- Home

- »

- Advanced Interior Materials

- »

-

Unmanned Composites Market Size, Industry Report, 2030GVR Report cover

![Unmanned Composites Market Size, Share & Trends Report]()

Unmanned Composites Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Carbon Fiber Reinforced Polymer, Glass Fiber Reinforced Polymer), By Application (Interior, Exterior), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-328-5

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Unmanned Composites Market Summary

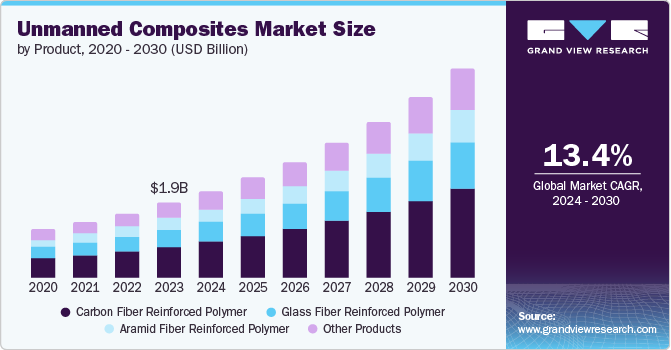

The global unmanned composites market size was valued at USD 2.29 billion in 2024 and is estimated to reach USD 5.53 billion by 2030, growing at a CAGR of 15.8% from 2025 to 2030. This growth is attributed to unmanned system manufacturers' increasing inclination toward using composites to reduce the overall weight.

Key Market Trends & Insights

- The North America unmanned composites market dominated the global market with the largest revenue share of 40.6% in 2024.

- U.S. led the North American market with the largest revenue share in 2024.

- By product, carbon fiber-reinforced polymer segment accounted for the largest revenue share of 41.9% in 2024.

- By application, the interior segment accounted for the largest revenue share, 61.9%, in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.29 Billion

- 2030 Projected Market Size: USD 5.53 Billion

- CAGR (2025-2030): 15.8%

- North America: Largest market in 2024

In addition, the growing environmental regulations laid down by governments of different countries are initiating the use of lightweight and fuel-efficient unmanned systems. This is further expected to propel market growth.The use of composite materials in unmanned systems is resulting in improved performance. Furthermore, advancements in the composite manufacturing process lead to enhanced performance and durability of unmanned systems. These materials provide an exceptional strength-to-weight ratio, which helps increase fuel efficiency and reduce operational costs. Such factors are considered critical when choosing materials for unmanned system production.

Unmanned systems are used in several industries, such as agriculture, logistics, infrastructure inspection, defense sector, and aerospace. The defense sector highly relies on these systems, such as unmanned aerial vehicles (UAV), for reconnaissance, several operations, and surveillance. Moreover, the rapidly expanding aerospace industry worldwide, with rising emphasis on the use of high-performance and lightweight materials, is expected to increase material use in these systems. In addition, Government investment and rising expenditures in military and defense are key drivers of the unmanned composites market, as nations prioritize advanced surveillance, intelligence, and combat capabilities. Increased funding accelerates the adoption of lightweight, high-strength composites in unmanned systems, enhancing operational efficiency and mission effectiveness across defense sectors.

Raw materials required to manufacture composites include polyurethane, silicone, polyamide, and others. These materials are used in other applications, including construction, coatings & adhesives, and others. The individual material markets are characterized by many suppliers operating globally and catering to multiple application industries. However, only some composite manufacturers are integrated into their operations and manufacture high-cost raw materials, such as carbon and aramid fibers.

The significant presence of integrated composite manufacturing companies with strong distribution networks is responsible for a high entry barrier. In addition, new players need to invest considerably in R&D due to the patented technologies owned by key manufacturers or lease the said technologies to produce composites. In addition, high initial investments are required to sustain in the composites market. Owing to these factors, the threat of new entrants is expected to be low.

Product Insights

The carbon fiber-reinforced polymer (CFRP) segment dominated the market with the largest revenue share of 41.9% in 2024. This is due to its characteristics, including a high strength-to-weight ratio, excellent temperature & chemical resistance, high stiffness, and low thermal expansion. In interior and exterior applications, sandwich structures made of carbon fiber-reinforced polymer composite materials are widely used. CFRP composites are lightweight and have a high tensile strength. They are more fuel-efficient, require less upkeep, and help OEMs adhere to the strict environmental laws in Europe and North America.

Aramid fiber reinforced polymer is expected to grow at a CAGR of 16.0% over the forecast period. Its exceptional impact resistance, toughness, and high strength-to-weight ratio are critical for unmanned systems operating in demanding environments. In addition, these fibers contribute to lightweight yet durable structures, enhancing flight endurance, maneuverability, and operational efficiency. Moreover, their resistance to heat, chemicals, and abrasion, combined with the ability to be molded into complex aerodynamic shapes, further supports their increasing adoption in UAVs and other unmanned platforms.

The glass fiber-reinforced polymer product segment is expected to grow significantly from 2025 to 2030. This growth is attributed to glass fiber-reinforced polymers' durability and low weight. These polymers can be molded into various sizes and shapes, enhancing their diverse range of applications and making them a preferred choice in manufacturing structural components of drones. In addition, increasing advancements in production methods to improve the efficiency of GFRP in unmanned systems applications are likely to support segment growth.

Application Insights

The interior application segment accounted for the largest revenue share, 61.9%, in 2024. Composites are used to manufacture structural components, insulation, panels, seating, interior compartments, conduits, and control surfaces of unmanned systems. Properties of this material, such as low weight, durability, and ability to increase the performance and safety of interior parts, drive the segment's growth.

The exterior application is expected to grow at a CAGR of 15.7% from 2025 to 2030. This material is used in various exterior parts of unmanned systems, such as fuselage, wings, control surfaces, rotors blades, landing gear components, external housings, engine cowlings, and external structural reinforcements. Composite usage helps construct lightweight parts with high strength, efficiency, and improved performance. Furthermore, external antennas and radomes are supposed to be constructed from lightweight material, thus not interrupting the signal transmission. This is expected to increase the use of this material in external applications of unmanned systems.

Regional Insights

The North America unmanned composites market dominated the global market with the largest revenue share of 40.6% in 2024. This is due to various factors, such as high investments in defense & security, a strong technological and industrial base, and the rising use of unmanned systems in commercial applications, including logistics, environmental monitoring, and agriculture, which, in turn, is anticipated to fuel the regional market's growth.

U.S. Unmanned Composites Market Trends

The unmanned composites market in the U.S. led the North American market with the largest revenue share in 2024. Government initiatives and regulatory support to integrate drones into different industries are expected to contribute to the rising demand for advanced composites, as these materials are essential for manufacturing lightweight and high-strength unmanned vehicles that can meet regulatory requirements. Furthermore, expanding use of drones in sectors like infrastructure inspection and logistics further accelerates market growth.

Asia Pacific Unmanned Composites Market Trends

Asia Pacific unmanned composites market is expected to grow at a CAGR of 16.4% over the forecast period. This is due to emerging countries like China, India, and Japan. These countries invest in developing advanced technologies, including deploying unmanned systems for various applications, which is expected to drive the need for high-performance composite materials. In addition, this growth is further supported by the rise in space exploration initiatives, satellite development, and the need for efficient, lightweight materials to meet the demands of diverse unmanned platforms.

The unmanned composites market in China dominated the Asia Pacific market with the largest revenue share in 2024, driven by defense modernization and the commercial drone sector. In addition, the country’s focus on technological innovation, mass production capabilities, and the development of high-performance composites supports its leadership in unmanned aerial and ground vehicle manufacturing.

Europe Unmanned Composites Market Trends

The Europe unmanned composites market is projected to grow significantly over the forecast period. The growing emphasis on innovation and research in aerospace and robotics fuels the advancements in composite materials, which are essential for enhancing the performance, durability, and efficiency of unmanned systems.

Key Unmanned Composites Company Insights

Key players in the unmanned composites market employ strategies such as investing in research and development, forming strategic partnerships, optimizing supply chains, and advancing manufacturing technologies. Furthermore, they focus on innovation, expanding product portfolios, and enhancing material performance to strengthen market presence and address evolving industry demands. Some of the key players operating in the market include Teijin Ltd., Toray Industries, Inc., PPG Industries, Inc., and Owens Corning:

-

Teijin Ltd. provides a range of services and products in information & electronics, safety & protection, environment & energy, and healthcare. It operates its business across Europe, Asia, and the Americas. Its operations are classified into five segments: advanced fibers & composites, electronics materials & performance polymer products, healthcare, trading & retail, and others.

-

Toray Industries, Inc. manufactures and supplies a wide range of carbon fiber products, thermoset and thermoplastic prepregs, unidirectional tapes, and laminates, which are utilized for structural, semi-structural, and interior components.

Key Unmanned Composites Companies:

The following are the leading companies in the unmanned composites market. These companies collectively hold the largest market share and dictate industry trends.

- Teijin Ltd.

- Toray Industries, Inc.

- PPG Industries, Inc.

- SGL Group

- Hexcel Corporation

- Compagnie de Saint-Gobain S.A.

- Cytec Industries (Solvay, S.A.)

- Renegade Materials Corporation

- Unitech Aerospace

- Gurit

Recent Developments

-

In December 2024, Hexcel announced its collaboration with Boeing to support the development of the MQ-25 Stingray with honeycomb core solution. Flex-Core HRH-302 honeycomb core is under evaluation for use in the structure surrounding the high-temperature exhaust nozzle of the engine powering the Navy's MQ-25

-

In August 2023, Murugappa group's company Carborundum Universal Limited (CUMI), an India-based manufacturer of abrasives, electron minerals, industrial ceramics, and super refractories, announced its collaboration with drone manufacturer ideaForge Technology Ltd. to develop nanomaterial-reinforced composite parts for drones. This composites provide a wide range of possibilities, including higher specific strength or modulus, which is likely to shape the future of structural-related drone components

Unmanned Composites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.65 billion

Revenue forecast in 2030

USD 5.53 billion

Growth rate

CAGR of 15.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region.

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina.

Key companies profiled

Teijin Ltd.; Toray Industries, Inc.; PPG Industries, Inc.; SGL Group; Hexcel Corporation; Compagnie de Saint-Gobain S.A.; Cytec Industries (Solvay, S.A.); Renegade Materials Corporation; Unitech Aerospace; Gurit

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unmanned Composites Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global unmanned composites market report based on, product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber Reinforced Polymer

-

Glass Fiber Reinforced Polymer

-

Aramid Fiber Reinforced Polymer

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Interior

-

Exterior

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. The global unmanned composites market size was estimated at USD 1.98 billion in 2023 and is expected to reach USD 2.29 billion in 2024.

b. The global unmanned composites market is expected to grow at a compound annual growth rate (CAGR) of 13.4% from 2024 to 2030 to reach USD 5.53 billion by 2030.

b. The carbon fiber reinforced polymer accounted for the largest revenue share of over 41% in 2023 due to its properties, including a high strength-to-weight ratio, high temperature tolerance, high stiffness, low thermal expansion, and high chemical resistance.

b. Some key players operating in the unmanned composites market include Teijin Ltd., Toray Industries, Inc., PPG Industries, Inc., SGL Group, Hexcel Corporation, Compagnie de Saint-Gobain S.A.

b. The key factors that are driving the market growth is the increasing use of composites in unmanned systems to reduce its overall weight and increase performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.