Unmanned Traffic Management Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By End Use (Commercial, Military & Government), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-441-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

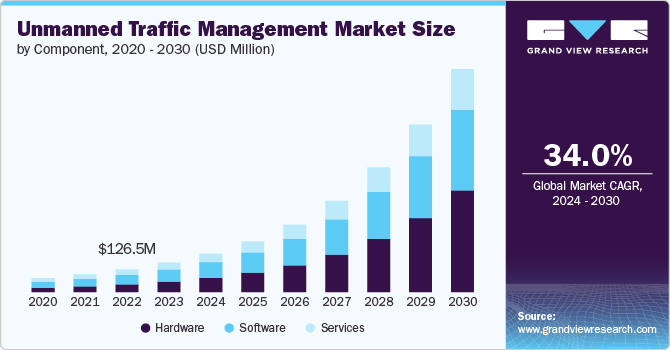

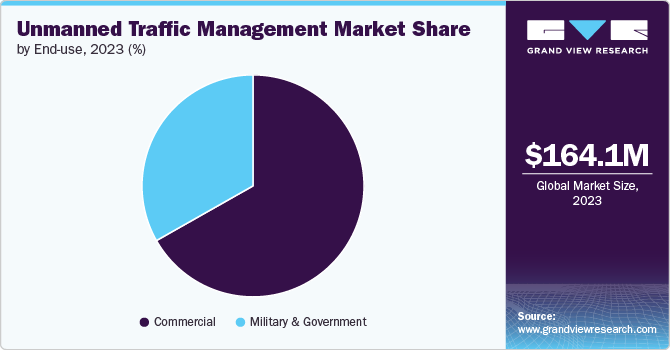

The global unmanned traffic management market size was estimated at USD 164.1 million in 2023 and is projected to grow at a CAGR of 34.0% from 2024 to 2030. The growing adoption of drones in various sectors, such as agriculture, logistics, and emergency services, has created a need for effective unmanned traffic management (UTM) systems, thereby driving market growth. The demand for UTM solutions to manage airspace safely and efficiently is growing as drones are increasingly used for commercial purposes. This expansion is driven by the need to prevent collisions, ensure regulatory compliance, and optimize flight paths in increasingly congested airspace, thereby driving market growth.

Moreover, the governments and aviation authorities are actively developing and implementing regulations to integrate drones into national airspace. As regulations become more defined and supportive, the adoption of unmanned traffic management systems is expected to accelerate. These regulations are crucial for setting the standards for safety, privacy, and coordination among multiple drones, which is fueling the market growth in the coming years.

Advances in artificial intelligence (AI), machine learning (ML), and automation technologies are enhancing UTM systems' capabilities. These technologies enable real-time data processing, predictive analytics, and autonomous decision-making, which are essential for managing complex drone operations. The continuous evolution of AI-driven UTM solutions is a significant driver for market expansion as it improves system efficiency and reliability.

The UTM industry is witnessing significant investments from both public and private sectors, including government agencies, technology companies, and drone manufacturers. Collaborative efforts, including partnerships between aviation authorities and technology firms, are fostering innovation in UTM solutions. These investments are helping to scale UTM infrastructure, driving the market forward by expanding the deployment of these systems globally.

Furthermore, the emerging concept of Urban Air Mobility (UAM), which involves the use of air taxis and passenger drones in urban environments, is creating a demand for advanced UTM systems. As cities prepare for the integration of UAM, the need for robust UTM solutions to manage the increased air traffic and ensure safety in densely populated areas is becoming more critical. This trend is expected to significantly contribute to the growth of unmanned traffic management.

Component Insights

The software segment dominated the market in 2023 with a market share of around 41% due to the increasing complexity of drone operations and the need for sophisticated traffic management solutions. Software plays a significant role in enabling real-time data processing, flight planning, and dynamic airspace management, which are essential for safe and efficient drone operations. In addition, the integration of AI and machine learning algorithms into UTM software is enhancing its capabilities, making it more adaptive to changing air traffic scenarios, thereby driving the segment growth.

The hardware segment is expected to record the fastest CAGR of around 39% from 2024 to 2030, owing to the increasing demand for advanced communication, navigation, and surveillance equipment required to manage drone traffic safely and efficiently. The proliferation of drones across various sectors necessitates robust ground-based and airborne hardware, such as radars, transponders, and remote sensing devices, to ensure accurate tracking and coordination. In addition, the development of specialized UTM hardware, such as dedicated control stations and sensors for real-time data processing, is further driving this segment growth.

Application Insights

The commercial aviation segment held the largest revenue share in 2023, owing to the increasing integration of drones into commercial airspace for tasks such as cargo delivery, infrastructure inspection, and emergency services. As these operations become more common, there is a growing need for sophisticated UTM systems to safely manage the high volume of drone traffic alongside traditional manned aircraft. Technological advancements in communication, navigation, and surveillance are further enhancing UTM capabilities, enabling more complex and large-scale commercial drone operations and contributing to segment growth.

The logistics and transportation segment is estimated to register the fastest CAGR from 2024 to 2030 due to the increasing use of drones for efficient cargo delivery and last-mile logistics. Drones offer a faster, more cost-effective alternative to traditional transportation methods, particularly in remote or congested areas. The expansion of e-commerce and the need for timely deliveries are driving investments in UTM systems that can manage and optimize drone operations for logistics. This growth is further supported by advancements in technology that enhance the reliability and integration of drones into existing transport networks.

End Use Insights

The commercial segment held the largest revenue share in 2023, owing to the expanding use of drones across industries such as logistics, agriculture, construction, and inspection services. Companies are increasingly adopting drones for tasks such as delivery, crop monitoring, infrastructure surveys, and asset management, driving the need for sophisticated UTM systems to ensure safe and efficient airspace management. The rise of drone delivery services, particularly in urban areas, is further propelling demand for UTM solutions to manage high-density drone operations. Moreover, regulatory bodies are developing frameworks that facilitate commercial drone use, supporting the segment growth.

The military & government segment is estimated to register a considerable CAGR from 2024 to 2030 due to the rising adoption of drones for surveillance, reconnaissance, and defense operations. Governments are increasingly investing in UTM systems to ensure the safe and efficient integration of military drones into national airspace, particularly as drone fleets expand. In addition, the need to monitor and manage airspace activities during large-scale events, disaster response, and border security operations is driving the demand for advanced UTM solutions. This growth is further supported by government initiatives and collaborations aimed at developing standardized UTM frameworks for both military and civilian drone operations.

Regional Insights

The unmanned traffic management market in North America accounted for the largest revenue share of nearly 45% in 2023. The UTM market in North America is being driven by strong regulatory support from bodies like the Federal Aviation Administration (FAA), which is actively working to integrate UTM systems into the national airspace. The region is also seeing rapid adoption of drones across various sectors, such as agriculture, infrastructure, and defense, necessitating robust traffic management solutions. Advancements in AI, machine learning, and communication technologies are enhancing the capabilities of UTM systems, making them more efficient and reliable.

U.S. Unmanned Traffic Management Market

The unmanned traffic management market in the U.S. is anticipated to grow at a CAGR of around 30% from 2024 to 2030. In the U.S., the UTM market is propelled by federal initiatives like the UAS Integration Pilot Program (IPP), which fosters innovation in drone operations and integration into the airspace. The expansion of drone delivery services by major companies like Amazon.com, Inc. is creating a significant demand for sophisticated UTM systems to manage the expected increase in drone traffic.

Asia Pacific Unmanned Traffic Management Market Trends

The Asia Pacific unmanned traffic management market is anticipated to grow at a CAGR of over 36% from 2024 to 2030. The UTM market in Asia Pacific is growing rapidly, driven by the region's rapid urbanization and the rise of smart city initiatives that integrate drone technology. The commercial use of drones is expanding, particularly in agriculture, logistics, and infrastructure inspection, creating a need for effective UTM solutions to manage airspace safety and efficiency. Government policies across countries like China, Japan, and South Korea are increasingly supportive of drone integration, providing a conducive environment for UTM adoption.

Europe Unmanned Traffic Management Market Trends

The unmanned traffic management market in Europe accounted for a notable revenue share of over 23% in 2023. Europe’s UTM market is experiencing growth due to the harmonized regulatory framework established by the European Union Aviation Safety Agency (EASA), which facilitates seamless cross-border drone operations. The increasing focus on urban air mobility (UAM) is driving demand for UTM solutions to manage the complex air traffic expected in densely populated areas. Europe is also home to a strong drone industry, with significant contributions from countries like Germany and France, boosting the development of UTM technologies.

Key Unmanned Traffic Management Company Insights

Some of the key players operating in the market are Leonardo S.p.A., RTX Corporation, and Airbus SE.

-

Leonardo S.p.A. is a multinational corporation that specializes in aerospace, defense, and security. The company plays a crucial role in its sector, providing a wide range of high-technology products and services. Its global operations and partnerships solidify Leonardo's position as one of the key players in the international market.

-

RTX Corporation is a multinational conglomerate that specializes in aerospace and defense. The company's operations include the design, development, and manufacturing of advanced systems for global defense and intelligence applications, including radars, missiles, aircraft engines, and cybersecurity products. Raytheon Technologies Corporation serves customers worldwide, providing a broad spectrum of services and solutions to meet a variety of modern challenges in the aerospace and defense industries.

Unifly NV, Frequentis AG, and OneSky Systems, among others, are some of the emerging market participants in the unmanned traffic management industry.

-

Unifly NV is a technology company focused on the development and deployment of unmanned traffic management (UTM) systems. Their technology aims to facilitate the safe integration of unmanned aerial vehicles (UAVs) into the airspace, catering to a diverse range of sectors, including logistics, surveillance, and transportation.

-

Frequentis AG is a provider of communication and information systems for control centers with safety-critical tasks. The company operates in sectors including air traffic management, public safety, maritime, and public transportation. Their solutions aim to enhance the safety and efficiency of operations in these vital areas, leveraging extensive experience and technology expertise.

Key Unmanned Traffic Management Companies:

The following are the leading companies in the unmanned traffic management market. These companies collectively hold the largest market share and dictate industry trends.

- Leonardo S.p.A.

- Thales Group

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Airbus SE

- Unifly NV

- Frequentis AG

- AirMap, Inc.

- OneSky Systems

- RTX Corporation

Recent Developments

-

In April 2024, Terra Drone Corporation, a provider of drone and Advanced Air Mobility (AAM) technology based in Japan announced plans for collaborative development efforts with its group entities, Aloft Technologies Inc. and Unifly NV, aimed at enhancing UAS Traffic Management (UTM) systems for Advanced Air Mobility applications on a global scale.

-

In December 2023, Unifly NV successfully concluded a project focused on refining a Unified Unmanned Traffic Management (UTM) Cybersecurity Model. This endeavor, supported by the Federal Aviation Administration (FAA) under the Broad Agency Announcement Call 003, was conducted in collaboration with the Rhea Group and the NY UAS Test Site. The project's objective was to fine-tune a cybersecurity model for UTM, encompass the necessary requirements and certification framework, and test the model's effectiveness in a real-world setting.

-

In December 2022, Altitude Angel announced a partnership with SAAB Group on Digital Tower technology. The company incorporated Altitude Angel’s top-tier UTM (Unmanned Traffic Management) technology platform into SAAB Group’s Digital Tower (r-TWR) solution.

Unmanned Traffic Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 214.7 million |

|

Revenue forecast in 2030 |

USD 1,241.0 million |

|

Growth rate |

CAGR of 34.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, end use, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Leonardo S.p.A., Thales Group, L3Harris Technologies, Inc., Lockheed Martin Corporation, Airbus SE, Unifly NV, Frequentis AG, AirMap, Inc., OneSky Systems, RTX Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Unmanned Traffic Management Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels, along with analyzing the latest market trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has further segmented the global unmanned traffic management market report based on component, end-use, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Military & Government

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Aviation

-

Homeland Security

-

Logistics and Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global unmanned traffic management market size was estimated at USD 164.1 million in 2023 and is expected to reach USD 214.7 million in 2024.

b. The global unmanned traffic management market is expected to grow at a compound annual growth rate of 34.0% from 2024 to 2030 to reach USD 1,241.0 million by 2030.

b. The North America region accounted for the largest share of over 45% in the unmanned traffic management market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the unmanned traffic management market include Leonardo S.p.A., Thales Group, L3Harris Technologies, Inc., Lockheed Martin Corporation, Airbus SE, Unifly NV, Frequentis AG, AirMap, Inc., OneSky Systems, RTX Corporation.

b. Key factors that are driving the unmanned traffic management market growth include the growing adoption of drones in various sectors, such as agriculture, logistics, and emergency services that has created a need for effective unmanned traffic management (UTM) systems.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."