- Home

- »

- Medical Devices

- »

-

Unit Dose Manufacturing Market Size, Industry Report, 2030GVR Report cover

![Unit Dose Manufacturing Market Size, Share Trends Report]()

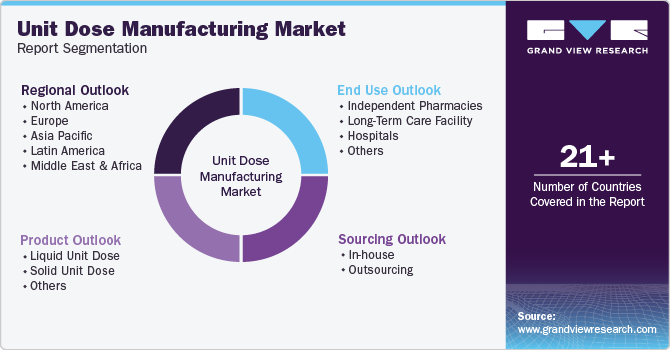

Unit Dose Manufacturing Market (2025 - 2030) Size, Share Trends Analysis Report By Sourcing (In-house, Outsourcing), By Product (Liquid, Solid), By End-use (Independent Pharmacies, Long Term Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-695-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Unit Dose Manufacturing Market Trends

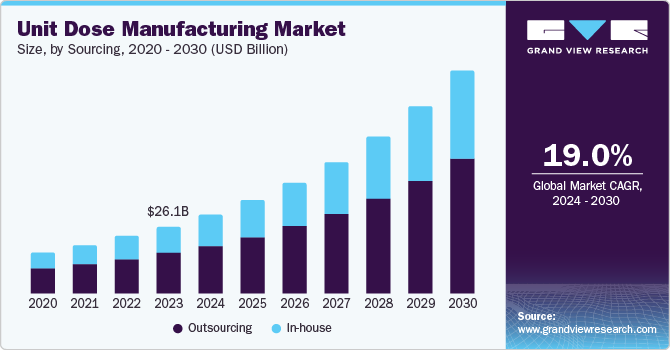

The global unit dose manufacturing market size was estimated at USD 79.05 billion in 2024 and is projected to grow at a CAGR of 11.43% from 2025 to 2030. The rising prevalence of chronic diseases and an aging population have spurred demand for personalized and efficient drug delivery systems, boosting unit dose packaging solutions. Regulatory emphasis on reducing medication errors and improving patient safety further supports the adoption of unit dose formats, particularly in healthcare institutions such as hospitals and long-term care facilities.

Technological advancements such as automation and precision dosing enhance production efficiency and scalability, enabling manufacturers to meet rising product demand effectively. In addition, the growing trend toward home-based care and self-administration of medications has increased the need for convenient, single-dose packaging solutions.

The increased adoption of unit dose packaging is significantly driving the growth and innovation of the global market. Unit dose systems offer precise medication delivery, reducing the risk of dosing errors and enhancing patient safety, which has made them increasingly popular in hospitals, long-term care facilities, and home healthcare settings. This format aligns with global healthcare trends, highlighting patient-centric care and improved clinical outcomes.

The growing prevalence of chronic diseases, aging populations, and the rising demand for personalized treatment have accelerated the adoption of unit dose solutions. These formats are particularly suited for medications requiring strict adherence to dosing schedules, improving patient compliance. In addition, unit dose packaging supports healthcare providers by reducing medication waste, improving inventory management, and streamlining workflows, which is particularly valuable in high-pressure medical environments.

Technological advancements, such as automated packaging systems and smart unit dose solutions, have further boosted the appeal of these systems. Numerous manufacturers outsource manufacturing services to contract service providers to enhance efficiency, precision, and scalability and meet the rising demand worldwide. Moreover, the increasing trend toward self-administration of medications at home has driven the demand for convenient, easy-to-use unit dose formats.

Growing outsourcing activities in the unit dose manufacturing industry enhance efficiency, cost savings, and scalability for pharmaceutical companies. As the demand for specialized packaging solutions like unit doses rises, several pharmaceutical companies are partnering with contract manufacturing organizations (CMOs) to leverage their expertise, advanced technologies, and regulatory compliance capabilities. This allows pharmaceutical firms to focus on core activities such as drug development and marketing while reducing operational costs associated with in-house manufacturing setups.

Outsourcing unit dose manufacturing also accelerates access to innovative solutions, including automation and precision dosing technologies, enabling faster production timelines and improved quality assurance. CMOs, with their established infrastructure, are well-equipped to handle varying production volumes, from small-scale clinical trial batches to large-scale commercial production, accommodating market demands efficiently. Furthermore, the increasing need for customization, such as customized dosing formats for specific patient populations or therapeutic areas, is met more effectively through outsourcing partnerships.

Moreover, Regulatory bodies' focus on reducing medication errors and ensuring traceability has also fueled the shift to unit dose systems, with manufacturers adapting to meet these compliance requirements. Stringent regulatory environments in developed regions encourage pharmaceutical companies to collaborate with CMOs experienced in meeting compliance standards. However, dependency on third-party manufacturers may pose risks such as quality control challenges and supply chain disruptions, which necessitate robust partnership agreements and oversight mechanisms.

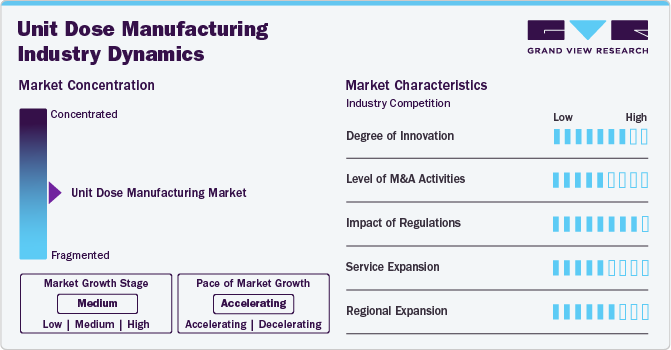

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansions, and regional expansions.

The global unit dose manufacturing industry demonstrates a high degree of innovation, driven by advancements in packaging technologies, automation, and precision dosing. Companies are developing smarter, more efficient packaging solutions to enhance medication safety, improve patient adherence, and reduce errors. Continuous research and development efforts are key to maintaining competitive advantages in this industry.

Stringent regulations play a critical role in shaping the global unit dose manufacturing industry, with stringent standards set by regulatory bodies like the FDA and EMA. These regulations ensure safety, quality, and compliance, influencing packaging formats, materials, and labeling. Market participants must comply with evolving regulatory frameworks to avoid penalties and gain market access.

The level of M&A activity in the market is moderate, driven by companies seeking to expand capabilities, enter new markets, or integrate advanced technologies. M&A activity helps enhance product offerings, improve operational efficiencies, and strengthen market position, particularly among leading players looking to consolidate resources and capabilities.

Market participants in the unit dose manufacturing sector are expanding services through several key strategies. These participants integrate advanced technologies such as automation and artificial intelligence (AI) to boost efficiency and product quality. The market focuses on customization, and flexibility, offering custom solutions across development, production, and packaging. This expansion helps to meet diverse customer needs, including healthcare providers and pharmaceutical companies. Service diversification propels customer loyalty and strengthens competitive positioning in the global market.

The increasing healthcare expenditure worldwide, the existence of advanced contract manufacturing market players, and the rising requirement for various unit dose medications drive the market growth. Moreover, participants are involved in strategic partnerships to broaden global reach, tap into emerging markets, and enhance operational capabilities. The increasing demand for cost-effective healthcare solutions and improved pharmaceutical infrastructure in these regions encourages global players to establish local manufacturing plants and distribution networks for enhanced market penetration.

Sourcing Insights

Based on sourcing, the outsourcing segment led the market with the largest revenue market share of 60.74% in 2024. Outsourcing services dominated the unit dose manufacturing industry, owing to cost-effectiveness, expertise, flexibility, risk reduction, and access to global markets. Outsourcing unit dose manufacturing through specialized contract manufacturing organizations (CMOs) allows companies to reduce costs, use advanced technologies, and reduce labor costs without significant capital investment.

Further, outsourcing manufacturing services offers scalability and flexibility to adjust production capacity to market demand, reducing the risks associated with in-house manufacturing. In addition, outsourcing enables companies to expand globally through marketing organization networks and partnerships.

The in-house segment is expected to grow at a steady CAGR over the forecast period. The segment growth is prominently attributed to pharmaceutical companies' desire for greater control over production processes, quality standards, and supply chains. By maintaining in-house manufacturing capabilities, companies can ensure adherence to stringent regulatory requirements, minimize risks of quality issues, and safeguard intellectual property. This approach allows for seamless integration of production with research and development, enabling the customization of unit dose solutions tailored to specific drug formulations or therapeutic needs. Companies with high-volume products or proprietary technologies particularly benefit from maintaining in-house unit dose manufacturing capabilities, making it an aspect of segmental growth.

Product Insights

The solid unit dose segment led the market with the largest revenue share of 50.49% in 2024. Solid unit dosage forms such as tablets and capsules dominate unit dose marketing due to their high demand, widespread applications, and patient convenience. Tablets and capsules, the primary forms of solid unit doses, are increasingly preferred for their ease of storage, portability, and precise dosing, making them ideal for patient compliance. The rising prevalence of chronic diseases and the growing demand for cost-effective and easily administrable medications have intensified their adoption. Furthermore, the pharmaceutical industry’s shift toward personalized medicine and fixed-dose combinations is increasing the demand for solid unit dose formulations. The solid unit dose is expected to witness rapid expansion in the coming years. This is due to fixed-dose combinations, controlled-release dosage forms, and reformulations of existing drugs, which drive the contract manufacturing of solid dosage formulations.

The liquid unit dose segment is expected to witness at a significant CAGR over the forecast period. The growing prevalence of pediatric and geriatric populations, which often require liquid medications for ease of swallowing, further boosts segmental demand. Innovations in packaging, such as pre-filled syringes, vials, and ampoules, enhance usability and extend shelf life, meeting healthcare providers' and patients' needs. In addition, regulatory emphasis on single-use packaging to minimize cross-contamination and ensure precise dosing contributes to market growth. Rising self-administration trends and the increasing adoption of biologics requiring liquid formulations further contribute to the expansion of this segment.

End-use Insights

Based on end use, the independent pharmacies segment led the market with the largest revenue share of 39.11% in 2024 and is also anticipated to register at the fastest CAGR over the forecast period. This growth can be attributed to a growing focus on personalized patient care and enhanced medication safety. These pharmacies increasingly rely on unit dose packaging to ensure precise dosing, minimize medication errors, and improve adherence, especially among patients with chronic conditions or complex medication regimens. The rising demand for convenient, ready-to-use packaging aligns with pharmacies' need to streamline dispensing processes and reduce labor-intensive tasks. Furthermore, the adoption of unit dose solutions helps independent pharmacies differentiate themselves in a competitive market by offering value-added services such as compliance packaging for seniors and customized dosing solutions.

The hospital segment is estimated to witness at a substantial CAGR over the forecast period. The high segment growth is due to their focus on improving patient safety and operational efficiency. Unit dose packaging enables precise medication administration, reducing the risk of dosing errors and enhancing compliance with strict healthcare regulations. Hospitals benefit from streamlined inventory management, as unit doses simplify storage, tracking, and distribution within healthcare facilities. In addition, the increasing prevalence of multi-drug therapies and the need for ready-to-administer medications in acute care settings further accelerate adoption. Unit dose solutions support infection control practices by minimizing handling and contamination risks, a critical requirement in hospitals is a major consumer of single-use drugs, driven by the need to improve patient safety and reduce medication errors.

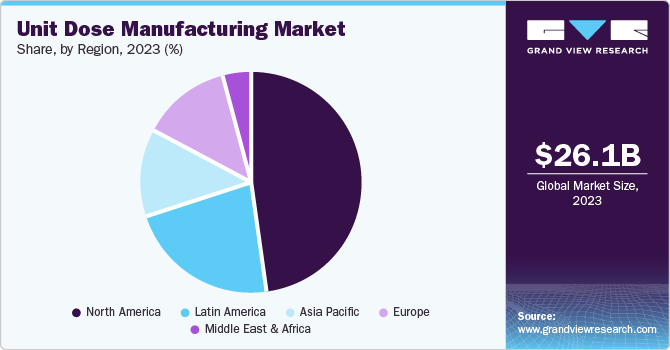

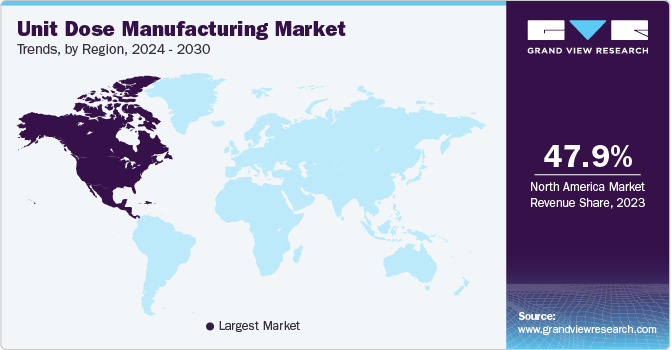

Regional Insights

North America dominated the unit dose manufacturing market with the largest revenue share of 37.73% in 2024. The market revenue growth is driven by the region's advanced healthcare infrastructure, high prevalence of chronic diseases, and strong regulatory focus on patient safety and medication accuracy. The widespread adoption of advanced technologies, such as automation and precision dosing, supports efficient production and enhances compliance with stringent U.S. FDA regulations. Rising demand for personalized medication solutions, coupled with the growth of home-based care and self-administration trends, further propels market growth. In addition, the increasing role of outsourcing and a strong focus on sustainability through eco-friendly packaging materials contribute to the market's expansion in North America.

U.S. Unit Dose Manufacturing Market Trends

The U.S. unit dose manufacturing market in the accounted for the largest revenue share in North America in 2024. Increasing demand for efficient healthcare delivery, especially in hospitals and long-term care facilities, is a key aspect accelerating industry revenue growth. The rise in outpatient care and home health services and a growing emphasis on medication adherence and personalized treatment plans boost the need for precise, single-dose packaging. In addition, the U.S. market benefits from strong investments in technological innovation, such as automated dispensing systems and integration with electronic health records, enhancing workflow efficiency.

The Canada unit dose manufacturing market is expected to witness at the fastest CAGR over the forecast period. Market growth is owing to growing demand for cost-effective healthcare solutions, particularly in rural and remote areas. Increasing focus on improving medication adherence, reducing hospital readmissions, and streamlining pharmaceutical distribution in healthcare facilities further support market growth.

Europe Unit Dose Manufacturing Market Trends

The unit dose manufacturing market in Europe is driven by an increasing importance on patient safety, particularly in response to growing concerns over medication errors and adverse drug events. The region’s stringent regulatory standards, including EU-wide guidelines on pharmaceutical packaging, encourage the adoption of unit dose solutions. In addition, the rising demand for personalized medicines, efficient drug delivery systems, and the expansion of outpatient care and home healthcare services further boost market growth. Furthermore, the strong presence of pharmaceutical companies and manufacturing facilities in the region also contributes to the ongoing expansion of the market across Europe.

The Germany unit dose manufacturing market held the largest revenue share in Europe in 2024 and is expected to witness at the fastest CAGR over the forecast period. The market growth is due to the country’s advanced healthcare system and a strong focus on improving medication, safety, and treatment efficiency. The growing trend of outpatient care and home-based healthcare services increases demand for precise, ready-to-administer medications. In addition, stringent regulatory frameworks and rising healthcare costs promote the adoption of cost-effective unit dose manufacturing solutions.

The unit dose manufacturing market in the UK is growing due to the government’s focus on improving healthcare efficiency and reducing medication errors. Moreover, increasing demand for homecare services, coupled with a shift toward personalized medicine, propel the need for accurate, single-dose packaging. In addition, stringent regulatory requirements for accurate dosing further support market growth in the UK.

The France unit dose manufacturing market growth is primarily attributable to rising healthcare demands and the need for enhanced patient safety. The growing prevalence of chronic diseases and the geriatric population create a higher demand for precise medication administration. In addition, France’s robust healthcare infrastructure, regulatory support, and focus on reducing hospital readmissions and medication errors further accelerate market growth.

Asia Pacific Unit Dose Manufacturing Market Trends

The Asia Pacific unit dose manufacturing market in is projected to witness at the fastest CAGR over the forecast period, owing to the rapid improvements in healthcare infrastructure, increasing healthcare access, and rising chronic disease prevalence. Economic growth in emerging markets fuels demand for cost-effective healthcare solutions. In addition, government initiatives to enhance medication safety, a growing focus on personalized medicine, and the adoption of advanced pharmaceutical technologies further boost industry expansion in the Asia Pacific region.

The China unit dose manufacturing market is driven by the country's expanding healthcare sector, aging population, and rising incidence of chronic diseases. Government initiatives to improve healthcare accessibility, coupled with a push for greater medication safety and adherence, fuel demand for unit dose packaging. In addition, increasing pharmaceutical exports and advancements in manufacturing technologies contribute to the country’s market growth.

The India unit dose manufacturing market is driven by the country's growing healthcare access, urbanization, and rising chronic disease burden. Government policies supporting affordable healthcare and increasing adoption of generic drugs further boost demand for unit dose packaging. In addition, the expansion of the pharmaceutical export sector and improving manufacturing capabilities in India accelerate the overall market growth.

The Japan unit dose manufacturing market is driven by the country’s aging population and a strong focus on healthcare quality. Several initiatives to enhance patient safety and reduce medical errors, coupled with a preference for efficient, personalized medication delivery systems, boost demand for unit dose packaging. In addition, Japan's advanced pharmaceutical industry and technological innovations support market expansion.

Key Unit Dose Manufacturing Company Insights

Some key players in the global unit dose manufacturing industry are Catalent, Inc., Amgen, Thermo Fisher Scientific, Inc., West Pharmaceutical Services, Mikart, and others. These companies are increasingly focusing on automation, sustainability in packaging, and expanding production capabilities to cater to emerging markets, strengthening their position in the competitive landscape of unit dose manufacturing.

Major players are implementing strategies such as service launches/upgrades and innovations, collaborations, partnerships, and mergers and acquisitions to strengthen their position in the market. For instance, In February 2024, Novo Holdings and Catalent, Inc. announced a merger agreement. In the agreement, Novo Holdings will acquire Catalent for USD 16.5 billion. Such acquisitions offered numerous growth opportunities to the company in a significant market.

Key Unit Dose Manufacturing Companies:

The following are the leading companies in the unit dose manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent Inc.

- Unither Pharmaceuticals

- Thermo Fisher Scientific

- Corden Pharma

- Mikart LLC

- LTS LOHMANN Therapie-Systeme AG (TapeMark)

- Renaissance Lakewood LLC

- Medical Packaging Inc.

- American Health Packaging

- PCI Pharma Services

- Amcor PLC

- Bristol-Myers Squibb

- AbbVie Inc.

- Amgen

- West Pharmaceutical Services,

- Merck & Co. Inc.

- Pfizer Inc.

Recent Developments

-

In February 2024, Mikart LLC announced the addition of advanced Fette double-sided tablet presses to broaden its oral solid dosage production capacity. This integration enables Mikart to enhance its operation capabilities in a significant market.

-

In February 2024, Catalent, Inc. upgraded its capsule filling of dry powders for inhalation and capsule blistering facilities in Boston. The facility aimed to handle potent drugs, enhancing the operational capabilities of the company.

-

In September 2023, Mikart LLC acquired the advanced Flexpack NF-150 Horizontal Sachet-Packaging Machine, strengthening its production capabilities and commitment to high-quality pharmaceutical manufacturing.

Unit Dose Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 87.68 billion

Revenue forecast in 2030

USD 150.61 billion

Growth rate

CAGR of 11.43% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sourcing, product, end use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Catalent Inc.; Unither Pharmaceuticals; Thermo Fisher Scientific; Corden Pharma; Mikart; LTS LOHMANN Therapie-Systeme AG (TapeMark); Renaissance Lakewood LLC; Medical Packaging Inc.; American Health Packaging; PCI Pharma Services; Amcor PLC; Bristol-Myers Squibb; AbbVie Inc.; Merck & Co. Inc.; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unit Dose Manufacturing Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global unit dose manufacturing market report based on sourcing, product, end-use, and region:

-

Sourcing Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Unit Dose

-

Solid Unit Dose

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Independent Pharmacies

-

Long Term Care Facility

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global unit dose manufacturing market size was estimated at USD 79.05 billion in 2024 and is expected to reach USD 87.68 billion in 2025.

b. The global unit dose manufacturing market is expected to grow at a compound annual growth rate of 11.43% from 2025 to 2030 to reach USD 150.61 billion by 2030.

b. Independent pharmacies dominated the unit dose manufacturing market with a share of 39.11% in 2024. This growth can be attributed to patient preference, different types of products offered by the establishment, and huge patient footfall.

b. Some key players operating in the unit dose manufacturing market include CCatalent Inc.; Unither Pharmaceuticals; Thermo Fisher Scientific; Corden Pharma; Mikart; LTS LOHMANN Therapie-Systeme AG (TapeMark); Renaissance Lakewood LLC; Medical Packaging Inc.; American Health Packaging; PCI Pharma Services; Amcor PLC; Bristol-Myers Squibb; AbbVie Inc.; Merck & Co. Inc.; Pfizer Inc.

b. Key factors that are driving the unit dose manufacturing market growth include increasing adoption of unit doses, benefits of manufacturing unit doses over packaging, and flourishing pharmaceutical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.