Unattended Ground Sensors Market Size, Share & Trends Analysis Report By Sensor, By Deployment (Fixed Systems, Portable Systems), By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-467-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Unattended Ground Sensors Market Trends

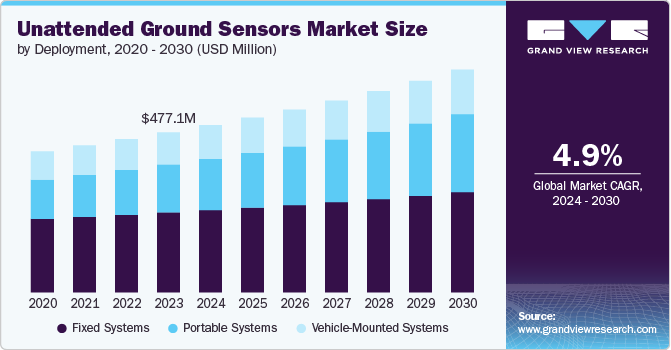

The global unattended ground sensors market size was estimated at USD 477.08 million in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The adoption of acoustic and infrared unattended ground sensors is on the rise, driven by their growing effectiveness in enhancing situational awareness for defense and security applications. Acoustic sensors, capable of detecting sound signatures like gunshots and vehicle movements, are being increasingly used for real-time intruder detection and perimeter security.

Meanwhile, infrared sensors, which track heat signatures, are gaining traction for detecting human or vehicle presence in low-light environments. As security threats become more sophisticated, the demand for these advanced sensor technologies is expected to accelerate, marking a key trend in the security landscape.

Ongoing advancements in sensor technology are making unattended ground sensor systems more cost-effective and practical for deployment in diverse environments. Innovations in miniaturization have led to the development of highly energy-efficient, durable, and compact sensors that can be easily installed in remote or challenging locations. Furthermore, the integration of artificial intelligence and data analytics is enhancing sensor capabilities, resulting in lower false alarm rates and improved threat detection accuracy. These technological improvements are driving greater interest from both military and civilian sectors.

The evolving nature of warfare, coupled with rising terrorism and geopolitical tensions, is significantly driving the adoption of unattended ground sensors in military and security applications. These systems enable military forces to establish effective perimeter security and deter unauthorized intrusions across borders. In addition, public security agencies are increasingly utilizing UGS to enhance urban safety and surveillance capabilities. As nations continue to prioritize national security, the demand for these systems is expected to rise substantially.

There is a growing trend towards utilizing unattended ground sensors for environmental monitoring applications. These sensors can collect data on various environmental parameters, aiding in wildlife conservation, natural disaster management, and ecological studies. The ability to monitor remote or sensitive areas without human presence makes UGS an invaluable tool for researchers and environmental agencies. As awareness of environmental issues increases, the demand for these applications of UGS is likely to expand significantly.

Sensor Insights

Based on sensor, the seismic sensors segment led the market with the largest revenue share of 35.00% in 2023, reflecting their growing importance in unattended ground sensor (UGS) systems. These sensors are increasingly vital for detecting ground disturbances with high accuracy, making them essential for perimeter defense, human and vehicle movement detection, and early threat warnings. The rising demand for sensitive detection in harsh and remote environments is driving the adoption of seismic sensors, especially where traditional surveillance methods fall short. Their ability to operate in extreme conditions and provide real-time alerts positions seismic sensors as a key trend in modern security solutions.

The acoustic sensors segment is estimated to grow at the fastest CAGR of 6.7% from 2024 to 2030. Acoustic sensors are becoming increasingly important in UGS systems due to their ability to detect sound signatures over long distances. These sensors are particularly effective in environments where visual or seismic detection may be limited, such as dense forests or urban settings. Their capability to analyze sound patterns and differentiate between human, vehicle, or wildlife movement makes them highly valuable for surveillance applications. As a result, acoustic sensors are in demand for both military operations and civilian security uses, driving market growth.

Deployment Insights

Based on deployment, the fixed systems segment led the market with the largest revenue share of 50.00% in 2023, reflecting a growing trend in the demand for uninterrupted, around-the-clock monitoring in strategically critical locations. These systems are increasingly favored for their ability to provide consistent surveillance over extended periods without the need for frequent redeployment or maintenance. Known for their robustness, fixed unattended ground sensor (UGS) systems are designed to withstand extreme environmental conditions, including harsh weather and rugged terrains. Their reliability allows for accurate detection of threats such as unauthorized personnel and vehicle intrusions. As industries pursue long-term security solutions, fixed systems are becoming the preferred choice for governments, military forces, and private enterprises alike.

The portable systems segment is estimated to register at the fastest CAGR from 2024 to 2030. Portable UGS systems are also gaining traction in border security and law enforcement applications, where dynamic monitoring and fast deployment are essential. These systems enable authorities to monitor remote areas, detect unauthorized crossings, and respond swiftly to emerging threats along national borders or in urban security operations. Law enforcement agencies value portable UGS for their ability to provide surveillance during large events, temporary checkpoints, or search-and-rescue missions. The rising concerns about human trafficking, smuggling, and illegal immigration are driving the demand for portable systems that offer flexible, real-time monitoring solutions.

Application Insights

Based on application, the military & defense segment led the market with the largest revenue share of 38.5% in 2023. The demand for UGS systems in battlefield surveillance is increasing as modern warfare becomes more reliant on advanced sensor technology for real-time data collection. UGS systems are deployed to detect enemy troop movements, vehicle activity, and potential threats, providing essential data to command centers. These sensors allow military personnel to gain a tactical advantage by identifying enemy positions and planning strategic responses based on accurate, real-time information. As military operations often occur in rugged and inaccessible terrains, the ability of UGS systems to operate autonomously in challenging environments makes them a critical tool in the defense sector. This rising demand for enhanced battlefield surveillance capabilities is driving market growth.

The public security segment is estimated to register at the fastest CAGR from 2024 to 2030, driven by the increasing demand for unattended ground sensor (UGS) systems for monitoring public spaces and mitigating security threats. These systems provide 24/7 surveillance in locations such as parks, city centers, and transportation hubs, enabling real-time detection of suspicious activities and swift alerts to authorities. In addition, UGS solutions are being utilized to enhance security at public events, adding a crucial layer of protection for large gatherings. As urbanization and concerns about public safety rise, governments are investing more in UGS technology to safeguard civilians and prevent incidents like terrorism, vandalism, and unauthorized access. The capability for continuous, autonomous monitoring positions UGS as an essential component of modern public security strategies.

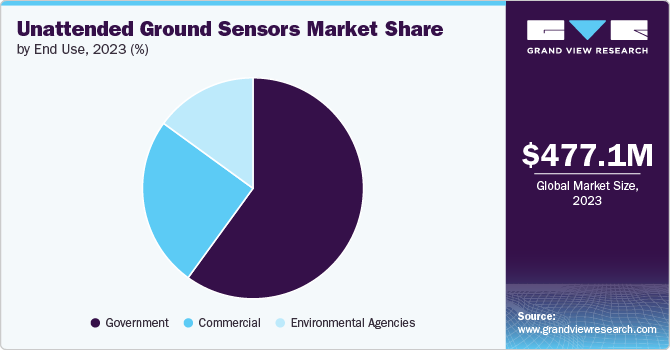

End-use Insights

Based on end use, the government segment led the market with the largest revenue share of 60.00% in 2023. The demand for UGS systems in the Government segment is largely influenced by the need for enhanced surveillance capabilities in both urban and rural areas. These systems provide continuous monitoring of critical sites such as government buildings, military installations, and public infrastructure, ensuring timely detection of potential threats. UGS solutions also support disaster response efforts by monitoring affected areas and facilitating real-time data collection. As governments face increasing pressure to secure public safety and critical assets, the adoption of UGS technology is becoming essential. This trend is driving investments in advanced sensor networks that enhance situational awareness and operational efficiency.

The commercial segment is estimated to register at the fastest CAGR from 2024 to 2030. Unattended ground sensors are increasingly being utilized for asset protection and theft prevention in commercial settings, where the value of safeguarding inventory and equipment is paramount. These systems allow businesses to monitor high-risk areas, such as loading docks and storage rooms, detecting unauthorized access or suspicious activities in real-time. The integration of UGS solutions into existing security frameworks enhances the overall security posture of commercial operations, providing peace of mind for business owners. As retail theft and industrial espionage continue to rise, the demand for UGS systems that can provide round-the-clock surveillance is growing. This focus on asset protection is driving significant growth in the commercial UGS market.

Regional Insights

North America dominated the unattended ground sensors market with the largest revenue share of 35.34% in 2023. The demand for UGS in North America is driven by increased defense spending and border security initiatives, particularly along the U.S. and Mexico border. The region's focus on homeland security and the protection of critical infrastructure further boosts UGS adoption. Moreover, integration with advanced technologies like Artificial Intelligence (AI) and IoT is enhancing UGS capabilities, making them indispensable for modern surveillance systems.

U.S. Unattended Ground Sensors Market Trends

The unattended ground sensors market in the U.S. is anticipated to grow at a CAGR of over 3.5% from 2024 to 2030. The U.S. leads the market, driven by significant government investments in defense, border security, and counter-terrorism measures. UGS systems are widely deployed along the U.S.-Mexico border to combat illegal immigration and drug trafficking. The U.S. military's growing reliance on autonomous surveillance technologies and intelligence systems further accelerates UGS adoption across various defense operations.

Europe Unattended Ground Sensors Market Trends

The unattended ground sensors market in Europe is anticipated to grow at a notable CAGR during the forecast period. Europe is witnessing growing UGS demand due to heightened geopolitical tensions and border security concerns, particularly in Eastern Europe. Countries are increasingly using UGS for military surveillance and protecting critical infrastructure, such as energy facilities and transportation networks. The adoption of UGS is also driven by advancements in sensor technology and their role in defense modernization programs.

Asia Pacific Unattended Ground Sensors Market Trends

The unattended ground sensors market in Asia Pacific is anticipated to grow at the fastest CAGR of 6.0% from 2024 to 2030. Rising military budgets, territorial disputes, and border surveillance requirements are fueling market growth in the region. Countries like China and India are investing heavily in UGS technology to monitor vast border regions and safeguard against external threats. The region’s focus on enhancing defense and security capabilities is driving UGS deployment across both military and civilian sectors.

Key Unattended Ground Sensors Insights

The market is fiercely competitive, with prominent players like BAE Systems, Raytheon Technologies Corporation, Elbit Systems Ltd., Saab AB, Rafael Advanced Defense Systems Ltd., and Leonardo S.p.A. leading the industry as of 2023. These companies are aggressively growing their market presence through strategic moves, such as collaborations, mergers, acquisitions, and the introduction of cutting-edge products and technologies.

-

For instance, In June 2023, Raytheon Technologies unveiled its new Multi-Mission Modular Sensor (MMS) system, designed to be adaptable for various operational needs. This modular system can be tailored to effectively detect and track a range of targets, including vehicles and personnel. The MMS represents a significant advancement in sensor technology, allowing for versatile configurations that cater to diverse mission requirements

Key Unattended Ground Sensors Companies:

The following are the leading companies in the unattended ground sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Northrop Grumman Corporation

- Thales Group

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Textron Systems

- BAE Systems

- Raytheon Technologies Corporation

- Elbit Systems Ltd.

- Saab AB

- Rafael Advanced Defense Systems Ltd.

- Leonardo S.p.A.

- Harris Corporation

- Rheinmetall AG

- FLIR Systems, Inc.

- Honeywell International Inc.

Recent Developments

-

In April 2023, Thales Group announced the development of a cutting-edge UGS system that incorporates artificial intelligence to improve target identification and tracking capabilities. This innovative system is engineered to operate effectively in complex environments, particularly urban settings where traditional systems may struggle. By leveraging AI, Thales aims to enhance operational efficiency and accuracy in surveillance tasks. The initiative reflects a broader trend toward integrating advanced technologies into security systems to address emerging challenges

-

In May 2023, Elbit Systems Ltd. successfully delivered its Unattended Ground Sensor (UGS) system to a client in the Middle East. This system is specifically deployed to enhance the protection of critical infrastructure against potential terrorist threats. By utilizing advanced surveillance technology, the UGS aims to bolster security measures in sensitive areas. The deployment underscores the growing demand for sophisticated security solutions in regions facing heightened risks

Unattended Ground Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 498.81 million |

|

Revenue forecast in 2030 |

USD 664.32 million |

|

Growth rate |

CAGR of 4.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Sensor, deployment, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Northrop Grumman Corporation; Thales Group; L3Harris Technologies, Inc.; Lockheed Martin Corporation; Textron Systems; BAE Systems; Raytheon Technologies Corporation; Elbit Systems Ltd.; Saab AB; Rafael Advanced Defense Systems Ltd.; Leonardo S.p.A.; Harris Corporation; Rheinmetall AG; FLIR Systems, Inc.; Honeywell International Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Unattended Ground Sensors Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global unattended ground sensors market report based on the sensor, deployment, application, end use, and region.:

-

Sensor Outlook (Revenue, USD Million, 2018 - 2030)

-

Seismic Sensors

-

Acoustic Sensors

-

Magnetic Sensors

-

Infrared Sensors

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Systems

-

Portable Systems

-

Vehicle-Mounted Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military & Defense

-

Public Security

-

Environmental Monitoring

-

Industrial Security

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Commercial

-

Environmental Agencies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global unattended ground sensors market size was estimated at USD 477.08 million in 2023 and is expected to reach USD 498.81 million in 2024.

b. The global unattended ground sensors market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 664.32 million by 2030.

b. North America dominated the UGS market with a share of around 35% in 2023, driven by increased defense spending and border security initiatives, particularly along the U.S. and Mexico border. The region's focus on homeland security and the protection of critical infrastructure further boosts UGS adoption.

b. Some key players operating in the unattended ground sensors market include Northrop Grumman Corporation, Thales Group, L3Harris Technologies, Inc., Lockheed Martin Corporation, Textron Systems, BAE Systems, Raytheon Technologies Corporation, Elbit Systems Ltd., Saab AB, Rafael Advanced Defense Systems Ltd., Leonardo S.p.A., Harris Corporation, Rheinmetall AG, FLIR Systems, Inc., Honeywell International Inc.

b. Key factors that are driving the unattended ground sensors market growth include the adoption of acoustic and infrared unattended ground sensors, ongoing advancements in sensor technology, and rising terrorism and geopolitical tensions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."