, Inc. launched a urine collection and transport device named UriSponge, featuring a new formulation of advanced preservatives to maintain specimen stability.

The instruments segment is expected to advance at the fastest CAGR from 2025 to 2030 owing to the rising approval rate and the launch of new instruments for urinalysis. For instance, in January 2023, Withings launched U-Scan, a breakthrough in-home biomarker analysis platform. This small pebble-shaped device analyzes urine components after syncing it with the Withings Health Mate app. Also, in April 2023, Sysmex Europe SE launched UF-1500, a fully automated urine particle analyser that provides high levels of functionality, and usability by using advanced fluorescence flow cytometry technology to detect various urinary tract infections.

End Use Insights

The clinical laboratories segment accounted for the highest revenue share of around 45.88% in 2024. This can be attributed to their easy accessibility to patients and the availability of advanced products in these laboratories. For instance, in the U.S., more than 20,000 clinical laboratories perform clinical tests, including urinalysis. New test methods have been used to improve the detection of kidney diseases, such as proteomics, genetic testing, microarrays, biomarkers, etc.

The home care segment is estimated to expand at the fastest CAGR of 9.09% over the forecast period due to the increasing launch of home-based UTI test kits. The increasing demand for convenience & privacy and the low cost of home urinalysis tests, compared to clinical tests, are driving segment growth. For instance, in September 2024, Mankind Pharma launched its RAPID NEWS self-test kits, for at-home screening in India. These kits are designed to address three major health challenges that include dengue, urinary tract infections (UTIs), and early menopause.

Application Insights

The urinary tract infection screening segment dominated the market and accounted for a revenue share of 24.07% in 2024, due to the rising incidence of UTIs worldwide. According to the National Center for Biotechnology Information (NCBI), around 150 million people suffer from urinary tract infections each year worldwide. Accurate diagnosis and treatment can significantly reduce the severity of infection and assist in controlling the occurrence. Urinalysis forms an integral part of the treatment procedure in UTIs thus increasing demand to fuel the market growth.

On the other hand, the diabetes screening segment is expected to expand at the fastest CAGR of 10.59% during the forecast period. Urinalysis is an important screening test to find out about diabetes. According to the CDC, in August 2023, the prevalence of total diagnosed and undiagnosed diabetes in adults was 15.8%, whereas the rate of incidence of undiagnosed diabetes was 4.5%. Thus, the steadily increasing number of patients with diabetes acts as a major market driver. IDF projections indicate that by 2045, around 783 million adults, or 1 in 8, will be living with diabetes, representing a 46% increase. Type 2 diabetes is the most prevalent form, affecting over 90% of diabetic people. Various factors, including socioeconomic status, demographics, environment, and genetics, influence this type of diabetes.

Regional Insights

North America urinalysis market dominated the market and accounted for the largest revenue share of 37.9% in 2024. This dominance can be attributed to strategic initiatives undertaken by key players, such as enhancing existing portfolios, to expand their business footprint. For instance, in February 2024, Orchard Software completed the interface with the Clarity Platinum Urine Analyzer by adding multiple features to the device making it the first urine analyzer with built-in networking, eliminating the need for costly external hardware. Such collaborations have had a positive impact on market growth

U.S. Urinalysis Market Trends

The urinalysis market in the U.S. is expected to grow over the forecast period due to the increasing incidence of urinary infections, particularly among high-risk populations like infants and the elderly. The adoption of advanced diagnostic technologies is expanding in hospitals, clinics, and point-of-care settings. For instance, according to the Urologic Diseases in America annual data report 2024, the annual incidence of any urinary infection was 290 per 10,000 persons among people aged 65 and older during 2015 - 2021.

Europe Urinalysis Market Trends

Europe urinalysis market accounted for a significant share of the global market in 2024. This can be attributed to the rising awareness of UTIs, kidney disorders, and diabetes, which impact a large number of people, including women and the elderly. The increasing adoption of rapid, cost-effective diagnostic solutions in hospitals and outpatient settings is driving demand.

The urinalysis market in the UK is growing as healthcare providers focus on improving early detection and management of urinary infections, particularly in women and older adults. The adoption of rapid diagnostic tests and point-of-care solutions is increasing in hospitals and clinics. Moreover, the development of new at home testing devices and the launch of advanced urine analyzers by established players such as F. Hoffmann-La Roche Ltd. in the country is expected to fuel the market growth.

France urinalysis market is expected to grow over the forecast period due to increasing efforts to improve early diagnosis and treatment of kidney related disorders. The adoption of rapid and accurate diagnostic tests, including biochemical and automated urine sediment analyzers, is expanding in hospitals and healthcare settings.

The urinalysis market in Germany is expected to witness substantial growth supported by a strong healthcare system and increasing awareness of kidney infections, urinary infections and other chronic diseases. The demand for advanced diagnostic technologies, is rising in hospitals and diagnostic labs.

Asia Pacific Urinalysis Market Trends

The Asia-Pacific urinalysis market is expected to witness the fastest CAGR of over the projected period driven by increasing healthcare investments, rising awareness of chronic diseases, and improving diagnostic capabilities. Growing populations, especially in countries like China and India, are contributing to higher demand for diagnostic solutions in both urban and rural areas. Additionally, the adoption of affordable, rapid diagnostic tests and the expansion of healthcare infrastructure are accelerating market growth in the region.

The urinalysis market in China is expected to grow over the forecast period due to the rising incidence of UTIs, and the increasing demand for rapid, cost-effective diagnostic solutions is expanding, especially in hospitals and clinics. For instance, according to the retrospective study reported in an article in February 2024, the incidence of UTI was 49.8% among total number of 538 hospitalized patients with SCI (spinal cord injury) included in the study.

The urinalysis market in Japan is expected to grow over the forecast period, driven by the rising incidence of chronic diseases and a focus on early diagnosis of kidney infections. For instance, according to an article published in March 2024, around 13 million individuals suffer from chronic kidney diseases in Japan, comprising 13% of the country's adult population. The incidences are projected to increase in the coming years, further boosting the demand for urinalysis to monitor the condition and thereby contributing to market growth.

Latin America Urinalysis Market Trends

Latin America urinalysis market was identified as a lucrative region in this industry owing to improving healthcare infrastructure and increasing awareness about several diseases. As governments invest more in healthcare and diagnostic technologies, demand for affordable and accessible urine testing is rising.

The urinalysis market in Brazil is expected to grow over the forecast period. The country has observed steady rise in the geriatric population thus making the population more susceptible to urinary infections, kidney disorders and diabetes. For instance, according to an article published in August 2024, 15.6 % of Brazil’s population was aged over 60 years in 2023 and this number is projected to reach to reach 38% by 2070 as per the report by IBGE (Brazilian Institute of Geography and Statistics). This scenario increases the need for diagnostic methods including urinalysis.

MEA Urinalysis Market Trends

MEA urinalysis market was identified as a lucrative region in this industry, fueled by increasing healthcare investments and rising awareness of respiratory infections. Improvements in healthcare infrastructure, particularly in countries like Saudi Arabia and the UAE, are driving the adoption of advanced diagnostic technologies.

The urinalysis market in Saudi Arabia is expected to grow over the forecast period, attributed to the increasing healthcare investments and advancements in diagnostic technologies. Rising awareness of chronic kidney disorders and urinary infections, further driving demand for rapid and accurate urine testing.

Key Urinalysis Company Insights

Some of the leading players operating in the market include Abbott, F. Hoffmann-La Roche Ltd., and Siemens Healthineers AG, who are known for their advanced diagnostic solutions and strong market presence. These companies offer a wide range of urinalysis products, catering to hospitals, diagnostic labs, and point-of-care settings.

Emerging players such as Vivoo are leveraging advances in artificial intelligence, automation, and microfluidics to create next-generation diagnostic tools that promise enhanced sensitivity and convenience.

Key Urinalysis Companies:

The following are the leading companies in the urinalysis market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Sysmex Corporation

- Siemens Healthineers AG

- ACON Laboratories, Inc.

- ARKRAY Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Quidel Corporation

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In December 2024, Copan Diagnostics announced FDA approval for its urine collection and transport device “UriSponge” that uses a new formulation of advanced preservatives to maintain specimen stability.

-

In August 2024, Alpha Laboratories Ltd. entered into a partnership with Clinical Design Technologies Ltd. To support the marketing and distribution of world's first digital closed urine testing system

-

In June 2024, Community Health Center (CHC) Marwah introduced a digital urine and blood analyser to revolutionize diagnostic capabilities.

Urinalysis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.70 billion

Revenue forecast in 2030

USD 6.85 billion

Growth Rate

CAGR of 7.83% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product , application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; Sysmex Corporation; Siemens Healthineers AG; ACON Laboratories, Inc.; ARKRAY Inc.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; F. Hoffmann-La Roche Ltd.; Quidel Corporation; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urinalysis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global urinalysis market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Biochemical Urine Analyzer

-

Automated Biochemical Analyzers

-

Semi-automated Urine Sediment Analyzers

-

-

Automated Urine Sediment Analyzers

-

Microscopic Urine Analyzers

-

Flowcytometric Urine Analyzers

-

-

-

Consumables

-

Dipsticks

-

Reagents

-

Disposables

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

UTI Screening

-

Diabetes

-

Kidney Disease

-

Hypertension

-

Liver Disease

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Clinical Laboratories

-

Home Care

-

Research and Academics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global urinalysis market size was estimated at USD 4.37 billion in 2024 and is expected to reach USD 4.70 billion in 2025.

b. The global urinalysis market is expected to grow at a compound annual growth rate of 7.83% from 2025 to 2030 to reach USD 6.85 billion by 2030.

b. North America dominated the urinalysis market with a share of 37.9% in 2024. This is attributable to the introduction of the automated urine sediment analyzers such as digital flow morphology (digital imaging) & fluorescence flow cytometry coupled with high healthcare expenditure in this region.

b. Some key players operating in the urinalysis market include Abbott, ARKRAY, Inc., Bio-Rad Laboratories, Inc., Mindray, F. Hoffmann-La Roche Ltd., Siemens Healthcare, and Sysmex Corporation.

b. Key factors driving the urinalysis market growth include an increasing incidence of UTIs, the introduction of technologically advanced diagnostic instruments, and introduction of point-of-care and at-home urinalysis tests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.