Unsaturated Polyester Resin Market Size, Share & Trends Analysis Report By Product (DCPD, Orthophthalic, Isophthalic), By End-use, By Form (Liquid Form, Powder Form), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-283-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global unsaturated polyester resin market size was valued at USD 12.2 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Recent developments in the construction and end-use of tanks & pipes are likely to drive demand for isophthalic compounds in these segments. The increase in the use of environment-friendly and energy-saving products is also expected to have a positive impact on the market during the forecast period. Unsaturated polyester resins are primarily used for glass fiber-reinforced plastics (FRP). In addition, owing to their various physical and chemical properties such as excellent tensile strength, impact strength, bonding strength, and corrosion & heat resistance, these resins are widely utilized for construction material, housing equipment, and transportation equipment. Ongoing R&D in bio-based unsaturated polyester resins is likely to drive market growth as they provide recyclability, superior strength, and thermal & corrosion resistance at lower thicknesses. Technological breakthroughs, innovations, and research carried out to expand the product range are designed to stimulate demand.

The growth of the construction industry in the U.S. is an important factor driving the market for unsaturated polyester resins (UPR) in the country. The U.S. construction industry has seen favorable growth in recent years, driven by infrastructure development, new import tariffs, changing trade agreements, a strong economy, a proliferation of mega-projects, a focus on smart cities, and an increase in the number of households. Construction projects such as TEXRail in New York, USA are spurring the growth of the construction sector, thus driving demand for unsaturated polyester resin in the country.

The energy sector in the country has witnessed significant growth in recent years. According to the World Wind Energy Association, the U.S. was the second-largest market in terms of the new addition of wind energy generation capacity of 93 GW, yielding a cumulative total of 743 GW in 2020. In the past few years, wind energy witnessed a huge deployment in electricity generation.

For instance, Texas added 4.1 GW of wind energy generation capacity in 2020 and increased its capacity to 32.6 GW. The investment in wind power projects is increasing owing to the vast benefits of these projects, such as cost-competitiveness over non-renewable sources of energy, potential environmental benefits, excellent reliability, and high efficiency. This is likely to drive the demand for unsaturated polyester resin in wind energy end-use over the forecast period.

Product Insights

In terms of revenue, orthophthalic emerged as the largest product segment and accounted for over 35% of the market in 2022. Its properties such as corrosion resistance, low thermal stability and low cost compared to other substitutes make it suitable for various industries. The lighter weight of the orthophthalic coating also makes it easier to use and transport.

DCPD is a white crystalline compound obtained from the separation of C5 petroleum products such as gas oils, naphtha, and crude oil. Dicyclopentadiene (DCPD) polymerizes to form PDCPD, which has properties such as high deformation temperature, high chemical corrosion resistance, and high impact resistance.

PDCPD is commonly used for construction machinery, tractors, buses, and trucks. Increased penetration of dicyclopentadiene (DCPD) into marine products such as pleasure boats due to low resin shrinkage without fiber addition is expected to boost segment growth over the forecast period. In addition, DCPD's low VOC emissions and styrene content are likely to drive demand for it as an alternative to orthophthalic resin in the coming years.

Form Insights

The liquid form segment of unsaturated polyester resin dominated the market and accounted for more than 72.0% of revenue share in 2022. It is primarily driven by the growth in the construction, electronics, and glass industries due to their use for coating, insulation, and other purposes. The liquid form of Unsaturated Polyester Resin (UPS) and unsaturated polyester resin-based composites are widely used in construction.

In addition, Unsaturated Polyester Resins (UPR) are produced on a large scale by a large number of companies including Ashland, Reichhold, and Royal DSM. They are usually sold in liquid form in an unsaturated and reactive solvent, generally, styrene, which is available in grades of various viscosities, unsaturations, and cure rates. In addition, resins modified with DCPD are produced by companies such as Deltech, Polynt, Dow Inc., and others.

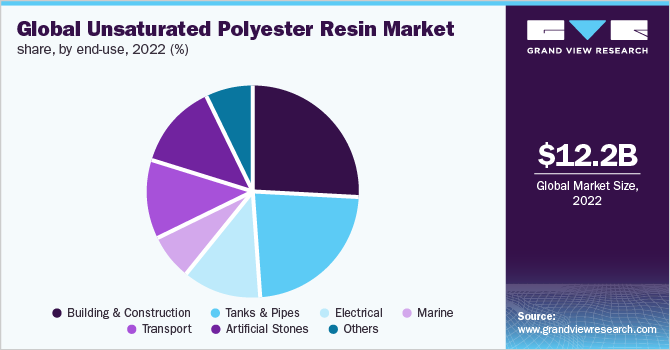

End-use Insights

In terms of revenue, building and construction dominated as the largest end-use segment and accounted for over 25% of the market in 2022. In construction, UPR is increasingly being used in roofing, reinforcement, concrete, and composites in domestic structures, factories, buildings, and public transportation products. Infrastructure development in Brazil, Russia, India, China, South Africa (BRICS), and the Middle East countries is driving the global construction market, which in turn will boost demand for unsaturated polyester resins over the forecast period.

Growing concerns about corrosion associated with metallic tanks and pipes, coupled with the growing importance of tank management in offshore and onshore oil and gas products, have increased the scope for fiber-reinforced plastic (FRP) tanks and pipes. The growing demand for FRP tanks and pipes is expected to drive growth in the unsaturated polyester resin market over the next eight years. In addition, increased drilling for crude oil in offshore areas, which are more susceptible to corrosion in Brazil and the Middle East, is likely to increase the use of fiber-reinforced plastic in the coming years.

The increasing demand for unsaturated polyester resin (UPR) in printed circuit boards, due to their preferable properties such as durability and unparalleled rigidity, is expected to have a positive impact on the unsaturated polyester resin (UPR) market in the near future. In addition, the growing demand for composites in solder trays, speaker enclosures, and reinforced cell phones is expected to drive growth in the unsaturated polyester resin (UPR) market during the forecast period. However, the availability of alternative polymer resins such as nylon and epoxy for composite production is expected to limit the demand for unsaturated polyester resin in electrical applications.

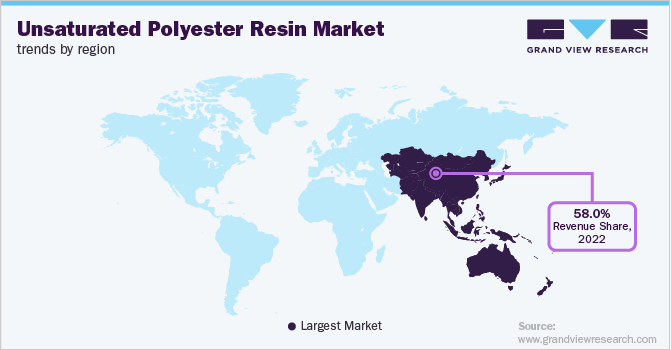

Regional Insights

Asia Pacific region dominated the market and accounted for the largest revenue share of more than 58.0% in 2022. The market is driven by growth in key end-use industries such as transportation, construction, electronics, and marine. A strong automotive manufacturing base in China, Japan, and India, coupled with an increase in passenger car sales, is expected to drive growth in the unsaturated polyester resin market in the near future.

In addition, favorable policies such as Foreign Direct Investment (FDI) and "Make in India" implemented by the Government of India are expected to create ample room for growth in the automotive industry, which in turn will increase the consumption of unsaturated polyester resin in automotive products. The market for unsaturated polyester resins in North America is mainly driven by growth in the construction, electronics, and manufacturing sectors. Unsaturated polyester resin and unsaturated polyester resin-based composites are widely used in the construction sector and in other products such as tanks and pipes. Recovery of the construction industry in the region, owing to the increasing demand for non-residential construction projects such as hospitals, schools, and colleges, is expected to positively impact the North American market over the forecast period.

Key Companies & Market Share Insights

Key companies in the market compete based on the quality of products offered. Leading market players compete based on their product development capabilities and new technologies used in product formulations.

Established players such as BASF SE, DSM N.V., and DOW Inc. are investing in the development of innovative and sustainable solutions for formulating new and advanced resins that give them an edge over their competitors. For instance, in December 2020, the unsaturated polyester resin (UPR) production facility at Spolchemie in St nad Labem, Czech Republic, was acquired by AOC. As a result of the expansion, AOC has been able to improve service and logistics for its customers in Central/Eastern Europe and Germany. Some of the prominent players in the global unsaturated polyester resin market include:

-

AOC, LLC

-

INEOS

-

BASF SE

-

Polynt

-

LERG SA

-

Koninklijke DSM N.V.

-

U-PICA Company. Ltd.

-

Eternal Materials Co., Ltd.

-

Satyen Polymers Pvt. Ltd.

-

CIECH Group

-

Dow Inc.

-

UPC Group

-

Scott Bader Company Ltd.

-

Deltech Corporation

-

Tianhe Resin Co., Ltd.

-

Qualipoly Chemical Corp.

Unsaturated Polyester Resin Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 12.9 billion |

|

Revenue forecast in 2030 |

USD 20.9 billion |

|

Growth Rate |

CAGR of 7.1% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, form, region |

|

Region scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India |

|

Key companies profiled |

INEOS, BASF SE; Polynt; Koninklijke DSM N.V.; U-PICA Company. Ltd.; Eternal Materials Co., Ltd.; Satyen Polymers Pvt. Ltd.; Dow Inc.; UPC Group; Scott Bader Company Ltd.; Tianhe Resin Co., Ltd.; LERG SA |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Unsaturated Polyester Resin Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global unsaturated polyester resin market report on the basis of product, end-use, form, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

DCPD

-

Orthopthalic

-

Isophthalic

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Tanks & Pipes

-

Electrical

-

Marine

-

Transport

-

Artificial Stones

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Liquid Form

-

Powder Form

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global unsaturated polyester resin market size was estimated at USD 12.21 billion in 2022 and is expected to reach USD 12.9 billion in 2023.

b. The global unsaturated polyester resin market is expected to witness a compound annual growth rate of 7.1% from 2023 to 2030 to reach USD 20.9 billion by 2030.

b. Asia Pacific held the largest share of over 58% in 2022 due to rising demand from the end-use industries such as construction, electronics, transport, and marine. Moreover, the robust manufacturing base of the automotive industry in China, Japan, and India coupled with increased sales of passenger vehicles is anticipated to augment unsaturated polyester resin market growth in the near future.

b. Some key players operating in the unsaturated polyester resin market include INEOS, BASF SE, Polynt, Koninklijke DSM N.V., U-PICA Company. Ltd., Eternal Materials Co., Ltd., Satyen Polymers Pvt. Ltd., Dow, UPC Group, Scott Bader Company Ltd., Tianhe Resin Co., Ltd., and LERG SA.

b. Key factors that are driving the unsaturated polyester resin market growth include its properties such as recyclability, excellent strength, and thermal and corrosion resistance with lower thickness and also finds use in used in the manufacturing of plastic composites.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."