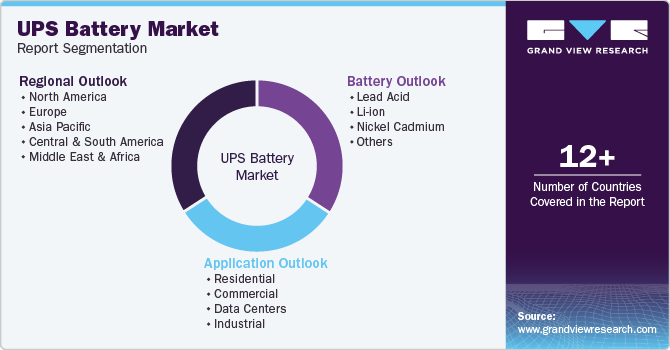

UPS Battery Market Size, Share & Trends Analysis Report By Battery (Lithium-ion, Lead Acid, Nickel Cadmium), By Application (Residential, Commercial, Data Centers, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-539-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

UPS Battery Market Size & Trends

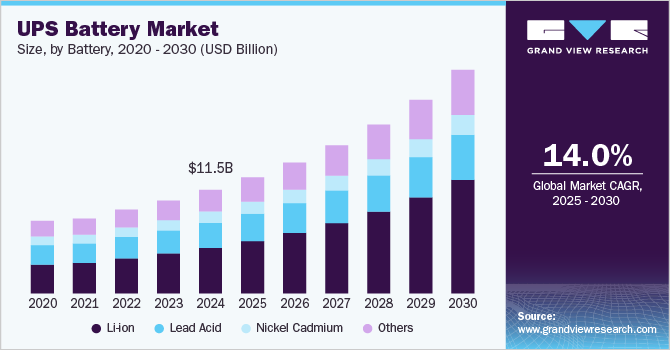

The global UPS battery market size was valued at USD 11.49 billion in 2024 and is expected to grow at a CAGR of 14% from 2025 to 2030. The rapid digitization of industries and the growing reliance on data centers, cloud computing, and IoT have significantly boosted the demand for uninterrupted power supply systems. Data centers require reliable power backup to prevent costly downtimes and ensure seamless operations. This has led to the adoption of advanced UPS batteries, particularly lithium-ion (Li-ion) batteries, which offer higher energy density, longer lifespan, and faster recharge times than traditional lead-acid batteries.

The Asia Pacific region has emerged as a key growth driver for the market. Rapid industrialization, urbanization, and digital transformation in countries like China, India, and Japan have fueled the demand for reliable power backup solutions. The expansion of IT infrastructure and telecommunications in this region further amplifies the need for UPS systems to support critical operations during power disruptions.

Sustainability concerns are reshaping market dynamics. Businesses worldwide are increasingly prioritizing eco-friendly solutions to reduce their environmental footprint. Li-ion batteries are gaining traction due to their lower environmental impact than traditional lead-acid batteries. This shift aligns with corporate sustainability goals and regulatory mandates that emphasize reducing carbon emissions.

Additionally, technological advancements in battery design and integration with innovative technologies have driven market growth. Features like remote monitoring and intelligent automation enhance operational efficiency and reliability, making UPS systems more attractive to various industries. These innovations cater to the evolving needs of a digitally interconnected world.

The post-pandemic economic recovery has also contributed to market expansion. Increased energy consumption across automotive, industrial manufacturing, and consumer goods sectors has driven demand for efficient power backup solutions. Furthermore, businesses invest in UPS systems to ensure resilience against future disruptions.

Lastly, regional dynamics play a crucial role in shaping market trends. North America remains dominant due to its robust technological infrastructure and growing data center investments. Meanwhile, Europe’s focus on sustainability and renewable energy integration drives the adoption of advanced UPS battery technologies. Together with Asia Pacific's rapid growth, these regions highlight diverse yet interconnected market expansion.

The UPS battery industry faces several challenges that impact its growth and sustainability. One of the primary concerns is the volatility of raw material costs and supply chain disruptions. The high and fluctuating prices of materials such as lithium, cobalt, and nickel pose a significant challenge, as these components account for a substantial portion of the battery cost. Additionally, geopolitical tensions and supply disruptions further complicate the supply chain. The increasing demand for these materials from other sectors, like electric vehicles, exacerbates the issue, making it difficult for UPS battery manufacturers to maintain stable pricing and supply.

UPS battery failures and maintenance are another critical challenge. Battery failures can lead to significant financial losses, particularly in critical infrastructure sectors like data centers. Regular inspections and maintenance are crucial to mitigate these risks. However, ensuring the reliability and longevity of UPS systems while managing maintenance costs is a delicate balance. This requires sophisticated monitoring systems and skilled personnel, which can be resource-intensive

Battery Insights

The lithium-ion battery was the most significant and fastest-growing UPS battery and had a market revenue of USD 5.07 billion in 2024. The growth of lithium-ion (Li-ion) batteries in the UPS market is primarily driven by their superior performance characteristics and adaptability across various applications. Li-ion batteries offer a higher energy density, longer lifespan, and lower maintenance requirements than traditional lead-acid batteries, making them the preferred choice for critical sectors such as data centers, telecommunications, and industrial operations. For instance, in data centers, where even a second of downtime can lead to significant financial losses, Li-ion batteries provide reliable power backup with faster recharge cycles and stable power delivery. Their compact size and lightweight design save valuable space in high-demand environments like data centers and communication base stations. The scalability of Li-ion systems also allows businesses to adjust their power backup capacity as operational needs evolve, further fueling their adoption in these sectors.

Environmental sustainability is another key factor driving the growth of Li-ion batteries. With increasing regulatory pressures to minimize hazardous waste and reduce carbon footprints, industries are transitioning to greener technologies. Li-ion batteries are more eco-friendly than lead-acid alternatives, as they do not contain toxic materials like lead or sulfuric acid. Their longer lifespan also reduces the frequency of replacements, lowering overall waste generation. Moreover, the global rollout of 5G and the expansion of telecommunications infrastructure have heightened the demand for reliable power solutions that can handle higher energy loads efficiently. As industries prioritize energy efficiency and sustainability, adoption of Li-ion batteries continues to rise across diverse applications.

Despite the growing popularity of Li-ion batteries, lead-acid batteries are a significant player in the UPS market due to their cost-effectiveness and widespread availability. The lead acid battery market accounted for approximately 35% of the market share in 2024. These batteries are particularly favored in applications where budget constraints are a primary consideration. Their relatively low upfront cost makes them an attractive option for small- to medium-scale businesses and residential users seeking reliable power backup solutions without significant capital investment. Lead-acid batteries are also widely used in industrial applications where weight and size are less critical than cost efficiency. Their ability to deliver high surge currents further enhances their suitability for specific use cases like heavy machinery and emergency power systems.

However, the growth of lead-acid batteries is increasingly challenged by environmental concerns and advancements in alternative battery technologies. Lead-acid batteries contain hazardous materials like lead and sulfuric acid, which pose significant disposal and recycling challenges. Regulatory pressures to adopt more sustainable practices have led many industries to explore greener alternatives like Li-ion batteries. Nonetheless, lead-acid batteries remain a strong presence in regions with limited access to advanced battery technologies or where affordability is a key consideration. Their reliability in providing short-term backup power during outages ensures that they remain relevant in specific segments of the UPS market.

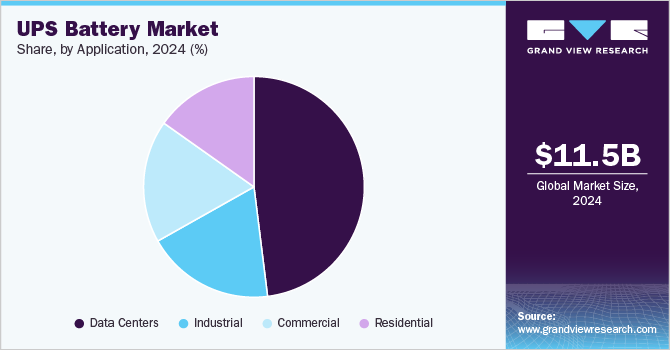

Application Insights

Industrial applications of UPS batteries is expected to grow at a CAGR of 13.2% from 2025 to 2030. Industrial operations require continuous power supply to maintain productivity and prevent costly downtime. UPS systems provide essential backup power during outages or grid fluctuations, ensuring that critical machinery and equipment remain operational. This reliability is crucial in sectors like manufacturing, where even brief power interruptions can lead to significant losses. Rising Adoption of Automation and Digitization: The industrial sector is undergoing rapid automation and digitization, increasing reliance on electronic systems and data-driven operations. As industries adopt more sophisticated technologies, the need for uninterrupted power supply grows, driving the demand for UPS batteries.

The shift towards renewable energy sources like solar and wind power necessitates advanced energy storage solutions to stabilize the grid and manage intermittent energy supply. Industrial batteries, including UPS systems, play a vital role in this transition by providing reliable backup power and supporting grid stability. Advances in battery technology, such as improvements in lithium-ion batteries, have enhanced the efficiency, safety, and cost-effectiveness of UPS systems. These advancements make UPS batteries more appealing for industrial applications, where reliability and performance are paramount.

UPS battery applications in data centers accounted for a market revenue of USD 5.52 billion in 2024. The growth of the UPS battery industry for data centers is driven by several factors, reflecting the increasing importance of reliable power backup in a rapidly digitalizing world. One of the primary reasons for this growth is the surge in data generation, storage, and consumption fueled by emerging technologies such as 5G, edge computing, IoT, and artificial intelligence. Data centers are critical infrastructure for managing these technologies, and their operations require uninterrupted power supply to ensure uptime and prevent costly disruptions. With hyperscale data centers rising globally, particularly in regions like Asia Pacific and North America, there is a growing demand for advanced UPS systems to handle increasing workloads. The adoption of modular UPS systems, which offer scalability, reliability, and cost-efficiency, has further boosted market growth. These systems are critical in hyperscale and Tier III/IV data centers where power redundancy and energy efficiency are crucial.

Another significant driver is the shift toward sustainable and energy-efficient solutions. Lithium-ion batteries are increasingly being adopted in data centers due to their higher energy density, longer lifespan, and smaller physical footprint compared to traditional lead-acid batteries. These batteries also require less maintenance and offer faster recharge times, making them ideal for modern data centers focused on reducing operating expenses (OPEX) and environmental impact. Furthermore, the trend toward green facilities powered by renewable energy sources has led to greater integration of advanced UPS technologies. As businesses prioritize sustainability alongside operational efficiency, investments in lithium-ion-based UPS systems continue to grow.

Regional Insights

The North America UPS battery market was valued at USD 2.27 billion in 2024. Several key factors drive the growth of UPS batteries in North America. A significant factor contributing to market growth is the integration of advanced battery technologies, particularly lithium-ion batteries. These batteries offer superior performance characteristics, including longer lifespans, higher energy density, and reduced maintenance requirements, making them more appealing for data centers and other critical infrastructure. The adoption of lithium-ion batteries enhances the efficiency and reliability of UPS systems, which is crucial for maintaining high uptime levels in data centers and other mission-critical facilities. Lithium-ion batteries' compact size and faster recharge times provide flexibility and scalability, allowing businesses to adjust their power backup capacity as operational needs evolve.

U.S. UPS Battery Market Trends

The U.S. UPS battery market is expected to exceed USD 2.26 billion by 2030. Regulatory and sustainability initiatives play a crucial role in driving market growth. There is a growing focus on sustainability and energy efficiency in the U.S., which encourages the adoption of advanced UPS technologies. This includes the integration of renewable energy sources and the development of more eco-friendly battery solutions. For instance, government initiatives like the Federal Energy Management Program set standards for power storage technology, promoting innovation in this sector. As businesses prioritize sustainability alongside operational efficiency, investments in lithium-ion-based UPS systems continue to grow. The emphasis on reducing carbon footprints and minimizing environmental impact aligns with the advantages of lithium-ion batteries, further boosting their adoption in the U.S.

Asia Pacific UPS Battery Market Trends

The Asia Pacific UPS battery market dominated the global market with revenue share of 36.51% in 2024 and is expected to grow at a CAGR of 13.4% from 2025 to 2030. Rapid urbanization and industrialization across countries like China, India, Japan, and South Korea are significant growth drivers. These nations are experiencing an increased demand for uninterrupted power supplies to support their economic progress. The expansion of IT infrastructure, including data centers and colocation facilities, is also a significant factor. The BFSI sector, comprising insurance firms, commercial banks, and non-banking financial companies, relies heavily on UPS systems to ensure continuous operations for critical services like ATMs, monetary transfers, and online transactions. The Asia Pacific region's strong manufacturing base and investments in grid-level energy storage create substantial opportunities for industrial battery manufacturers. The escalating demand from renewable energy sectors and electric vehicle adoption also propels market expansion. Overall, the combination of technological advancements, increasing demand for reliable power, and government support for clean energy transitions is driving the growth of the UPS battery industry in Asia Pacific.

Key UPS Battery Company Insights

The global UPS battery industry exhibits a competitive landscape characterized by the presence of both established players and emerging companies, driven by technological advancements and evolving consumer demands. Major players such as Schneider Electric, Eaton Corporation, East Penn Manufacturing, Exide Industries, and CSB Energy Technology Co., Ltd dominate the market due to their strong product portfolios, extensive distribution networks, and focus on innovation. These companies are heavily investing in research and development to improve battery technologies, particularly lithium-ion (Li-ion) batteries, which are increasingly preferred for their superior energy density, longer lifespan, and reduced maintenance requirements.

The market is witnessing a shift towards advanced battery solutions as organizations across industries prioritize uninterrupted power supply to safeguard critical operations. Li-ion batteries are gaining traction globally due to their efficiency and sustainability, gradually replacing traditional lead-acid batteries in many applications. However, lead-acid batteries remain relevant in cost-sensitive markets and among small- to medium-sized enterprises (SMEs) seeking affordable solutions. The competitive environment is further shaped by regional dynamics: North America leads the market with significant investments in data centers and telecommunications infrastructure, while Asia Pacific is the fastest-growing region due to rapid industrialization and urbanization. Europe focuses on sustainability-driven innovations while emerging markets in Latin America, the Middle East & Africa offer growth opportunities as infrastructure development accelerates.

Key UPS Battery Companies:

The following are the leading companies in the UPS battery market. These companies collectively hold the largest market share and dictate industry trends.

- Schneider Electric

- Eaton Corporation

- Vertiv Group Corp.

- Emerson Electric Co.

- Delta Electronics, Inc.

- Exide Industries Limited

- GS Yuasa International Ltd.

- East Penn Manufacturing Company

- EnerSys

- Vision Group

UPS Battery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 12.88 billion |

|

Revenue forecast in 2030 |

USD 24.81 billion |

|

Growth Rate |

CAGR of 14% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Battery, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia |

|

Key companies profiled |

Schneider Electric; Eaton Corporation; Vertiv Group Corp.; Emerson Electric Co.; Delta Electronics, Inc.; Exide Industries Limited; GS Yuasa International Ltd.; East Penn Manufacturing Company; EnerSys; Vision Group |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global UPS Battery Market Trends Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global UPS battery market report by battery, application and region:

-

Battery Outlook (Revenue, USD Billion; 2018 - 2030)

-

Lead Acid

-

Li-ion

-

Nickel Cadmium

-

Others

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Residential

-

Commercial

-

Data Centers

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global UPS battery market size was estimated at USD 11.49 billion in 2024 and is expected to reach USD 12.88 billion in 2025.

b. The global UPS battery market is expected to grow at a compound annual growth rate of 14% from 2025 to 2030 to reach USD 24.81 billion by 2030.

b. The Asia Pacific UPS battery market accounted for more than 36% revenue share in 2024. Rapid urbanization and industrialization across countries like China, India, Japan, and South Korea are significant growth drivers. These nations are experiencing an increased demand for uninterrupted power supplies to support their economic progress. The expansion of IT infrastructure, including data centers and colocation facilities, is also a significant factor.

b. The key players in the UPS battery market include Schneider Electric, Eaton Corporation, Vertiv Group Corp., Emerson Electric Co., Delta Electronics, Inc., Exide Industries Limited, GS Yuasa International Ltd., East Penn Manufacturing Company, EnerSys, and Vision Group, among others.

b. Key factors that are driving market growth include the rapid digitization of industries and the growing reliance on data centers, cloud computing, and IoT.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."