- Home

- »

- Healthcare IT

- »

-

Urgent Care Apps Market Size, Share, Industry Report, 2030GVR Report cover

![Urgent Care Apps Market Size, Share & Trends Report]()

Urgent Care Apps Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Pre-hospital Emergency Care & Triaging Apps), By Clinical Area Type (Trauma, Stroke, Cardiac Conditions), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-114-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Urgent Care Apps Market Size & Trends

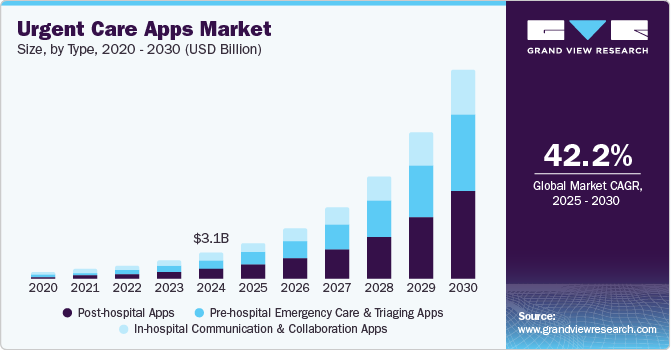

The global urgent care apps market size was valued at USD 3.10 billion in 2024 and is anticipated to grow at a CAGR of 42.2% from 2025 to 2030. The increased demand for convenient healthcare, coupled with advancements in telemedicine, has led to the rise of urgent care apps for quick consultations and treatment. The global expansion of smartphone and internet penetration further supports adopting these apps, making healthcare services more accessible. In addition, urgent care apps are increasingly addressing critical health concerns such as trauma, stroke, and cardiac conditions by offering timely consultations and remote monitoring. These apps enable patients to receive immediate care guidance for life-threatening situations, improving outcomes and reducing emergency room visits.

The growing demand for accessible healthcare and the rise of telemedicine have significantly contributed to the popularity of urgent care apps, enabling patients to receive timely consultations and treatment from the comfort of their homes. These apps offer a convenient alternative to traditional in-person visits, especially for minor health issues. For instance, in June 2023, the Lincolnshire Integrated Care Board (ICB) launched the Shrewd WaitLess app to improve patient flow and reduce hospital waiting times. The app helps manage non-urgent emergency department patients by offering real-time updates on waiting times and directing them to alternative services if needed.

The global expansion of smartphone and internet penetration has made healthcare services more accessible through urgent care apps. As smartphones become universal, patients increasingly turn to mobile platforms for convenient, on-demand healthcare solutions. This widespread adoption drives the growth of urgent care apps, offering quicker access to medical advice and treatment, especially in underserved areas.

Urgent care apps are crucial in addressing critical health concerns such as trauma, stroke, and cardiac conditions by providing timely consultations and remote monitoring. For instance, in June 2024, Australian researchers created a new technology that enables smartphones to detect strokes faster than current methods. Technology uses artificial intelligence to analyze a patient's facial symmetry and muscle movements, as stroke victims often experience facial asymmetry. This advancement aims to provide quicker stroke identification and improve response times for treatment.

Type Insights

Post-hospital apps accounted for the largest share of 43.2% in 2024, which can be attributed to the need for digital solutions that streamline patient care, improve communication, and enhance the tracking and management of health conditions post-treatment. For instance, in November 2024, WoundZoom launched the WoundZoom Light mobile application, designed to assist healthcare providers in post-acute care by offering a digital wound assessment and management solution. The app allows clinicians to capture images, track wound healing progress, and share information for collaborative care. This innovation aims to improve the quality of care, enhance communication, and streamline the wound-healing process in post-acute settings.

The Pre-hospital emergency care & triaging apps segment is expected to grow at the fastest CAGR of 44.2% over the forecast period. Pre-hospital emergency care and triaging apps enhance response times by enabling quick coordination with emergency services. They provide accurate assessments through symptom checklists, ensuring timely and appropriate care. These apps also optimize medical resources by prioritizing critical cases, reducing pressure on emergency departments.

Clinical Area Type Insights

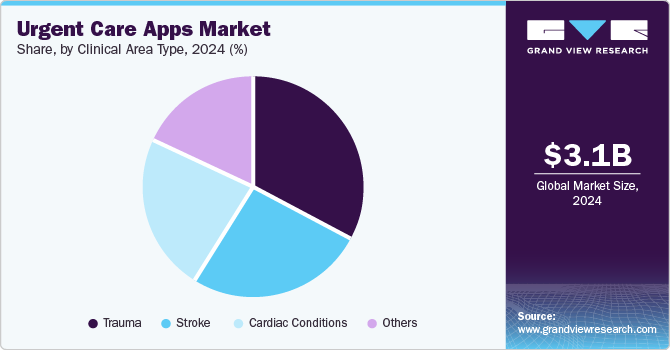

The trauma segment held the largest market share of 32.2% in 2024, which can be attributed to the ability to provide timely and efficient emergency response by connecting victims with trained responders, ultimately improving pre-hospital care and reducing injury-related mortality and morbidity. For instance, in March 2021, the Trauma Care International Foundation launched an Emergency Response app to connect emergency victims with trained volunteer responders. The app aims to improve pre-hospital care in Nigeria, particularly Lagos, by reducing injury-related morbidity and mortality. It complements existing emergency frameworks and offers collaboration opportunities with stakeholders to enhance the country's trauma care system.

The stroke segment is expected to grow at the fastest CAGR of 43.7% over the forecast period attributed to the rapid detection and diagnosis of stroke symptoms, enabling timely medical intervention, and improving patient outcomes. These apps also support real-time monitoring and communication between patients, caregivers, and medical professionals, ensuring swift action during critical moments. In addition, they help optimize emergency resources by facilitating fast access to stroke care facilities, reducing delays in treatment.

Regional Insights

North America urgent care apps market held the largest share of 38.0% in 2024, which can be attributed to the increasing demand for 24/7 virtual healthcare access. This access enables timely consultations, seamless integration with healthcare systems, and reduced physician burnout while offering convenient care for various conditions. For instance, in October 2023, Cedars-Sinai launched the Cedars-Sinai Connect mHealth app, which leverages AI from K Health to provide virtual care for various conditions, including urgent and primary care. The app enables 24/7 access to healthcare professionals, streamlining the intake process and connecting patients with providers for video consultations. It integrates care plans into Cedars-Sinai’s health record system, ensuring seamless transitions between virtual and in-person care while addressing physician burnout.

U.S. Urgent Care Apps Market Trends

The U.S. urgent care apps market held a dominant position in 2024 due to the increasing adoption of advanced mobile health technologies, such as smartphone-based stethoscopes, which enable early detection of medical conditions and enhance personalized care through AI and real-time health data analysis. For instance, in February 2024, Sparrow BioAcoustics Inc. launched the FDA-cleared Stethophone software, turning smartphones into medical-grade stethoscopes to monitor heart health. The app offers advanced visualizations and AI integration, enhancing early cardiac condition detection and personalized care for healthcare providers and consumers.

Europe Urgent Care Apps Market Trends

The Europe urgent care apps market was identified as a lucrative region in 2024. Driving factors for the Europe urgent care apps market include the increasing demand for quick access to healthcare, particularly in remote or underserved areas. Integrating telemedicine, real-time health monitoring, and AI-driven diagnostics enhances patient care. In addition, growing healthcare costs and the need to optimize healthcare resources are pushing the adoption of urgent care apps to improve efficiency and reduce pressure on emergency services.

Asia Pacific Urgent Care Apps Market Trends

The Asia Pacific urgent care apps market is anticipated to grow at a CAGR of 5.5% during the forecast period. A key driving factor for the Asia Pacific urgent care apps market is the growing adoption of AI-enabled platforms that provide healthcare professionals with real-time access to patient data, facilitate virtual consultations, and enhance healthcare delivery, particularly in remote areas. For instance, in April 2022, HealthPlix, an Indian health tech startup, launched a mobile version of its AI-enabled EMR platform, HealthPlix Spot. This platform provides doctors with real-time access to patient information and enables virtual consultations. The app features appointment management, automated reminders, and telehealth services to improve healthcare delivery, especially in remote areas of India. It has been adopted by doctors across over 350 cities, enhancing accessibility and efficiency in patient care.

The China urgent care apps market held the largest market share in 2024. The urgent care apps market in China is driven by increasing healthcare demands, especially among urban and aging populations seeking convenient access to medical advice and triage. Adopting 4G and 5G networks and AI and machine learning integration enhances remote consultation services. Government initiatives to support digital health and telemedicine in rural areas further fuel the growth of mobile healthcare platforms.

India urgent care apps market is expected to grow at the fastest CAGR of 45.2% over the forecast period. The widespread smartphone penetration, especially in rural areas with growing internet access, positions India as a ripe market for urgent care apps, driven by the increasing digital connectivity and demand for accessible healthcare solutions. For instance, as of January 2023, India had over 700 million smartphone users, including 425 million in rural areas. Over half of the population uses smartphones, and active internet users have grown by 45% since 2019, positioning rural India as a key driver of the global smart revolution.

Key Urgent Care Apps Company Insights

Some of the key companies in the urgent care apps market include Allm Inc., Johnson & Johnson Services, Inc., PatientSafe Solutions (Stryker), AlayaCare and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Medtronic is a global medical technology company that designs, develops, and manufactures various medical devices for treating heart valve disorders, heart failure, vascular diseases, neurological disorders, and musculoskeletal issues. The company also provides biologic solutions for orthopedics and dental markets.

-

Merit Medical Systems develops single-use medical devices for interventional and diagnostic procedures, including catheters, embolotherapy products, and fluid dispensing systems. Their products are widely used across fields such as cardiology, radiology, oncology, vascular surgery, and pain management.

Key Urgent Care Apps Companies:

The following are the leading companies in the urgent care apps market. These companies collectively hold the largest market share and dictate industry trends.

- Allm Inc.

- Johnson & Johnson Services, Inc.

- PatientSafe Solutions (Stryker)

- AlayaCare

- Twiage Solutions Inc.

- TigerConnect

- Siilo from Doctolib

- Imprivata, Inc.

- Medisafe

Recent Developments

-

In June 2024, the University of Ottawa Heart Institute partnered with TELUS to launch a smartphone app to enhance the efficiency of emergency cardiac care. The app improves communication between paramedics, emergency teams, and cardiac specialists, enabling faster treatment for heart attack patients.

-

In May 2023, Zocdoc, Inc. expanded its platform by adding urgent care services, enabling patients to quickly access care for acute medical issues. The service connects users with nearby urgent care providers for same-day or next-day appointments, streamlining the process of finding immediate healthcare.

-

In August 2021, the Mount Sinai Health System launched a mobile app to enhance care for heart attack patients by streamlining communication among care teams and expediting treatment. The app provides real-time data and notifications to coordinate between paramedics, emergency departments, and cardiologists, improving response times during critical moments.

Urgent Care Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.34 billion

Revenue forecast in 2030

USD 25.23 billion

Growth Rate

CAGR of 42.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, clinical area type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Allm Inc.; Johnson & Johnson Services, Inc.; PatientSafe Solutions (Stryker); AlayaCare; Twiage Solutions Inc.; TigerConnect; Siilo from Doctolib; Imprivata, Inc.; Medisafe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urgent Care Apps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global urgent care apps market report based on type, clinical area type, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-hospital Emergency care & Triaging Apps

-

In-hospital Communication & Collaboration Apps

-

Post-hospital Apps

-

Medication Management Apps

-

Rehabilitation Apps

-

Care Provider Communication & Collaboration Apps

-

-

-

Clinical Area Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Trauma

-

Stroke

-

Cardiac Conditions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.