Underwater Communication System Market Size, Share & Trends Analysis Report By Component, By Connectivity, By Application (Environmental Monitoring, Pollution Monitoring), By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-967-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

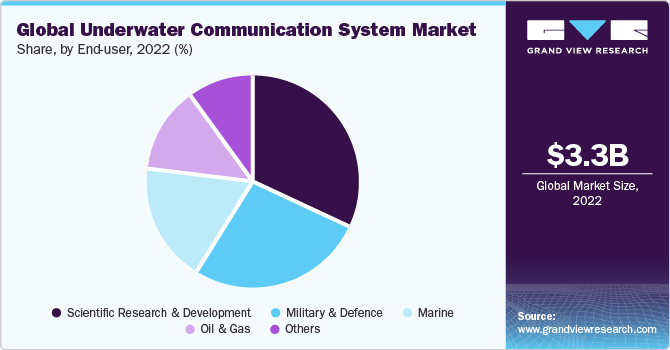

The global underwater communication system market size was worth USD 3.34 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. The rise in spending on defense by various countries is one of the main reasons for the industry's growth. Threats, concerns over contested areas, and security worries have increased global defense spending. The naval defense system mainly uses underwater communication system (UCS) for safe communication and dependability. The military uses it to detect intrusion and conduct underwater surveillance. These factors will contribute to the industry's growth in the forthcoming years. UCS is helpful for commercial purposes, mainly in industries like oil and gas. The system is used in exploring submerged resources.

UCS is also advantageous to science as they are used for data collection and underwater exploration. It is used in oceanology, marine archeology, and marine biology. These systems also help the government in monitoring the environment. Activities of companies in the oil and gas industry about how they affect the environment can be checked with the help of these systems. Environmental pollution can also be monitored and subsequently controlled through these systems.

In August 2022, Stanford University researchers developed a robot capable of diving deep into sunken planes and ruins. Its operators can have the same sense as OceanOneK’s underwater trips. OceanOneK’s 3D camera catches the underwater environment in vivid color, and its arms and hands can reach those of a diver. In March 2022, WhitePointer is a DSIT Solutions underwater acoustic communication system that provides simultaneous communication between underwater platforms and multiple surfaces.

The system is based on the company's undersea technology and allows networked communication among several users. The WhitePointer system is NATO-compliant and allows for reliable voice and data communication between submarines, surface ships, and other underwater users such as drones and divers such as unmanned underwater vehicles (UUVs), autonomous underwater vehicles (AUVs), diver propulsion vehicles (DPVs), and swimmer's delivery vehicles (SDVs).

Subsea, marine, and subsea communication systems frequently convey positional data for inspection, mapping, and tracking. They can also relay video data and control UUVs. Using intelligent nodes on the seafloor to interact with autonomous underwater vehicles allows access to a broad range of subsea applications that may need bi-directional, low latency, high bandwidth, and wireless communication links.

Positioning data must be communicated for subsea drones to perform complicated autonomous activities underwater. In addition to subsea inspection and mapping, secure, interoperable maritime communication systems enable autonomous undersea vessels to support countermeasures for anti-submarine operations and mining.

Many nations' COVID-19 restrictions and lockdowns have impacted the AUV supply chain. Lower supplier and customer activity, travel restrictions, and a higher risk of project delays owing to a temporary shutdown and a scarcity of inputs are all expected to impact sales, profitability, and order intake.

Furthermore, because a significant percentage of the customer base is affected, there is a greater chance of customer contract cancellation and late or non-payments, which may raise the risk of losses on accounts receivable, project assets, products, and currency futures.

OEMs and players in the AUV market have been particularly heavily hit. COVID-19 impacted the AUV sector long-term by driving changes in the macroeconomic climate, regulatory trends, and technology. Manufacturers found it more challenging to anticipate the industry's recovery due to uncertainty throughout the shutdown and supply-chain interruptions.

The pandemic crisis caused structural changes in the supply chain that had far-reaching commercial repercussions. The temporary shutdown of factories in the early half of 2020 resulted in production limits and limited operations throughout the year, significantly influencing 2020 supplies and deployments.

End-user Insights

In terms of end-user, the market is classified into marine, military & defense, oil & gas, scientific research & development, and others. Among these, the scientific research & development segment dominated in 2022, with a revenue share of 32.2%. It is expected to grow at a CAGR of 9.8% throughout the forecast period. A UCS also aids scientific research. Autonomous underwater vehicles have also been used to locate wrecked planes and investigate the reasons for their crashes. The development of communication systems has led to the discovery of the Titanic's wreckage and hydrothermal vents in the deep ocean. These devices identify items that help in mapping and discovery underwater. They are also quite dependable for rescue operations.

The military & defense segment is expected to grow at the fastest CAGR of 11.1% during the forecast period. The military utilizes it for underwater surveillance as well as incursion detection. As opposing states may plot sabotage via the water, installing a communication system will warn the nation of the threat. Underwater wireless communications applications for the defense industry include:

-

AUV communications are included in submarine communications systems.

-

Mine lift bags are used to remove mines from vulnerable regions and dispose of them in safer locations.

-

Special forces employ a variety of communications technologies, for example, mine clearing.

-

Different underwater instrument packages such as listening devices, communication systems, and underwater networks are used.

-

Wide-area networks that connect to radio-based equipment on the ground, such as network-centric combat systems.

Component Insights

The hardware segment dominated with the largest revenue share of 52.8% in 2022. Underwater communication hardware components include LCDs, capacitors, resistors, cables & connectors, transistors, PCBs, diodes, adapters/transformers, LEDs, and push buttons.

These devices transmit messages over water, and the electronic components are assembled on specialized circuit boards. The hardware implementations include reconstruction and amplification filters, minimizing hardware cost and complexity while increasing flexibility.

The services segment is expected to grow at the fastest CAGR of 11.3% during the forecast period. UCS provides engineering services and maritime solutions such as systems engineering, maintenance, and technical support. SEASCAPE is a corporation that sells, manufactures, and services underwater equipment and gadgets. SEASCAPE designs develops and manufactures specialized surface and subsea products for global distribution.

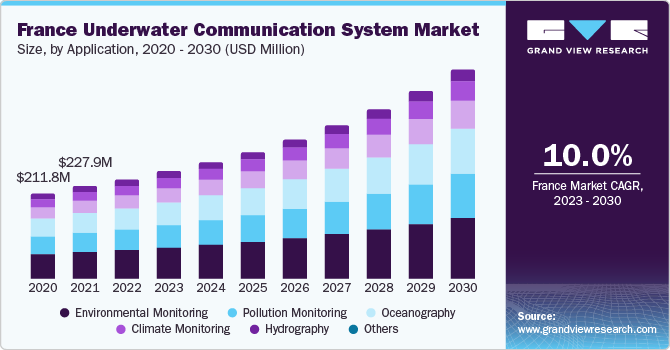

Regional Insights

North America led the overall market in 2022, with a revenue share of 32.1%. Underwater acoustic communication is predicted to have the biggest share in North America. Due to rising security concerns in these nations, the United States is deploying unmanned underwater vehicles (UUVs) for various defense purposes, including anti-submarine warfare, security, and surveillance.

As a result, the increasing utility of UUVs in the defense and commercial sectors is likely to drive market growth in North America. In January 2021, the US Office of Naval Research awarded a $9.3 million contract to Advanced Acoustic Concepts LLC to develop supporting technologies for autonomous underwater vehicles to detect and operate things in deep ocean conditions. Government investments of this nature are boosting industry in this area.

Asia Pacific is expected to grow at the fastest CAGR of 11.2% during the forecast period. It is due to various applications such as environmental monitoring, pollution monitoring, climate recording, hydrography, oceanography, aquaculture fisheries, and diving. The growing research and development activities in the region to develop new and innovative underwater communication technologies are driving the market growth of the market for underwater communication system.

Connectivity Insights

The wireless segment held the largest revenue share of 64.1% in 2022. The segment is expected to grow at a rapid CAGR of 10.6% throughout the forecast period. Wireless communication uses water to transport data. Environmental monitoring, underwater exploration, and collecting scientific data rely on underwater wireless communications; due to the unique and severe circumstances that define underwater channels, underwater wireless communications still need to be made easier.

These situations include, for example, significant attenuation, multipath dispersion, and restricted resource usage. Nonetheless, improved communication systems based on acoustic, electromagnetic, and optical waves have evolved to address the basic and practical constraints of underwater wireless communications. Many academic and corporate researchers have recently focused on developing cutting-edge solutions for future underwater wireless communications and networks.

The hardwired communication segment is expected to grow at a significant CAGR of 9.7% over the forecast period. Hardwired communication involves the use of a cable to transport data. While many divers love being able to dive wherever they choose with the ability to communicate wirelessly, for professional divers, this is not always the most practical choice owing to the environment, scenario, and function required for the work at hand.

Hardwired communications, similar to a landline phone, offer the greatest quality and most dependable type of underwater communications by removing the influence of outside factors. As a result, hardwired communications function best in circumstances where extrinsic forces make wireless transmission impossible. Furthermore, many professional divers in the Public Safety or Commercial Dive industries require tethering to a cable for safety reasons, making hardwired communications the logical next step.

Application Insights

In terms of application, the market is classified into climate monitoring, environmental monitoring, hydrography, oceanography, pollution monitoring, and others. Among these, the environmental monitoring segment dominated in 2022, gaining a revenue share of around 31.3%. The activities of corporations in the oil and gas sector can be monitored in terms of how they affect the environment. Environmental contamination may also be monitored and managed with these methods. Climate change is also detectable. These technologies can also predict natural catastrophes by detecting early warning indications. It minimizes the risk of such calamities occurring.

The oceanography segment is expected to grow at the fastest CAGR of 11.4% during the forecast period. UCS aids in the study of oceanography since they are utilized for underwater exploration and data collecting. The underwater discoveries might be valuable to the health sector and the development of current innovations. Offshore demonstration and verification tests are carried out for various experimental sea regions, such as offshore and deep sea, in conjunction with the application requirements of ocean observation.

The submarine observation network and the underwater acoustic communication network are combined to improve connection and optimization between the underwater communication network and the submarine optical cable network, as well as to increase the flexibility of the deep-sea observation network.

Key Companies & Market Share Insights

Significant firms are investing a lot of money in research and development to incorporate new technologies in underwater communication systems used for military and defense purposes has increased rivalry among these players. Kongsberg, L3Harris Technologies, Inc., Thales, Saab AB, Teledyne Marine, and Ultra Electronics Holdings plc are among the market's significant companies.

These companies are concentrating on improving their technology and developing better underwater communication equipment. These businesses also partner with other organizations and local and regional players to gain a competitive advantage and market share. For instance, in July 2023, Thales signed an agreement with the French Defense Procurement Agency to design and provide a new sonar suite for the French Navy's 3rd generation nuclear energy-powered ballistic missile submarines as well as to modernize the sonar suites of its second-generation SSBNs. The new suite will be based on Thales' most advanced technologies, significantly improving the French Navy's underwater situational understanding.

Key Underwater Communication System Companies:

- Kongsberg Maritime

- L3Harris Technologies, Inc.

- Thales

- Saab AB

- Teledyne Marine Technologies Incorporated.

- Ultra

- Sonardyne

- Underwater Wireless Modem & Communication Devices

- Undersea Systems International, Inc.

- Sea and Land Technologies Pte Ltd.

- EvoLogics GmbH

- HYDROMEA

Recent Developments

-

In October 2022, Kongsberg Maritime signed a contract to supply three sets of KONGSBERG HUGIN AUV systems and related HiPAP positioning and communication systems for three new Polish Navy vessels. The HiPAP allows real-time communication with high-accuracy position updates.

-

In June 2021, Thales started manufacturing the underwater communication system TUUM-6 in Spain. The technology is part of the company's integrated suite of sonars and acoustic systems and is set to be employed on the five new F110 frigates for the Spanish Navy.

-

In June 2021, Sonardyne launched Phorcys, a new secure and open standard for underwater communications. Phorcys are to be used by various underwater platforms, including submarines, surface ships, and autonomous underwater vehicles. It allows for interoperability between different platforms within the underwater battlespace as it uses different frequency bands.

Underwater Communication System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 3.63 billion |

|

Revenue forecast in 2030 |

USD 7.20 billion |

|

Growth rate |

CAGR of 10.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, connectivity, application, end-user, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, UAE |

|

Key companies profiled |

Kongsberg Maritime; L3Harris Technologies, Inc. Thales; Saab AB; Teledyne Marine Technologies Incorporated.; Ultra.; Sonardyne; Underwater Wireless Modem & Communication Devices; Undersea Systems International, Inc.; Sea and Land Technologies Pte Ltd.; EvoLogics GmbH; HYDROMEA. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Underwater Communication System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global underwater communication system market report based on component, connectivity, application, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Connectivity Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardwired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Climate monitoring

-

Environmental monitoring

-

Hydrography

-

Oceanography

-

Pollution monitoring

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Marine

-

Military & defence

-

Oil & gas

-

Scientific research & development

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global underwater communication system market size was estimated at USD 3.34 billion in 2022 and is expected to reach USD 3.63 billion in 2023.

b. The global underwater communication system market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 7.20 billion by 2030.

b. North America dominated the underwater communication system market with a share of 32.2% in 2022. This is attributable to the rising security concerns in North America coupled with the increasing utility of UUVs in the defense and commercial sectors.

b. Some key players operating in the underwater communication system market include Kongsberg, L3Harris Technologies, Inc., Thales, Saab AB, Teledyne Marine, Ultra Electronics Holdings plc, Sonardyne, DSPComm, Undersea Systems International, Inc., Sea and Land Technologies Pte Ltd., EvoLogics GmbH, Hydromea.

b. Key factors that are driving underwater communication system market growth include increased spending on defense by various countries, rising demand for data collection and underwater explorations, and increasing awareness for underwater surveillance.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."