- Home

- »

- Medical Devices

- »

-

Upper Limb Prosthetics Market Size & Share Report, 2030GVR Report cover

![Upper Limb Prosthetics Market Size, Share & Trends Report]()

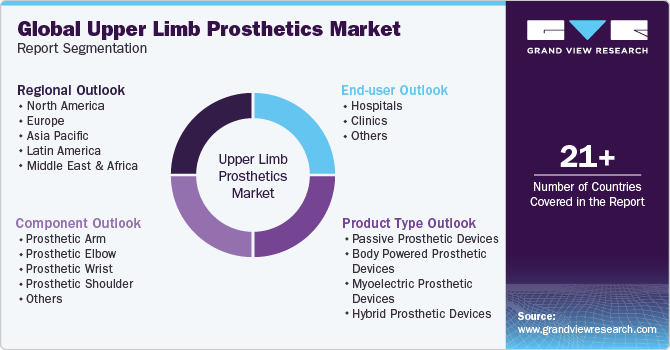

Upper Limb Prosthetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Prosthetic Wrist, Prosthetic Arm), By Product Type (Passive Prosthetic Devices, Body Powered Prosthetic Devices), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-175-3

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Upper Limb Prosthetics Market Summary

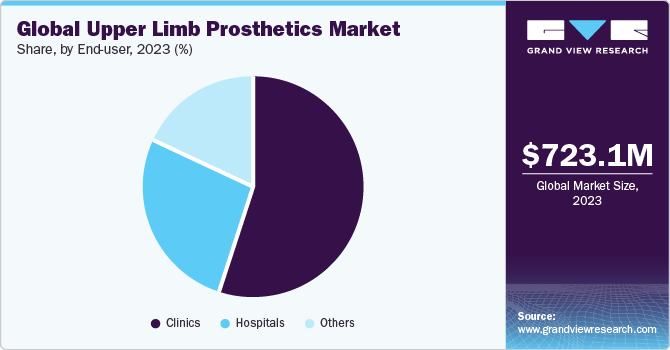

The global upper limb prosthetics market size was estimated at USD 723.1 million in 2023 and is projected to reach USD 1.03 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. Factors such as growing prevalence of osteosarcoma across the globe, increasing incidence of sports injuries, and rising number of road accidents are driving the market growth.

Key Market Trends & Insights

- North America dominated the overall upper limb prosthetics sector with a revenue share of 45.8% in 2023.

- The soil stabilization market in China is one of the most dynamic and significant sectors in the world.

- Based on end-user, the clinics segment held the largest revenue share in 2023 and is anticipated to witness the fastest market growth over the forecast period.

- Based on component, the prosthetic arm segment held the largest revenue share of 30.9% in 2023 and is anticipated to witness the fastest CAGR over the forecast period.

- Based on product type, the passive prosthetic devices segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 723.1 Million

- 2030 Projected Market Size: USD 1.03 Billion

- CAGR (2024-2030): 5.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to The Johns Hopkins University, in the U.S. over 3.5 million children aged 14 and above suffer from sports injuries annually. These injuries are anticipated to drive the market growth. Rapid technological advancements have also been a key driver for the growth of the market. The use of biosensor technology, better materials, artificial intelligence, non-invasive methods, and other tools are behind the rapidly evolving field of prosthetics. These advanced technologies are still being developed and tested and are attributed to revolutionizing the market. For instance, in July 2021, Össur introduced the new Rebound Post-Op Elbow Brace, a lightweight adjustable brace with non-invasive prosthetics intended to optimize the fitting experience for physicians and patients recovering from surgical procedures and severe elbow injury. Such innovations contribute to the overall growth of the market globally.

Furthermore, rise in the number of road accidents is one of the major factors contributing to market growth. Road accidents lead to severe injuries, such as loss or irreparable damage to upper limbs and upper limb amputations. For instance, according to an article published by the European Commission, 20,640 deaths were reported on European roads in 2022. Similarly, according to data published by the World Health Organization (WHO) in June 2022, around 1.3 million people die from road traffic crashes annually. Thus, rising road accidents lead to increased demand for upper limb prosthetics.

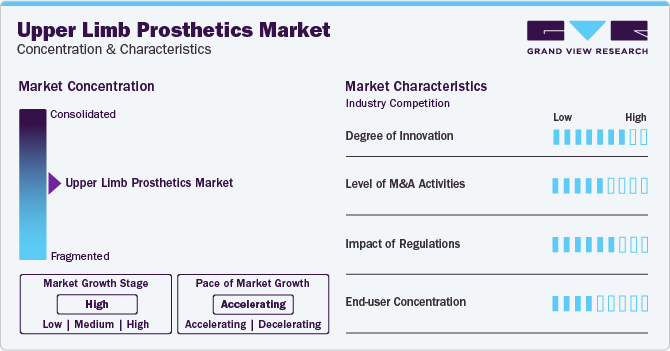

Market Concentration & Characteristics

The global upper limb prosthetics industry is characterized by new technologies, high innovation, and especially robotics prosthetics being developed and introduced. Upper limb robotics prosthetics have become popular due to their aesthetically appealing looks, human-like movements, feel more like regular limbs, and are more agile. As a result, market players invest in novel and innovative technologies to meet the customer demand.

Several market players, such as Össur, Ottobock, and Steeper Group are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. The trend of M&A activity in the market is expected to continue in the coming years. This is driven by factors such as the growing global demand for upper limb prosthetics products and services, increasing adoption of innovative technologies, and the potential for cost optimization through consolidation.

The government invests in a growing number of research and development activities in prosthetics and supports regulatory submissions to obtain regulatory approval, as these prosthetics are considered medical devices. This may increase the cost of developing novel and technologically advanced upper limb prosthetics.

The substitute for upper limb prosthetics is an osseointegration limb replacement surgery, as it improves mobility, eliminates problems associated with sockets, and reduces nerve pain. For instance, the Hospital for Special Surgery, a New York-based Osseointegration Limb Replacement Center, provides technologically advanced and novel amputation reconstruction surgery for individuals not interested in using a traditional prosthetic socket.

End-user Insights

The clinics segment held the largest revenue share in 2023 and is anticipated to witness the fastest market growth over the forecast period. The increased prevalence of limb amputation, propelled by factors such as accidents, diabetes, vascular diseases, and sports injuries, drives the demand for specialized clinic services in this field. Moreover, clinics that provide personalized and customized prosthetic solutions with skilled professionals providing expert evaluation, fitting, and ongoing care for prosthetic limbs tend to attract more patients and promote the segment's growth.

The hospitals segment shows significant growth over the forecast period. Hospitals offer and adopt novel and modern prosthetic technologies and devices, attracting patients seeking advanced and innovative solutions. These factors are anticipated to propel the growth of this segment. Moreover, patients often perceive hospitals as trustworthy and secure environments for such treatments, enhancing their preference for treatments in these settings.

Regional Insights

North America dominated the overall upper limb prosthetics sector with a revenue share of 45.8% in 2023.Factors such as a strong distribution network, a high presence of key market players, and a well-established healthcare infrastructure drive the growth of the market in this region. In addition, developing and customizing prosthetic devices as per patients' functional needs and using new polymer materials contributed to the growth of the market in North America.

The key market players are developing lightweight, technologically advanced, and long-lasting upper limb prosthetics to satisfy users' needs. For instance, in September 2021, Researchers at the Cleveland Clinic developed a bionic arm for individuals with upper-limb amputations that enables users to think, act, and function similarly to individuals without amputations. Such factors are responsible for growth of the market in this region. The U.S. dominated North America market due to an increase in prosthetic surgeries, accidents, and traumas, the availability of advanced healthcare facilities staffed by trained medical professionals, and an increase in demand for prosthetic devices in the country.

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period.The market in the region is expected to grow due to factors such as greater healthcare spending and a growing older population with a higher incidence of osteoarthritis, osteoporosis, bone injuries, & obesity. The rapidly developing healthcare infrastructure in major countries, such as India, China, & Japan, and the booming medical tourism industry are propelling demand for these devices in the region.

Component Insights

The prosthetic arm segment held the largest revenue share of 30.9% in 2023 and is anticipated to witness the fastest CAGR over the forecast period owing to rise in road accidents, increasing geriatric population, and increased prevalence of joint disorders such as osteoarthritis in both developed and developing countries. For instance, according to the Centers for Disease Control and Prevention, during 2019 – 2021, about 53.2 million people had doctor-diagnosed arthritis. Due to such factors, there is an increase in the demand for prosthetic arms.

The prosthetic wrist segment shows substantial growth over the forecast period. Factors such as cost efficiency, high wrist arthroplasty success rate, and increased incidence of wrist amputations drive the segment’s growth. It provides benefits such as natural movement patterns and enhanced upper limb range motion, contributing to increased product penetration. For instance, a study published by the National Center for Biotechnology Information highlights significant advancements in prosthetic wrist functionality that empower users with improved quality of life.

Product Type Insights

The passive prosthetic devices segment held the largest revenue share in 2023. The growth of this segment is attributed to factors such as a rise in demand for upper limb prosthetic surgeries, increased number of amputees, advancements in prosthetic devices, and growing awareness of prosthetic devices among patients. For instance, according to data published by Ohio State University, around 3 million people across the globe have an arm amputation. Similarly, according to the same source, in the U.S., 2 million people live with limb loss. Thus, an increase in cases of amputations leads to a rise in market growth.

The body-powered prosthetic devices segment is estimated to register the fastest CAGR over the forecast period. These devices generally have simpler designs and fewer components, resulting in a cost-effective option for patients. In addition, these devices are characterized by fewer electronic components, which reduces the need for frequent repairs and risk of malfunctions, thereby improving patient satisfaction. The accessibility and cost-effectiveness of these devices make them suitable for regions with limited resources. The World Health Organization (WHO) emphasizes the importance of these prosthetic solutions and promoting body-powered devices in resource-constrained settings.

Key Companies & Market Share Insights

-

Össur, Ottobock, and Steeper Group. are some of the dominant players operating in the global market.

-

Össur has over 2,000 patents and invests in research and development to strengthen its market position.

-

Ottobock has a presence in more than 50 countries and has over 240 of its patient care centers across the globe.

-

Steeper Group. has a wide range of product portfolios, including upper and lower-limb prosthetics.

-

Fillauer LLC, Open Bionics, Comprehensive Prosthetics & Orthotics, and COAPT LLC. are some of the emerging market players functioning in the global market.

-

Fillauer LLC has its presence globally and provides prosthetics solutions that enhance patients' lives.

-

Open Bionics partnered with leading prosthetic clinics around the world to provide Hero Arms to patients. The company made bionic limbs more affordable and accessible to a wider population, improving the lives of people with limb differences.

Key Upper Limb Prosthetics Companies:

- Össur

- Ottobock

- Steeper Group.

- Fillauer LLC

- Open Bionics

- Comprehensive Prosthetics & Orthotics

- COAPT LLC.

- Mobius Bionics.

- Protunix

- Motorica

Recent Developments

-

In September 2023, Össur's upper limb R&D facility received funding grant to support the development of new upper limb prosthetic solutions from Scottish Enterprise.

-

In July 2021, Stryker unveiled the Tornier shoulder arthroplasty portfolio and introduced its first product, the Perform Humeral Stem. It is available in multiple lengths, allowing for the optimization of humeral fit.

Upper Limb Prosthetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 759.3 million

Revenue forecast in 2030

USD 1.03 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Össur; Ottobock; Steeper Group; Fillauer LLC; Open Bionics; Comprehensive Prosthetics & Orthotics; COAPT LLC; Mobius Bionics; Protunix; Motorica

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Upper Limb Prosthetics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global upper limb prosthetics market report based on component, product type, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Prosthetic Arm

-

Prosthetic Elbow

-

Prosthetic Wrist

-

Prosthetic Shoulder

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passive Prosthetic Devices

-

Body Powered Prosthetic Devices.

-

Myoelectric Prosthetic Devices

-

Hybrid Prosthetic Devices

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global upper limb prosthetics market size was estimated at USD 723.1 million in 2023 and is expected to reach USD 759.3 million in 2024.

b. The global upper limb prosthetics market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 1.03 billion by 2030.

b. North America dominated the upper limb prosthetics market with a share of 45.8% in 2023 Factors such as a strong distribution network, a high presence of key market players, and a well-established healthcare infrastructure drive the growth of the market in this region.

b. Some key players operating in the upper limb prosthetics market include Össur, Ottobock, Steeper Group., Fillauer LLC, Open Bionics, Comprehensive Prosthetics & Orthotics, COAPT LLC., Mobius Bionics., Protunix, Motorica

b. Key factors that are driving the market growth include growing prevalence of osteosarcoma across the globe, increasing incidence of sports injuries, and rising number of road accidents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.