Unified Threat Management Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size (SMEs, Large Enterprises), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-957-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Research

Unified Threat Management Market Trends

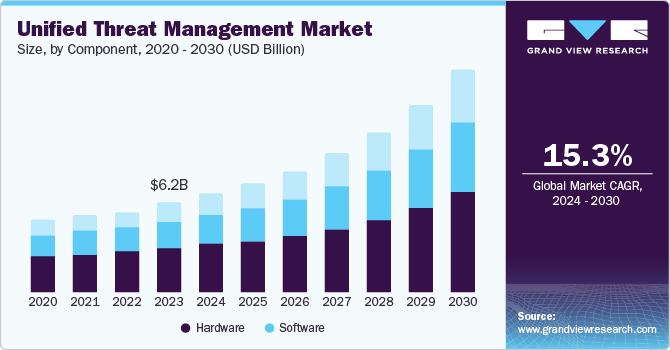

The global unified threat management market size was valued at USD 6.17 billion in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. Increasing incidents of cyberattacks across the world, stringent data privacy regulations by regional authorities, and technological advancements in unified threat management (UTM) services have led to an increased demand for comprehensive IT security solutions. For instance, as per experts at SecurityScorecard, a cybersecurity company, future cyber threats are expected to become more sophisticated with artificial intelligence and deepfake for phishing and other fraudulent activities. The article, published by the World Economic Forum (WEF) in 2023, also highlighted the issue of increased incidences of data breaches. This vulnerable IT security landscape is expected to drive demand for a comprehensive solution such as UTM for enhanced security in the coming years.

Globally, the number of Internet users has increased exponentially over the past two decades, with an article published by DataReportal stating that as of 2024, over 66% of the global population is using the Internet. Consequently, a rising dependency on internet-based solutions is expected to cause a substantial growth in incidents of identity theft and data stealing. This susceptibility is expected to boost the demand for all-inclusive UTM solutions to optimize the security of web applications. Additionally, these solutions can be used at a low cost and are convenient to deploy. Rising awareness regarding virtual private networks (VPN) among industry verticals, along with the rapid development of advanced UTM solutions, are factors expected to further enhance market expansion prospects.

UTM solutions offer an integrated approach to deal with a variety of digital threats such as spam, phishing, viruses, malware, ransomware, and many such sophisticated attacks. These solutions are all-inclusive and contain anti-malware, firewall, intrusion prevention solutions, web filtering, and virtual private networking (VPN). Moreover, they offer high levels of flexibility and adaptability that have become a common requirement among enterprises. The centralized integration of these solutions and their convenient management offers enhanced security and data privacy. Furthermore, the requirement of fewer resources compared to traditional solutions makes unified threat management an attractive option for small and medium-sized organizations, driving market expansion.

Component Insights

Hardware components accounted for the largest revenue share of 47.1% in 2023. These devices are a necessity to build a dedicated and physically secure platform for implementing comprehensive security measures. Additionally, hardware-based UTM solutions offer superior performance, reliability, and scalability, particularly in environments with high traffic volumes or stringent security requirements. The integration of multiple security functions within a single hardware appliance streamlines operations and reduces management complexity. These factors account for a heightened demand for such components, leading to segment dominance.

The virtual components segment is expected to register the fastest CAGR over the forecast period. This is owing to the escalating prevalence of remote work models, cloud adoption, and virtualization initiatives across enterprises. The characteristic flexibility, scalability, and cost-effectiveness of virtual UTM solutions have rendered them highly attractive to organizations seeking to strengthen their digital infrastructures against an increasingly complex cyberthreat landscape. Additionally, the capacity of virtual components to seamlessly integrate with existing IT environments has accelerated their market penetration in recent years.

Deployment Insights

The on-premise segment accounted for the highest revenue share in 2023. The need for stringent data security and control within organizational infrastructure has driven a strong preference for on-premise solutions. Additionally, the complexity of network infrastructures and existing IT investments require a localized UTM deployment. Industries subject to rigorous compliance regulations, such as finance and healthcare, have traditionally exhibited an inclination towards deploying on-premise solutions to safeguard sensitive data. Such factors are expected to maintain the significance of this segment in the coming years.

The cloud segment is anticipated to register the fastest growth from 2024 to 2030. This is owing to the scalability and flexibility of cloud-based UTM solutions, which align seamlessly with the evolving IT landscape, enabling organizations to rapidly adapt to changing threat courses. Additionally, the reduced upfront costs and operational overheads associated with cloud deployment have made it an attractive option for businesses of all sizes. Furthermore, the growing reliance on cloud-based applications and data storage has compelled organizations to deploy robust cloud security measures, thereby driving demand for cloud UTM solutions.

Enterprise Size Insights

The large enterprises segment held the highest market revenue share in 2023. This is owing to the presence of an extensive digital infrastructure in such organizations, their heightened vulnerability to cyberattacks, and substantial financial resources allocated to cybersecurity. The complexity of their IT environments demands comprehensive security solutions, and UTM platforms offer a consolidated approach to managing multiple security functions. Additionally, the protection of sensitive data and intellectual property requires stringent security measures, driving demand for advanced UTM capabilities among large organizations.

Small and medium-sized enterprises (SMEs) are expected to register the fastest CAGR during the forecast period. This is attributed to the escalating frequency and sophistication of cyber threats, coupled with the increasing digital footprint of SMEs. UTM platforms offer a cost-effective and comprehensive approach to safeguarding sensitive data, thereby driving adoption in this segment. Additionally, government initiatives and financial support programs aimed at strengthening SME cybersecurity have accelerated market penetration. The growing reliance on cloud-based services and remote work models among SMEs has further amplified the demand for UTM solutions to protect their functions against evolving threats.

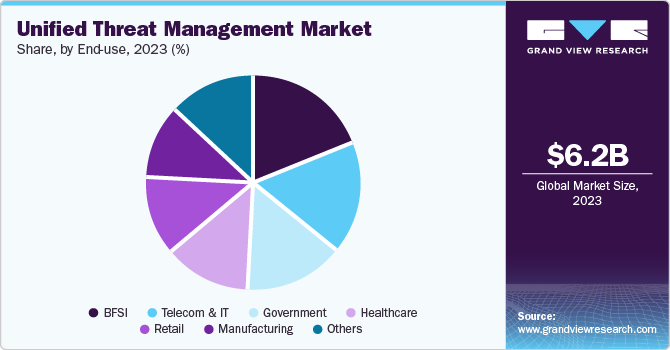

End Use Insights

The BFSI segment held the largest revenue share in 2023. This is owing to the heightened vulnerability of financial institutions to cyberattacks. The protection of sensitive customer data, financial transactions, and overall operational resilience requires robust security measures, aiding market expansion. For instance, IMF’s 2024 Global Financial Stability Report estimated that cyber incidences have led to over USD 12 billion worth of direct losses to financial institutions over the past two decades. UTM systems offer a comprehensive solution to protect these critical assets by consolidating multiple security functions into a unified platform, thereby addressing the complex threats faced by the BFSI industry.

On the other hand, the manufacturing sector is anticipated to register the fastest growth rate during the forecast period. Manufacturing industries worldwide are increasingly adopting IT-based solutions for enhancing their operational efficiency. This gradual shift and dependence on digital infrastructure solutions has made them increasingly susceptible to cyberattacks. Moreover, stringent regulatory compliance mandates and the protection of sensitive intellectual property have driven the adoption of UTM solutions within the manufacturing industry, contributing to its accelerated growth.

Regional Insights

North America led the global unified threat management market with a revenue share of 40.5% in 2023. This substantial share is owing to the region’s early adoption of IT and cloud technology and the established presence of a robust IT security infrastructure. Additionally, high awareness among businesses about the importance of deploying comprehensive unified threat management solutions has led to increased adoption of these services in the region, leading to market dominance.

U.S. Unified Threat Management Market Trends

The U.S. accounted for the highest share of the regional market in 2023. This is attributed to the presence of a well-developed IT industry and a focus on implementing a robust information security infrastructure in the country. The U.S. has ensured a conducive environment for the growth of small enterprises and startups, which has fueled the demand for all-inclusive IT security solutions such as UTM.

Europe Unified Threat Management Market Trends

Europe held a significant share of the global UTM market in 2023. This is owing to the diverse industrial landscape in the region, which demands UTM solutions for its digital security. The economies and industries in Europe are governed by General Data Protection Regulation (GDPR), which puts stringent regulations for ensuring data security and data privacy. A significant demand for unified threat management solutions is observed in industrially advanced economies such as the UK, Germany, and France.

The UK accounted for a notable share of the European market. The country is among the prominent industrial economies in Europe, and its diverse industrial landscape of manufacturing, IT, BFSI, and healthcare sectors has necessitated the presence of cost-effective and comprehensive IT security solutions. UTM ensures the availability of complete digital security to these sectors, accounting for the high share of the economy in this region.

Asia Pacific Unified Threat Management Market Trends

Asia Pacific is expected to register the fastest CAGR during the forecast period. The region has undergone a significant digital transformation in the past two decades. Multinational organizations have established their offices in regional economies such as India, Japan, and China at a fast pace. This has led to a heightened demand for unified threat management solutions across enterprises. Additionally, government initiatives to reinforce cybersecurity and data protection regulations have created a favorable environment for UTM market expansion within the region.

India accounted for a significant revenue share of the regional market. India has emerged as a prominent IT services provider in the past two decades. The presence of a large network of small and medium-sized enterprises has been a major factor behind market growth. As these organizations become an easy target for cybercriminals, they are increasingly adopting cost-effective and all-inclusive security solutions such as UTM. Furthermore, the country's large and growing population, coupled with rising disposable incomes, has led to increased internet usage, fueling demand for advanced IT infrastructure and driving the adoption of UTM solutions.

Key Unified Threat Management Company Insights

Some key companies involved in the unified threat management market include Sophos Ltd., Cisco Systems, Inc., and SonicGuard, among others.

-

Sophos Ltd. is a British IT security and data protection services company. Sophos offers comprehensive security solutions such as endpoint security, email security, cloud security, and network security, as well as services such as managed security services and management platforms. Sophos offers its flagship XG Firewall for a holistic security solution. It combines advanced threat protection, firewall, intrusion prevention, antivirus, and VPN.

-

Cisco Systems, Inc. is a U.S.-based multinational IT services, telecom, and networking solutions company. Cisco’s UTM solutions integrate multiple security functions such as firewall, intrusion prevention, antivirus, and VPN capabilities into a single platform. These services include the Cisco ASA (Adaptive Security Appliance) series for VPN capabilities, the Cisco Firepower series for intrusion prevention capabilities, the Cisco Umbrella for cloud-based security and threat protection, and the Cisco Advanced Malware Protection (AMP).

Key Unified Threat Management Companies:

The following are the leading companies in the unified threat management market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- SonicGuard

- Fortinet, Inc.

- Huawei Technologies Co., Ltd.

- Untangle

- Juniper Networks, Inc.

- Sophos Ltd.

- WatchGuard Technologies, Inc.

- Trend Micro Incorporated

Recent Developments

-

In August 2024, Fortinet, Inc. announced the acquisition of Lacework, an integrated cloud security company. This strategic move by Fortinet is expected to augment its efforts toward providing advanced AI-driven cloud security solutions to its customers.

-

In May 2024, Sophos Ltd. announced its distribution agreement with Infinigate to expand in the UK market. This agreement will enable Sophos to find new avenues of growth in the country with aid from Infinigate's established network.

Unified Threat Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.78 billion |

|

Revenue Forecast in 2030 |

USD 15.96 billion |

|

Growth rate |

CAGR of 15.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Component, deployment, enterprise size, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, Australia, South Korea, India, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Cisco Systems, Inc.; Check Point Software Technologies Ltd.; SonicGuard; Fortinet, Inc.; Huawei Technologies Co., Ltd.; Untangle; Juniper Networks, Inc.; Sophos Ltd.; WatchGuard Technologies, Inc.; Trend Micro Incorporated |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Unified Threat Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the unified threat management market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Virtual

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small and Medium Enterprises (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

Manufacturing

-

Retail

-

Telecom & IT

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."